Introducing the dataset

Introduction to Python for Finance

Adina Howe

Instructor

Overall Review

- Python shell and scripts

- Variables and data types

- Lists

- Arrays

- Methods and functions

- Indexing and subsetting

- Matplotlib

S&P 100 Companies

Standard and Poor's S&P 100:

- made up of major companies that span multiple industry groups

- used to measure stock performance of large companies

S&P 100 Case Study

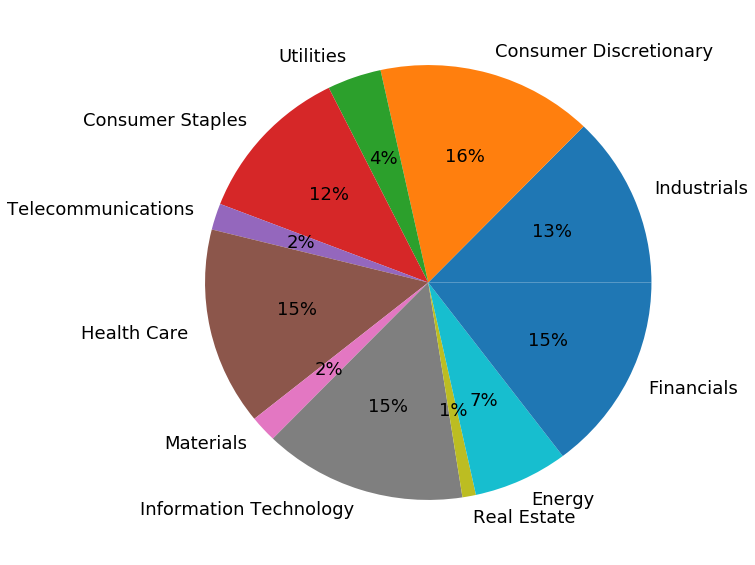

Sectors of Companies within the S&P 100 in 2017

The data

Price to Earnings Ratio

$$ \text{Price to earning ratio} = \frac{\text{Market price}}{\text{Earnings per share}} $$

- The ratio for valuing a company that measures its current share price relative to its per-share earnings

- In general, higher P/E ratio indicates higher growth expectations

Your mission

Given

Lists of data describing the S&P 100: names, prices, earnings, sectors

Objective Part I

Explore and analyze the S&P 100 data, specifically the P/E ratios of S&P 100 companies

Step 1: examine the lists

In [1]: my_list = [1, 2, 3, 4, 5]

# first element

In [2]: print(my_list[0])

1

# last element

In [3]: print(my_list[-1])

5

# range of elements

In [4]: print(my_list[0:3])

[1, 2, 3]

Step 2: Convert lists to arrays

# Convert lists to arrays

import numpy as np

my_array = np.array(my_list)

Step 3: Elementwise array operations

# Elementwise array operations

array_ratio = array1 / array2

Let's analyze!

Introduction to Python for Finance