Column selection for credit risk

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

Choosing specific columns

- We've been using all columns for predictions

# Selects a few specific columns

X_multi = cr_loan_prep[['loan_int_rate','person_emp_length']]

# Selects all data except loan_status

X = cr_loan_prep.drop('loan_status', axis = 1)

- How you can tell how important each column is

- Logistic Regression: column coefficients

- Gradient Boosted Trees: ?

Column importances

- Use the

.get_booster()and.get_score()methods- Weight: the number of times the column appears in all trees

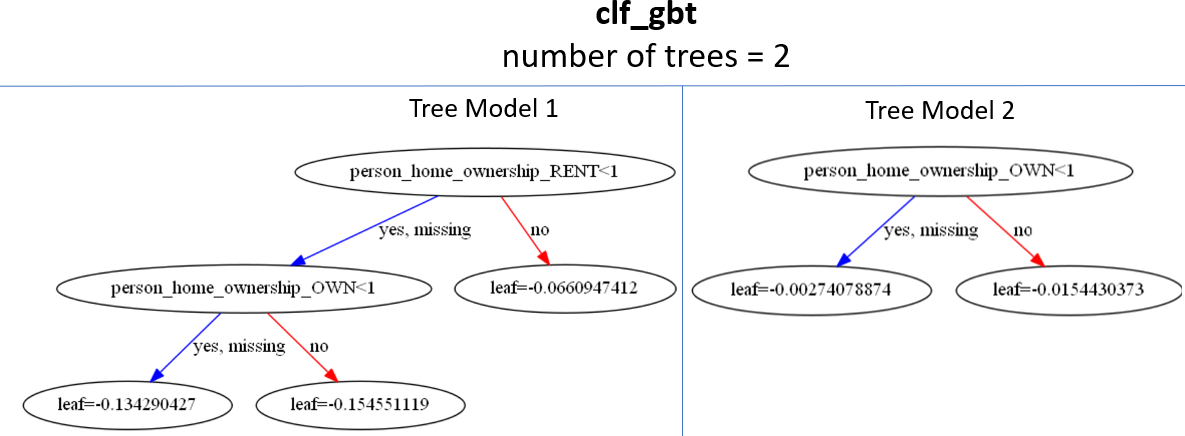

# Train the model

clf_gbt.fit(X_train,np.ravel(y_train))

# Print the feature importances

clf_gbt.get_booster().get_score(importance_type = 'weight')

{'person_home_ownership_RENT': 1, 'person_home_ownership_OWN': 2}

Column importance interpretation

# Column importances from importance_type = 'weight'

{'person_home_ownership_RENT': 1, 'person_home_ownership_OWN': 2}

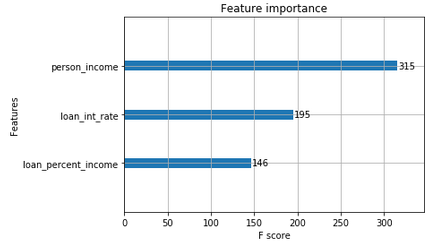

Plotting column importances

- Use the

plot_importance()function

xgb.plot_importance(clf_gbt, importance_type = 'weight')

{'person_income': 315, 'loan_int_rate': 195, 'loan_percent_income': 146}

Choosing training columns

- Column importance is used to sometimes decide which columns to use for training

- Different sets affect the performance of the models

| Columns | Importances | Model Accuracy | Model Default Recall |

|---|---|---|---|

| loan_int_rate, person_emp_length | (100, 100) | 0.81 | 0.67 |

| loan_int_rate, person_emp_length, loan_percent_income | (98, 70, 5) | 0.84 | 0.52 |

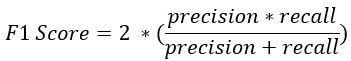

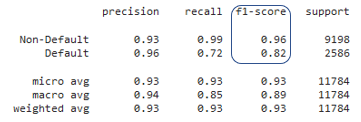

F1 scoring for models

- Thinking about accuracy and recall for different column groups is time consuming

- F1 score is a single metric used to look at both accuracy and recall

- Shows up as a part of the

classification_report()

Let's practice!

Credit Risk Modeling in Python