Model discrimination and impact

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

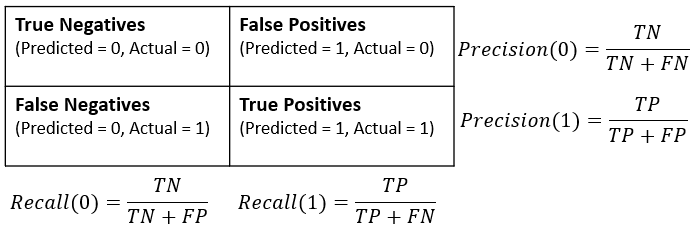

Confusion matrices

- Shows the number of correct and incorrect predictions for each

loan_status

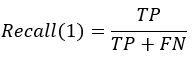

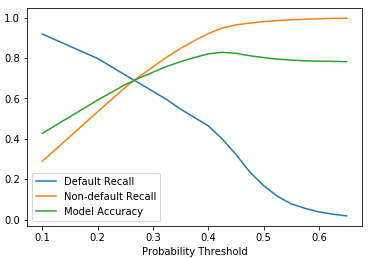

Default recall for loan status

- Default recall (or sensitivity) is the proportion of true defaults predicted

Recall portfolio impact

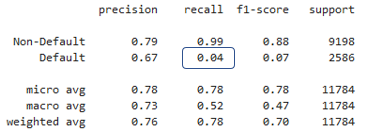

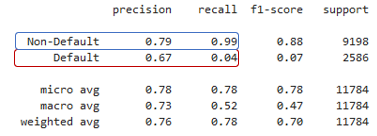

- Classification report - Underperforming Logistic Regression model

Recall portfolio impact

- Classification report - Underperforming Logistic Regression model

- Number of true defaults: 50,000

| Loan Amount | Defaults Predicted / Not Predicted | Estimated Loss on Defaults |

|---|---|---|

| $50 | .04 / .96 | (50000 x .96) x 50 = $2,400,000 |

Recall, precision, and accuracy

- Difficult to maximize all of them because there is a trade-off

Let's practice!

Credit Risk Modeling in Python