Outliers in Credit Data

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

Data processing

- Prepared data allows models to train faster

- Often positively impacts model performance

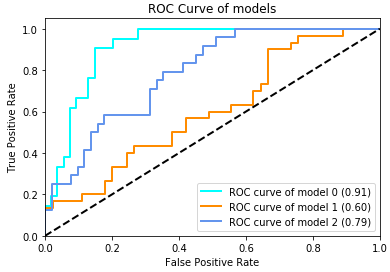

Outliers and performance

Possible causes of outliers:

- Problems with data entry systems (human error)

- Issues with data ingestion tools

Outliers and performance

Possible causes of outliers:

- Problems with data entry systems (human error)

- Issues with data ingestion tools

| Feature | Coefficient With Outliers | Coefficient Without Outliers |

|---|---|---|

| Interest Rate | 0.2 | 0.01 |

| Employment Length | 0.5 | 0.6 |

| Income | 0.6 | 0.75 |

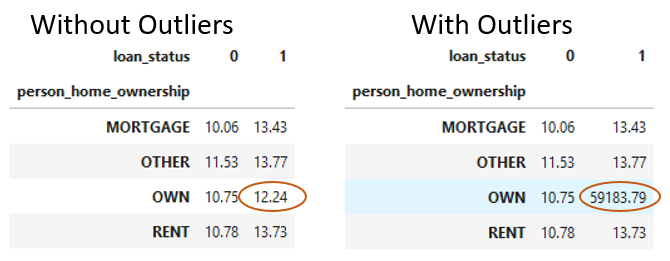

Detecting outliers with cross tables

- Use cross tables with aggregate functions

pd.crosstab(cr_loan['person_home_ownership'], cr_loan['loan_status'],

values=cr_loan['loan_int_rate'], aggfunc='mean').round(2)

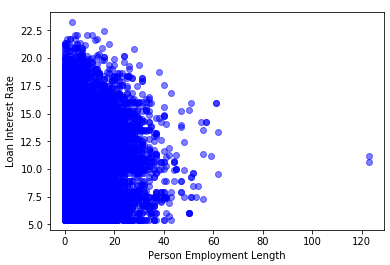

Detecting outliers visually

Detecting outliers visually

- Histograms

- Scatter plots

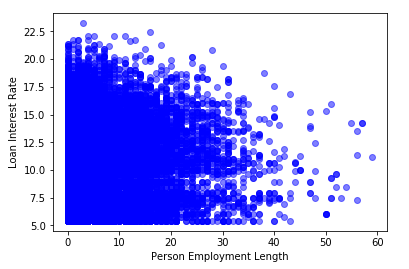

Removing outliers

- Use the

.drop()method within Pandas

indices = cr_loan[cr_loan['person_emp_length'] >= 60].index

cr_loan.drop(indices, inplace=True)

Let's practice!

Credit Risk Modeling in Python