Build a market-cap weighted index

Manipulating Time Series Data in Python

Stefan Jansen

Founder & Lead Data Scientist at Applied Artificial Intelligence

Build your value-weighted index

Key inputs:

number of shares

stock price series

Build your value-weighted index

Key inputs:

- number of shares

- stock price series

- Normalize index to start at 100

Stock index components

components

Company Name Market Capitalization Last Sale

Stock Symbol

PG Procter & Gamble Company (The) 230,159.64 90.03

TM Toyota Motor Corp Ltd Ord 155,660.25 104.18

ABB ABB Ltd 48,398.94 22.63

KO Coca-Cola Company (The) 183,655.31 42.79

WMT Wal-Mart Stores, Inc. 221,864.61 73.15

XOM Exxon Mobil Corporation 338,728.71 81.69

JPM J P Morgan Chase & Co 300,283.25 84.40

JNJ Johnson & Johnson 338,834.39 124.99

BABA Alibaba Group Holding Limited 275,525.00 110.21

T AT&T Inc. 247,339.52 40.28

ORCL Oracle Corporation 181,046.10 44.00

UPS United Parcel Service, Inc. 90,180.89 103.74

Number of shares outstanding

shares = components['Market Capitalization'].div(components['Last Sale'])

Stock Symbol

PG 2,556.48 # Outstanding shares in million

TM 1,494.15

ABB 2,138.71

KO 4,292.01

WMT 3,033.01

XOM 4,146.51

JPM 3,557.86

JNJ 2,710.89

BABA 2,500.00

T 6,140.50

ORCL 4,114.68

UPS 869.30

dtype: float64

- Market Capitalization = Number of Shares x Share Price

Historical stock prices

data = pd.read_csv('stocks.csv', parse_dates=['Date'],

index_col='Date').loc[:, tickers.tolist()]

market_cap_series = data.mul(no_shares)

market_series.info()

DatetimeIndex: 252 entries, 2016-01-04 to 2016-12-30

Data columns (total 12 columns):

ABB 252 non-null float64

BABA 252 non-null float64

JNJ 252 non-null float64

JPM 252 non-null float64

...

TM 252 non-null float64

UPS 252 non-null float64

WMT 252 non-null float64

XOM 252 non-null float64

dtypes: float64(12)

From stock prices to market value

market_cap_series.first('D').append(market_cap_series.last('D'))

ABB BABA JNJ JPM KO ORCL \\

Date

2016-01-04 37,470.14 191,725.00 272,390.43 226,350.95 181,981.42 147,099.95

2016-12-30 45,062.55 219,525.00 312,321.87 307,007.60 177,946.93 158,209.60

PG T TM UPS WMT XOM

Date

2016-01-04 200,351.12 210,926.33 181,479.12 82,444.14 186,408.74 321,188.96

2016-12-30 214,948.60 261,155.65 175,114.05 99,656.23 209,641.59 374,264.34

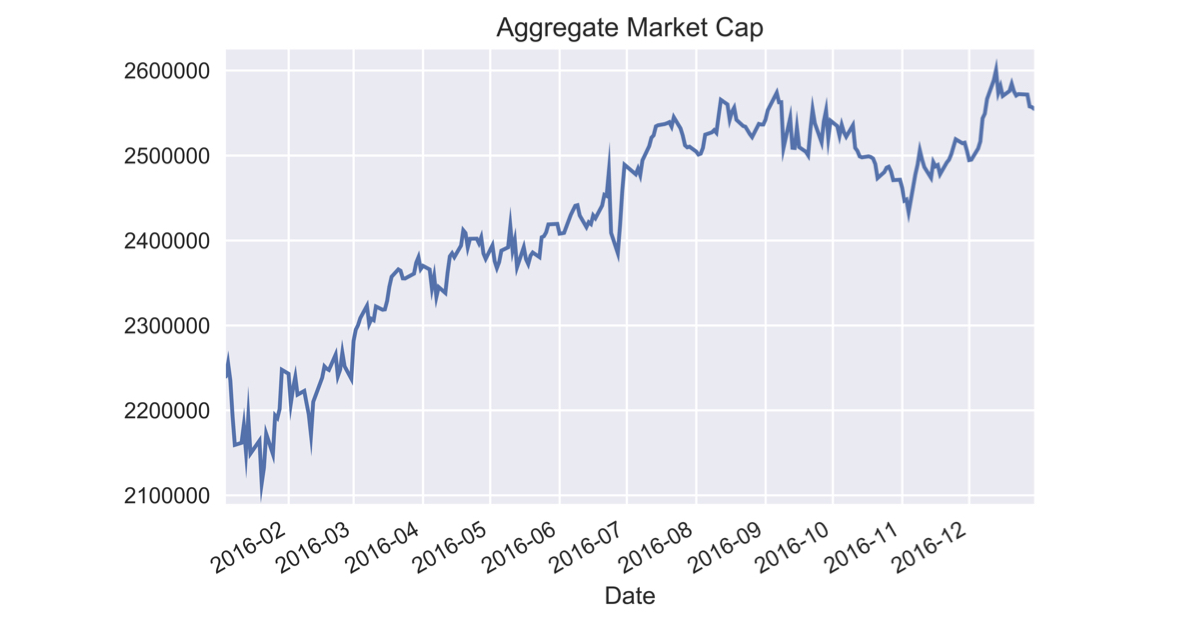

Aggregate market value per period

agg_mcap = market_cap_series.sum(axis=1) # Total market capagg_mcap(title='Aggregate Market Cap')

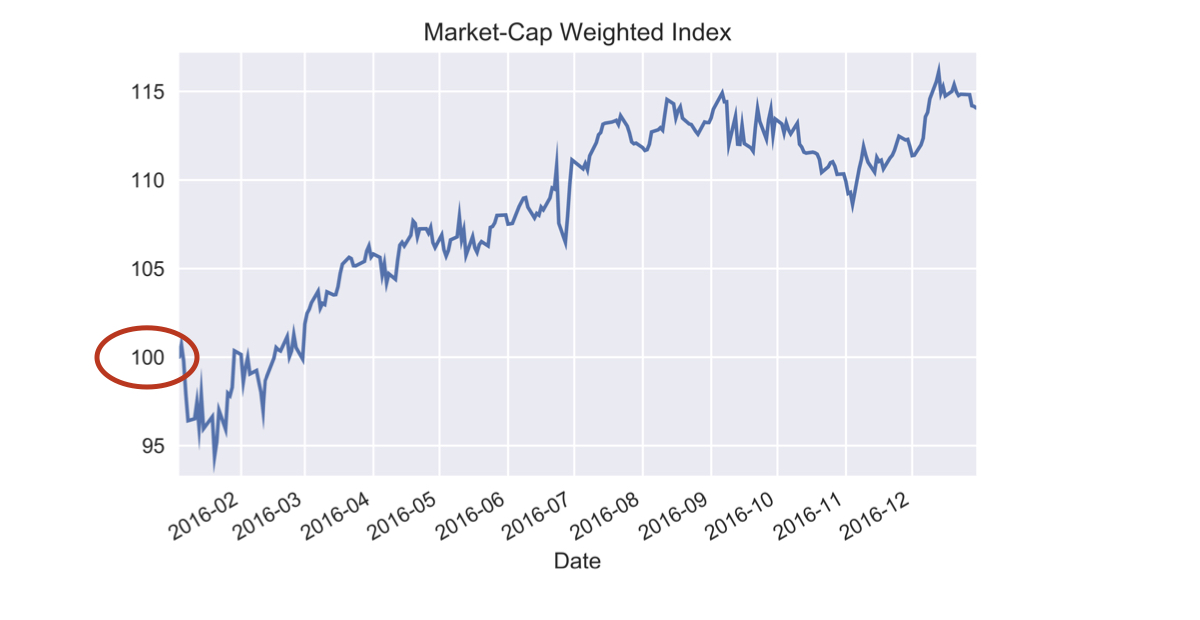

Value-based index

index = agg_mcap.div(agg_mcap.iloc[0]).mul(100) # Divide by 1st valueindex.plot(title='Market-Cap Weighted Index')

Let's practice!

Manipulating Time Series Data in Python