Evaluate index performance

Manipulating Time Series Data in Python

Stefan Jansen

Founder & Lead Data Scientist at Applied Artificial Intelligence

Evaluate your value-weighted index

Index return:

Total index return

Contribution by component

Performance vs Benchmark

Total period return

Rolling returns for sub periods

Value-based index - recap

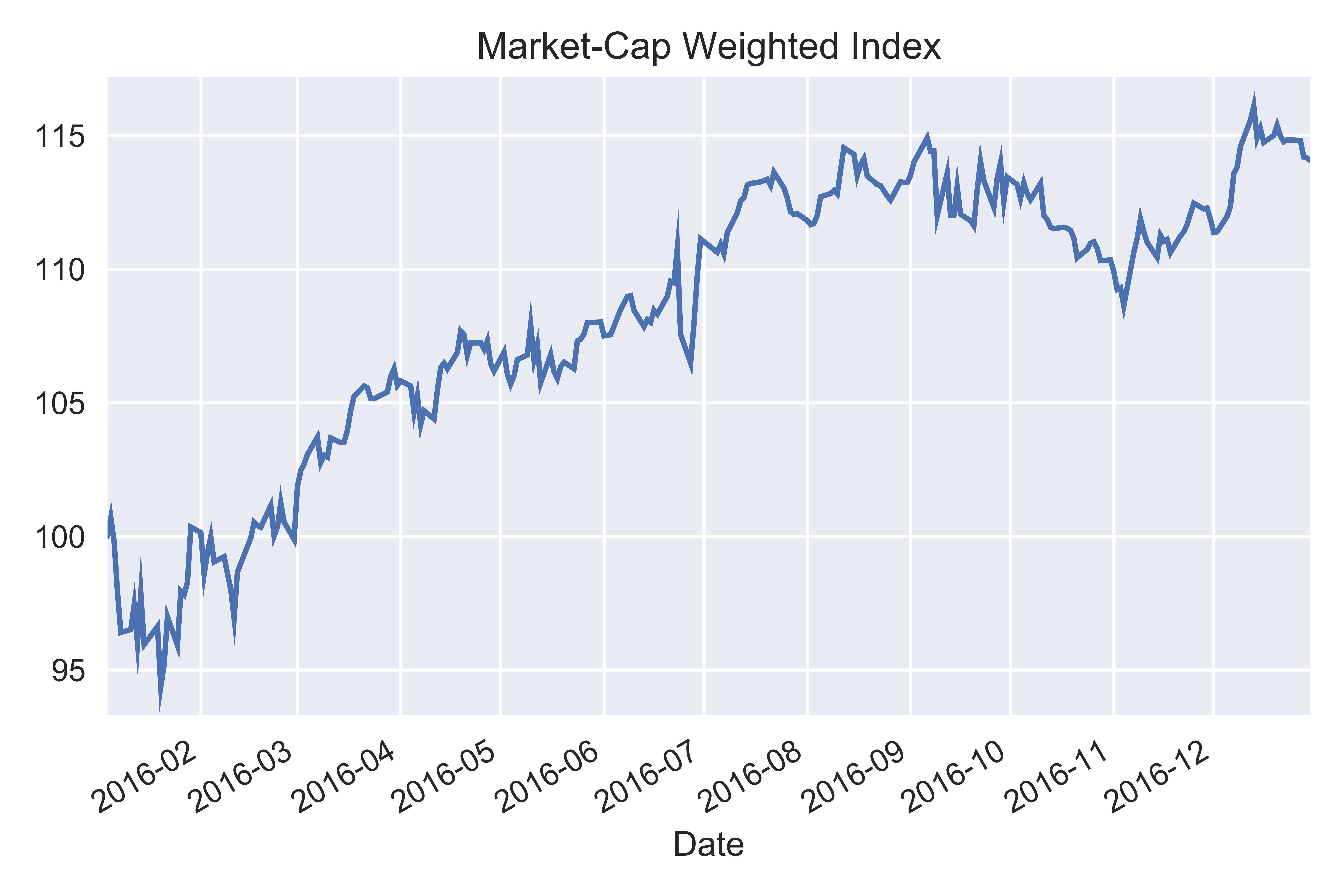

agg_market_cap = market_cap_series.sum(axis=1)index = agg_market_cap.div(agg_market_cap.iloc[0]).mul(100)index.plot(title='Market-Cap Weighted Index')

Value contribution by stock

agg_market_cap.iloc[-1] - agg_market_cap.iloc[0]

315,037.71

Value contribution by stock

change = market_cap_series.first('D').append(market_cap_series.last('D'))change.diff().iloc[-1].sort_values() # or: .loc['2016-12-30']

TM -6,365.07

KO -4,034.49

ABB 7,592.41

ORCL 11,109.65

PG 14,597.48

UPS 17,212.08

WMT 23,232.85

BABA 27,800.00

JNJ 39,931.44

T 50,229.33

XOM 53,075.38

JPM 80,656.65

Name: 2016-12-30 00:00:00, dtype: float64

Market-cap based weights

market_cap = components['Market Capitalization']weights = market_cap.div(market_cap.sum())weights.sort_values().mul(100)

Stock Symbol

ABB 1.85

UPS 3.45

TM 5.96

ORCL 6.93

KO 7.03

WMT 8.50

PG 8.81

T 9.47

BABA 10.55

JPM 11.50

XOM 12.97

JNJ 12.97

Name: Market Capitalization, dtype: float64

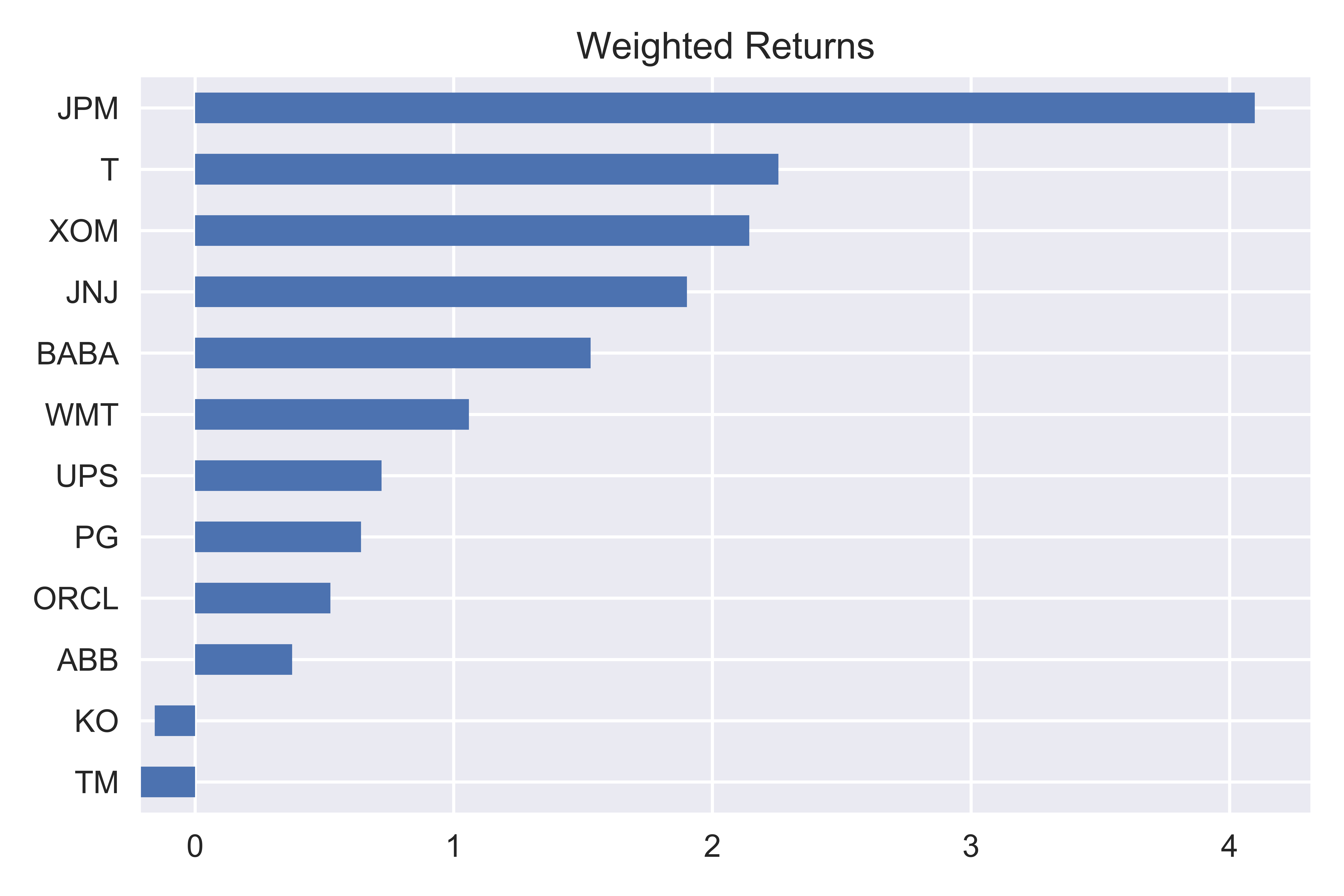

Value-weighted component returns

index_return = (index.iloc[-1] / index.iloc[0] - 1) * 100

14.06

weighted_returns = weights.mul(index_return)weighted_returns.sort_values().plot(kind='barh')

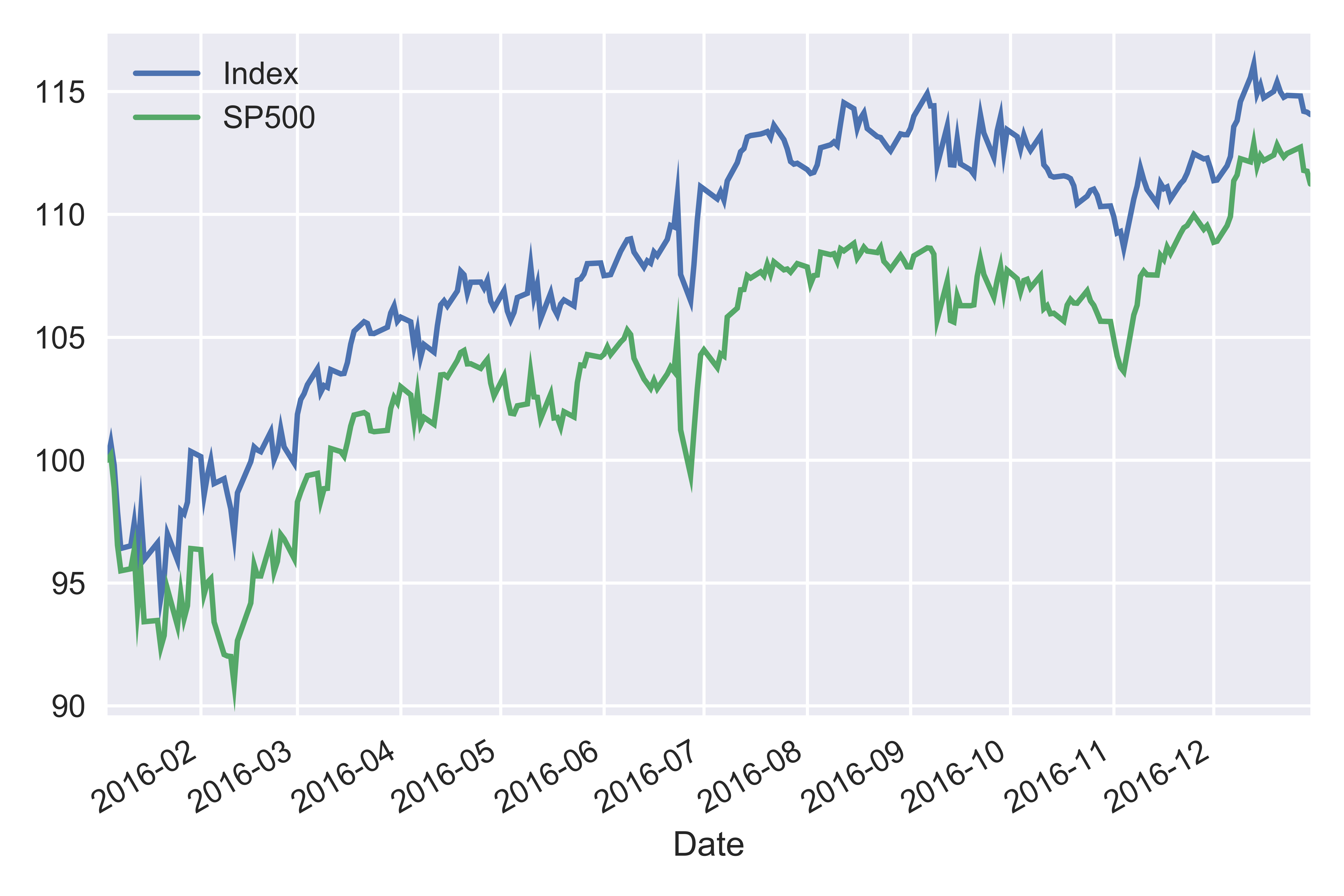

Performance vs benchmark

data = index.to_frame('Index') # Convert pd.Series to pd.DataFramedata['SP500'] = pd.read_csv('sp500.csv', parse_dates=['Date'], index_col='Date')data.SP500 = data.SP500.div(data.SP500.iloc[0], axis=0).mul(100)

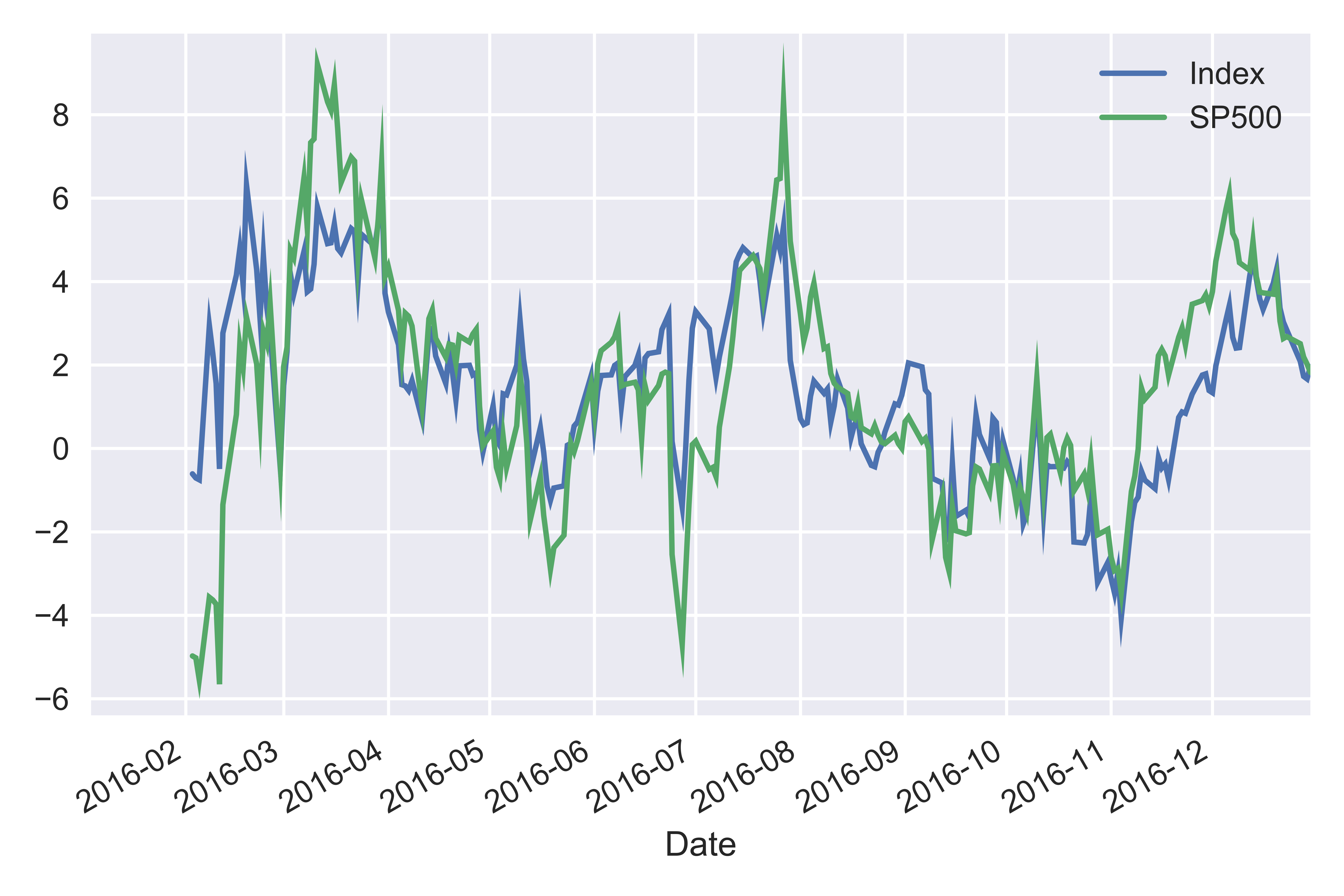

Performance vs benchmark: 30D rolling return

def multi_period_return(r): return (np.prod(r + 1) - 1) * 100data.pct_change().rolling('30D').apply(multi_period_return).plot()

Let's practice!

Manipulating Time Series Data in Python