Portfolio composition and backtesting

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

Calculating portfolio returns

Portfolio Return Formula:

$$ R_p = R_{a_1} w_{a_1} + R_{a_2} w_{a_2} + ... + R_{a_n} w_{a_1} $$

- $ R_p$: Portfolio return

- $ R_{a_n}$: Return for asset n

- $ w_{a_n}$: Weight for asset n

Assuming StockReturns is a pandas DataFrame of stock returns, you can calculate the portfolio return for a set of portfolio weights as follows:

import numpy as np

portfolio_weights = np.array([0.25, 0.35, 0.10, 0.20, 0.10])

port_ret = StockReturns.mul(portfolio_weights, axis=1).sum(axis=1)

port_ret

Date

2017-01-03 0.008082

2017-01-04 0.000161

2017-01-05 0.003448

...

StockReturns["Portfolio"] = port_ret

Equally weighted portfolios in Python

Assuming StockReturns is a pandas DataFrame of stock returns, you can calculate the portfolio return for an equally weighted portfolio as follows:

import numpy as np

numstocks = 5

portfolio_weights_ew = np.repeat(1/numstocks, numstocks)

StockReturns.iloc[:,0:numstocks].mul(portfolio_weights_ew, axis=1).sum(axis=1)

Date

2017-01-03 0.008082

2017-01-04 0.000161

2017-01-05 0.003448

...

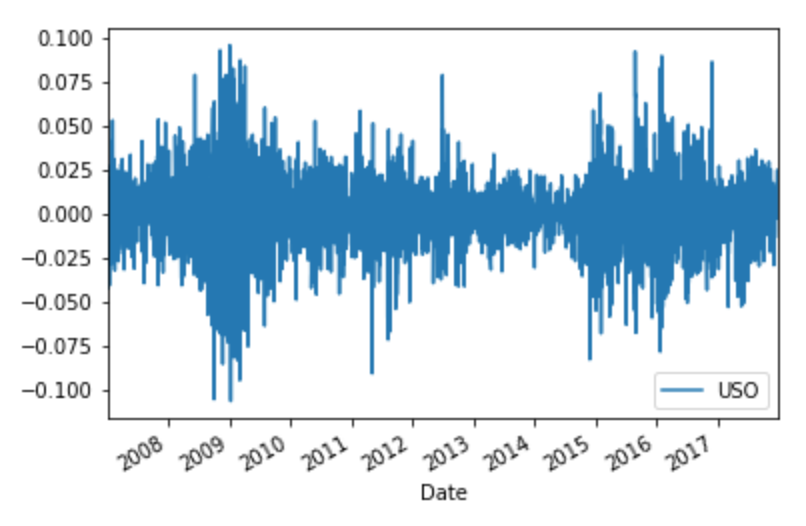

Plotting portfolio returns in Python

To plot the daily returns in Python:

StockPrices["Returns"] = StockPrices["Adj Close"].pct_change()

StockReturns = StockPrices["Returns"]

StockReturns.plot()

Plotting portfolio cumulative returns

In order to plot the cumulative returns of multiple portfolios:

import matplotlib.pyplot as plt

CumulativeReturns = ((1 + StockReturns).cumprod() - 1)

CumulativeReturns[["Portfolio","Portfolio_EW"]].plot()

Market capitalization

Market capitalization

Market capitalization: The value of a company's publicly traded shares.

Also referred to as Market cap.

Market-cap weighted portfolios

In order to calculate the market cap weight of a given stock n:

$$ w_{mcap_n} = \frac{mcap_n}{ \sum_{i=1}^n mcap_i } $$

Market-Cap weights in Python

To calculate market cap weights in python, assuming you have data on the market caps of each company:

import numpy as np

market_capitalizations = np.array([100, 200, 100, 100])

mcap_weights = market_capitalizations/sum(market_capitalizations)

mcap_weights

array([0.2, 0.4, 0.2, 0.2])

Let's practice!

Introduction to Portfolio Risk Management in Python