VaR extensions

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

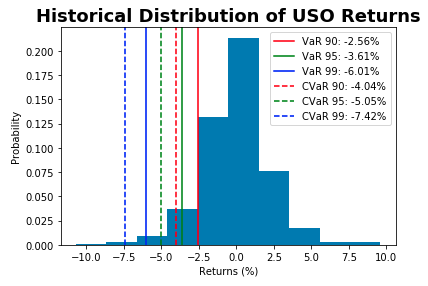

VaR quantiles

Empirical assumptions

Empirical historical values are those that have actually occurred.

How do you simulate the probability of a value that has never occurred historically before?

Sample from a probability distribution

Parametric VaR in Python

Assuming you have an object StockReturns which is a time series of stock returns.

To calculate parametric VaR(95):

mu = np.mean(StockReturns)

std = np.std(StockReturns)

confidence_level = 0.05

VaR = norm.ppf(confidence_level, mu, std)

VaR

-0.0235

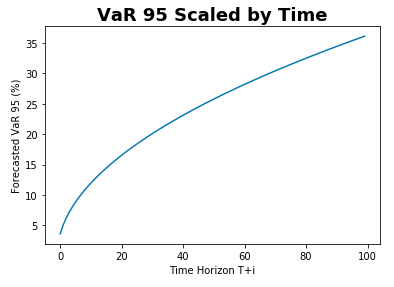

Scaling risk

Scaling risk in Python

Assuming you have a one-day estimate of VaR(95) var_95.

To estimate 5-day VaR(95):

forecast_days = 5

forecast_var95_5day = var_95*np.sqrt(forecast_days)

forecast_var95_5day

-0.0525

Let's practice!

Introduction to Portfolio Risk Management in Python