Alpha and multi-factor models

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

The Fama-French 3 factor Model

$$ R_{P} = $$

$$ RF + \beta_{M}(R_{M}-RF)+b_{SMB} \cdot SMB + b_{HML} \cdot HML + \alpha $$

- SMB: The small minus big factor

- $b_{SMB}$: Exposure to the SMB factor

- HML: The high minus low factor

- $b_{HML}$: Exposure to the HML factor

- $\alpha $: Performance which is unexplained by any other factors

- $\beta_{M}$: Beta to the broad market portfolio B

The Fama-French 3 factor model

The Fama-French 3 factor model in Python

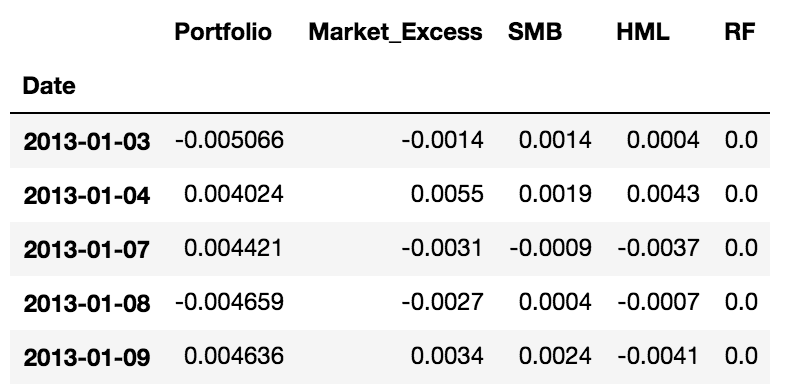

Assuming you already have excess portfolio and market returns in the object Data:

import statsmodels.formula.api as smf

model = smf.ols(formula='Port_Excess ~ Mkt_Excess + SMB + HML',

data=Data)

fit = model.fit()

adjusted_r_squared = fit.rsquared_adj

adjusted_r_squared

0.90

P-values and statistical significance

To extract the HML p-value, assuming you have a fitted regression model object in your workspace as fit:

fit.pvalues["HML"]

0.0063

To test if it is statistically significant, simply examine whether or not it is less than a given threshold, normally 0.05:

fit.pvalues["HML"] < 0.05

True

Extracting coefficients

To extract the HML coefficient, assuming you have a fitted regression model object in your workspace as fit:

fit.params["HML"]

0.502

fit.params["SMB"]

-0.243

Alpha and the efficient market hypothesis

Assuming you already have a fitted regression analysis in the object fit:

portfolio_alpha = fit.params["Intercept"]

portfolio_alpha_annualized = ((1 + portfolio_alpha) ** 252) - 1

portfolio_alpha_annualized

0.045

Let's practice!

Introduction to Portfolio Risk Management in Python