Random walks

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

Random walks

Most often, random walks in finance are rather simple compared to physics:

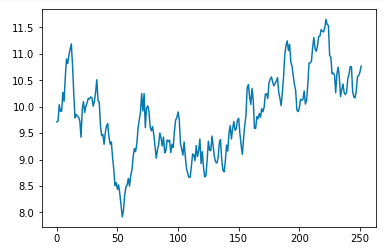

Random walks in Python

Assuming you have an object StockReturns which is a time series of stock returns.

To simulate a random walk:

mu = np.mean(StockReturns)

std = np.std(StockReturns)

T = 252

S0 = 10

rand_rets = np.random.normal(mu, std, T) + 1

forecasted_values = S0 * (rand_rets.cumprod())

forecasted_values

array([ 9.71274884, 9.72536923, 10.03605425 ... ])

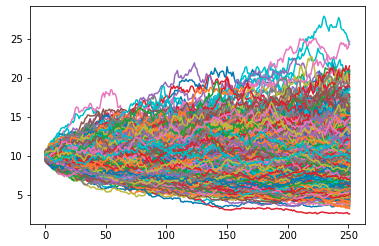

Monte Carlo simulations

A series of Monte Carlo simulations of a single asset starting at stock price $10 at T0. Forecasted for 1 year (252 trading days along the x-axis):

Monte Carlo VaR in Python

To calculate the VaR(95) of 100 Monte Carlo simulations:

mu = 0.0005

vol = 0.001

T = 252

sim_returns = []

for i in range(100):

rand_rets = np.random.normal(mu, vol, T)

sim_returns.append(rand_rets)

var_95 = np.percentile(sim_returns, 5)

var_95

-0.028

Let's practice!

Introduction to Portfolio Risk Management in Python