Expanding the 3-factor model

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

Fama French 1993

The original paper that started it all:

Cliff Assness on Momentum

A paper published later by Cliff Asness from AQR:

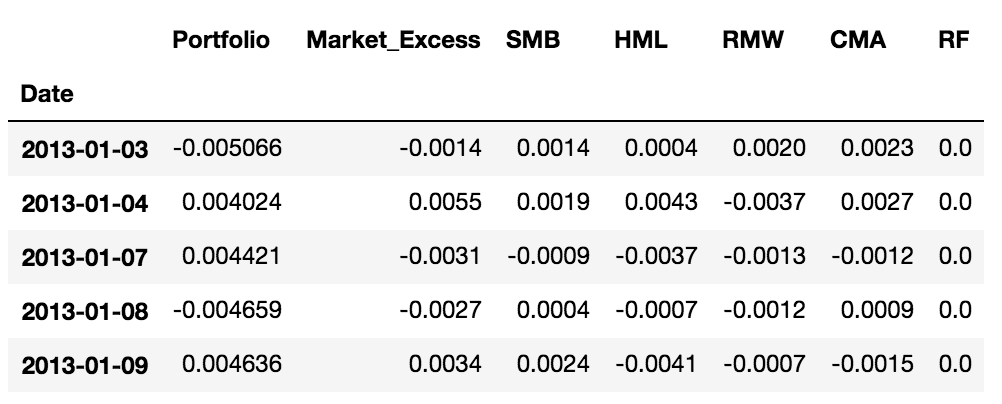

The Fama-French 5 factor model

In 2015, Fama and French extended their previous 3-factor model, adding two additional factors:

- RMW: Profitability

- CMA: Investment

The RMW factor represents the returns of companies with high operating profitability versus those with low operating profitability.

The CMA factor represents the returns of companies with aggressive investments versus those who are more conservative.

The Fama-French 5 factor model

The Fama-French 5 factor model in Python

Assuming you already have excess portfolio and market returns in the object Data:

import statsmodels.formula.api as smf

model = smf.ols(formula='Port_Excess ~ Mkt_Excess + SMB + HML + RMW + CMA',

data=Data)

fit = model.fit()

adjusted_r_squared = fit.rsquared_adj

adjusted_r_squared

0.92

Let's practice!

Introduction to Portfolio Risk Management in Python