Estimating tail risk

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

Estimating tail risk

Tail risk is the risk of extreme investment outcomes, most notably on the negative side of a distribution.

- Historical Drawdown

- Value at Risk

- Conditional Value at Risk

- Monte-Carlo Simulation

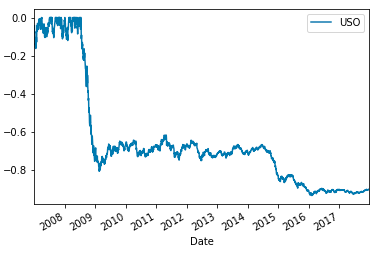

Historical drawdown

Drawdown is the percentage loss from the highest cumulative historical point.

$$ \text{Drawdown} = \frac{r_t}{RM} - 1$$

- $r_t$: Cumulative return at time t

- $RM$: Running maximum

Historical Drawdown of the USO Oil ETF

Historical drawdown in Python

Assuming cum_rets is an np.array of cumulative returns over time

running_max = np.maximum.accumulate(cum_rets)

running_max[running_max < 1] = 1

drawdown = (cum_rets) / running_max - 1

drawdown

Date Return

2007-01-03 -0.042636

2007-01-04 -0.081589

2007-01-05 -0.073062

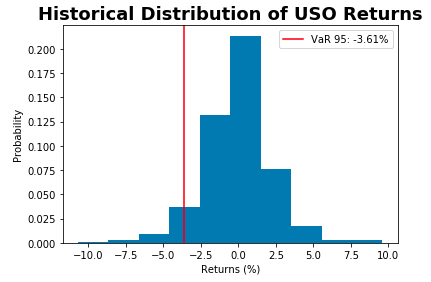

Historical Value at Risk

Value at Risk, or VaR, is a threshold with a given confidence level that losses will not (or more accurately, will not historically) exceed a certain level.

VaR is commonly quoted with quantiles such as 95, 99, and 99.9.

Example: VaR(95) = -2.3%

95% certain that losses will not exceed -2.3% in a given day based on historical values.

Historical Value at Risk in Python

var_level = 95

var_95 = np.percentile(StockReturns, 100 - var_level)

var_95

-0.023

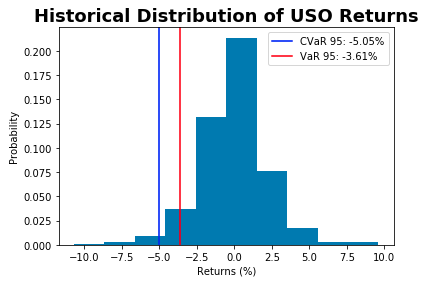

Historical expected shortfall

Conditional Value at Risk, or CVaR, is an estimate of expected losses sustained in the worst 1 - x% of scenarios.

CVaR is commonly quoted with quantiles such as 95, 99, and 99.9.

Example: CVaR(95) = -2.5%

In the worst 5% of cases, losses were on average exceed -2.5% historically.

Historical expected shortfall in Python

Assuming you have an object StockReturns which is a time series of stock returns.

To calculate historical CVaR(95):

var_level = 95

var_95 = np.percentile(StockReturns, 100 - var_level)

cvar_95 = StockReturns[StockReturns <= var_95].mean()

cvar_95

-0.025

Let's practice!

Introduction to Portfolio Risk Management in Python