Correlation and co-variance

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

Pearson correlation

Examples of different correlations between two random variables:

Pearson correlation

A heatmap of a correlation matrix:

Correlation matrix in Python

Assuming StockReturns is a pandas DataFrame of stock returns, you can calculate the correlation matrix as follows:

correlation_matrix = StockReturns.corr()

print(correlation_matrix)

Portfolio standard deviation

Portfolio standard deviation for a two asset portfolio:

$$ \sigma_p = \sqrt{ w_1^2 \sigma_1^2 + w_2^2 \sigma_2^2 + 2 w_1 w_2 \rho_{1, 2} \sigma_1 \sigma_2 }$$

- $\sigma_p$: Portfolio standard deviation

- w: Asset weight

- $\sigma$: Asset volatility

- $\rho_{1, 2}$: Correlation between assets 1 and 2

The Co-variance matrix

To calculate the co-variance matrix ($ \Sigma $) of returns X:

The Co-variance matrix in Python

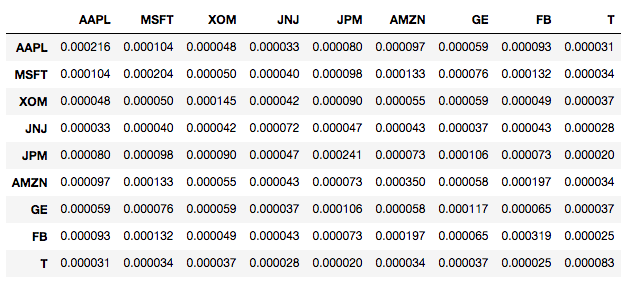

Assuming StockReturns is a pandas DataFrame of stock returns, you can calculate the covariance matrix as follows:

cov_mat = StockReturns.cov()

cov_mat

Annualizing the covariance matrix

To annualize the covariance matrix:

cov_mat_annual = cov_mat * 252

Portfolio standard deviation using covariance

The formula for portfolio volatility is:

$$ \sigma_{Portfolio} = \sqrt{ w_T \cdot \Sigma \cdot w } $$

- $ \sigma_{Portfolio} $: Portfolio volatility

- $ \Sigma $: Covariance matrix of returns

- w: Portfolio weights ($ w_T $ is transposed portfolio weights)

- $ \cdot $ The dot-multiplication operator

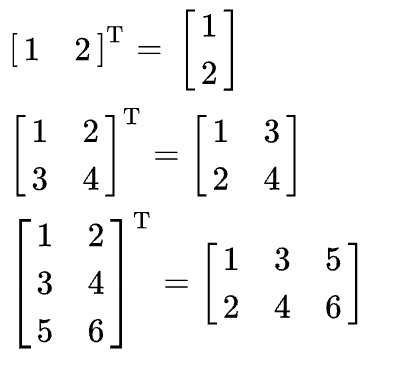

Matrix transpose

Examples of matrix transpose operations:

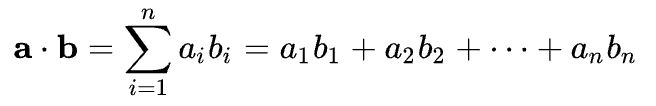

Dot product

The dot product operation of two vectors a and b:

Portfolio standard deviation using Python

To calculate portfolio volatility assume a weights array and a covariance matrix:

import numpy as np

port_vol = np.sqrt(np.dot(weights.T, np.dot(cov_mat, weights)))

port_vol

0.035

Let's practice!

Introduction to Portfolio Risk Management in Python