Financial returns

Introduction to Portfolio Risk Management in Python

Dakota Wixom

Quantitative Analyst | QuantCourse.com

Course overview

Learn how to analyze investment return distributions, build portfolios and reduce risk, and identify key factors which are driving portfolio returns.

- Univariate Investment Risk

- Portfolio Investing

- Factor Investing

- Forecasting and Reducing Risk

Investment risk

What is Risk?

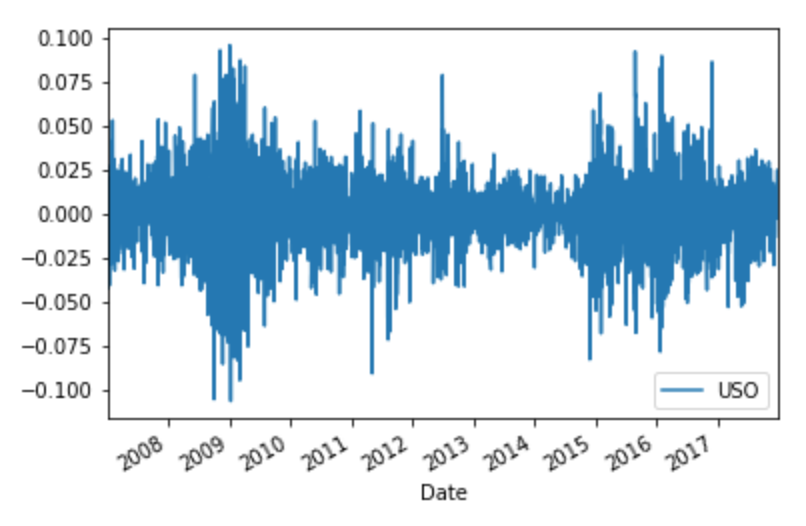

- Risk in financial markets is a measure of uncertainty

- Dispersion or variance of financial returns

How do you typically measure risk?

- Standard deviation or variance of daily returns

- Kurtosis of the daily returns distribution

- Skewness of the daily returns distribution

- Historical drawdown

Financial risk

Returns

Probability

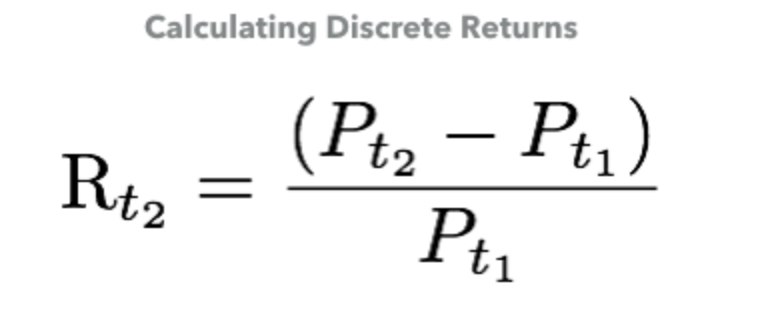

A tale of two returns

- Returns are derived from stock prices

- Discrete returns (simple returns) are the most commonly used, and represent periodic (e.g. daily, weekly, monthly, etc.) price movements

- Log returns are often used in academic research and financial modeling. They assume continuous compounding.

Calculating stock returns

- Discrete returns are calculated as the change in price as a percentage of the previous period's price

Calculating log returns

- Log returns are calculated as the difference between the log of two prices

- Log returns aggregate across time, while discrete returns aggregate across assets

$$ Rl = \ln(\frac{P_{t_2}}{P_{t_1}}) $$

or equivalently

$$ Rl = \ln(P_{t_2}) - \ln(P_{t_1}) $$

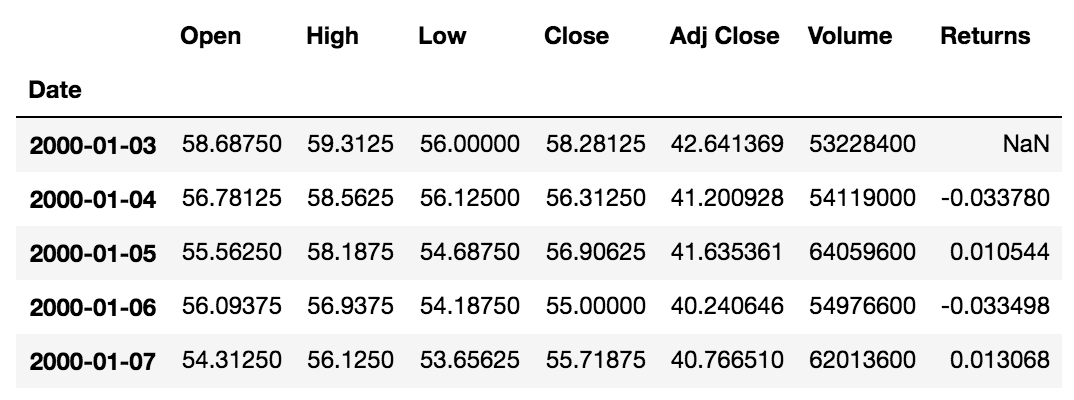

Calculating stock returns in Python

Step 1:

Load in stock prices data and store it as a pandas DataFrame organized by date:

import pandas as pd

StockPrices = pd.read_csv('StockData.csv', parse_dates=['Date'])

StockPrices = StockPrices.sort_values(by='Date')

StockPrices.set_index('Date', inplace=True)

Calculating stock Returns in Python

Step 2:

Calculate daily returns of the adjusted close prices and append the returns as a new column in the DataFrame.

StockPrices["Returns"] = StockPrices["Adj Close"].pct_change()

StockPrices["Returns"].head()

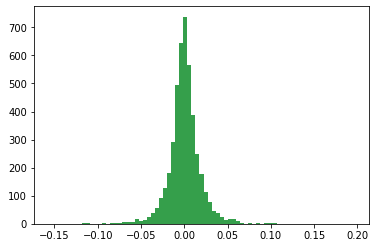

Visualizing return distributions

import matplotlib.pyplot as plt

plt.hist(StockPrices["Returns"].dropna(), bins=75, density=False)

plt.show()

Let's practice!

Introduction to Portfolio Risk Management in Python