Machine learning for MPT

Machine Learning for Finance in Python

Nathan George

Data Science Professor

Make train and test sets

# make train and test features

train_size = int(0.8 * features.shape[0])

train_features = features[:train_size]

train_targets = targets[:train_size]

test_features = features[train_size:]

test_targets = targets[train_size:]

print(features.shape)

(230, 3)

Fit the model

from sklearn.ensemble import RandomForestRegressor # fit the model and check scores on train and test rfr = RandomForestRegressor(n_estimators=300, random_state=42) rfr.fit(train_features, train_targets)print(rfr.score(train_features, train_targets)) print(rfr.score(test_features, test_targets))

0.8382262317599827

0.09504859048985377

Evaluate the model's performance

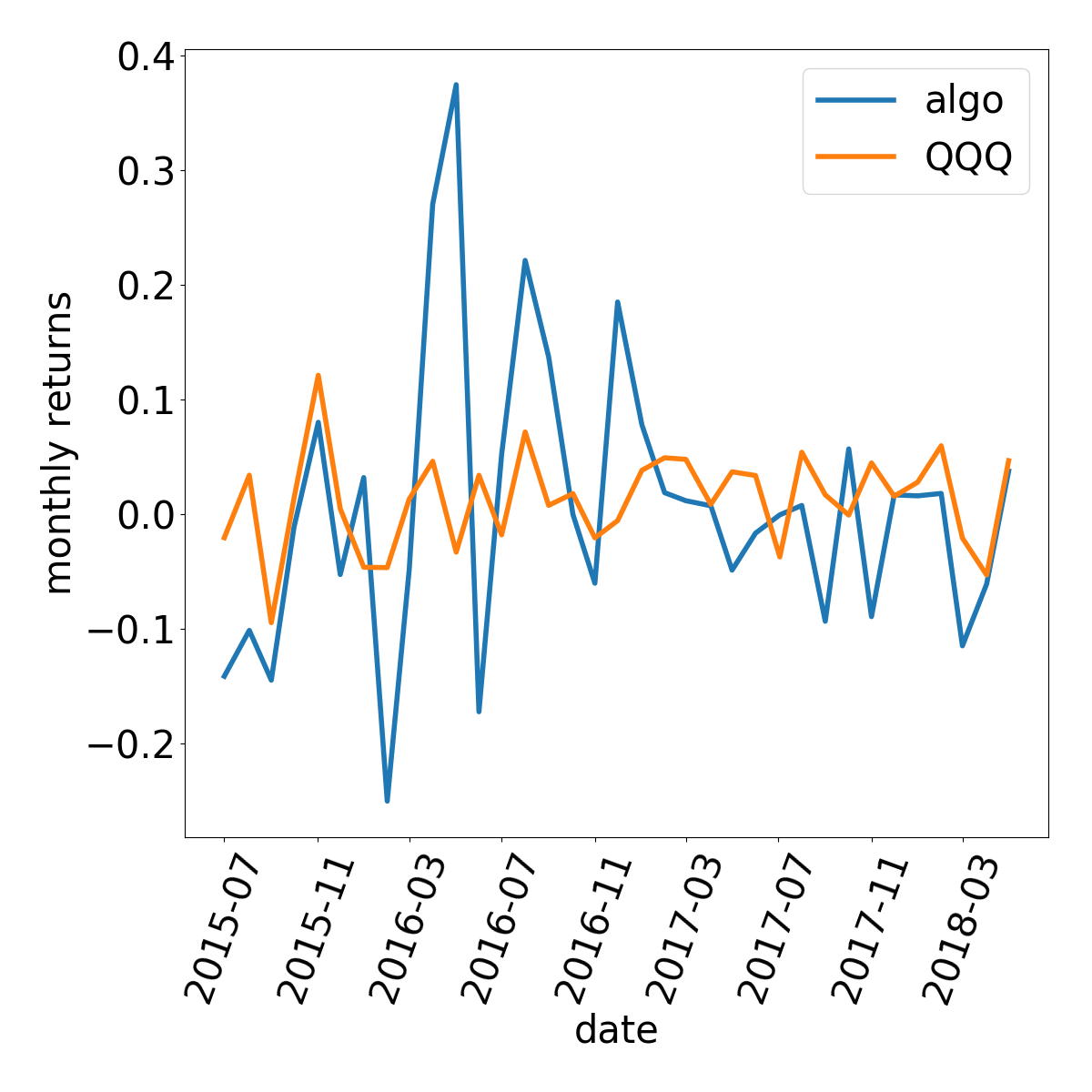

# get predictions from model on train and test test_predictions = rfr.predict(test_features)# calculate and plot returns from our RF predictions and the QQQ returns test_returns = np.sum(returns_monthly.iloc[train_size:] * test_predictions, axis=1)plt.plot(test_returns, label='algo') plt.plot(returns_monthly['QQQ'].iloc[train_size:], label='QQQ') plt.legend() plt.show()

cash = 1000 algo_cash = [cash]for r in test_returns: cash *= 1 + r algo_cash.append(cash)# calculate performance for QQQ cash = 1000 # reset cash amount qqq_cash = [cash] for r in returns_monthly['QQQ'].iloc[train_size:]: cash *= 1 + r qqq_cash.append(cash)print('algo returns:', (algo_cash[-1] - algo_cash[0]) / algo_cash[0]) print('QQQ returns:', (qqq_cash[-1] - qqq_cash[0]) / qqq_cash[0])

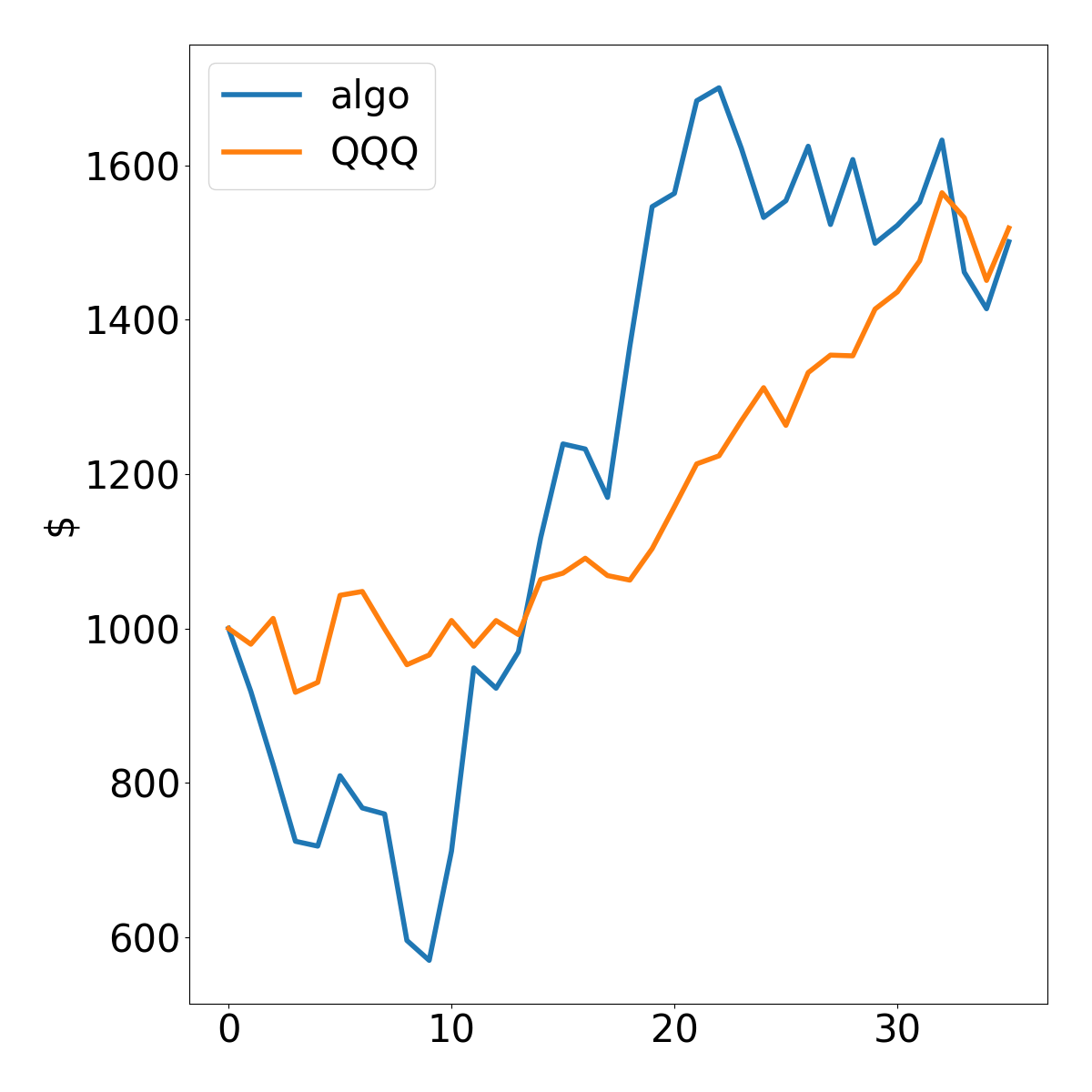

algo returns: 0.5009443507049591

QQQ returns: 0.5186775933696601

Plot the results

plt.plot(algo_cash, label='algo')

plt.plot(qqq_cash, label='QQQ')

plt.ylabel('$')

plt.legend() # show the legend

plt.show()

Train your model!

Machine Learning for Finance in Python