Feature importances and gradient boosting

Machine Learning for Finance in Python

Nathan George

Data Science Professor

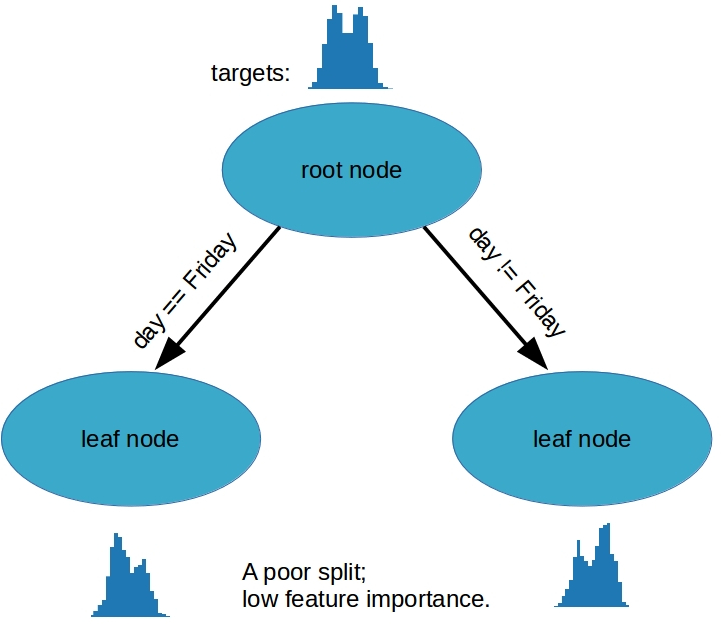

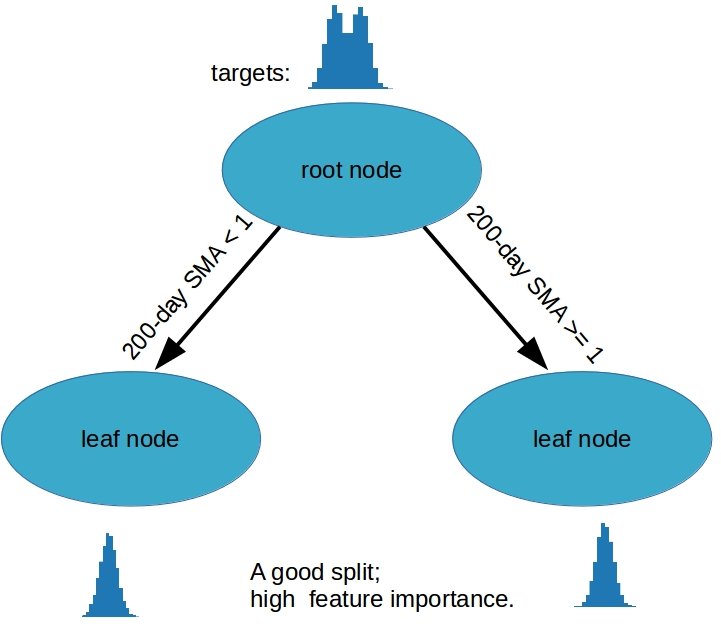

Extracting feature importances

from sklearn.ensemble import RandomForestRegressor

random_forest = RandomForestRegressor()

random_forest.fit(train_features, train_targets)

feature_importances = random_forest.feature_importances_

print(feature_importances)

[0.07586547 0.10697602 0.12215955 0.23969227 0.29010304 0.0314028

0.11977058 0.00276721 0.00246329 0.0026431 0.00615667]

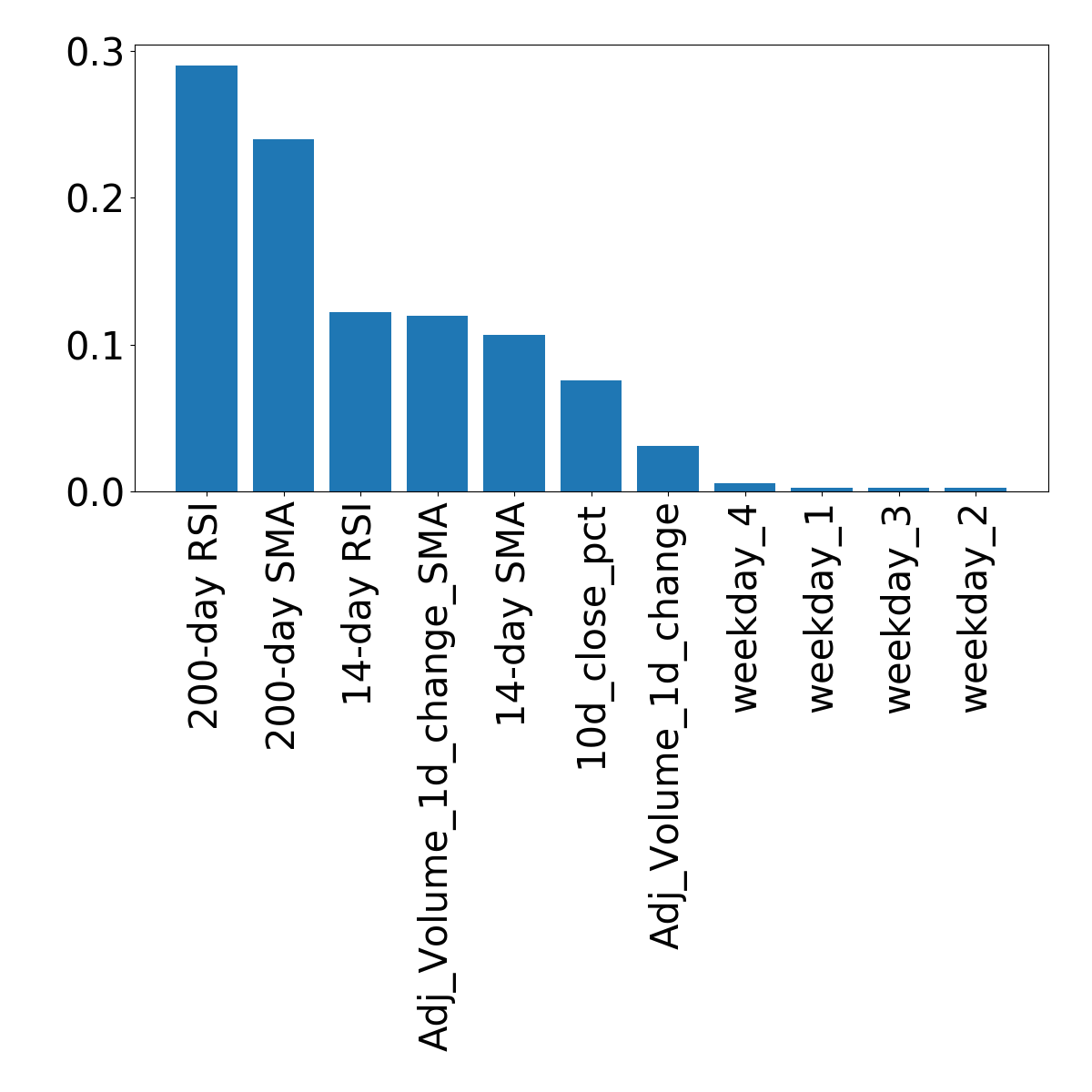

Sorting and plotting

# feature importances from random forest model importances = random_forest.feature_importances_ # index of greatest to least feature importances sorted_index = np.argsort(importances)[::-1]x = range(len(importances)) # create tick labels labels = np.array(feature_names)[sorted_index] plt.bar(x, importances[sorted_index], tick_label=labels) # rotate tick labels to vertical plt.xticks(rotation=90) plt.show()

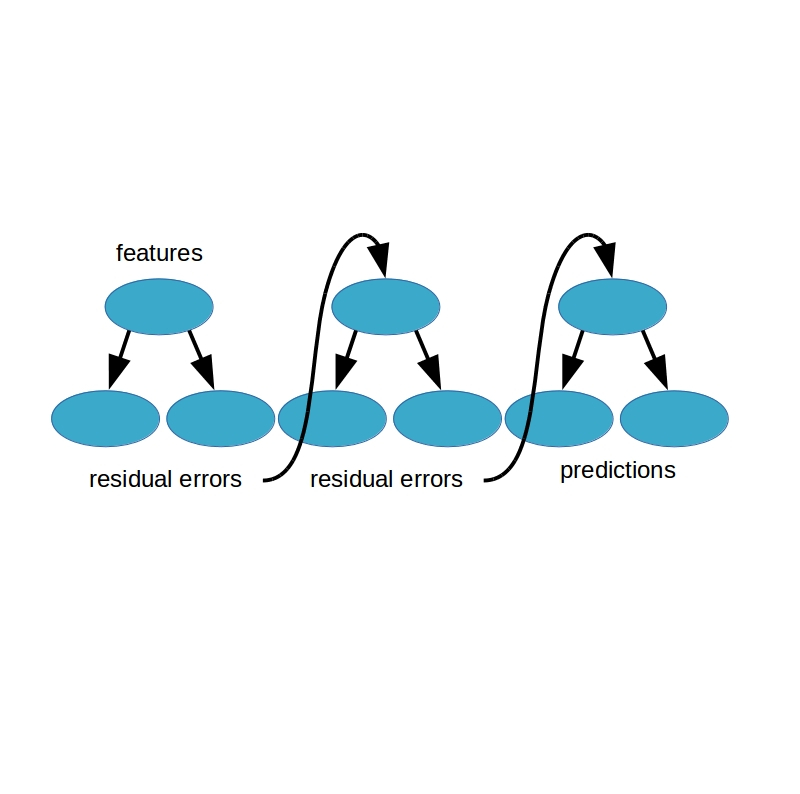

Linear models vs gradient boosting

Boosted models

Available boosted models:

- Gradient boosting

- Adaboost

Fitting a gradient boosting model

from sklearn.ensemble import GradientBoostingRegressor

gbr = GradientBoostingRegressor(max_features=4,

learning_rate=0.01,

n_estimators=200,

subsample=0.6,

random_state=42)

gbr.fit(train_features, train_targets)

Get boosted!

Machine Learning for Finance in Python