Overfitting and ensembling

Machine Learning for Finance in Python

Nathan George

Data Science Professor

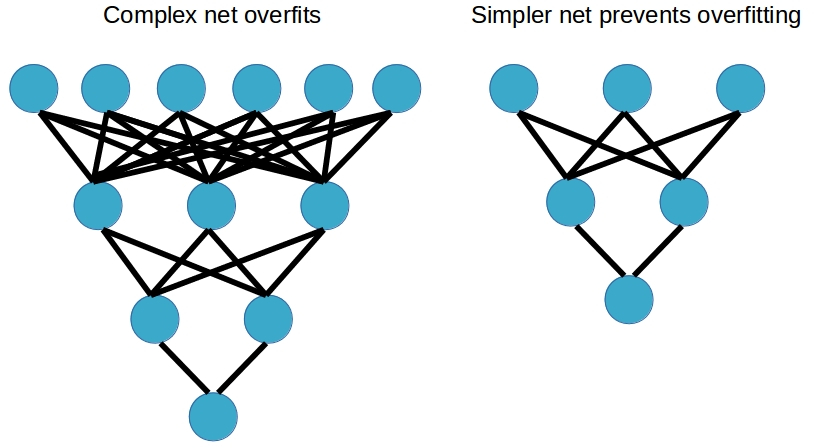

Simplify your model

Neural network options

Options to combat overfitting:

- Decrease number of nodes

- Use L1/L2 regulariation

- Dropout

- Autoencoder architecture

- Early stopping

- Adding noise to data

- Max norm constraints

- Ensembling

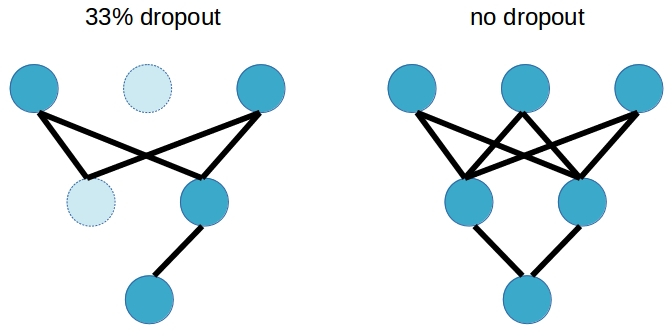

Dropout

Dropout in keras

from keras.layers import Dense, Dropoutmodel = Sequential() model.add(Dense(500, input_dim=scaled_train_features.shape[1], activation='relu')) model.add(Dropout(0.5)) model.add(Dense(100, activation='relu')) model.add(Dense(1, activation='linear'))

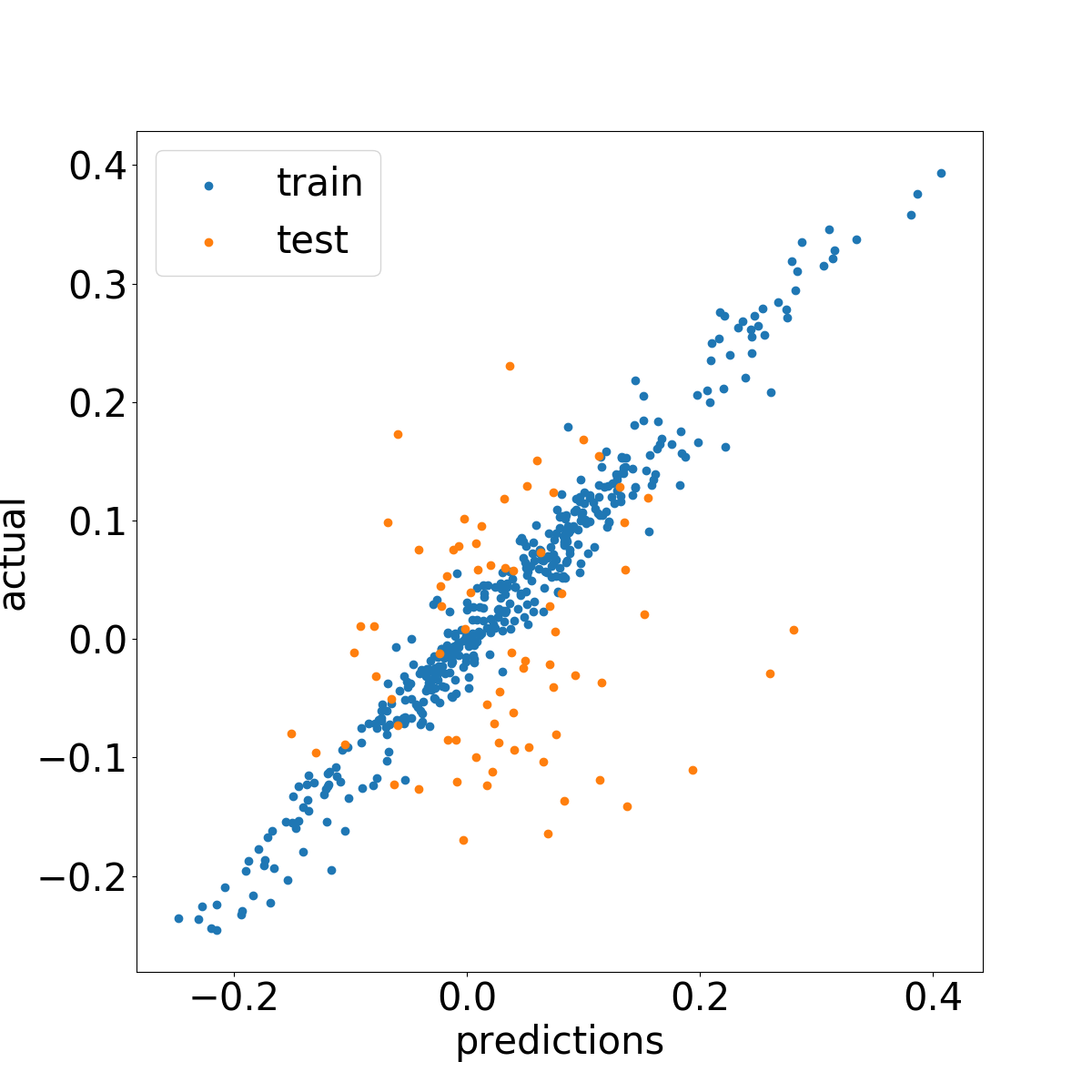

Test set comparison

R$^2$ values on AMD without dropout:

- train: 0.91

- test: -0.72

With dropout:

- train: 0.46

- test: -0.22

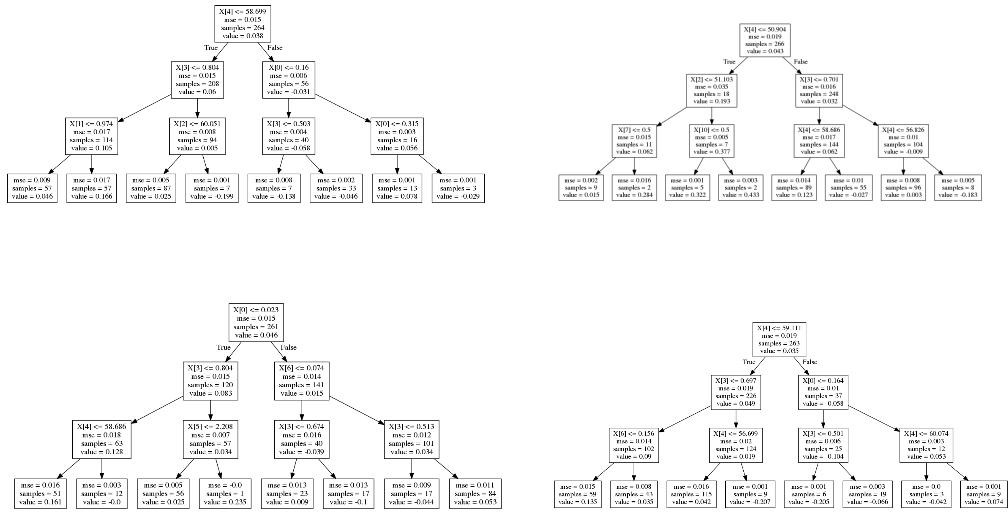

Ensembling

Implementing ensembling

# make predictions from 2 neural net models test_pred1 = model_1.predict(scaled_test_features) test_pred2 = model_2.predict(scaled_test_features)# horizontally stack predictions and take the average across rows test_preds = np.mean(np.hstack((test_pred1, test_pred2)), axis=1)

Comparing the ensemble

Model 1 R$^2$ score on test set:

- -0.179

model 2:

- -0.148

ensemble (averaged predictions):

- -0.146

Dropout and ensemble!

Machine Learning for Finance in Python