Sharpe ratios; features and targets

Machine Learning for Finance in Python

Nathan George

Data Science Professor

Getting our Sharpe ratios

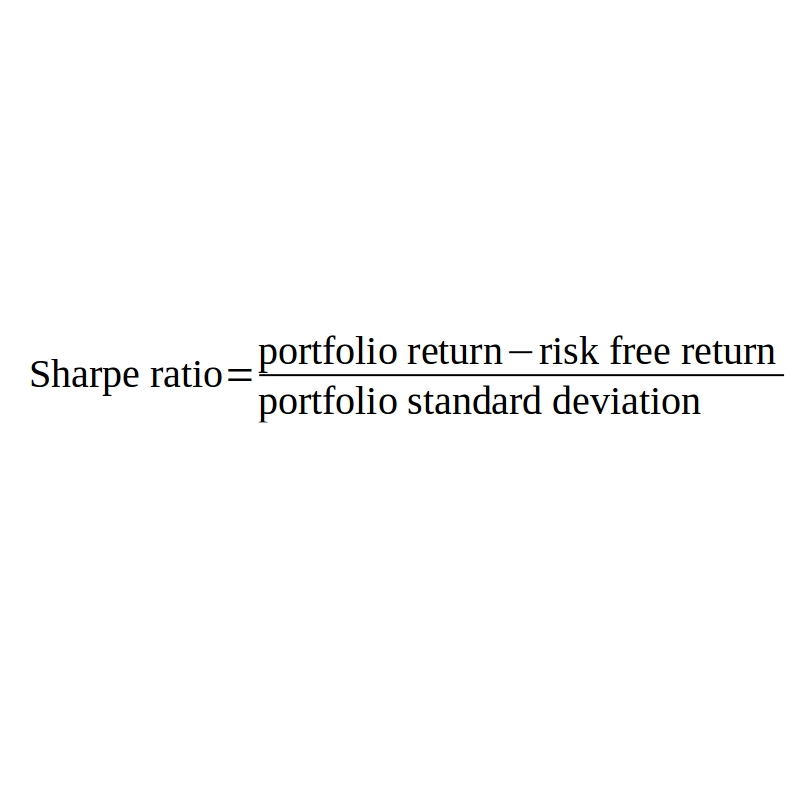

# empty dictionaries for sharpe ratios and best sharpe indexes by date sharpe_ratio, max_sharpe_idxs = {}, {}# loop through dates and get sharpe ratio for each portfolio for date in portfolio_returns.keys(): for i, ret in enumerate(portfolio_returns[date]): volatility = portfolio_volatility[date][i] sharpe_ratio.setdefault(date,[]).append(ret / volatility) # get the index of the best sharpe ratio for each date max_sharpe_idxs[date] = np.argmax(sharpe_ratio[date])

Create features

# calculate exponentially-weighted moving average of daily returns

ewma_daily = returns_daily.ewm(span=30).mean()

# resample daily returns to first business day of the month

ewma_monthly = ewma_daily.resample('BMS').first()

# shift ewma 1 month forward

ewma_monthly = ewma_monthly.shift(1).dropna()

Calculate features and targets

targets, features = [], []# create features from price history and targets as ideal portfolio for date, ewma in ewma_monthly.iterrows(): # get the index of the best sharpe ratio best_idx = max_sharpe_idxs[date] targets.append(portfolio_weights[date][best_idx]) features.append(ewma) targets = np.array(targets) features = np.array(features)

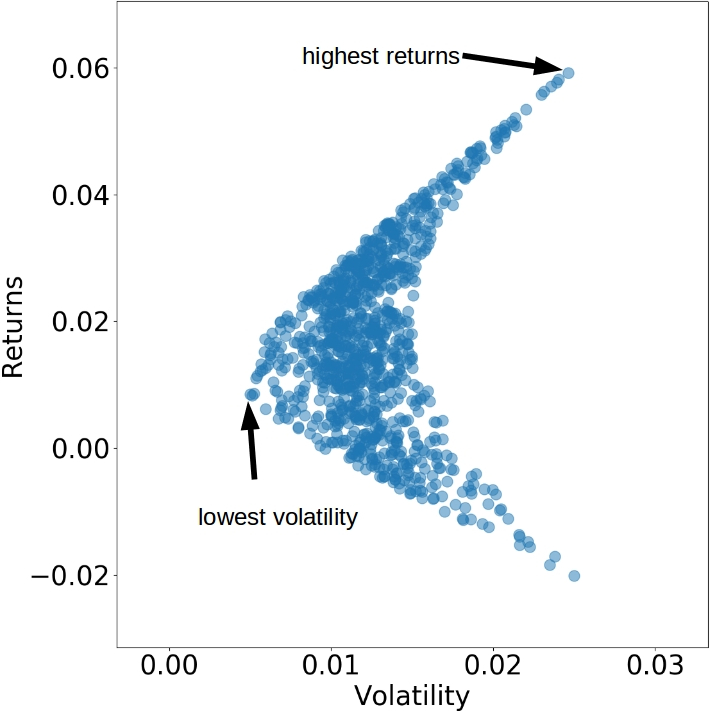

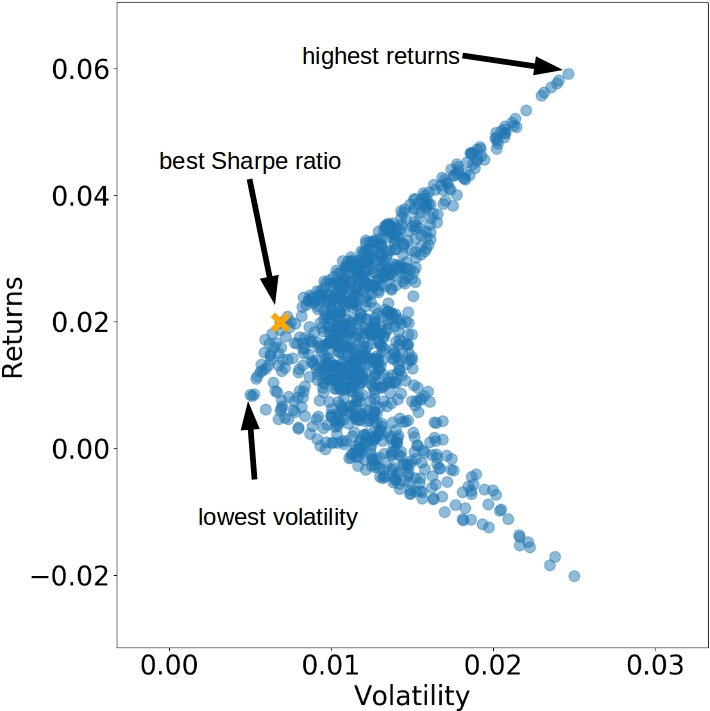

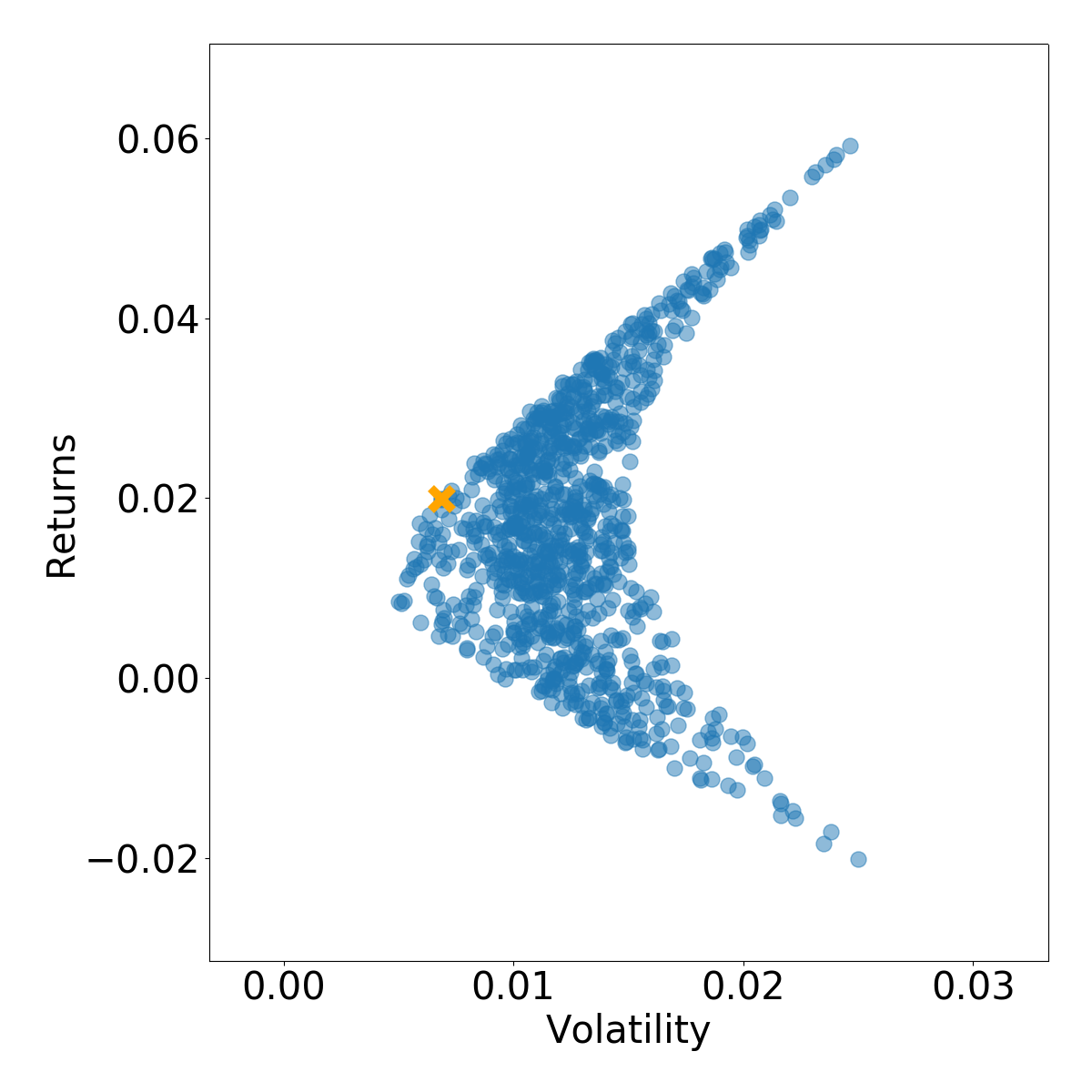

# latest date date = sorted(covariances.keys())[-1]cur_returns = portfolio_returns[date] cur_volatility = portfolio_volatility[date]plt.scatter(x=cur_volatility, y=cur_returns, alpha=0.1, color='blue') best_idx = max_sharpe_idxs[date] plt.scatter(cur_volatility[best_idx], cur_returns[best_idx], marker='x', color='orange') plt.xlabel('Volatility') plt.ylabel('Returns') plt.show()

Get Sharpe!

Machine Learning for Finance in Python