Random forests

Machine Learning for Finance in Python

Nathan George

Data Science Professor

Random forests

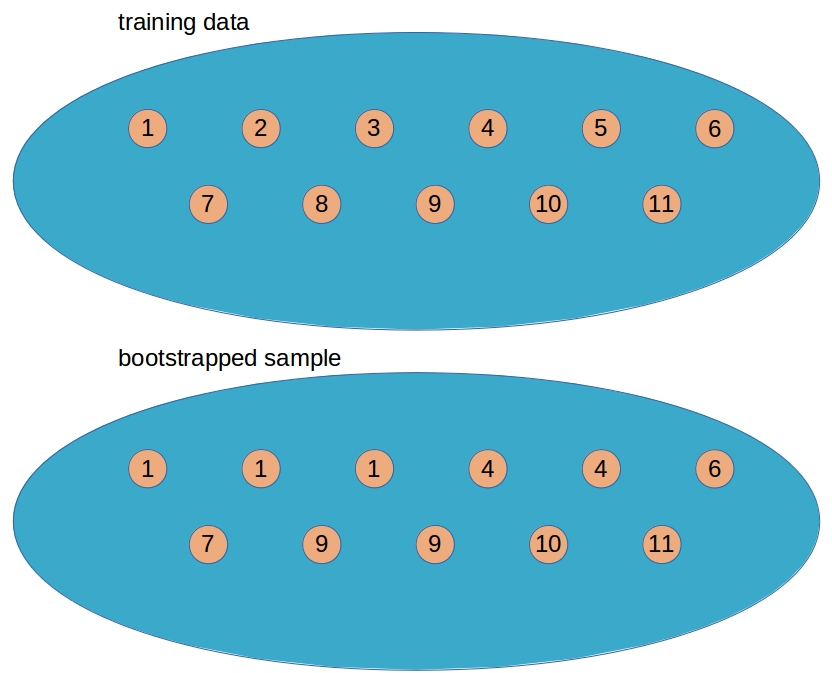

Bootstrap aggregating (bagging)

Feature sampling

Random Forests

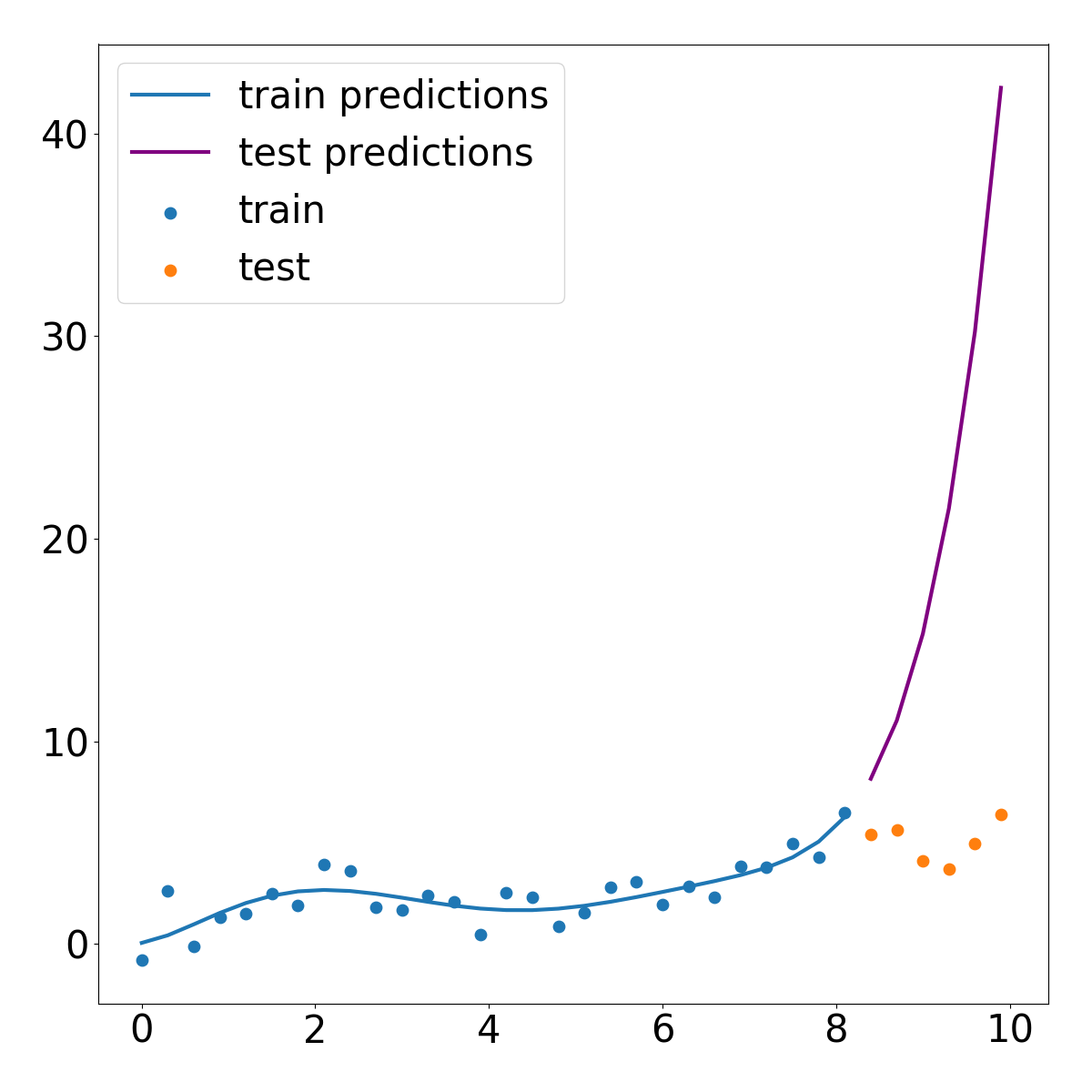

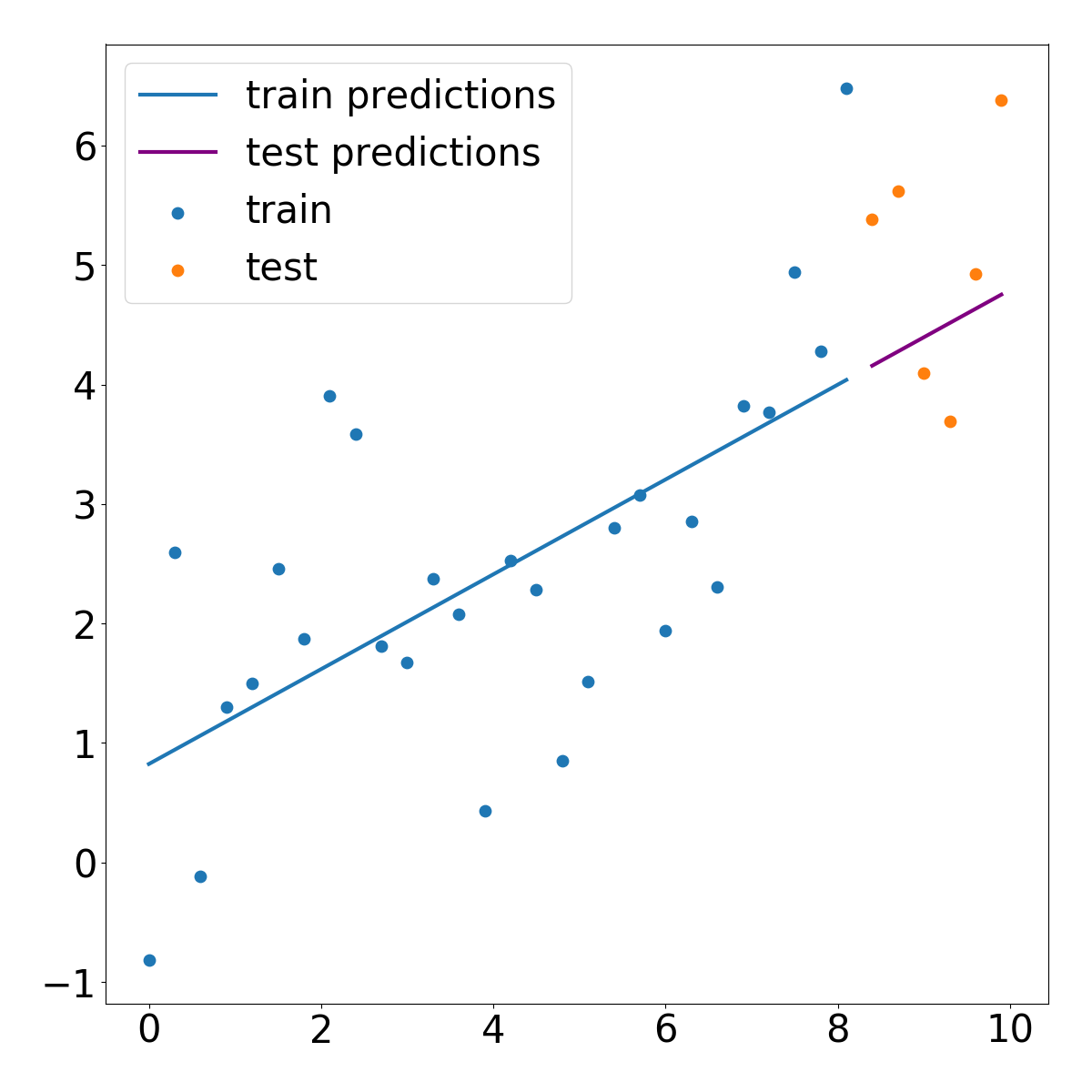

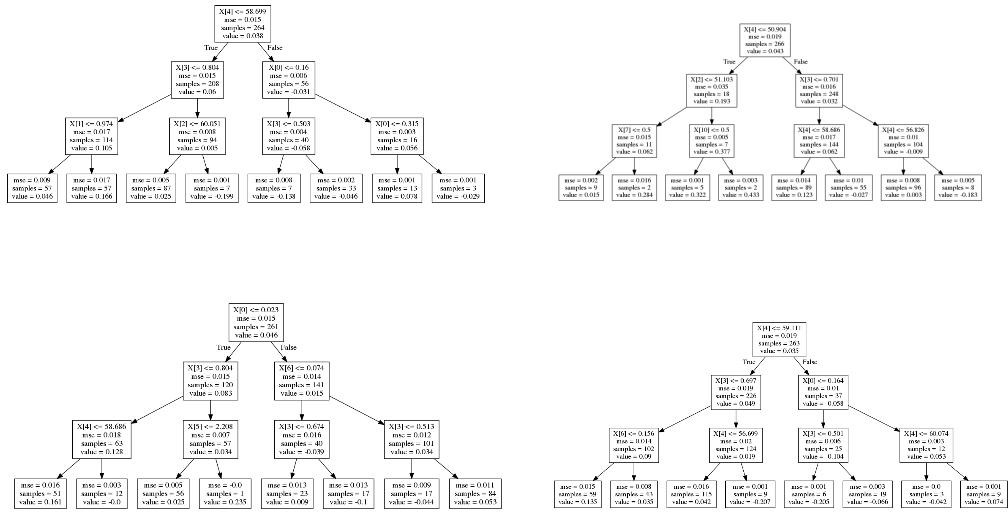

- A collection (ensemble) of decision trees

- Bootstrap aggregating (bagging)

- Sample of features at each split

sklearn implementation

from sklearn.ensemble import RandomForestRegressor

random_forest = RandomForestRegressor()

random_forest.fit(train_features, train_targets)

print(random_forest.score(train_features, train_targets))

Hyperparameters

random_forest = RandomForestRegressor(n_estimators=200,

max_depth=5,

max_features=4,

random_state=42)

ParameterGrid

from sklearn.model_selection import ParameterGrid grid = {'n_estimators': [200], 'max_depth':[3, 5], 'max_features': [4, 8]}from pprint import pprint pprint(list(ParameterGrid(grid)))

[{'max_depth': 3, 'max_features': 4, 'n_estimators': 200},

{'max_depth': 3, 'max_features': 8, 'n_estimators': 200},

{'max_depth': 5, 'max_features': 4, 'n_estimators': 200},

{'max_depth': 5, 'max_features': 8, 'n_estimators': 200}]

ParameterGrid

test_scores = [] # loop through the parameter grid, set hyperparameters, save the scores for g in ParameterGrid(grid): rfr.set_params(**g) # ** is "unpacking" the dictionary rfr.fit(train_features, train_targets) test_scores.append(rfr.score(test_features, test_targets))# find best hyperparameters from the test score and print best_idx = np.argmax(test_scores) print(test_scores[best_idx]) print(ParameterGrid(grid)[best_idx])

0.05594252725411142

{'max_depth': 5, 'max_features': 8, 'n_estimators': 200}

Plant some random forests!

Machine Learning for Finance in Python