Custom loss functions

Machine Learning for Finance in Python

Nathan George

Data Science Professor

MSE with directional penalty

If prediction and target direction match:

- $ \sum(y - \hat{y})^2$

If not:

- $\sum (y - \hat{y})^2 * \text{penalty} $

Implementing custom loss functions

import tensorflow as tf

Creating a function

import tensorflow as tf# create loss function def mean_squared_error(y_true, y_pred):

Mean squared error loss

import tensorflow as tf # create loss function def mean_squared_error(y_true, y_pred):loss = tf.square(y_true - y_pred) return tf.reduce_mean(loss, axis=-1)

Add custom loss to keras

import tensorflow as tf # create loss function def mean_squared_error(y_true, y_pred): loss = tf.square(y_true - y_pred) return tf.reduce_mean(loss, axis=-1)# enable use of loss with keras import keras.losses keras.losses.mean_squared_error = mean_squared_error

# fit the model with our mse loss function

model.compile(optimizer='adam', loss=mean_squared_error)

history = model.fit(scaled_train_features, train_targets, epochs=50)

Checking for correct direction

tf.less(y_true * y_pred, 0)

Correct direction:

- neg * neg = pos

- pos * pos = pos

Wrong direction:

- neg * pos = neg

- pos * neg = neg

Using tf.where()

# create loss function

def sign_penalty(y_true, y_pred):

penalty = 10.

loss = tf.where(tf.less(y_true * y_pred, 0),

penalty * tf.square(y_true - y_pred),

tf.square(y_true - y_pred))

Tying it together

# create loss function def sign_penalty(y_true, y_pred): penalty = 100. loss = tf.where(tf.less(y_true * y_pred, 0), penalty * tf.square(y_true - y_pred), tf.square(y_true - y_pred)) return tf.reduce_mean(loss, axis=-1)# enable use of loss with keras keras.losses.sign_penalty = sign_penalty

Using the custom loss

# create the model

model = Sequential()

model.add(Dense(50,

input_dim=scaled_train_features.shape[1],

activation='relu'))

model.add(Dense(10, activation='relu'))

model.add(Dense(1, activation='linear'))

# fit the model with our custom 'sign_penalty' loss function

model.compile(optimizer='adam', loss=sign_penalty)

history = model.fit(scaled_train_features, train_targets, epochs=50)

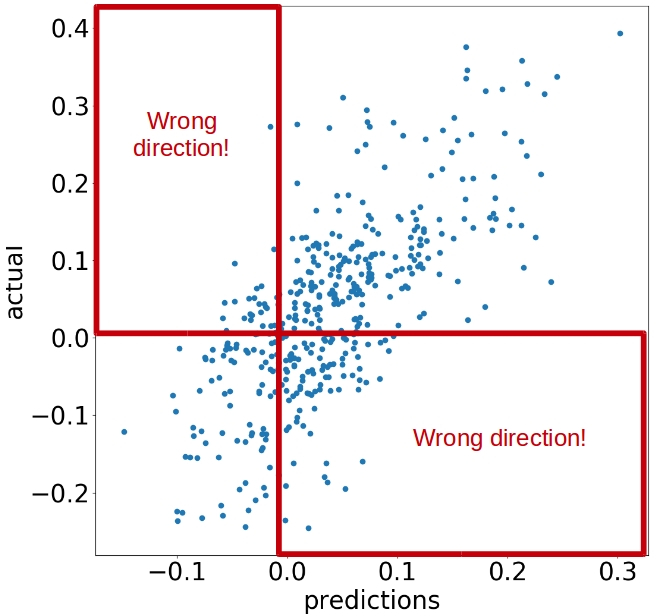

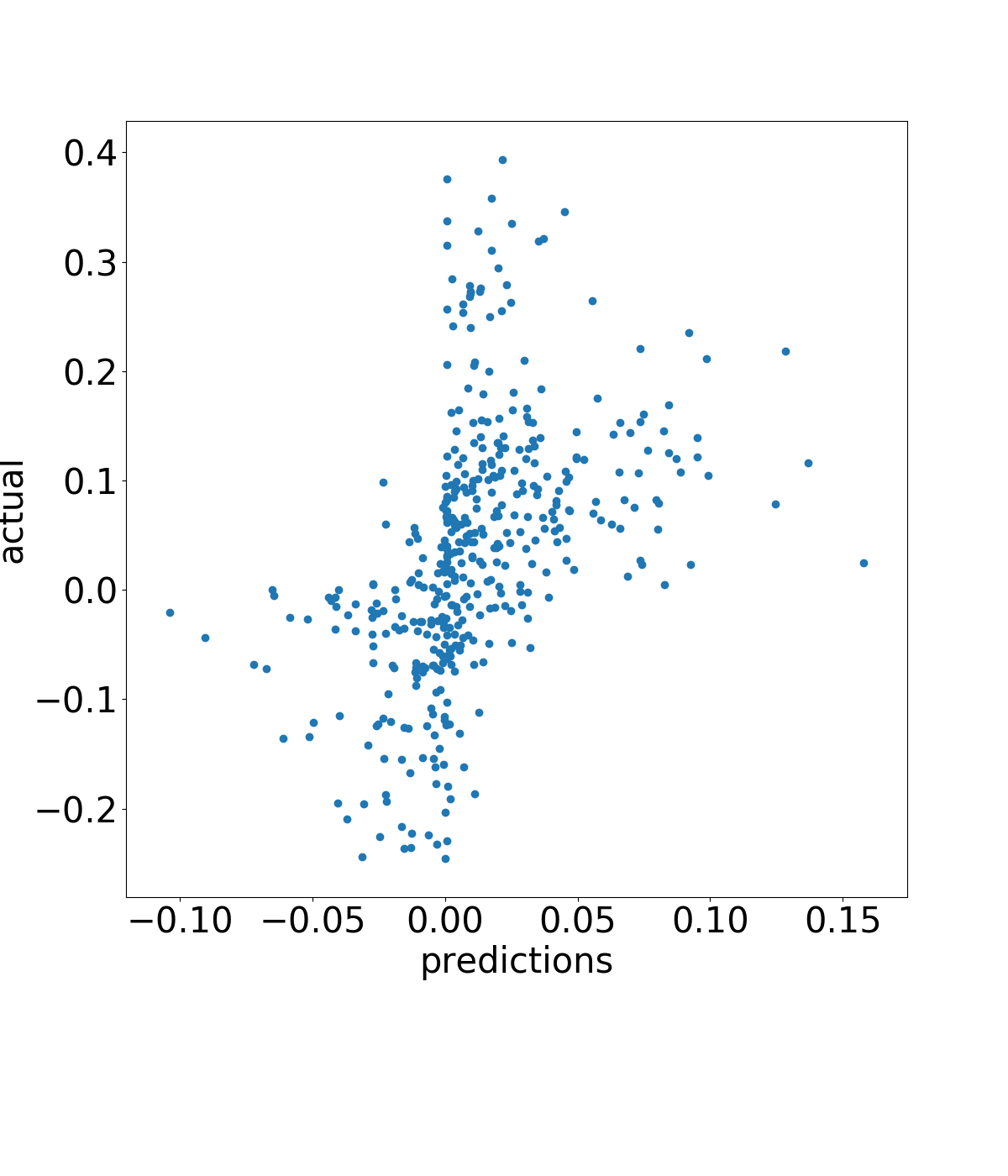

The bow-tie shape

train_preds = model.predict(scaled_train_features)

# scatter the predictions vs actual

plt.scatter(train_preds, train_targets)

plt.xlabel('predictions')

plt.ylabel('actual')

plt.show()

Create your own loss function!

Machine Learning for Finance in Python