Modern portfolio theory (MPT); efficient frontiers

Machine Learning for Finance in Python

Nathan George

Data Science Professor

Joining data

stocks = ['AMD', 'CHK', 'QQQ']

full_df = pd.concat([amd_df, chk_df, qqq_df], axis=1).dropna()

full_df.head()

AMD CHK QQQ

Date

1999-03-10 8.690 0.904417 45.479603

1999-03-11 8.500 0.951617 45.702324

1999-03-12 8.250 0.951617 44.588720

1999-03-15 8.155 0.951617 45.880501

1999-03-16 8.500 0.951617 46.281398

# calculate daily returns of stocks

returns_daily = full_df.pct_change()

# resample the full dataframe to monthly timeframe

monthly_df = full_df.resample('BMS').first()

# calculate monthly returns of the stocks

returns_monthly = monthly_df.pct_change().dropna()

print(returns_monthly.tail())

AMD CHK QQQ

Date

2018-01-01 0.023299 0.002445 0.028022

2018-02-01 0.206740 -0.156098 0.059751

2018-03-01 -0.101887 -0.190751 -0.020719

2018-04-02 -0.199160 0.060714 -0.052971

2018-05-01 0.167891 0.003367 0.046749

Covariances

# daily covariance of stocks (for each monthly period)

covariances = {}

for i in returns_monthly.index:

rtd_idx = returns_daily.index

# mask daily returns for each month (and year) & calculate covariance

mask = (rtd_idx.month == i.month) & (rtd_idx.year == i.year)

covariances[i] = returns_daily[mask].cov()

print(covariances[i])

AMD CHK QQQ

AMD 0.000257 0.000177 0.000068

CHK 0.000177 0.002057 0.000108

QQQ 0.000068 0.000108 0.000051

Generating portfolio weights

for date in covariances.keys():

cov = covariances[date]

for single_portfolio in range(5000):

weights = np.random.random(3)

weights /= np.sum(weights)

Calculating returns and volatility

portfolio_returns, portfolio_volatility, portfolio_weights = {},{},{} # get portfolio performances at each month for date in covariances.keys(): cov = covariances[date] for single_portfolio in range(5000): weights = np.random.random(3) weights /= np.sum(weights)returns = np.dot(weights, returns_monthly.loc[date]) volatility = np.sqrt(np.dot(weights.T, np.dot(cov, weights)))portfolio_returns.setdefault(date, []).append(returns) portfolio_volatility.setdefault(date, []).append(volatility) portfolio_weights.setdefault(date, []).append(weights)

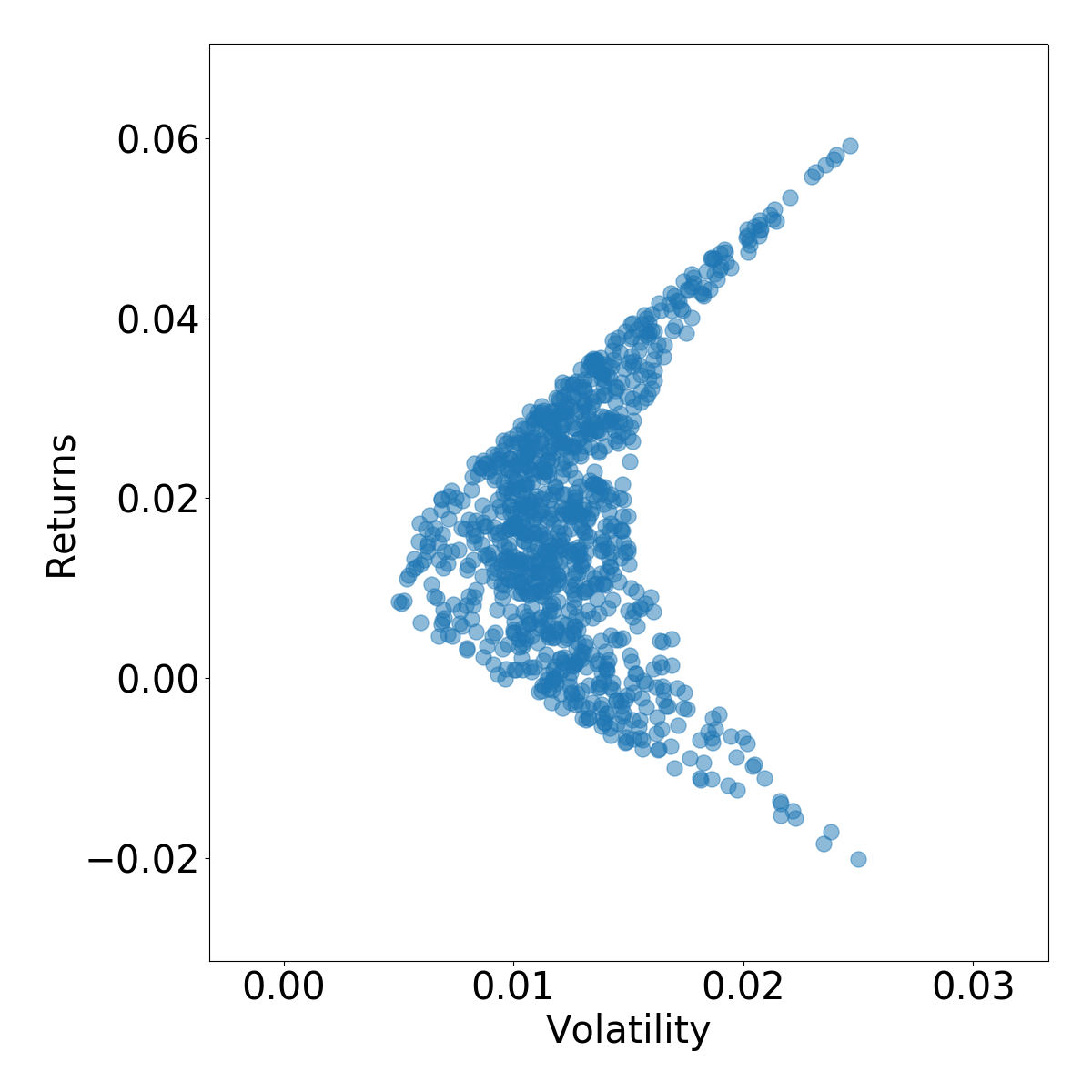

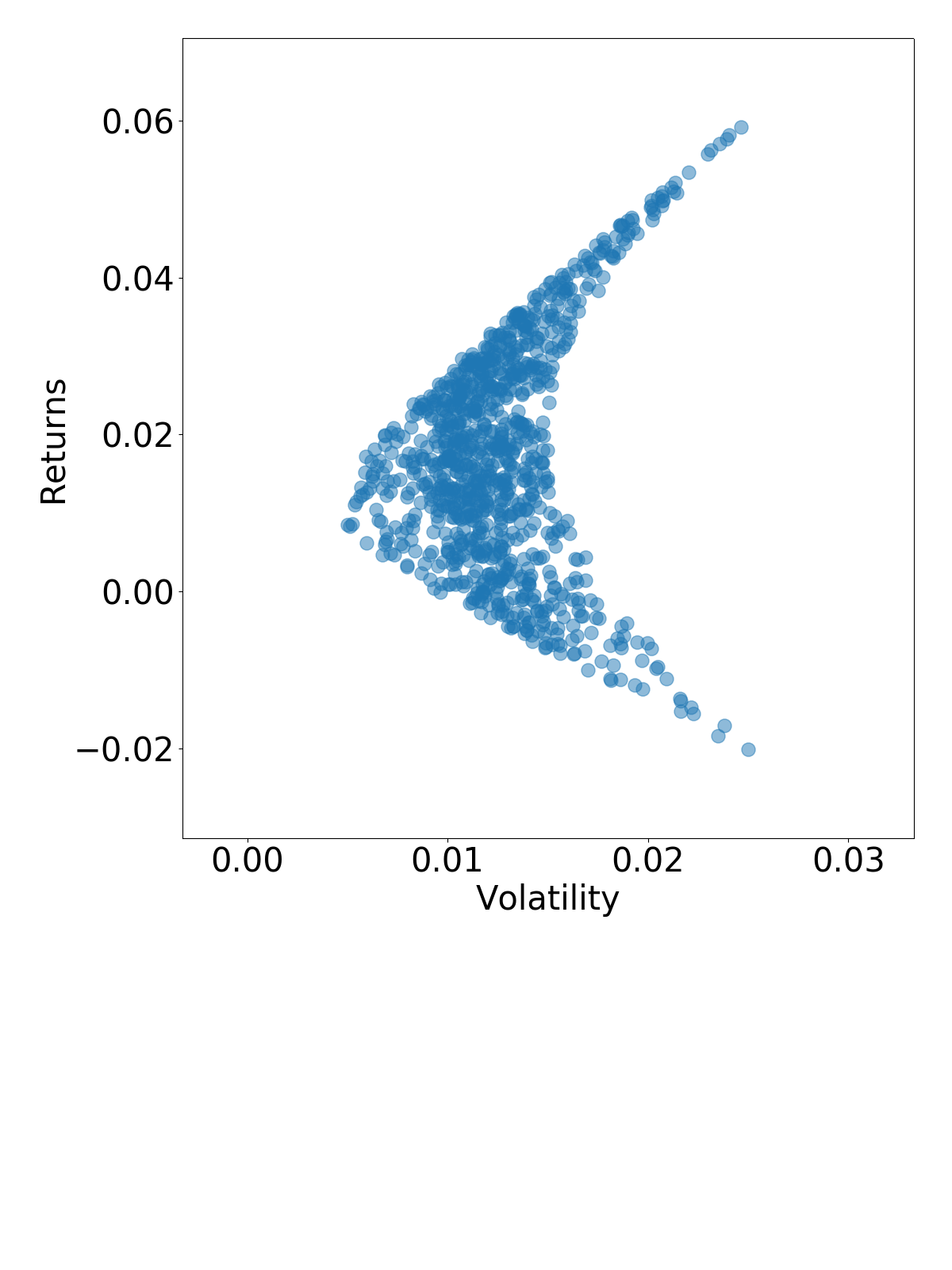

Plotting the efficient frontier

date = sorted(covariances.keys())[-1]

# plot efficient frontier

plt.scatter(x=portfolio_volatility[date],

y=portfolio_returns[date],

alpha=0.5)

plt.xlabel('Volatility')

plt.ylabel('Returns')

plt.show()

Calculate MPT portfolios!

Machine Learning for Finance in Python