Linear modeling with financial data

Machine Learning for Finance in Python

Nathan George

Data Science Professor

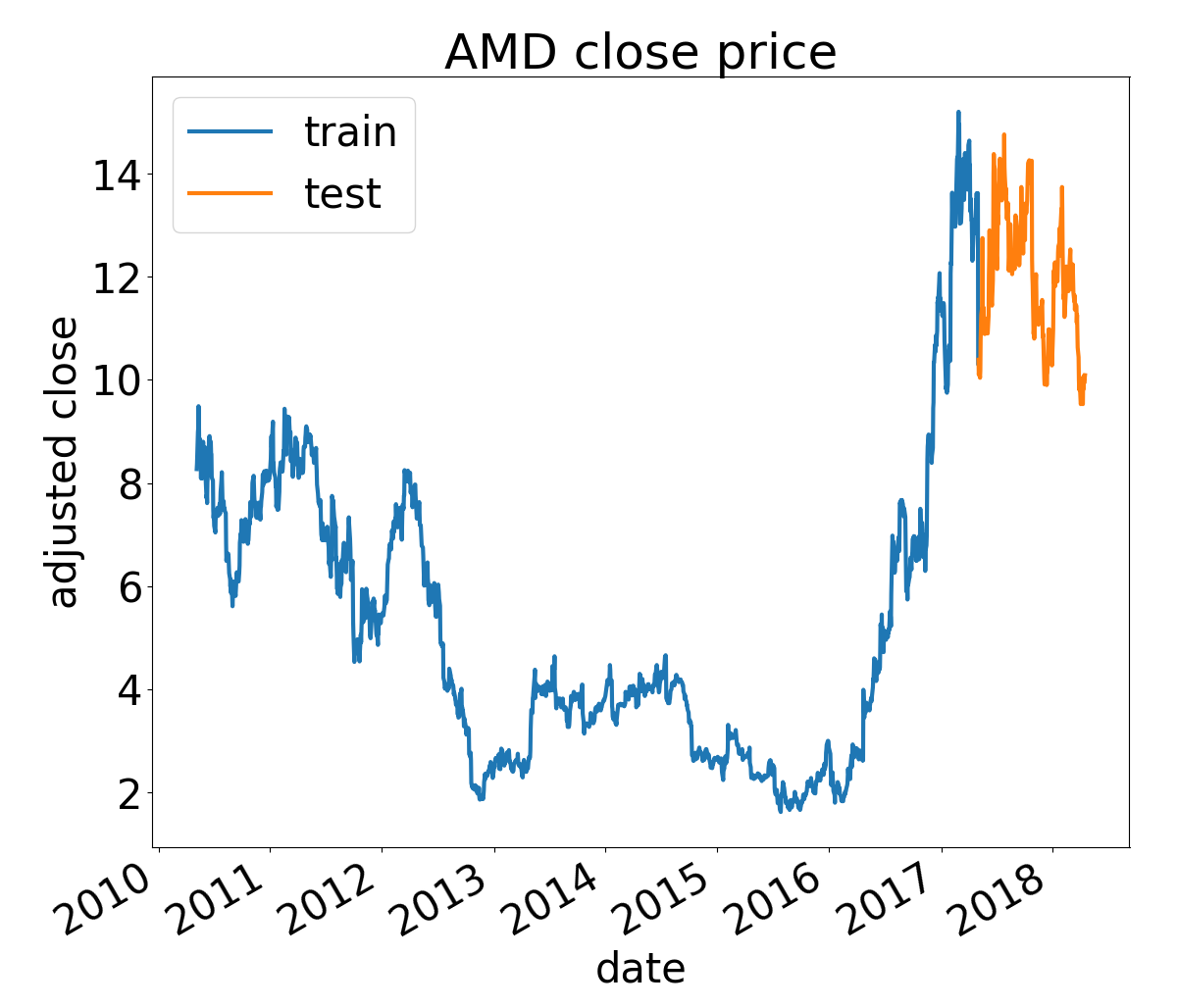

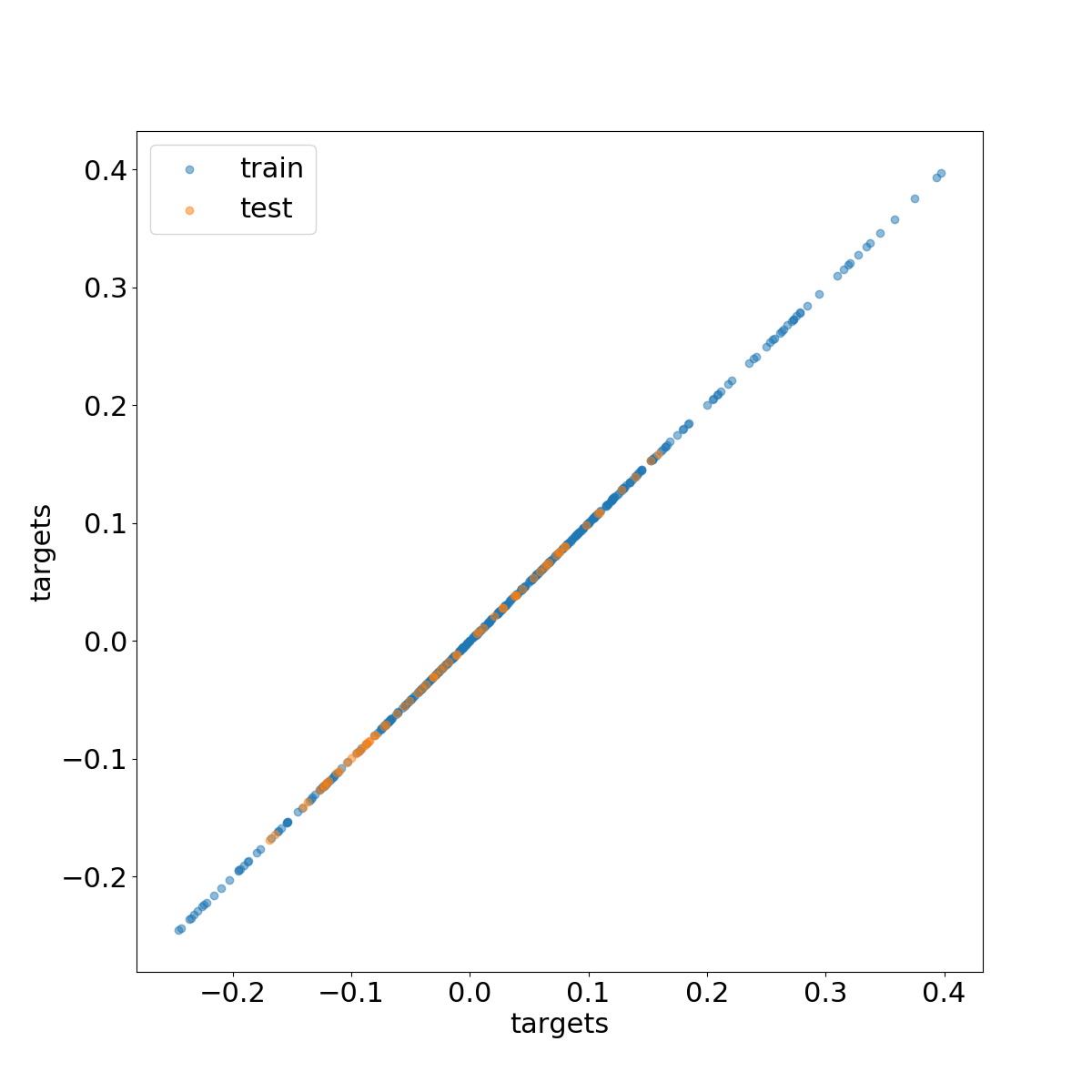

Make train and test sets

import statsmodels.api as smlinear_features = sm.add_constant(features)train_size = int(0.85 * targets.shape[0])train_features = linear_features[:train_size] train_targets = targets[:train_size] test_features = linear_features[train_size:] test_targets = targets[train_size:]

some_list[start:stop:step]

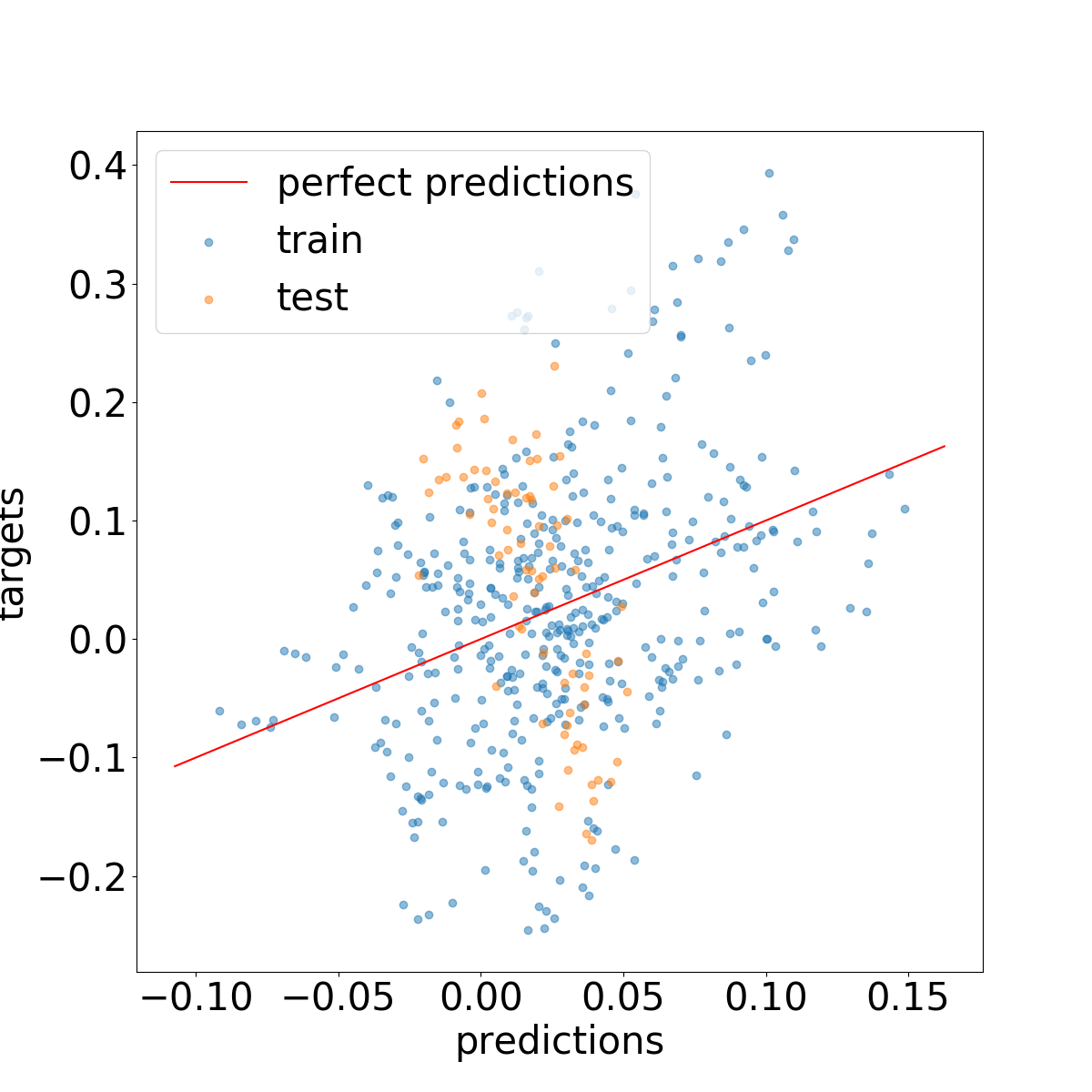

Linear modeling

model = sm.OLS(train_targets, train_features)results = model.fit()

Linear modeling

print(results.summary())

Dep. Variable: 10d_future_pct R-squared: 0.157

Model: OLS Adj. R-squared: 0.146

Method: Least Squares F-statistic: 15.55

Date: Thu, 19 Apr 2018 Prob (F-statistic): 4.79e-14

Time: 11:41:05 Log-Likelihood: 336.53

No. Observations: 425 AIC: -661.1

Df Residuals: 419 BIC: -636.8

Df Model: 5

Covariance Type: nonrobust

===========================================================================

coef std err t P>|t| [0.025 0.975]

<hr />-------------------------------------------------------------------------

const 1.3305 0.323 4.117 0.000 0.695 1.966

10d_close_pct 0.0906 0.098 0.927 0.355 -0.102 0.283

ma14 0.3313 0.209 1.585 0.114 -0.080 0.742

rsi14 -0.0013 0.001 -1.044 0.297 -0.004 0.001

ma200 -0.4090 0.053 -7.712 0.000 -0.513 -0.305

rsi200 -0.0224 0.003 -6.610 0.000 -0.029 -0.016

===========================================================================

Omnibus: 3.571 Durbin-Watson: 0.209

Prob(Omnibus): 0.168 Jarque-Bera (JB): 3.323

Skew: 0.202 Prob(JB): 0.190

Kurtosis: 3.159 Cond. No. 5.47e+03

p-values

print(results.pvalues)

const 4.630428e-05

10d_close_pct 3.546748e-01

ma14 1.136941e-01

rsi14 2.968699e-01

ma200 9.126405e-14

rsi200 1.169324e-10

Time to fit a linear model!

Machine Learning for Finance in Python