Scaling data and KNN Regression

Machine Learning for Finance in Python

Nathan George

Data Science Professor

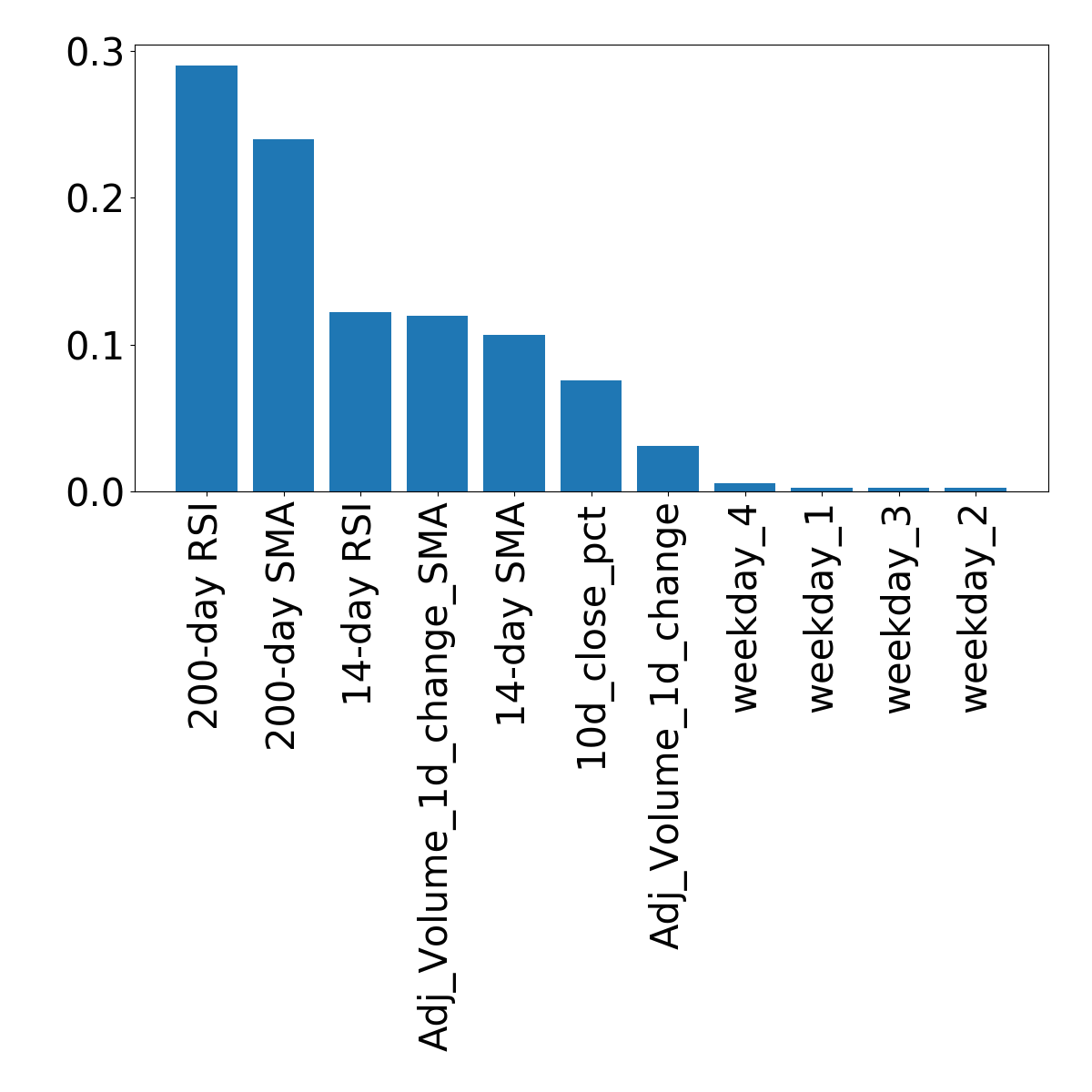

Feature selection: remove weekdays

print(feature_names)

['10d_close_pct',

'14-day SMA',

'14-day RSI',

'200-day SMA',

'200-day RSI',

'Adj_Volume_1d_change',

'Adj_Volume_1d_change_SMA',

'weekday_1',

'weekday_2',

'weekday_3',

'weekday_4']

print(feature_names[:-4])

['10d_close_pct',

'14-day SMA',

'14-day RSI',

'200-day SMA',

'200-day RSI',

'Adj_Volume_1d_change',

'Adj_Volume_1d_change_SMA']

Remove weekdays

train_features = train_features.iloc[:, :-4]

test_features = test_features.iloc[:, :-4]

Scaling options

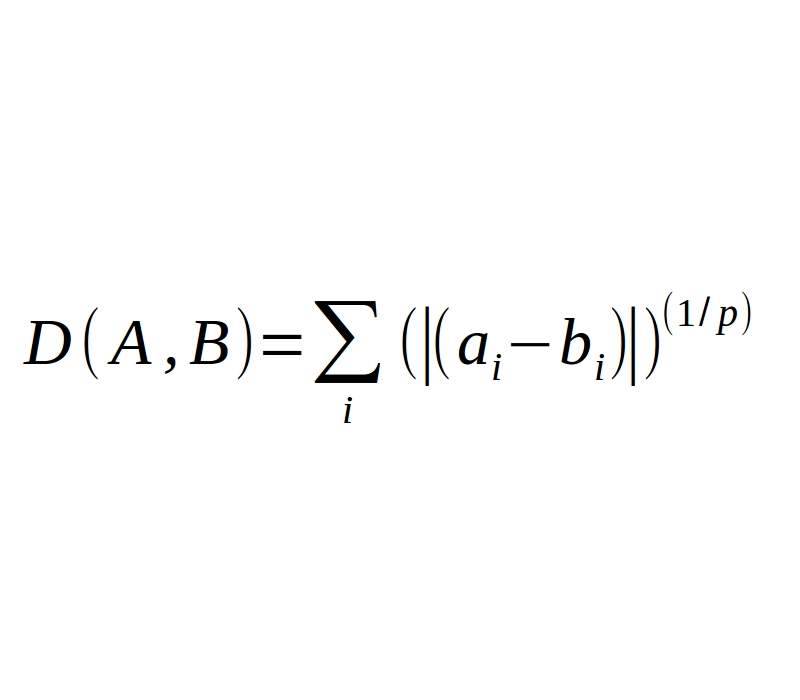

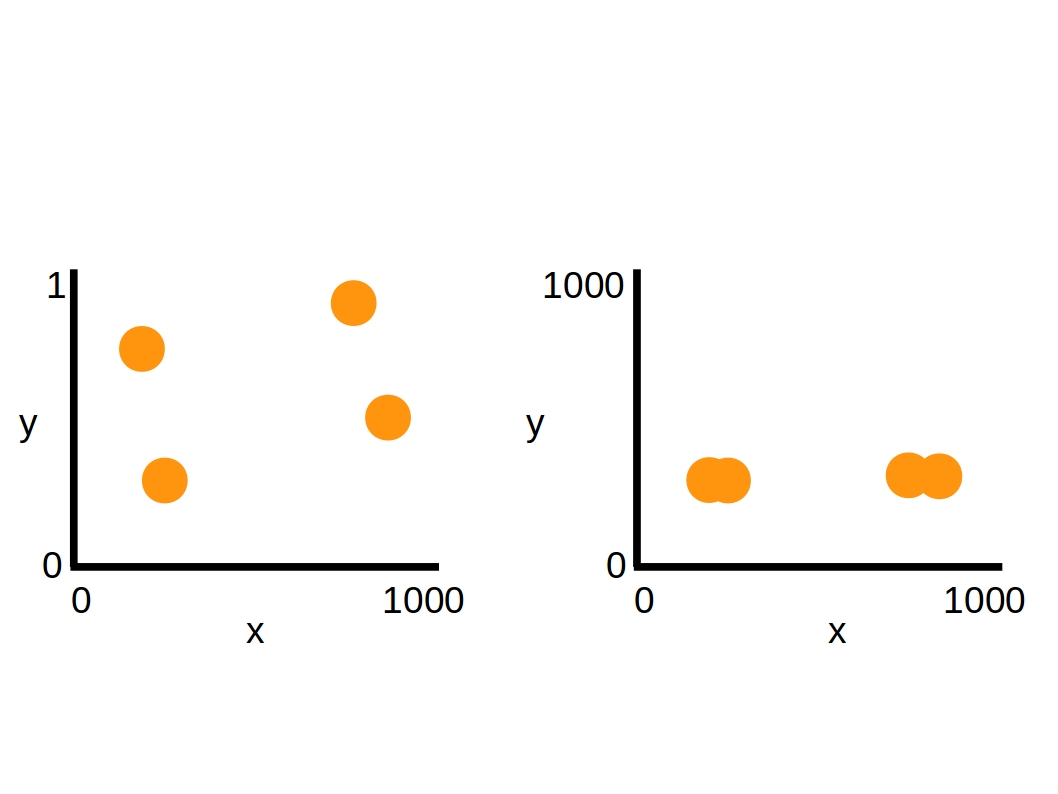

Scaling options:

- min-max

- standardization

- median-MAD

- map to arbitrary function (e.g. sigmoid, tanh)

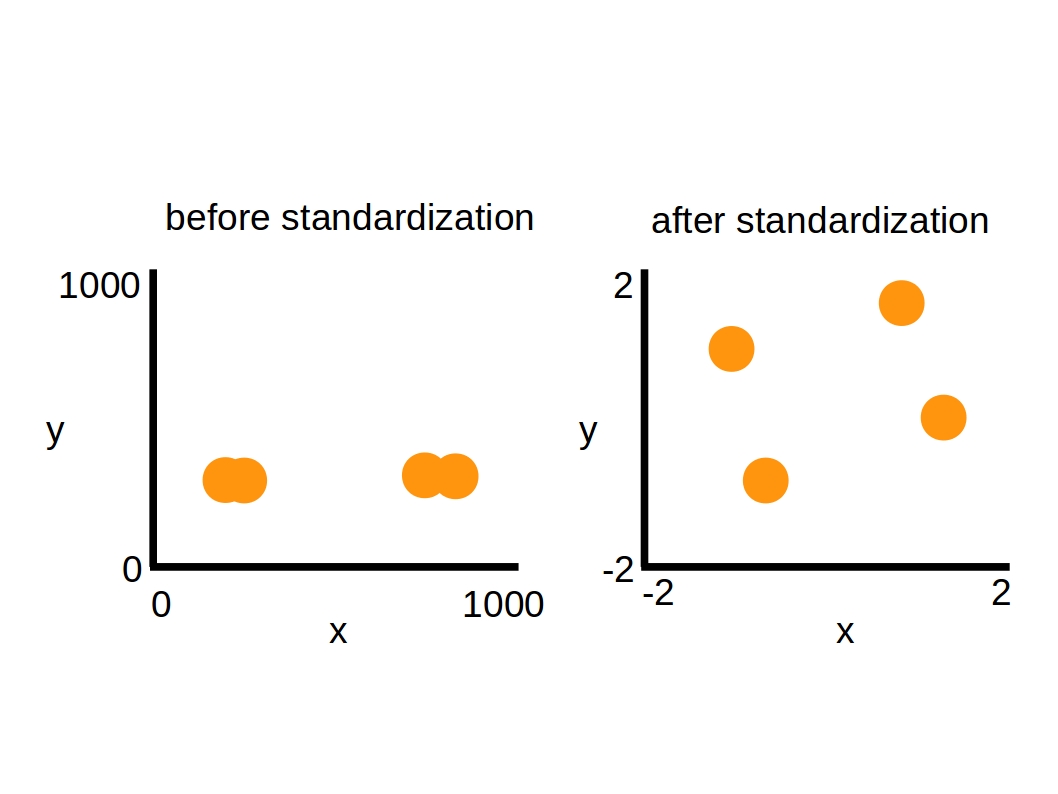

sklearn's scale

from sklearn.preprocessing import scale

sc = scale()

scaled_train_features = sc.fit_transform(train_features)

scaled_test_features = sc.transform(test_features)

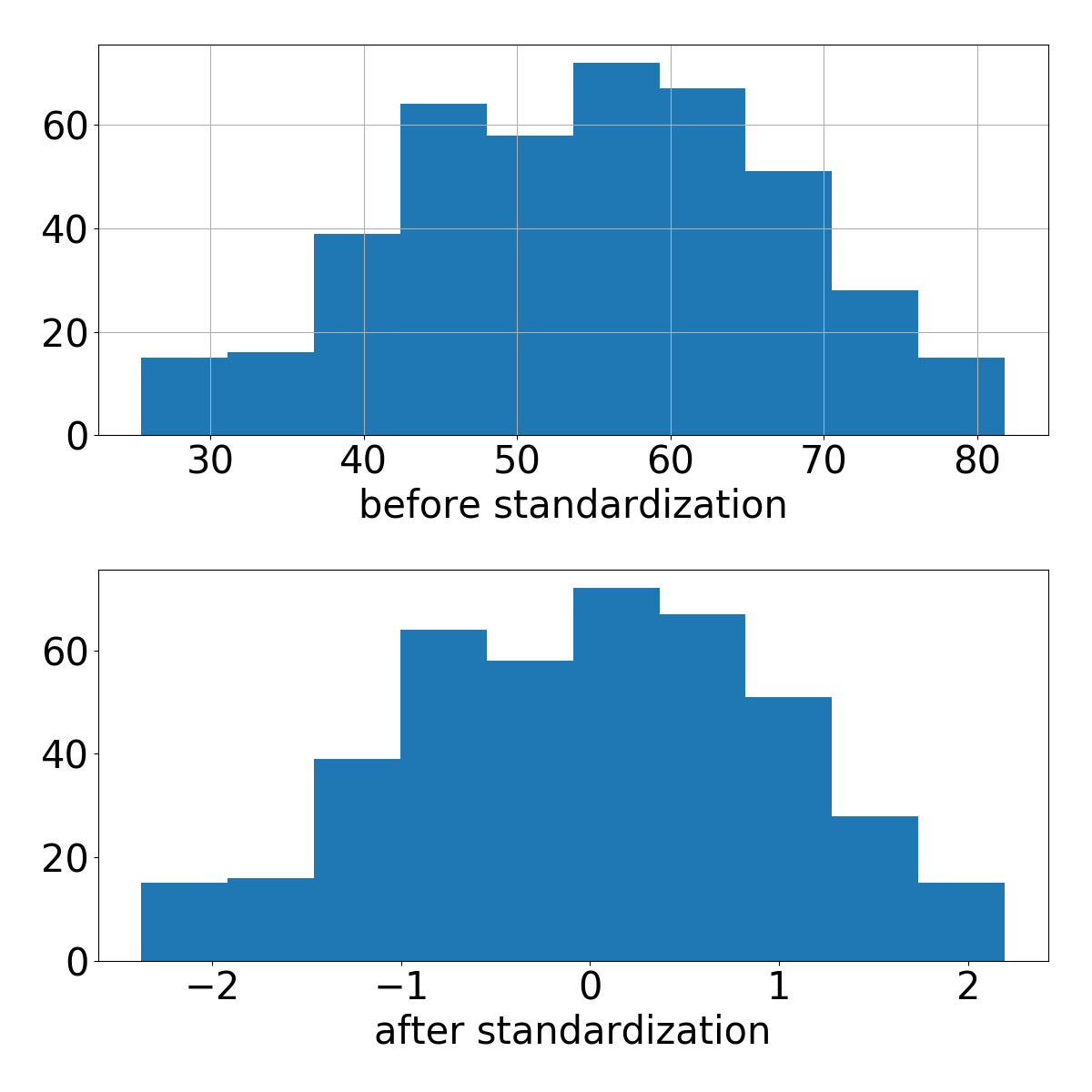

Making subplots

# create figure and list containing axes f, ax = plt.subplots(nrows=2, ncols=1)# plot histograms of before and after scaling train_features.iloc[:, 2].hist(ax=ax[0]) ax[1].hist(scaled_train_features[:, 2]) plt.show()

Scale data and use KNN!

Machine Learning for Finance in Python