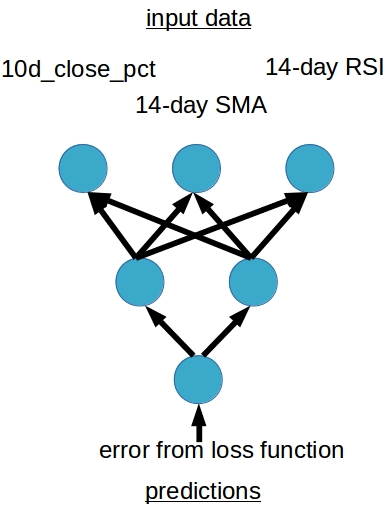

Neural Networks

Machine Learning for Finance in Python

Nathan George

Data Science Professor

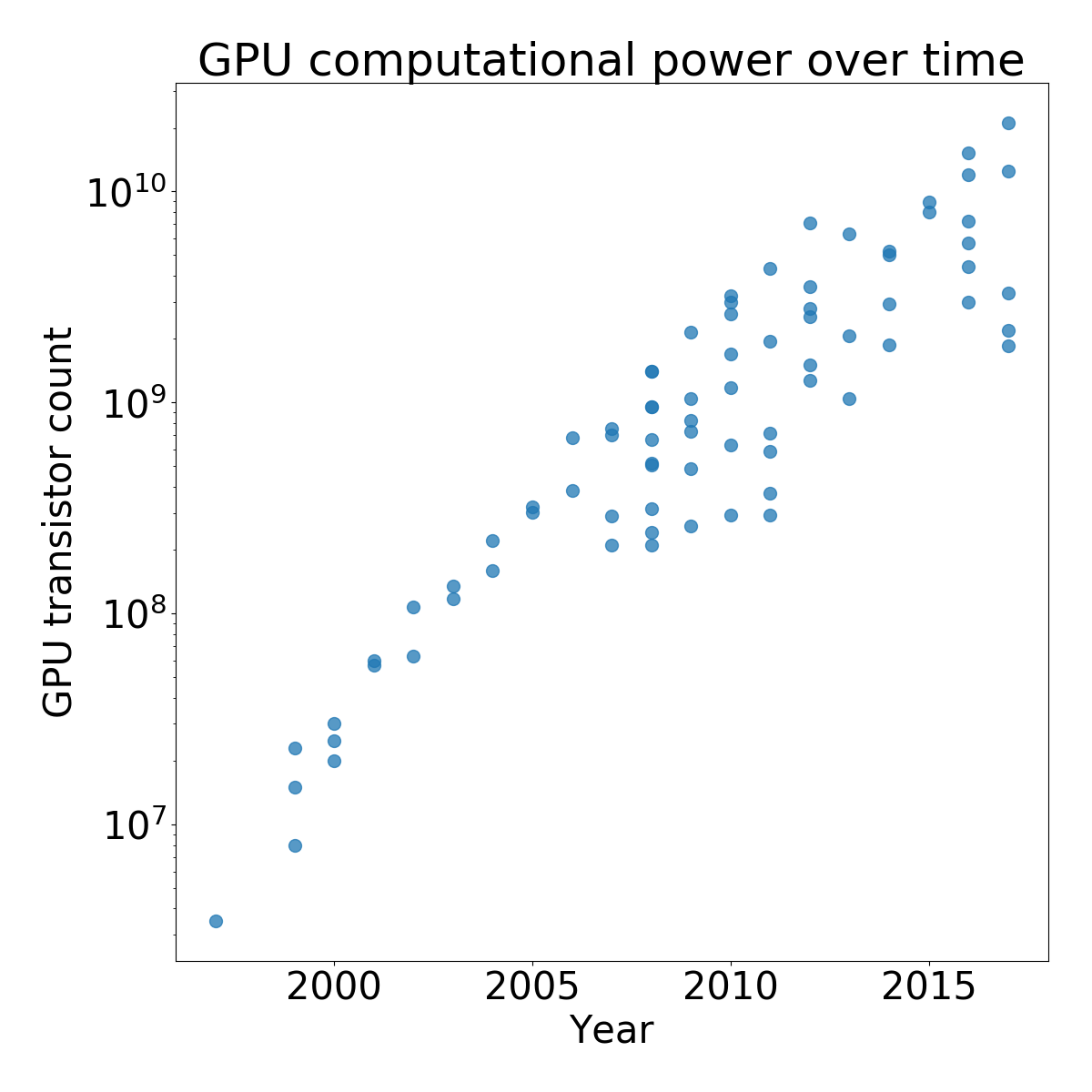

Neural networks have potential

Neural nets have:

- non-linearity

- variable interactions

- customizability

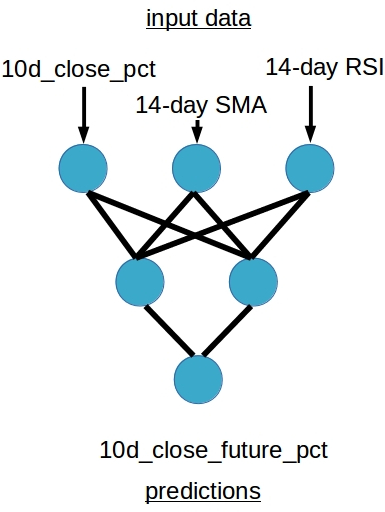

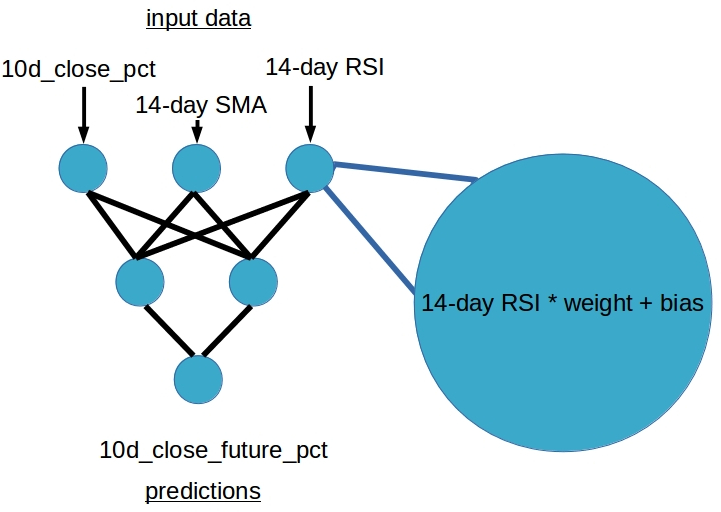

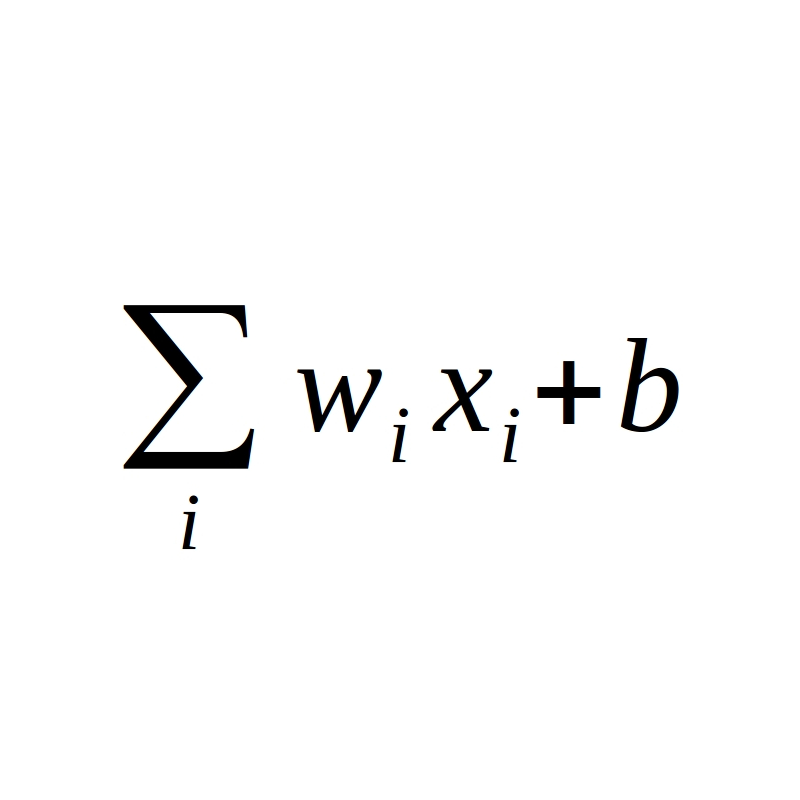

Implementing a neural net with keras

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense

Implementing a neural net with keras

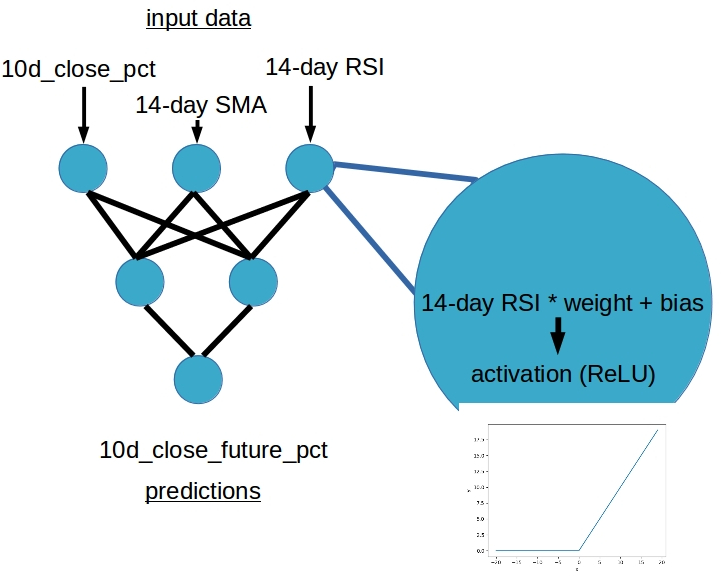

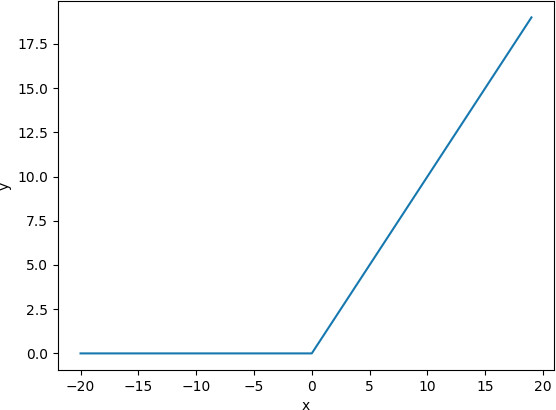

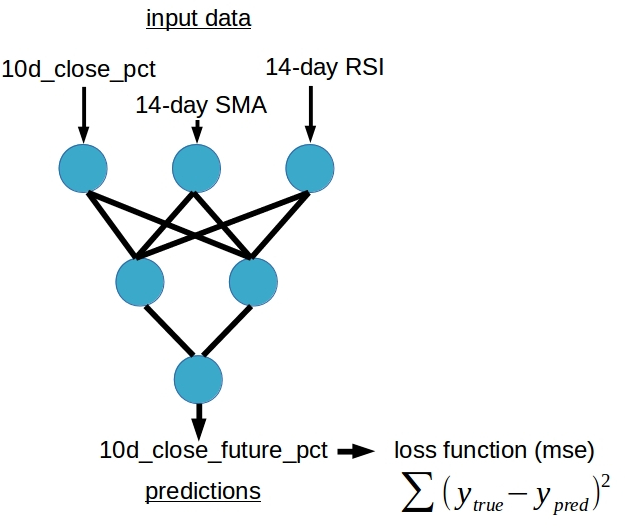

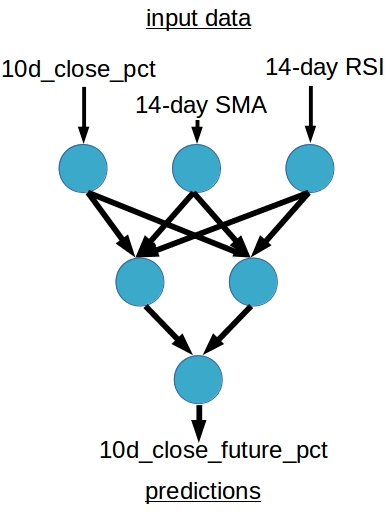

from tensorflow.keras.models import Sequential from tensorflow.keras.layers import Densemodel = Sequential()model.add(Dense(50, input_dim=scaled_train_features.shape[1], activation='relu')) model.add(Dense(10, activation='relu')) model.add(Dense(1, activation='linear'))

Fitting the model

model.compile(optimizer='adam', loss='mse')

history = model.fit(scaled_train_features,

train_targets,

epochs=50)

plt.plot(history.history['loss'])

plt.title('loss:' + str(round(history.history['loss'][-1], 6)))

plt.xlabel('epoch')

plt.ylabel('loss')

plt.show()

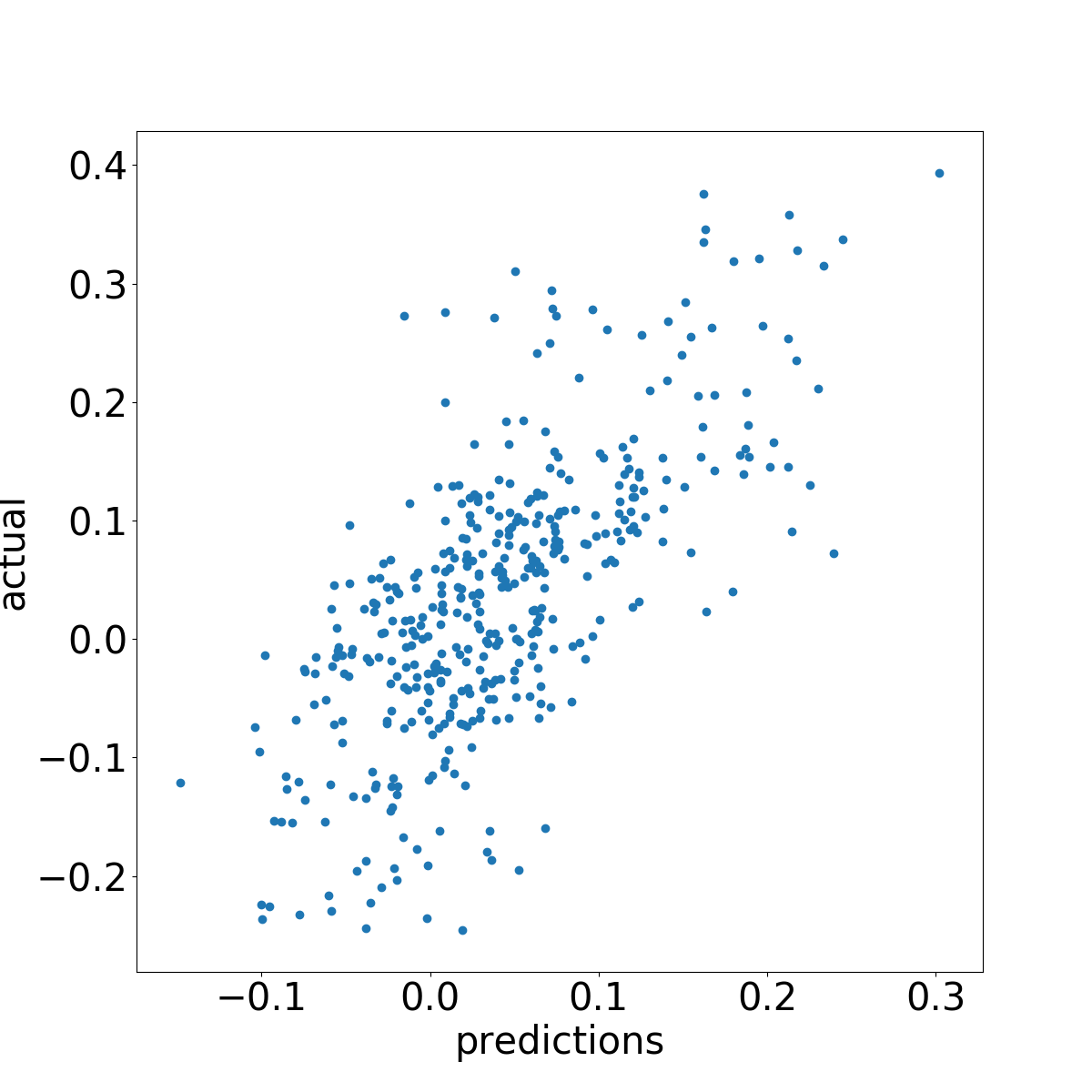

Checking out performance

from sklearn.metrics import r2_score

# calculate R^2 score

train_preds = model.predict(scaled_train_features)

print(r2_score(train_targets, train_preds))

0.4771387560719418

Plot performance

# plot predictions vs actual

plt.scatter(train_preds, train_targets)

plt.xlabel('predictions')

plt.ylabel('actual')

plt.show()

Make a neural net!

Machine Learning for Finance in Python