Dealing with imbalanced datasets

Fraud Detection in R

Bart Baesens

Professor Data Science at KU Leuven

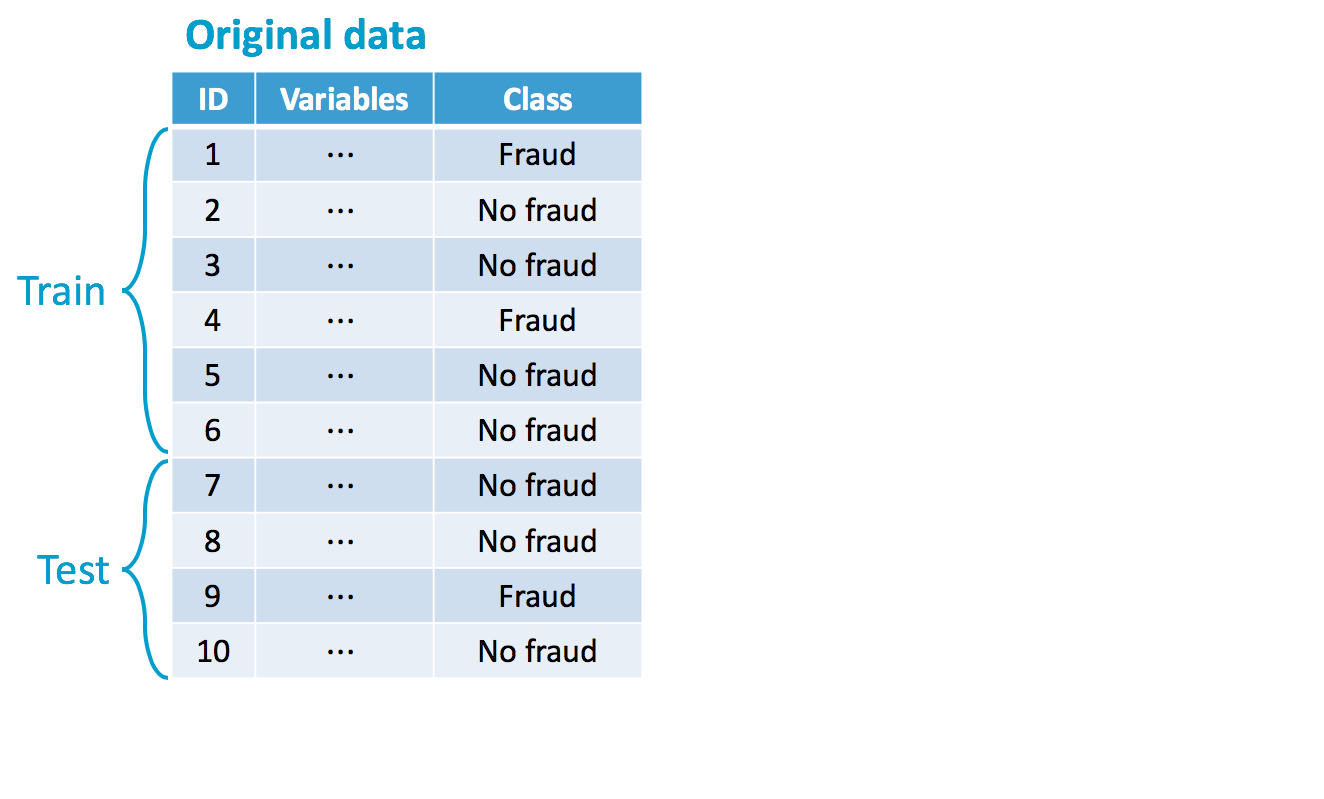

Imbalanced data sets

- Key challenge: label events as fraud or not

- Major challenge for classification methods & anomaly detection techniques

- Classifier tends to favour majority class (= no-fraud)

- large classification error over the fraud cases

- Classifiers learn better from a balanced distribution

Imbalanced data sets

- Key challenge : label events as fraud or not

- Major challenge for classification methods & anomaly detection techniques

- Classifier tends to favour majority class (= no-fraud)

- large classification error over the fraud cases

- Classifiers learn better from a balanced distribution

- Possible solution : change class distribution with sampling methods

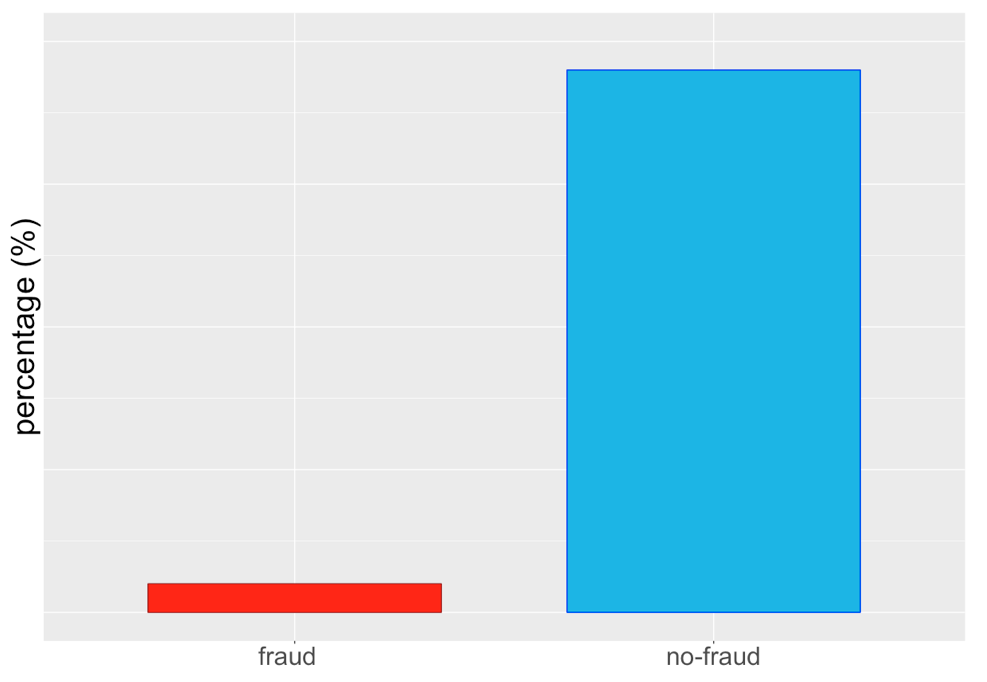

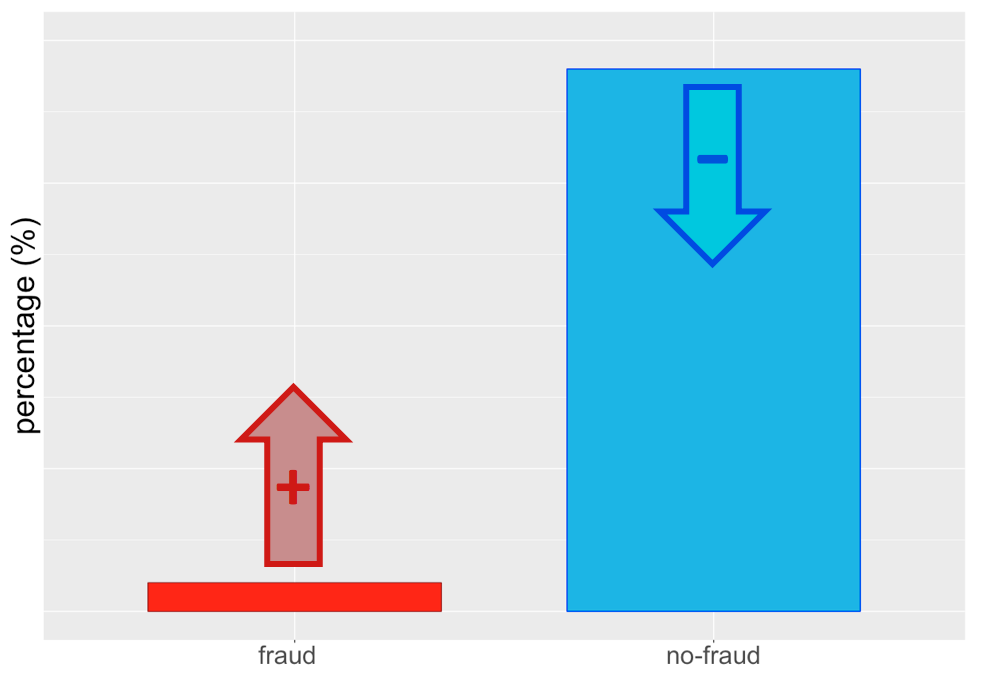

Original imbalance

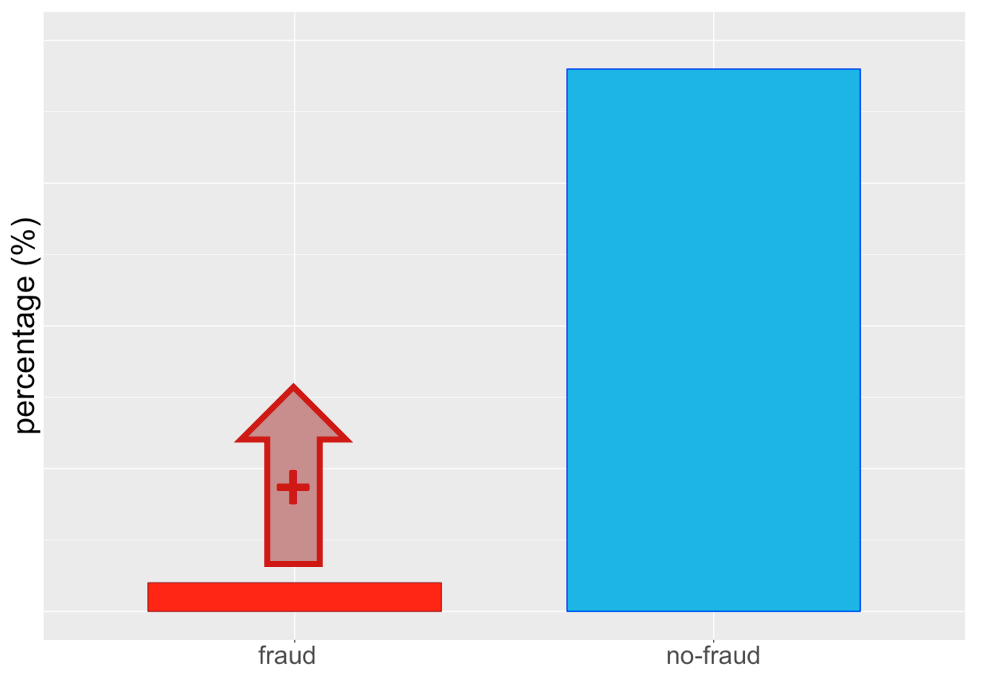

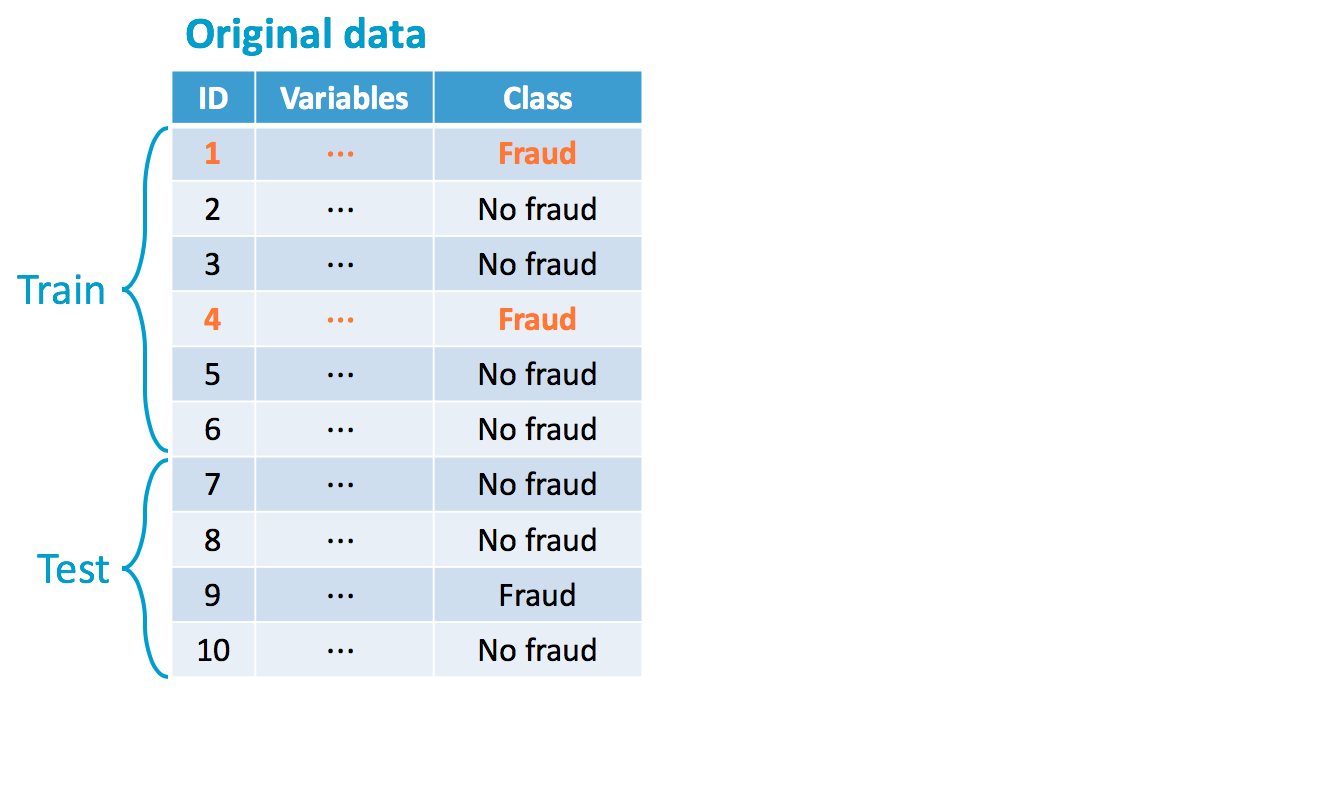

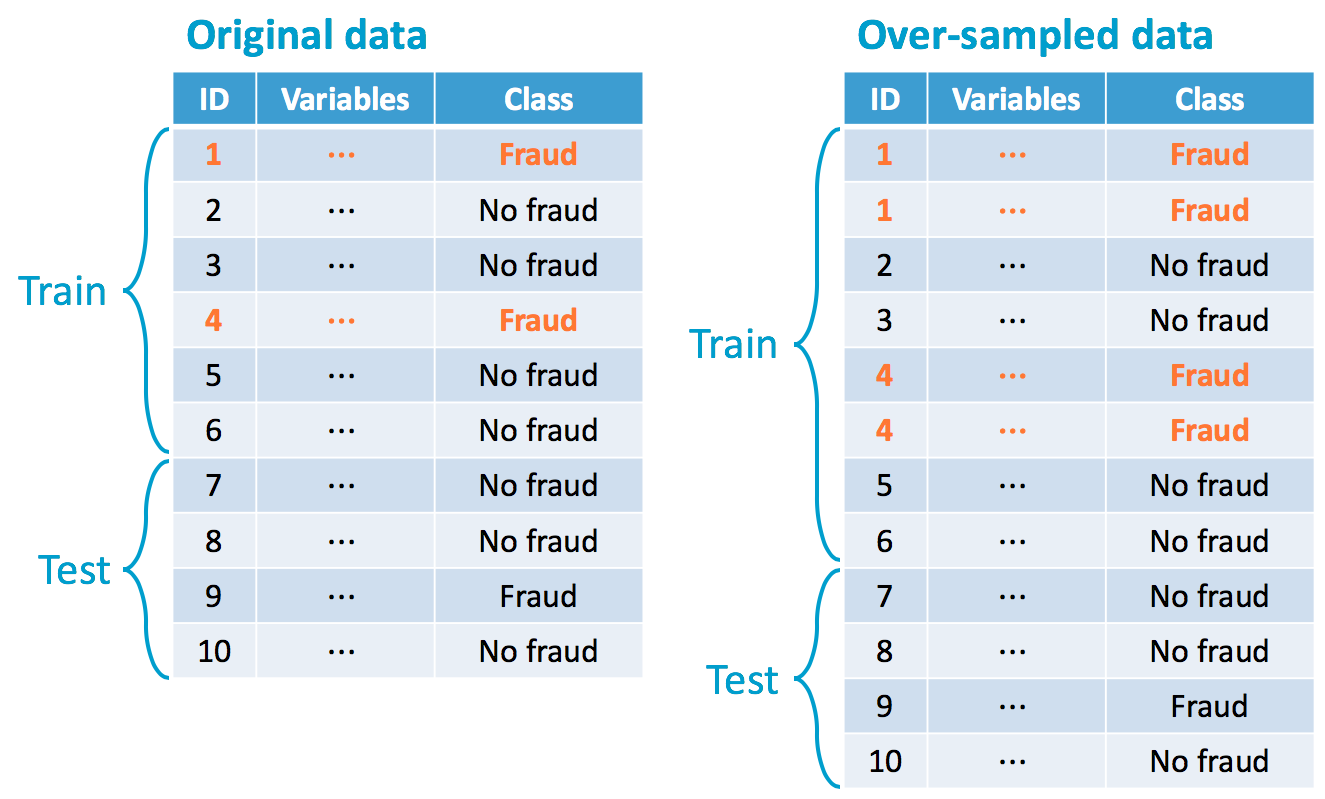

Over-sampling minority class...

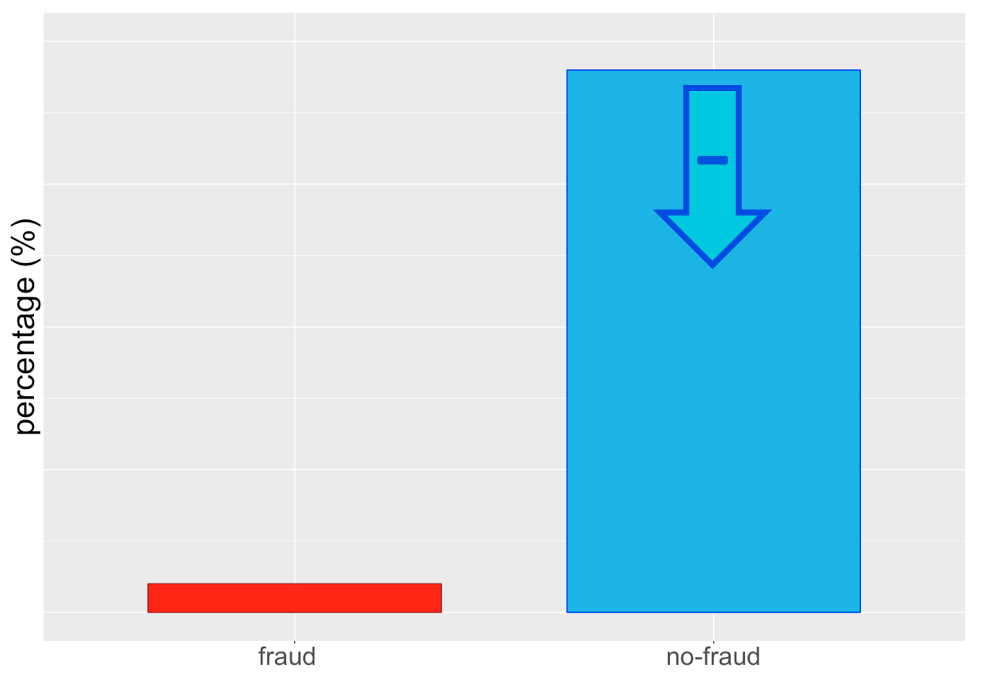

... or under-sampling majority class ...

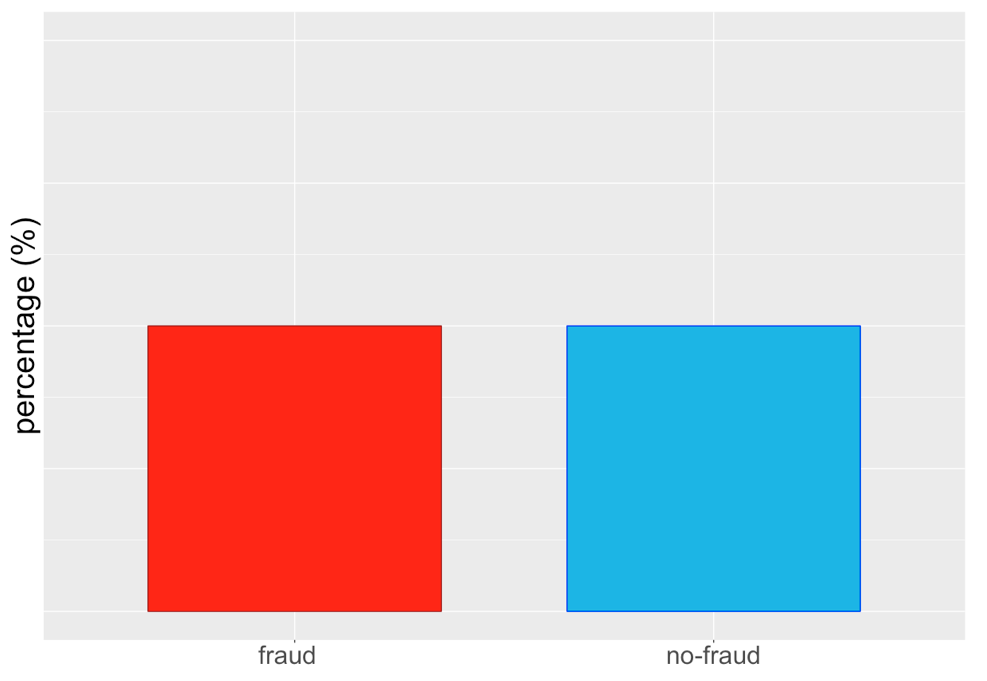

... or both!

Result after sampling...

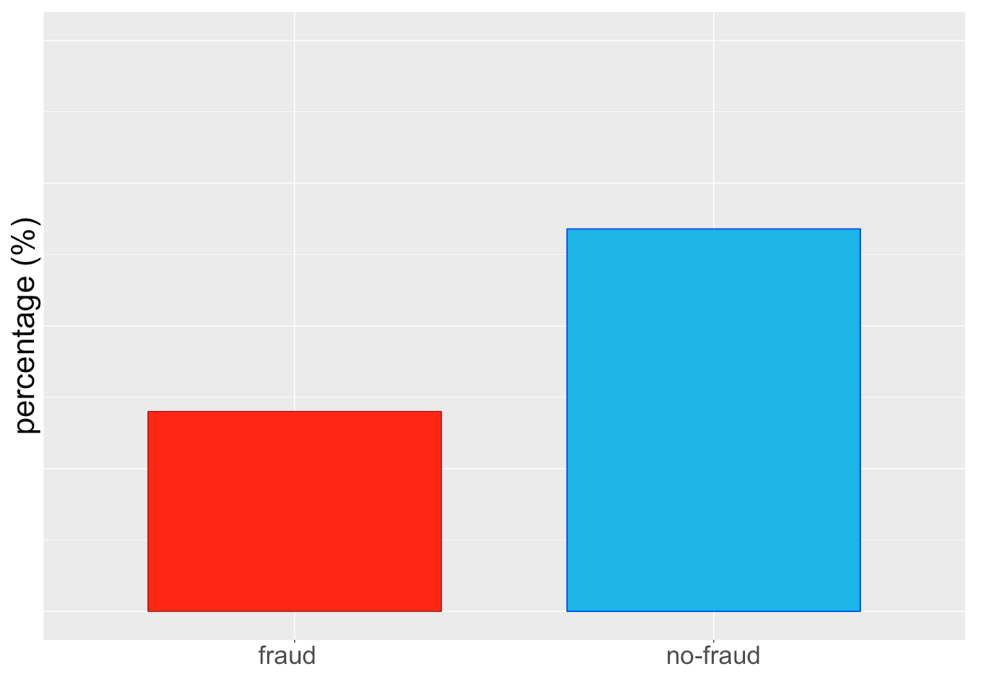

... or like this

Random over-sampling (ROS)

Random over-sampling in practice

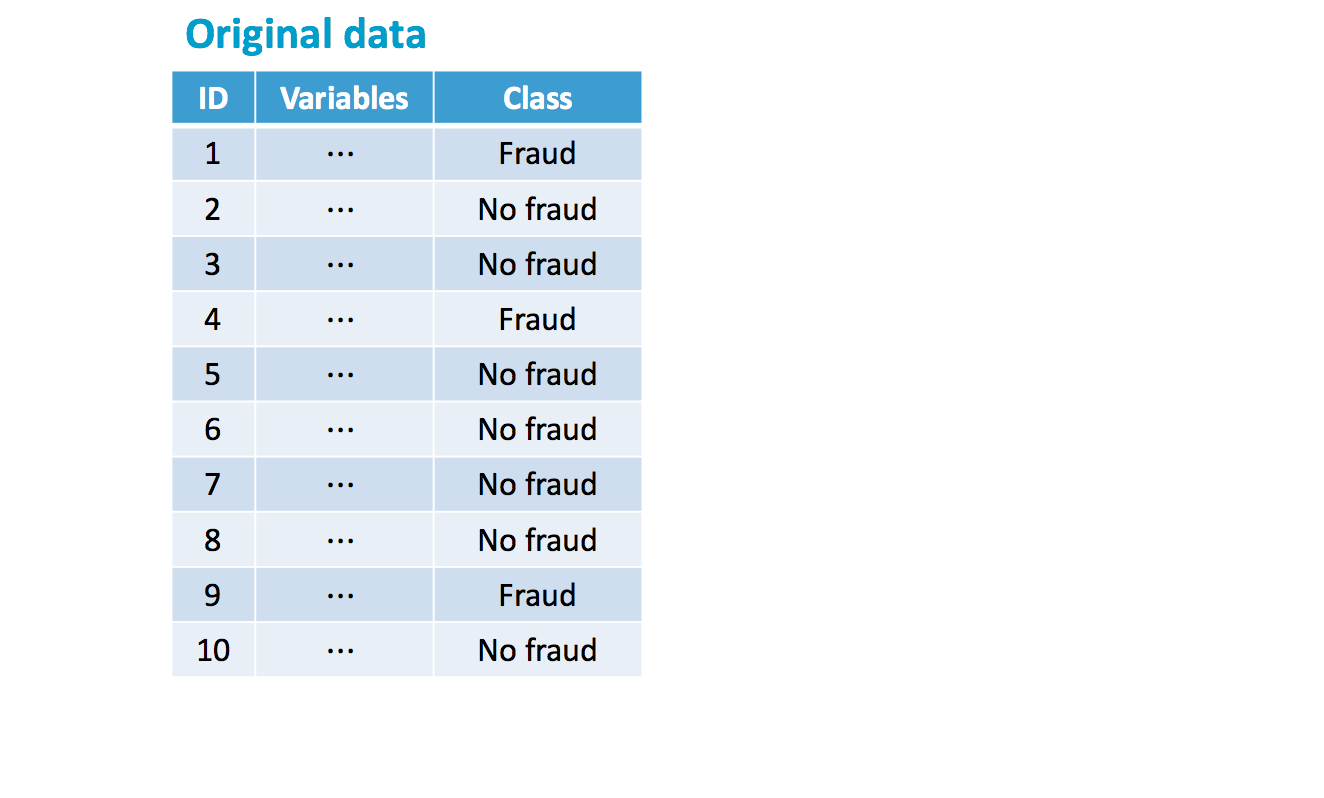

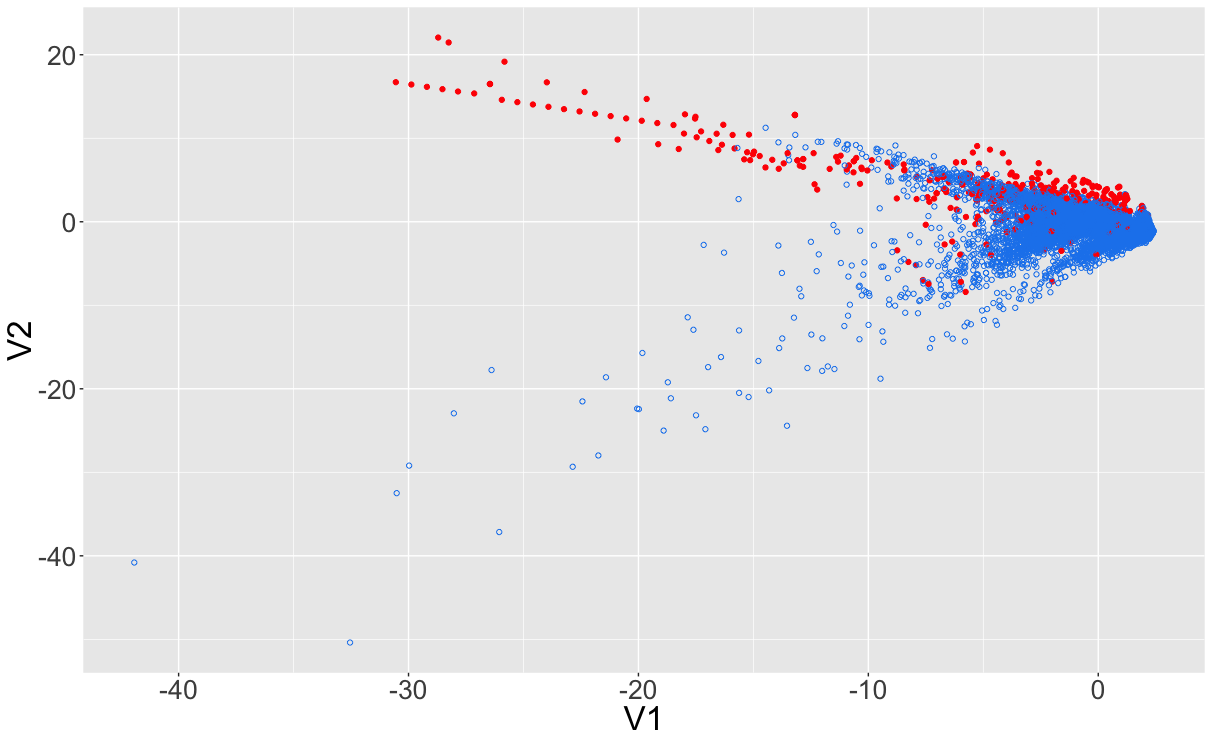

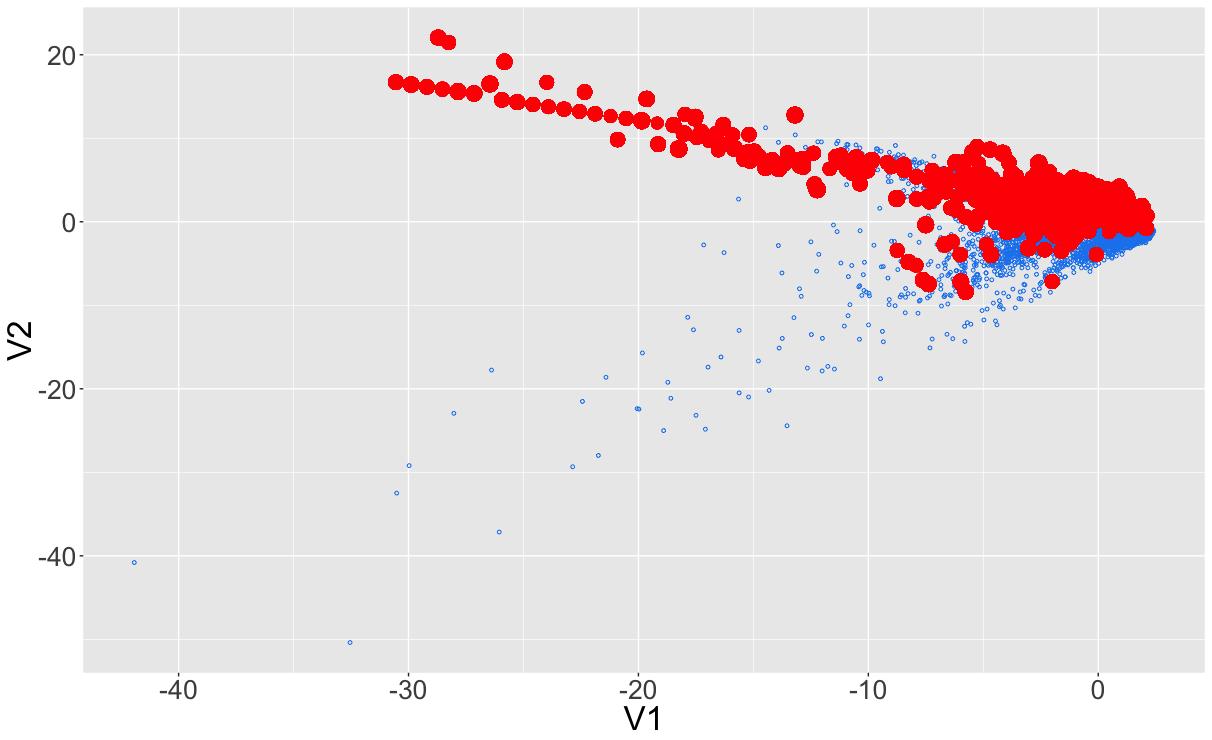

- Credit Card Fraud Detection dataset on Kaggle

- $\sim$ 300K anonymized credit card transfers labeled as fraudulent or genuine

- About the data...

- Numerical (anonymized) variables: V1, V2, ... , V28

- Time = seconds elapsed between each transfer and first transfer in the dataset

- Amount = transaction amount

- Class = response variable: value 1 in case of fraud and 0 otherwise

Check the imbalance

head(creditcard)

Time V1 V2 ... V27 V28 Amount Class

1 0 1.1918571 0.2661507 ... -0.0089830991 0.01472417 2.69 0

2 10 0.3849782 0.6161095 ... 0.0424724419 -0.05433739 9.99 0

3 12 -0.7524170 0.3454854 ... -0.1809975001 0.12939406 15.99 0

4 17 0.9624961 0.3284610 ... 0.0163706433 -0.01460533 34.09 0

5 34 0.2016859 0.4974832 ... 0.1427572469 0.21923761 9.99 0

prop.table(table(creditcard$Class))

0 1

0.98 0.02

ovun.sample from ROSE package

n_legit <- 24108 new_frac_legit <- 0.50 new_n_total <- n_legit / new_frac_legit ## = 24108 / 0.50 = 48216library(ROSE) oversampling_result <- ovun.sample(formula = Class ~ ., data = creditcard, method = "over", N = new_n_total, seed = 2018)oversampled_credit <- oversampling_result$data prop.table(table(oversampled_credit$Class))

0 1

0.5 0.5

Let's practice!

Fraud Detection in R