No pain, no gain

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

GARCH-in-mean model

- Quantify the risk-reward trade-off.

- Risk: $\sigma^2_t$. Reward: $\mu_t$.

- GARCH-in-mean model:

$$ \mu_{t} = \mu + \lambda \sigma^2_{t} $$

$\lambda > 0$ is the risk/reward parameter indicating the increase in expected return per unit of variance risk.

How?

Change the argument mean.model in ugarchspec() from list(armaOrder = c(0, 0)) to list(armaOrder = c(0, 0), archm = TRUE, archpow = 2):

garchspec <- ugarchspec(

mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

garchspec <- ugarchspec(

mean.model = list(armaOrder = c(0, 0), archm = TRUE, archpow = 2),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

Application to daily S&P 500 returns

Estimation

garchfit <- ugarchfit(data = sp500ret, spec = garchspec)

Inspection of estimated coefficients for the mean

round(coef(garchfit)[1:2], 4)

mu archm

0.0002 1.9950

Predicted mean returns

$$ \hat{\mu}_{t} = 0.0002 + 1.9950 \hat{\sigma}^2_{t} $$

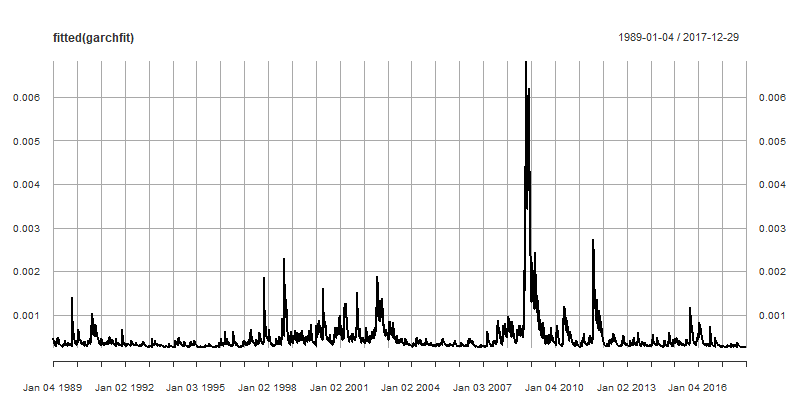

Time series plot of predicted returns

- Plot them in R

plot(fitted(garchfit))

Today's return predicts tomorrow's return

- The GARCH-in-mean uses the financial theory of a risk-reward trade-off to build a conditional mean model.

- Let's now use statistical theory to make a mean model that exploits the correlation between today's return and tomorrow's return.

- The most popular model is the AR(1) model:

- AR(1) stands for autoregressive model of order 1.

- It predicts the next return using the deviation of the return from its long term mean value $\mu$:

$$ \mu_{t} = \mu + \rho(R_{t-1} - \mu) $$

A positive autoregressive coefficient

$$ \mu_{t} = \mu + \rho(R_{t-1} - \mu) $$

- $\rho > 0$:

- A higher (resp. lower) than average return is followed by a higher (resp. lower) than average return.

- Possible explanation: markets underreact to news and hence there is momentum in returns.

- $|\rho|<1$: Mean reversion: The deviations of $R_t$ from $\mu$ are transitory.

A negative autoregressive coefficient

$$ \mu_{t} = \mu + \rho(R_{t-1} - \mu) $$

- $\rho < 0$:

- A higher (resp. lower) than average return is followed by a lower (resp. higher ) than average return.

- Possible explanation: markets overreact to news and hence there is reversal in returns.

Application to daily S&P 500 returns

Specification and estimation of AR(1)-GJR GARCH with sst distribution

garchspec <- ugarchspec(

mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

garchfit <- ugarchfit(data = sp500ret, spec = garchspec)

Estimates of the AR(1) model

round(coef(garchfit)[1:2], 4)

mu ar1

0.0003 -0.0292

MA(1) and ARMA(1,1) model

The Moving Average model of order 1 uses the deviation of the return from its conditional mean:

$$ \mu_{t} = \mu + \theta(R_{t-1} - \mu_{t-1}) $$

ARMA(1,1) combines AR(1) and MA(1):

$$ \mu_{t} = \mu + \rho(R_{t-1} - \mu) + \theta(R_{t-1} - \mu_{t-1}) $$

How?

MA(1)

garchspec <- ugarchspec(

mean.model = list(armaOrder = c(0, 1)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

ARMA(1, 1)

garchspec <- ugarchspec(

mean.model = list(armaOrder = c(1, 1)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

Your turn to change the mean.model argument

GARCH Models in R