Model risk is the risk of using the wrong model

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

Sources of model risk and solutions

Sources:

- modeling choices

- starting values in the optimization

- outliers in the return series

Solution: Protect yourself through a robust approach

- model-averaging: averaging the predictions of multiple models

- trying several starting values and choosing the one that leads to the highest likelihood

- cleaning the data

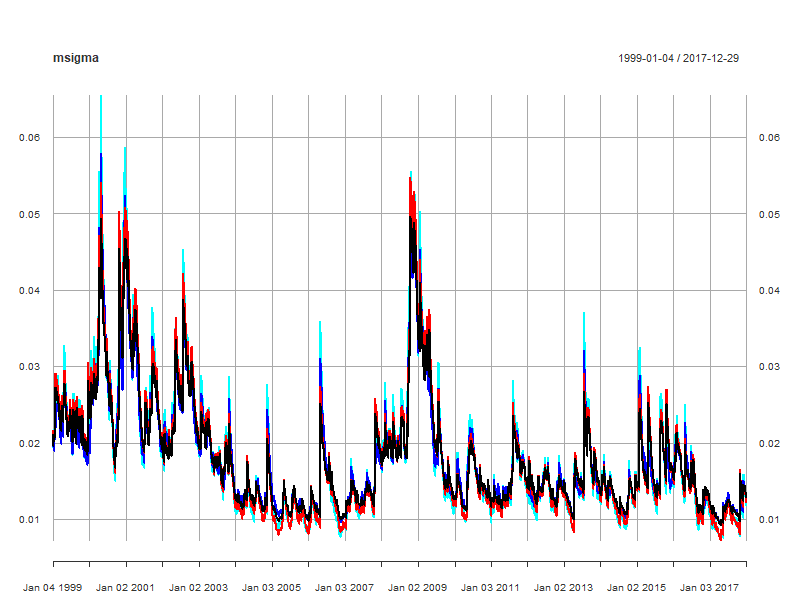

Model averaging

variance.models <- c("sGARCH", "gjrGARCH")

distribution.models <- c("norm", "std", "sstd")

c <- 1

for (var.model in variance.models) {

for (dist.model in distribution.models) {

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = var.model), distribution.model = dist.model)

garchfit <- ugarchfit(data = msftret, spec = garchspec)

if (c==1) { msigma <- sigma(garchfit)

} else { msigma <- merge(msigma, sigma(garchfit))}

c <- c + 1 }

}

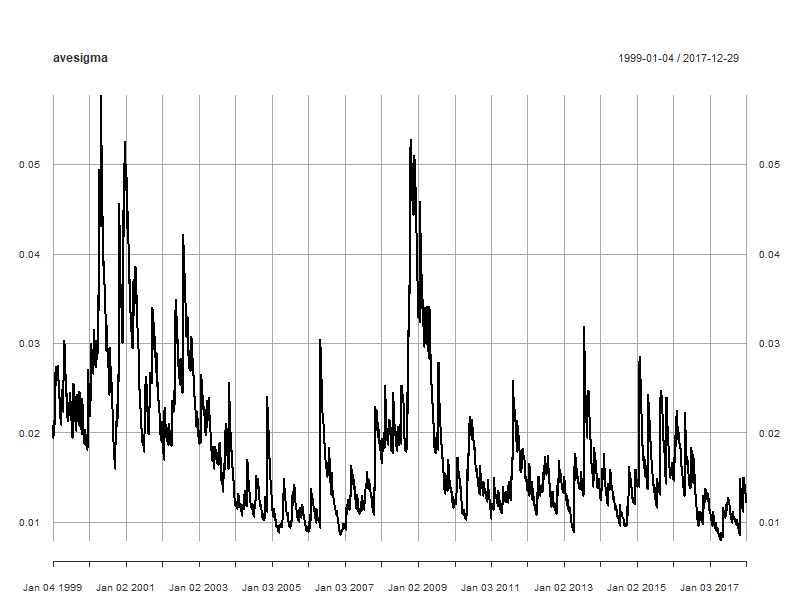

The average vol prediction

avesigma <- xts(rowMeans(msigma), order.by = time(msigma))

Robustness to starting values

coef(garchfit)

mu omega alpha1 beta1 skew shape

5.669200e-04 6.281258e-07 7.462984e-02 9.223701e-01 9.436331e-01 6.318621e+00

- Those estimates are the result of a complex optimization of the likelihood function

- Optimization is numeric and iterative: step by step improvement, which can be sensitive to starting values

rugarchhas a default approach in getting sensible starting values- You can specify your own starting values by applying the

setstart()method to yourugarchspec()GARCH model specification

Estimation with default starting values

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0,0)),

variance.model = list(model = "sGARCH"),

distribution.model = "sstd")

garchfit <- ugarchfit(data = sp500ret, spec = garchspec)

coef(garchfit)

mu omega alpha1 beta1 skew shape

5.669200e-04 6.281258e-07 7.462984e-02 9.223701e-01 9.436331e-01 6.318621e+00

likelihood(garchfit)

24280.33

Estimation with modified starting values

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = "sGARCH"), distribution.model = "sstd")

setstart(garchspec) <- list(alpha1 = 0.05, beta1 = 0.9, shape = 8)

garchfit <- ugarchfit(data = sp500ret, spec = garchspec)

coef(garchfit)

mu omega alpha1 beta1 skew shape

5.638002e-04 6.303949e-07 7.466503e-02 9.224117e-01 9.438978e-01 6.309185e+00

likelihood(garchfit) # returns 24280.33

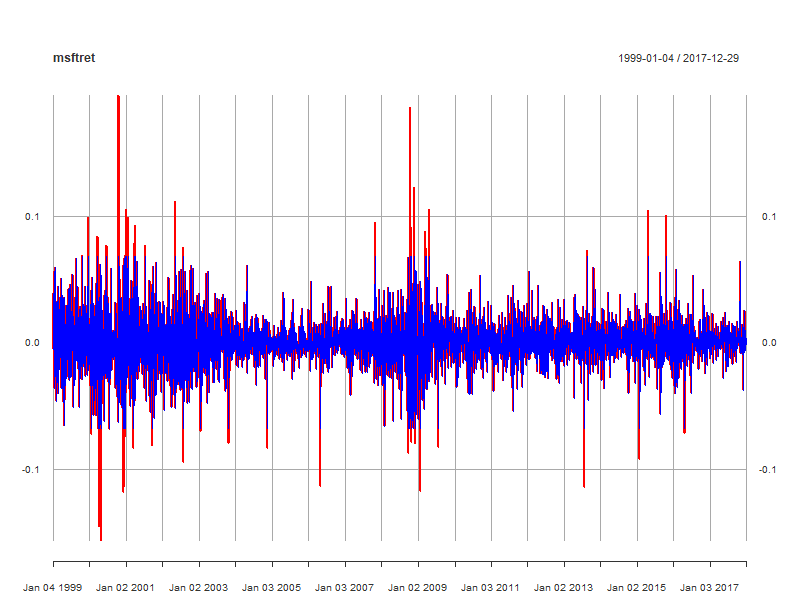

Cleaning the data

- Avoid that outliers distort the volatility predictions

- How? Through winsorization: reduce the magnitude of the return to an acceptable level using the function

Return.clean()in the packagePerformanceAnalyticswithmethod = "boudt":

# Clean the return series

library(PerformanceAnalytics)

clmsftret <- Return.clean(msftret, method = "boudt")

# Plot them on top of each other

plotret <- plot(msftret, col = "red")

plotret <- addSeries(clmsftret, col = "blue", on = 1)

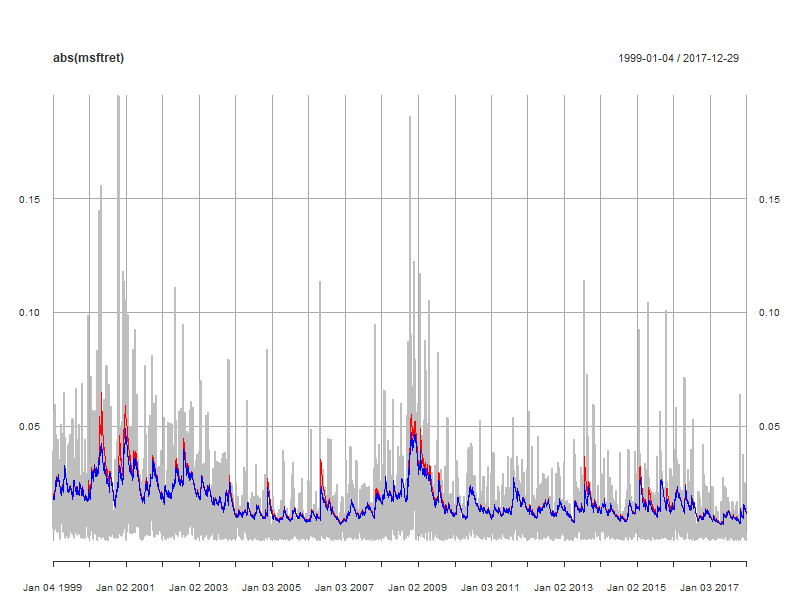

Impact of cleaning on volatility prediction

Make the volatility predictions using raw and cleaned Microsoft returns

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"), distribution.model = "sstd")

garchfit <- ugarchfit(data = msftret, spec = garchspec)

clgarchfit <- ugarchfit(data = clmsftret, spec = garchspec)

Compare them in a time series plot

plotvol <- plot(abs(msftret), col = "gray")

plotvol <- addSeries(sigma(garchfit), col = "red", on = 1)

plotvol <- addSeries(sigma(clgarchfit), col = "blue", on = 1)

plotvol

Be a robustnik: it is better to be roughly right than exactly wrong

GARCH Models in R