Value-at-risk

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

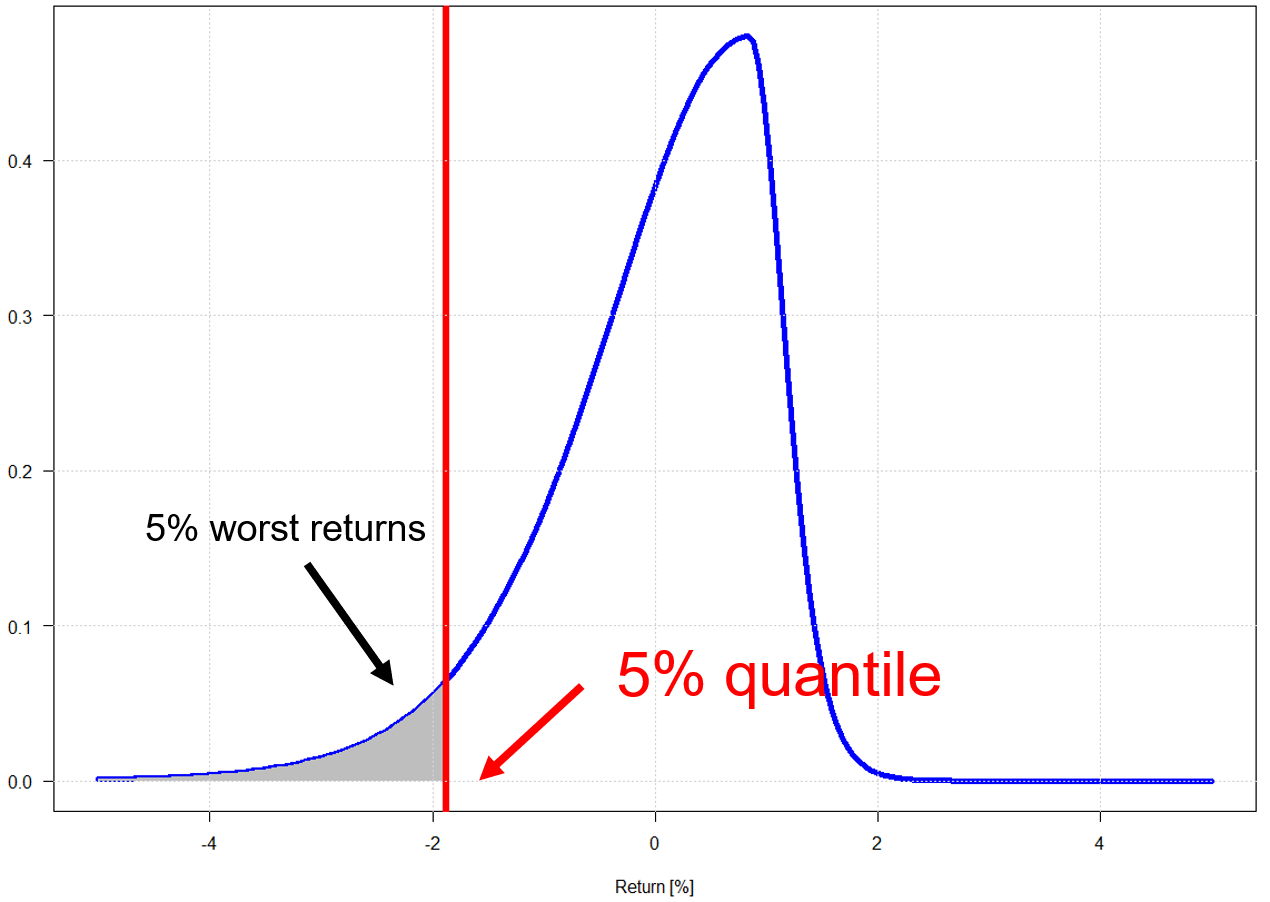

Value-at-risk

- A popular measure of downside risk: 5% value-at-risk. The 5% quantile of the return distribution represents the best return in the 5% worst scenarios.

Forward looking approach is needed

- Quantiles of rolling windows of returns are backward looking:

- ex post question: what has the 5% quantile been for the daily returns over the past year

- ex ante question: what is the 5% quantile of the predicted distribution of the future return?

- Forward looking risk management uses the predicted quantiles from the GARCH estimation.

- How? Method

quantile()applied to augarchrollobject.

Workflow to obtain predicted 5% quantiles from ugarchroll

ugarchspec(): Specify which GARCH model you want to use

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

ugarchroll(): Estimate the GARCH model on rolling estimation samples

garchroll <- ugarchroll(garchspec, data = sp500ret, n.start = 2500,

refit.window = "moving", refit.every = 100)

quantile(): Compute the predicted quantile

garchVaR <- quantile(garchroll, probs = 0.05)

You can choose another loss probability: 1% and 2.5% are also popular

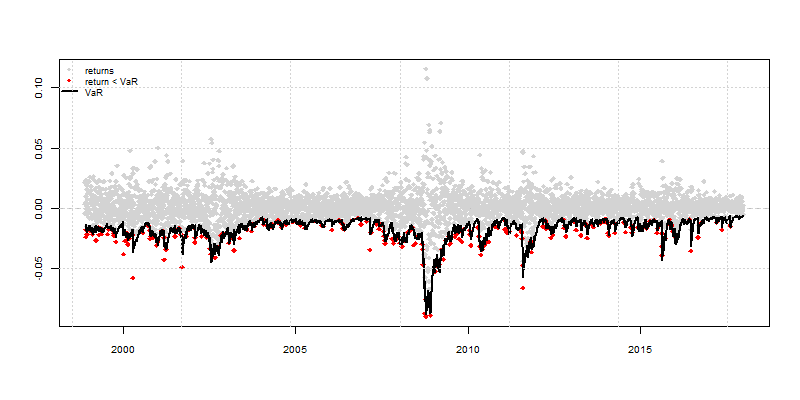

Value-at-risk plot for loss probability 5%

actual <- xts(as.data.frame(garchroll)$Realized, time(garchVaR))

VaRplot(alpha = 0.05, actual = actual, VaR = garchVaR)

Exceedance and VaR coverage

A VaR exceedance occurs when the actual return is less than the predicted value-at-risk: $ R_t \ < {VaR}_t$.

The frequency of VaR exceedances is called the VaR coverage.

# Calculation of coverage for S&P 500 returns and 5% probability level

mean(actual < garchVaR)

0.05159143

VaR coverage and model validation

- Interpretation of coverage for VaR at loss probability $\alpha$ (e.g., 5%):

- Valid prediction model has a coverage that is close to the probability level $\alpha$ used.

- If coverage $\gg$ $\alpha$: too many exceedances: the predicted quantile should be more negative. Risk of losing money has been underestimated.

- If coverage $\ll$ $\alpha$: too few exceedances, the predicted quantile was too negative. Risk of losing money has been overestimated.

Factors that deteriorate the performance

distribution.model = "std" instead of distribution.model = "sstd":

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "std")

Rolling estimation and 5% VaR prediction:

garchroll <- ugarchroll(garchspec, data = sp500ret, n.start = 2500,

refit.window = "moving", refit.every = 100)

garchVaR <- quantile(garchroll, probs = 0.05)

mean(actual < garchVaR) # returns 0.05783233

Further deterioration

variance.model = list(model = "sGARCH")

instead of

variance.model = list(model = "gjrGARCH"):

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "sGARCH"),

distribution.model = "std")

Rolling estimation and 5% VaR prediction:

garchroll <- ugarchroll(garchspec, data = sp500ret, n.start = 2500,

refit.window = "moving", refit.every = 100)

garchVaR <- quantile(garchroll, probs = 0.05)

mean(actual < garchVaR) # returns 0.06074475

Even further deterioration

refit.every = 1000

instead of

refit.every = 100:

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "sGARCH"),

distribution.model = "std")

garchroll <- ugarchroll(garchspec, data = sp500ret, n.start = 2500,

refit.window = "moving", refit.every = 1000)

garchVaR <- quantile(garchroll, probs = 0.05)

mean(actual < garchVaR) # returns 0.06199293

Downside risk means thinking about predicted quantiles.

GARCH Models in R