Avoid unnecessary complexity

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

Avoid unneeded complexity

- If you know

- The mean dynamics are negligible

- There is no leverage effect in the variance

- The distribution is symmetric and fat-tailed

Then a constant mean, standard GARCH(1, 1) with student t distribution is an appropriate specification to use:

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = "sGARCH"),

distribution.model = "std")

Restrict the parameter estimates

- If you know that the parameters

- are equal to a certain value

- or, are inside an interval

- Then you should impose this in the specification using the methods

setfixed()setbounds()

Application to exchange rates

Specification and estimation

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = "sGARCH"),

distribution.model = "std")

garchfit <- ugarchfit(data = EURUSDret, spec = garchspec)

Estimation results

coef(garchfit)

mu omega alpha1 beta1 shape

-3.562136e-05 8.005123e-08 3.097322e-02 9.674496e-01 8.821902e+00

Example of setfixed()

- If you know

alpha1 = 0.05andshape = 6: impose those values in the estimation. - How? Use of

setfixed()method on augarchspecobject

setfixed(garchspec) <- list(alpha1 = 0.05, shape = 6)

Result

garchfit <- ugarchfit(data = EURUSDret, spec = garchspec)

coef(garchfit)

mu omega alpha1 beta1 shape

-4.142922e-05 2.061772e-07 5.000000e-02 9.489622e-01 6.000000e+00

Bounds on parameters

- The GARCH parameters can be restricted to an interval.

- Sometimes the interval of plausible values is large:

- To ensure the variance is positive, we require e.g. that all variance parameters ($\omega$, $\alpha$, $\beta$, $\gamma$) are positive.

- Sometimes the interval of plausible values is smaller:

- Likely values of $\alpha$ are in between 0.05 and 0.2

- Likely values of $\beta$ are in between 0.7 and 0.95

- Such bound constraints on the parameters can be imposed using the

setbounds()method.

Example of setbounds()

setbounds(garchspec) <- list(alpha1 = c(0.05, 0.2), beta1 = c(0.8, 0.95))

Use your intuition to avoid unneeded complexity.

Use the information you have:

- to build simple (and smart) models

- to fix parameter values or set bounds

to make the GARCH dynamics realistic:

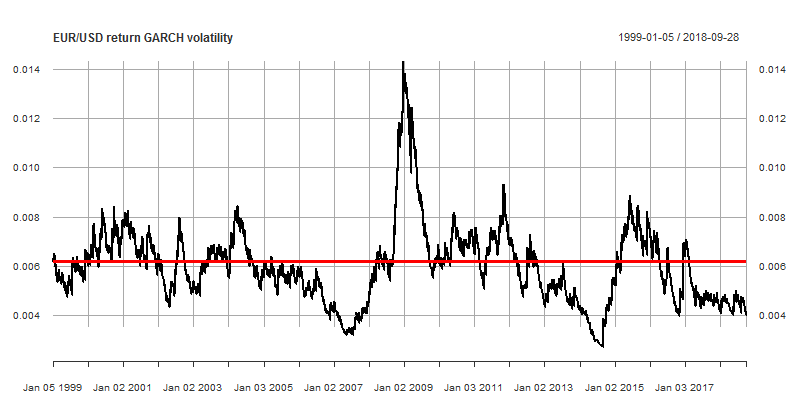

- mean reversion of the volatility around the sample standard deviation

sd(EURUSDret) # returns a value of 0.006194049

- mean reversion of the volatility around the sample standard deviation

Volatility clusters and mean reversion of volatility

Variance targeting

- Mathematically, this means that the unconditional variance implied by the GARCH models equals the sample variance $\hat \sigma^2$.

- How? By setting the argument

variance.targeting = TRUEinvariance.modelofugarchspec():

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0,0)),

variance.model = list(model = "sGARCH",

variance.targeting = TRUE),

distribution.model = "std")

garchfit <- ugarchfit(data = EURUSDret, spec = garchspec)

all.equal(uncvariance(garchfit), sd(EURUSDret) ^ 2, tol = 1e-4)

TRUE

Let's impose restrictions on the GARCH model

GARCH Models in R