Use only the data that were available at the time of prediction

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

Volatility prediction by applying `sigma()` to `ugarchforecast` object

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0,0)), variance.model = list(model = "sGARCH"), distribution.model = "norm") garchfit <- ugarchfit(data = sp500ret, spec = garchspec) garchforecast <- ugarchforecast(fitORspec = garchfit, n.ahead = 3) sigma(garchforecast)2017-12-29 T+1 0.005034754 T+2 0.005127582 T+3 0.005217770

Volatility estimation by applying `sigma()` to `ugarchfit` object (i)

head(sigma(garchfit), 3)

1989-01-04 0.01099465

1989-01-05 0.01129167

1989-01-06 0.01084294

tail(sigma(garchfit), 3)

2017-12-27 0.005051926

2017-12-28 0.004947569

2017-12-29 0.004862908

Volatility estimation by applying sigma() to ugarchfit object (ii)

Look ahead bias: Future returns are used to make the volatility estimate.

Solution to avoid look-ahead bias: Rolling estimation

- Program a

forloop: Iterate over the prediction times and useugarchfit()to estimate the model andugarchforecast()to make the volatility forecast - Built-in function

ugarchroll()in therugarchpackage - Options:

- Length of the estimation sample

- Frequency of model estimation

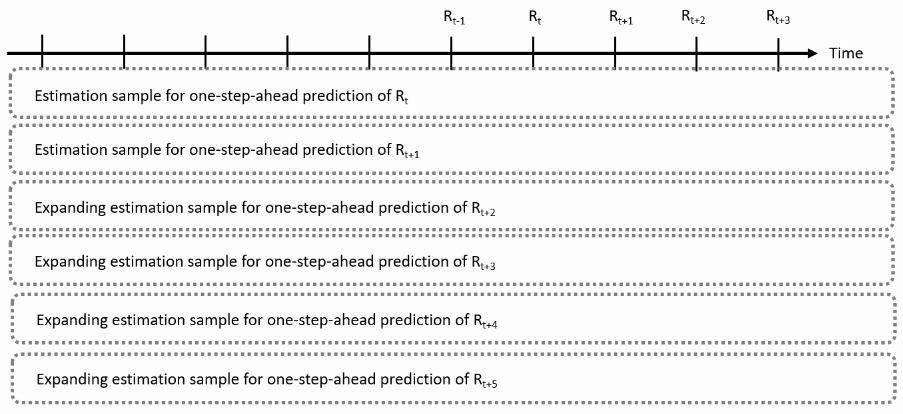

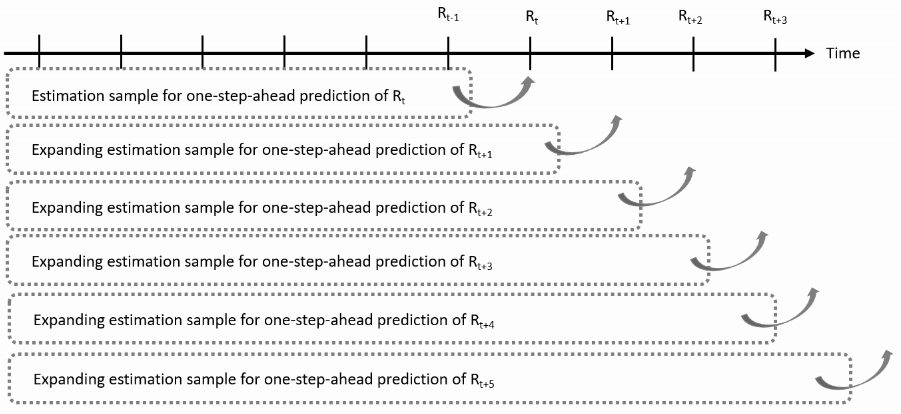

Expanding window estimation

Use all available returns at the time of prediction

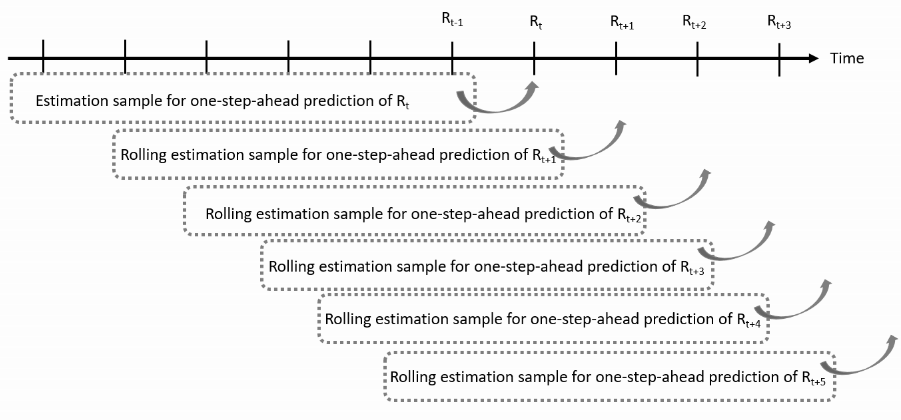

Moving window estimation

Only use a fixed number of the most return observations available at the time of prediction

Properties of rolling window estimation

- Rolling window lets you adapt to changes in the model parameters

- Computational cost of

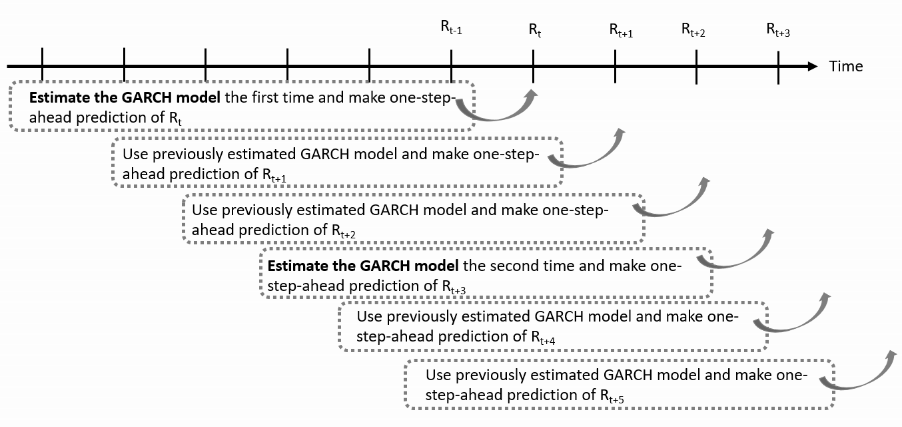

ugarchroll()is the loop across prediction times:- Can be reduced by re-estimate the model at a lower frequency than the frequency of prediction

Rolling and re-estimation

Reduce the computational cost by estimating the model every $K$ observations

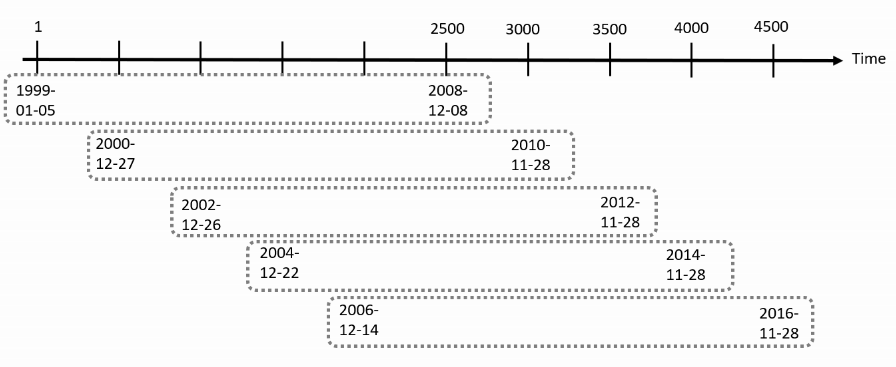

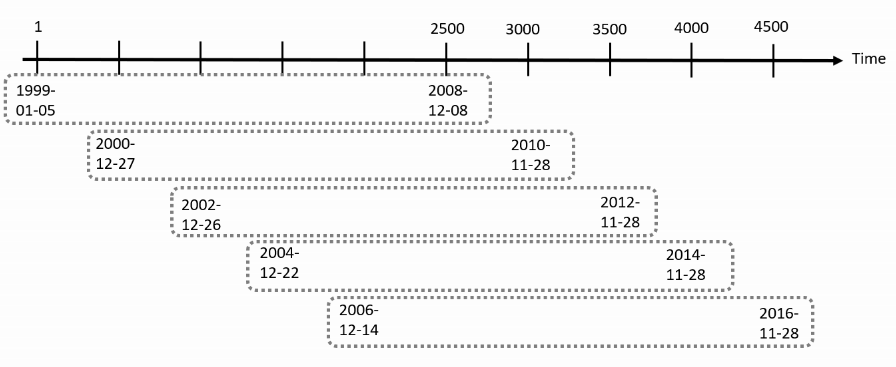

Function ugarchroll

garchroll <- ugarchroll(tgarchspec, data = EURUSDret, n.start = 2500,

refit.window = "moving", refit.every = 500)

Arguments to specify:

- GARCH specification used

data: return data to usen.start: the size of the initial estimation samplerefit.window: how to change that sample through time: "moving" or "expandingrefit.every: how often to re-estimate the model

Example on the Jan 1999-Dec 2018 daily EUR/USD returns

For the 4961 EUR/USD returns with 4961 observations, starting on 1999-01-05 and using a moving estimation window of 2500 observations:

Output of changing parameters

Method coef() produces a list with the estimated coefficients for each estimation

coef(garchroll)[[1]]

$index

"2008-12-08"

$coef

Estimate Std. Error t value Pr(>|t|)

mu -1.480000e-04 1.330915e-04 -1.11201737 0.2661307

ar1 -2.953484e-03 1.985344e-02 -0.14876432 0.8817396

omega 7.498928e-08 5.587618e-06 0.01342062 0.9892922

alpha1 2.805079e-02 6.401139e-02 0.43821564 0.6612300

beta1 9.709400e-01 6.080197e-02 15.96889122 0.0000000

shape 1.098068e+01 2.609293e+01 0.42082981 0.6738794

Changes between estimation windows

coef(garchroll)[[1]]$coef # 2008-12-08

Estimate Std. Error t value Pr(>|t|)

omega 7.498928e-08 5.587618e-06 0.01342062 0.9892922

alpha1 2.805079e-02 6.401139e-02 0.43821564 0.6612300

beta1 9.709400e-01 6.080197e-02 15.96889122 0.0000000

coef(garchroll)[[5]]$coef # 2016-11-28

Estimate Std. Error t value Pr(>|t|)

omega 8.982527e-08 2.639680e-05 0.003402885 9.972849e-01

alpha1 4.149787e-02 2.550381e-01 0.162712424 8.707449e-01

beta1 9.573885e-01 2.195782e-01 4.360125676 1.299878e-05

What is the rolling predicted mean and volatility?

For the EUR/USD returns with n.start = 2500, the first prediction is for observation 2501, namely 2008-12-09:

Method as.data.frame()

preds <- as.data.frame(garchroll)

head(preds, 3)

Mu Sigma Skew Shape Shape(GIG) Realized

2008-12-09 -8.271288e-05 0.01196917 0 10.98068 0 0.0003864884

2008-12-10 -1.495786e-04 0.01179742 0 10.98068 0 -0.0066799754

2008-12-11 -1.287079e-04 0.01167929 0 10.98068 0 -0.0203099142

Note:

preds$Mu: series of predicted mean valuespreds$Sigma: series of predicted volatility values

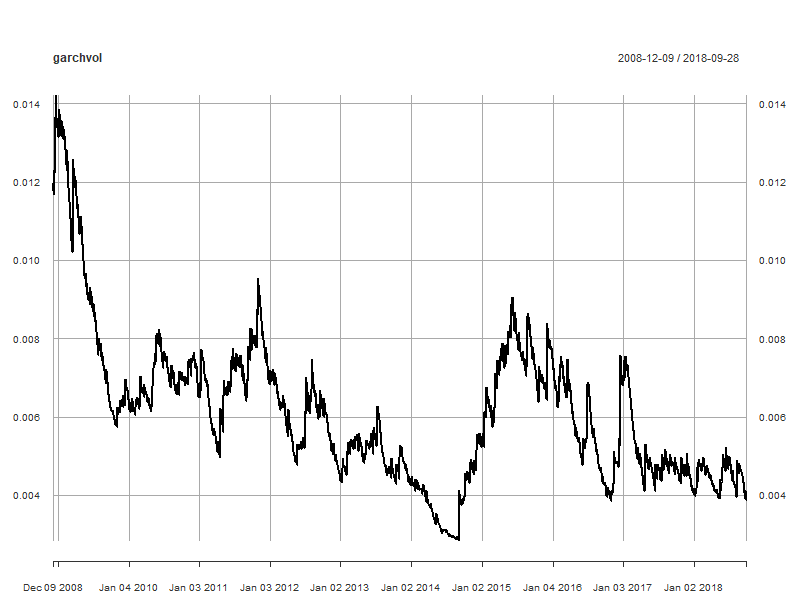

Predicted volatilities

garchvol <- xts(preds$Sigma, order.by = as.Date(rownames(preds)))

plot(garchvol)

Accuracy of rolling predictions

preds <- as.data.frame(garchroll)

head(preds)

Mu Sigma Skew Shape Shape(GIG) Realized

2008-12-09 -8.271288e-05 0.01196917 0 10.98068 0 0.0003864884

2008-12-10 -1.495786e-04 0.01179742 0 10.98068 0 -0.0066799754

2008-12-11 -1.287079e-04 0.01167929 0 10.98068 0 -0.0203099142

2008-12-12 -8.845214e-05 0.01199756 0 10.98068 0 -0.0041201588

2008-12-15 -1.362683e-04 0.01184438 0 10.98068 0 -0.0230532787

2008-12-16 -8.034966e-05 0.01228900 0 10.98068 0 -0.0105720492

Evaluate accuracy of preds$Mu and preds$Sigma by comparing with preds$Realized

Mean squared prediction error for the mean

# Prediction error for the mean

e <- preds$Realized - preds$Mu

mean(e ^ 2)

3.867998e-05

Mean squared prediction error for the variance

# Prediction error for the mean

e <- preds$Realized - preds$Mu

# Prediction error for the variance

d <- e ^ 2 - preds$Sigma ^ 2

mean(d ^ 2)

6.974161e-09

Compare two models

Standard GARCH with student t distribution

tgarchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "sGARCH"), distribution.model = "std")

garchroll <- ugarchroll(tgarchspec, data = EURUSDret, n.start = 2500,

refit.window = "moving", refit.every = 500)

GJR GARCH with skewed student t distribution

gjrgarchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"), distribution.model = "sstd")

gjrgarchroll <- ugarchroll(gjrgarchspec, data = EURUSDret, n.start = 2500,

refit.window = "moving", refit.every = 500)

Comparison of prediction accuracny

Standard GARCH with student t distribution

preds <- as.data.frame(garchroll)

e <- preds$Realized - preds$Mu

d <- e ^ 2 - preds$Sigma ^ 2

mean(d ^ 2) # yields 6.974161e-09

GJR GARCH with skewed student t distribution

gjrpreds <- as.data.frame(gjrgarchroll)

e <- gjrpreds$Realized - gjrpreds$Mu

d <- e ^ 2 - gjrpreds$Sigma ^ 2

mean(d ^ 2) # yields 6.965095e-09

The proof of the pudding is in the eating

GARCH Models in R