Leverage effect

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

Negative returns induce higher leverage

- $R_t <0 $

- $\downarrow$ market value

- $\uparrow$ leverage = debt / market value

- $\uparrow$ volatility

Two equations

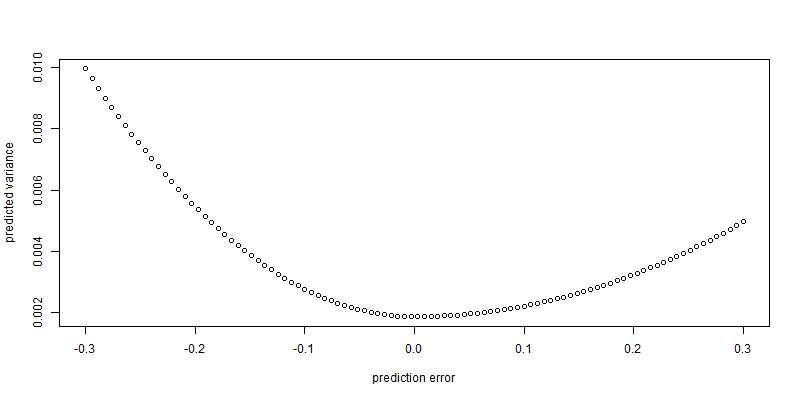

Use separate equations for the variance following negative and positive unexpected return $e_t = R_t - \mu_t$ :

Case when $ e_{t-1} \gt 0$

$$ \sigma^2_{t} = ??? $$

Case when $ e_{t-1} \le 0$

$$ \sigma^2_{t} = ??? $$

In case of a positive surprise

... we take the usual GARCH(1,1) equation:

Case when $ e_{t-1} \gt 0$

$$ \sigma^2_{t} = \omega + \alpha e^{2}_{t-1} + \beta \sigma^{2}_{t-1} $$

Case when $ e_{t-1} \le 0$

$$ \sigma^2_{t} = ??? $$

In case of a negative surprise

The predicted variance should be higher than after a positive surprise.

This means a higher coefficient multiplying the squared prediction error, namely $\alpha+\gamma$ instead of $\alpha$ with $\gamma \geq 0$

Case when $ e_{t-1} \gt 0$

$$ \sigma^2_{t} = \omega + \alpha e^{2}_{t-1} + \beta \sigma^{2}_{t-1} $$

Case when $ e_{t-1} \le 0$

$$ \sigma^2_{t} = \omega + (\alpha + \gamma) e^{2}_{t-1} + \beta \sigma^{2}_{t-1} $$

This is the GJR model proposed Glosten, Jagannathan and Runkle.

How?

Change the argument variance.model of ugarchspec() from model = "sGARCH" to model = "gjrGARCH":

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = "sGARCH"),

distribution.model = "sstd")

$$\downarrow$$

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

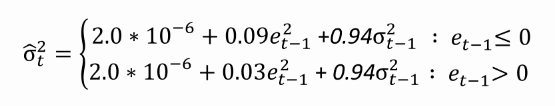

Illustration on MSFT returns

Estimate the model

garchfit <- ugarchfit(data = msftret, spec = garchspec)

Inspect the GARCH coefficients

coef(garchfit)[2:5]

omega alpha1 beta1 gamma1

2.007875e-06 3.423336e-02 9.363302e-01 5.531854e-02

Visualize volatility response using newsimpact()

out <- newsimpact(garchfit)

plot(out$zx, out$zy, xlab = "prediction error", ylab = "predicted variance")

Let's estimate a GJR GARCH model.

GARCH Models in R