The rugarch package

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

The normal GARCH(1,1) model with constant mean

The normal GARCH model

$$ R_t = \mu + e_t $$ $$ e_t \sim N(0, \sigma^2_t) $$ $$ \sigma^2_t = \omega + \alpha e^2_{t-1} + \beta \sigma^2_{t-1} $$

- Four parameters: $\mu, \omega, \alpha, \beta$.

- Estimation by maximum likelihood: find the parameter values for which the GARCH model is most likely to have generated the observed return series.

Alexios Ghalanos

library(rugarch) citation("rugarch")To cite the rugarch package, please use: Alexios Ghalanos (2018). rugarch: Univariate GARCH models.R package version 1.4-0.

Workflow

Three steps:

ugarchspec(): Specify which GARCH model you want to use (mean $\mu_t$, variance $\sigma^2_t$, distribution of $e_t$)ugarchfit(): Estimate the GARCH model on your time series with returns $R_1,...,R_T$.ugarchforecast(): Use the estimated GARCH model to make volatility predictions for $R_{T+1}$,...

Workflow in R

ugarchspec() specifies which GARCH model you want to use.

garchspec <- ugarchspec(mean.model = list(armaOrder = c(0,0)),

variance.model = list(model = "sGARCH"),

distribution.model = "norm")

ugarchfit() estimates the GARCH model.

garchfit <- ugarchfit(data = sp500ret, spec = garchspec)

ugarchforecast() forecasts the volatility of the future returns.

garchforecast <- ugarchforecast(fitORspec = garchfit, n.ahead = 5)

ugarchfit object

- The

ugarchfityields an object that contains all the results related to the estimation of the garch model. - Methods

coef,uncvar,fittedandsigma:

# Coefficients

garchcoef <- coef(garchfit)

# Unconditional variance

garchuncvar <- uncvariance(garchfit)

# Predicted mean

garchmean <- fitted(garchfit)

# Predicted volatilities

garchvol <- sigma(garchfit)

GARCH coefficients for daily S&P 500 returns

print(garchcoef)

mu omega alpha1 beta1

5.728020e-04 1.220515e-06 7.792031e-02 9.111455e-01

$$ R_{t} = 5.7 \times 10^{-4} + e_{t} $$ $$ e_{t} \sim N(0, \hat{\sigma}^{2}_{t}) $$ $$ \hat{\sigma}^{2}_{t} = 1.2 \times 10^{-6} + 0.08 e^{2}_{t-1} + 0.91 \hat{\sigma}^{2}_{t-1} $$

sqrt(garchuncvar)

0.01056519

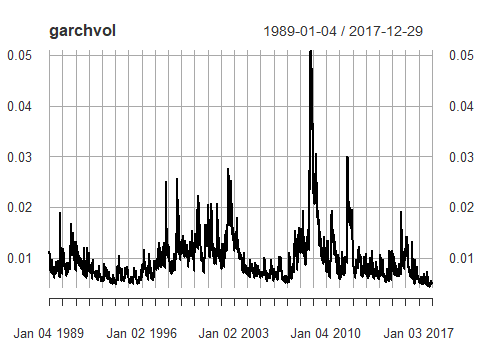

Estimated volatilities

garchvol <- sigma(garchfit)

plot(garchvol)

What about future volatility?

tail(garchvol, 1)

2017-12-29 0.004862908

What about the volatility for the days following the end of the time series?

Forecasting h-day ahead volatilities

- Applying the

sigma()method to theugarchforecastobject gives the volatility forecasts:

sigma(garchforecast)

2017-12-29

T+1 0.005034754

T+2 0.005127582

T+3 0.005217770

T+4 0.005305465

T+5 0.005390797

Forecasting h-day ahead volatilities

Applying the fitted() method to the ugarchforecast object gives the mean forecasts:

fitted(garchforecast)

2017-12-29

T+1 0.000572802

T+2 0.000572802

T+3 0.000572802

T+4 0.000572802

T+5 0.000572802

Application to tactical asset allocation

A portfolio that invests a percentage $w$ in a risky asset (with volatility $\sigma_t$) and keeps $1-w$ on a risk-free bank deposit account has volatility equal to

$$ \sigma_p = w \sigma_t$$

How to set $w$? One approach is volatility targeting: $w$ is such that the predicted annualized portfolio volatility equals a target level, say 5%. Then:

$$ w^* = 0.05 /\sigma_t $$

Since GARCH volatilities change, the optimal weight changes as well.

Let's play with rugarch!

GARCH Models in R