Validate your assumptions about the mean and variance

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

Check 1: Mean and standard deviation of standardized returns

Formula standardized returns

$$ Z_{t} = \frac{R_{t} - \hat{\mu_{t}}}{ \hat{\sigma_{t}}} $$

- First check of model validity:

- Sample mean of standardized returns $\approx$ 0

- Sample standard deviation of standardized returns $\approx$ 1

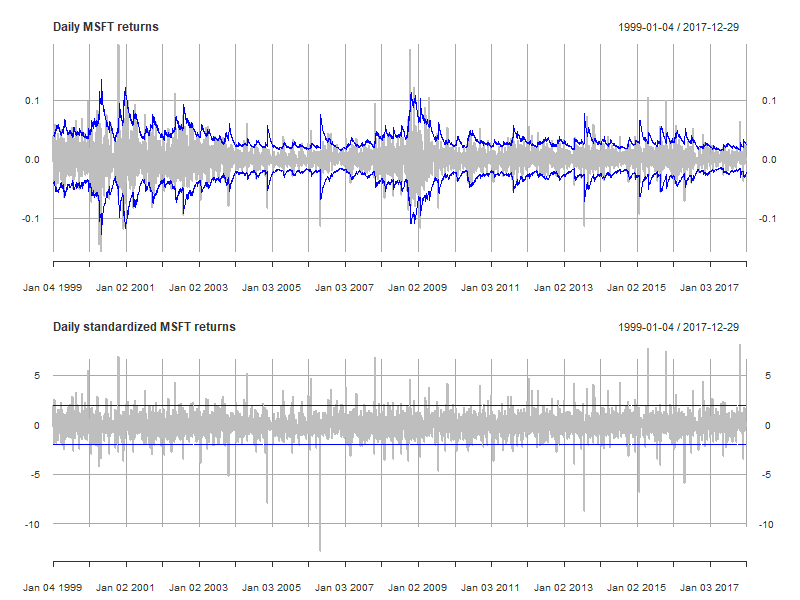

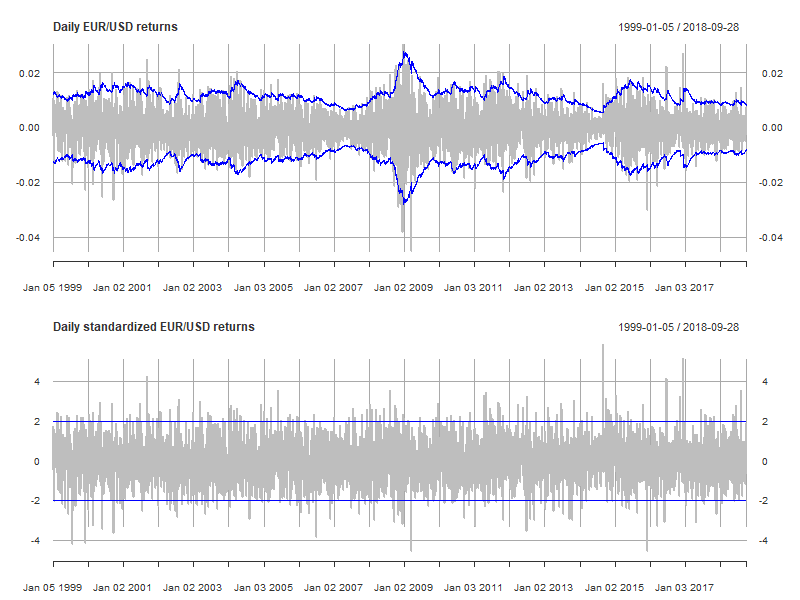

Check 2: Time series plot of standardized returns

- Second check of model validity:

- time series plot of standardized returns

- standardized returns should have constant variability

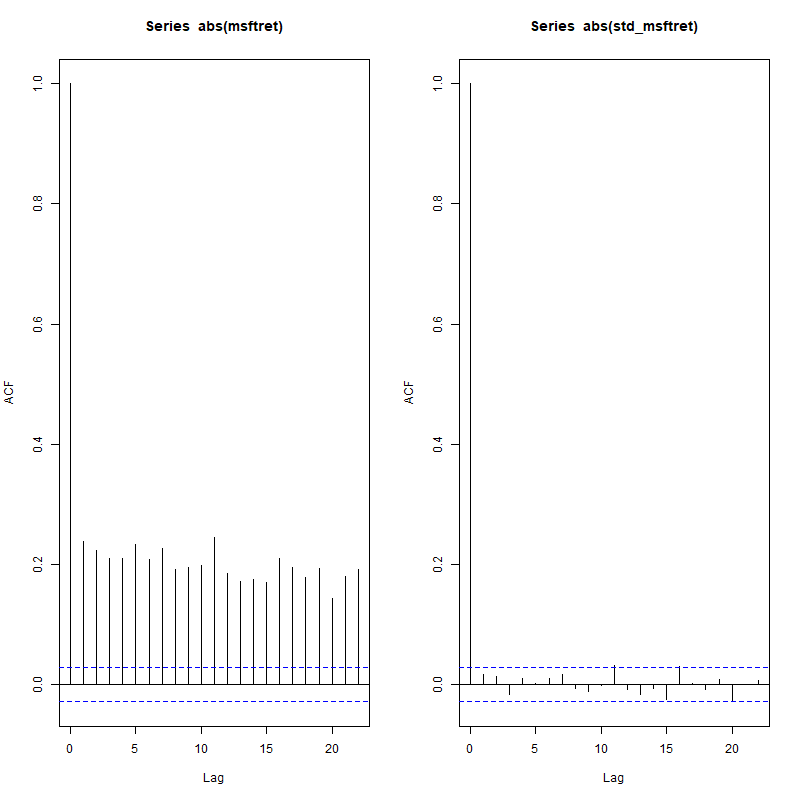

Check 3: No predictability in the absolute standardized returns

Third check of model validity:

- verify that there is no correlation between the past absolute standardized return and the current absolute standardized return.

- this means: $ Corr(|Z_{t-k}|, |Z_{t}|) \approx 0, $ for $k>0$

Why?

- The magnitude of the absolute standardized return should be constant $\rightarrow$ no correlations in the absolute standardized returns.

Autocorrelations

- Such within time series correlations are called autocorrelations of order k

- $k=1$: $Corr(|Z_{t-1}|, |Z_{t}|)$: Correlation of the current absolute standardized return and its previous value.

- $k=2$: $Corr(|Z_{t-2}|, |Z_{t}|)$: Correlation of the current absolute standardized return and its value two periods ago.

- ...

- All of these should be 0. Except:

- $k=0$: $Corr(|Z_{t}|, |Z_{t}|)$: Correlation of the absolute standardized return with itself: equals 1.

acf()

- In R, we can compute those autocorrelations using the autocorrelation function denoted by

acf()- Input: Time series, maximum order

- Output: The correlogram: plot showing the values of the autocorrelation for different orders $k = 0, 1, ...$.

Application to MSFT

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

garchfit <- ugarchfit(data = msftret, spec = garchspec)

stdmsftret <- residuals(garchfit, standardize = TRUE)

acf(abs(msftret), 22)

acf(abs(stdmsftret), 22)

Check 4: Ljung-Box test

- Fourth check of model validity:

- Ljung-Box test that the first k autocorrelations in the absolute standardized returns $|Z_t$| are zero: $$ H_0: Corr(|Z_t|,|Z_{t-1}|) = Corr(|Z_t|,|Z_{t-2}|) = ... = Corr(|Z_t|,|Z_{t-k}|) = 0 $$

- Similar to a $t$-test for statistical significance of the estimated parameters, but here we want to have 0 in order to have a good model.

Rule of thumb: p-value less than 5% indicates that the model used is not valid.

Ljung-Box test in R

- In R: function

Box.test()with 3 arguments:- series

- maximum order for which autocorrelations are zero

type = "Ljung-Box"

Example:

Box.test(abs(stdmsftret), 22, type = "Ljung-Box")

- Output: p-value

- Rule of thumb: p-value less than 5% indicates that the model used is not valid.

Box.test using absolute standardized MSFT returns

Test on absolute standardized returns:

Box.test(abs(stdmsftret), 22, type = "Ljung-Box")

Box-Ljung test

data: abs(stdmsftret)

X-squared = 25.246, df = 22, p-value = 0.2855

Note: p-value is 28.55% > 5%. We cannot reject that: $$ H_0: Corr(|Z_t|,|Z_{t-1}|) = Corr(|Z_t|,|Z_{t-2}|) = ... = Corr(|Z_t|,|Z_{t-22}|) = 0 $$

Let's diagnose the absolute standardized returns.

GARCH Models in R