Use the validated GARCH model in production

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

Use in production

New functionality

- Use

ugarchfilter()for analyzing the recent dynamics in the mean and volatility - Use

ugarchforecast()applied to augarchspecobject (instead ofugarchfit()) object for making the predictions about the future mean and volatility

Example on MSFT returns

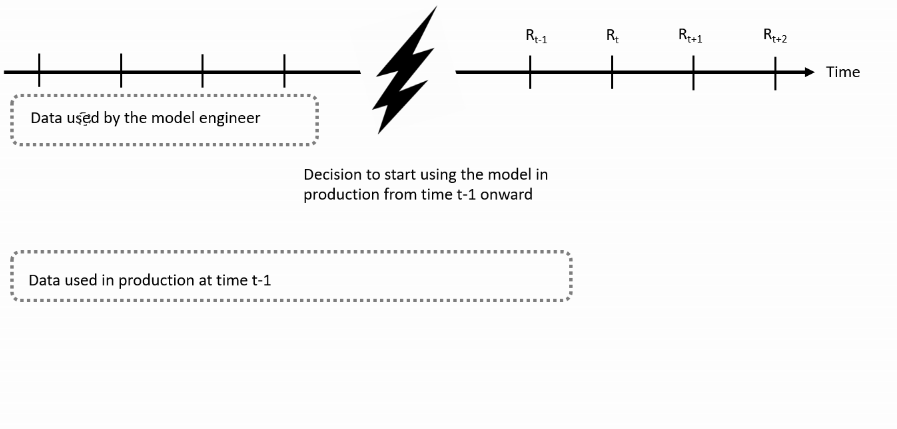

msftret: 1999–2017 daily returns.- Suppose the model fitting was done using the returns available at year-end 2010.

- You use this model at year-end 2017 to analyze past volatility dynamics and predict future volatility.

Step 1: Defines the final model specification

Fit the best model using the msftret available at year-end 2010:

# Specify AR(1)-GJR GARCH model with skewed student t distribution

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1,0)),

variance.model = list(model = "gjrGARCH"), distribution.model = "sstd")

# Estimate the model

garchfit <- ugarchfit(data = msftret["/2010-12"], spec = garchspec)

Define progarchspec as the specification to be used in production and use the instruction setfixed(progarchspec) <- as.list(coef(garchfit)):

progarchspec <- garchspec

setfixed(progarchspec) <- as.list(coef(garchfit))

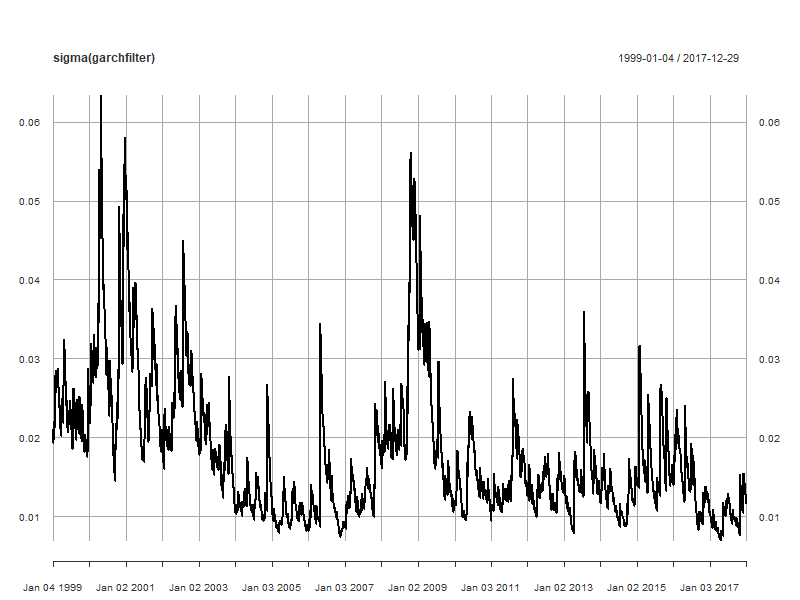

Step 2: Analysis of mean and volatility dynamics

Use the ugarchfilter() function:

garchfilter <- ugarchfilter(data = msftret, spec = progarchspec)

plot(sigma(garchfilter))

Step 3: Make predictions about future returns

garchforecast <- ugarchforecast(data = msftret,

fitORspec = progarchspec,

n.ahead = 10) # Make predictions for next ten days

cbind(fitted(garchforecast), sigma(garchforecast))

2017-12-29 2017-12-29

T+1 0.0004781733 0.01124870

T+2 0.0003610470 0.01132550

T+3 0.0003663683 0.01140171

T+4 0.0003661265 0.01147733

T+5 0.0003661375 0.01155238

T+6 0.0003661370 0.01162688

T+7 0.0003661371 0.01170083

T+8 0.0003661371 0.01177424

T+9 0.0003661371 0.01184712

T+10 0.0003661371 0.01191948

Use in simulation

Instead of applying the complete model to analyze observed returns, you can use it to simulate artificial log-returns:

$$ r_{t} = \log(P_{t}) - \log(P_{t-1}) $$

Useful to assess the randomness in future returns and the impact on prices, since the future price equals:

$$ P_{t + h} = P_{t} \exp(r_{t + 1} + r_{t + 2} + \ldots + r_{t + h}) $$

Step 1: Calibrate the simulation model

Use the log-returns in the estimation

# Compute log returns

msftlogret <- diff(log(MSFTprice))[-1]

Estimate the model and assign model parameters to the simulation model

garchspec <- ugarchspec(mean.model = list(armaOrder = c(1, 0)),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

# Estimate the model

garchfit <- ugarchfit(data = msftlogret, spec = garchspec)

# Set that estimated model as the model to be used in the simulation

simgarchspec <- garchspec

setfixed(simgarchspec) <- as.list(coef(garchfit))

Step 2: Run the simulation with `ugarchpath()`

Simulation using the ugarchpath() function requires to choose:

spec: completely specified GARCH modelm.sim: number of time series of simulated returns you wantn.sim: number of observations in the simulated time series (e.g. 252)rseed: any number to fix the seed used to generate the simulated series (needed for reproducibility)

simgarch <- ugarchpath(spec = simgarchspec, m.sim = 4,

n.sim = 10 * 252, rseed = 12345)

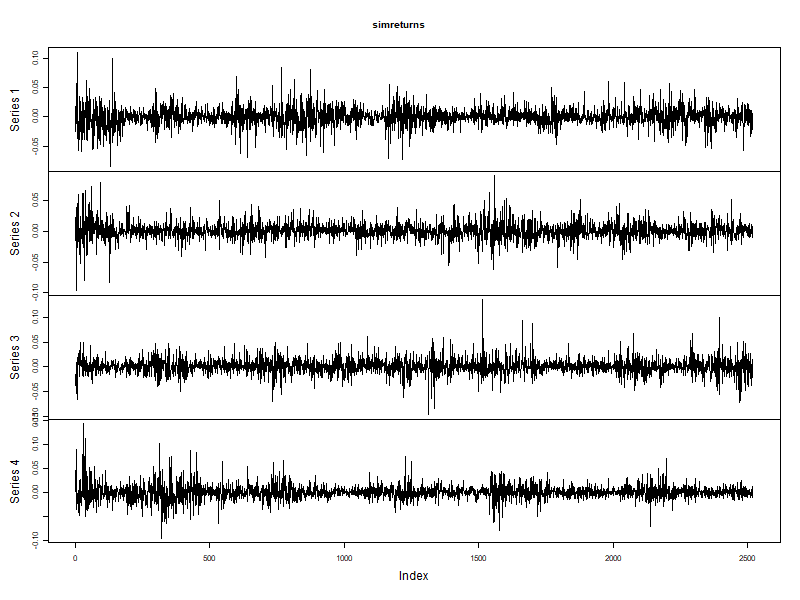

Step 3: Analysis of simulated returns

Method fitted() provides the simulated returns:

simret <- fitted(simgarch)

plot.zoo(simret)

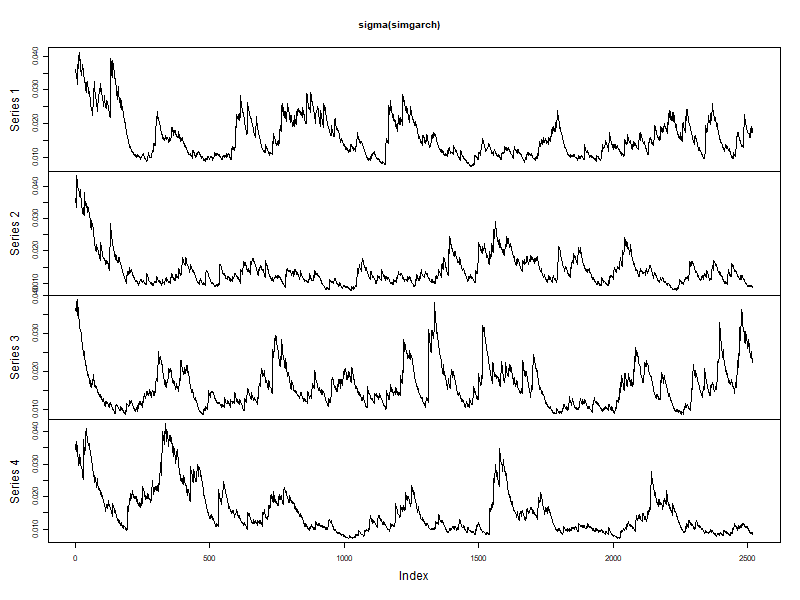

Analysis of simulated volatility

plot.zoo(sigma(simgarch))

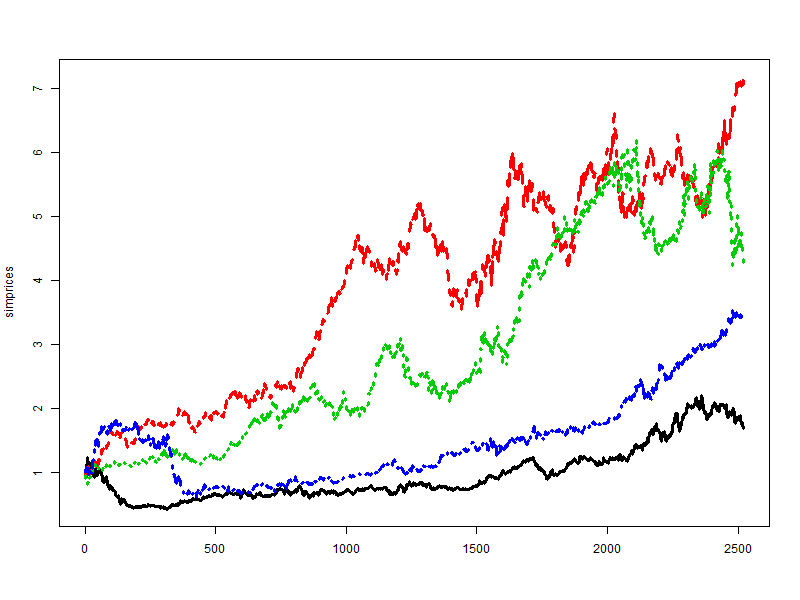

Analysis of simulated prices

Plotting 4 simulations of 10 years of stock prices, with initial price set at 1:

simprices <- exp(apply(simret, 2, "cumsum"))

matplot(simprices, type = "l", lwd = 3)

Time to practice with setfixed(), ugarchfilter(), ugarchforecast() and ugarchpath()

GARCH Models in R