Analyzing volatility

GARCH Models in R

Kris Boudt

Professor of finance and econometrics

About the instructor

- Kris Boudt

- PhD in financial risk forecasting

- Use GARCH models to win by not losing (much)

- R package rugarch of Alexios Ghalanos.

Calculating returns

- Relative financial gains and losses, expressed in terms of returns

$$ R_{t} = \frac{P_{t} - P_{t-1}}{P_{t-1}} $$

- Function

CalculateReturnsinPerformanceAnalytics

# Example in R for daily S&P 500 prices (xts object)

library(PerformanceAnalytics)

SP500returns <- CalculateReturns(SP500prices)

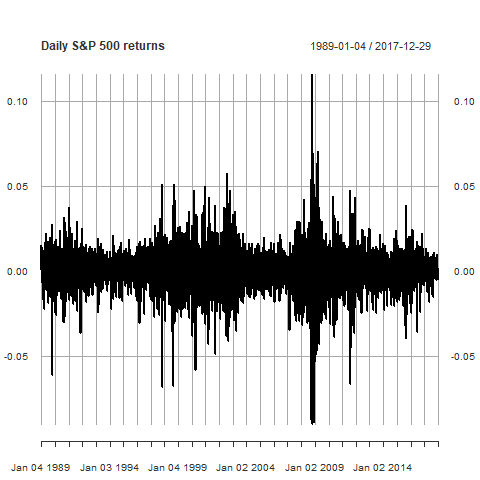

Daily S&P 500 returns

Properties of daily returns:

- The average return is zero

- Return variability changes through time

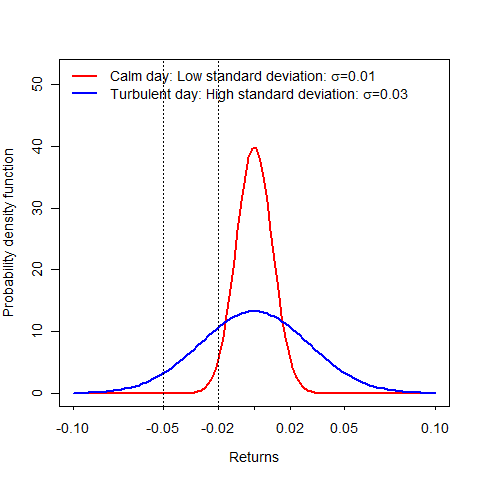

Standard deviation = measure of return variability.

Synonym: Return volatility.

Greek letter $\sigma_t$.

How to estimate return volatility

- Function

sd()computes the (daily) standard deviation:

sd(sp500ret)

0.01099357

- Corresponding formula for $\hat \sigma$ computed using $T$ daily returns:

$$ \hat \sigma = \sqrt{\frac{1}{T-1} \sum_{t=1}^T (R_t - \hat \mu )^2},$$

- where $\hat \mu$ is the mean return.

Annualized volatility

sd(sp500ret)is daily volatility- Annualized volatility = $\sqrt{252}$ $\times$ daily volatility

# Compute annualized standard deviation

sqrt(252) * sd(sp500ret)

0.1745175

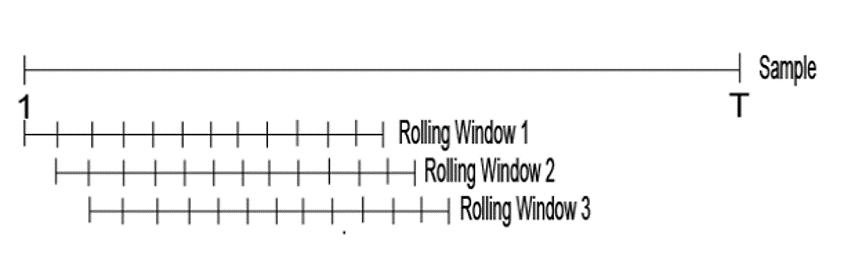

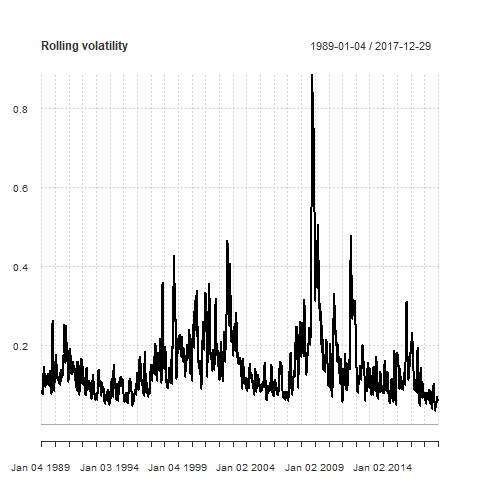

Rolling volatility estimation

- Rolling estimation windows :

- Window width? Multiple of 22 (trading days).

Function chart.RollingPerformance()

library(PerformanceAnalytics)

chart.RollingPerformance(R = sp500ret,

width = 22,

FUN = "sd.annualized",

scale = 252,

main = "Rolling 1 month volatility")

About GARCH models in R

- Estimation of $\sigma_t$ requires time series models, like GARCH.

Let's refresh the basics of computing rolling standard deviations in R

GARCH Models in R