Portfolio risk budget

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

Who did it?

Who did it?

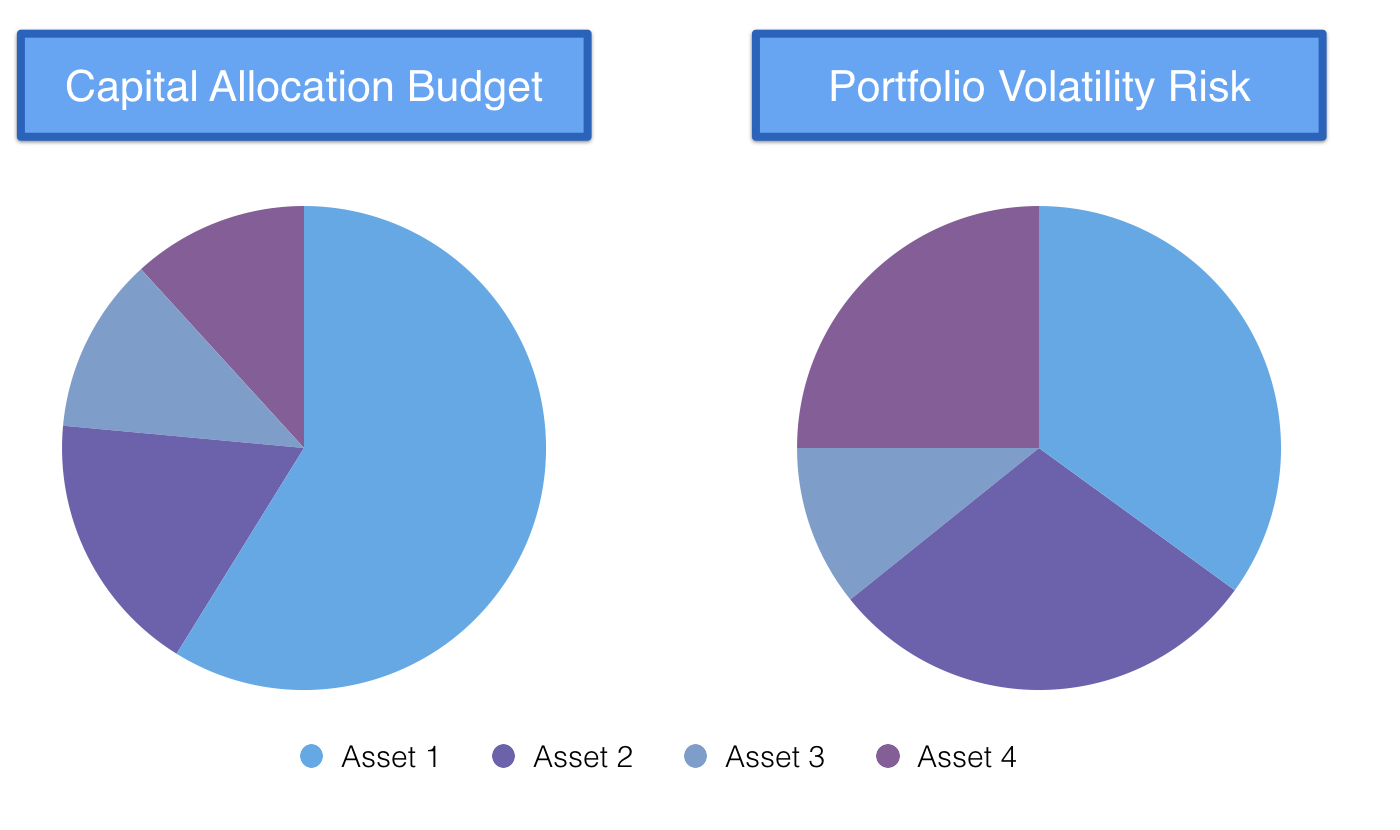

Portfolio volatility in risk contribution

$$\displaystyle \text{Portfolio Volatility} = \sum_{i=1}^{N} RC_i$$

where: $RC_i = \dfrac{w_i(\Sigma w)_i}{ \sqrt{w'\Sigma w}}$

- Risk contribution of asset $i$ depends on

- the complete matrix of weights $w$

- the full covariance matrix $\Sigma$

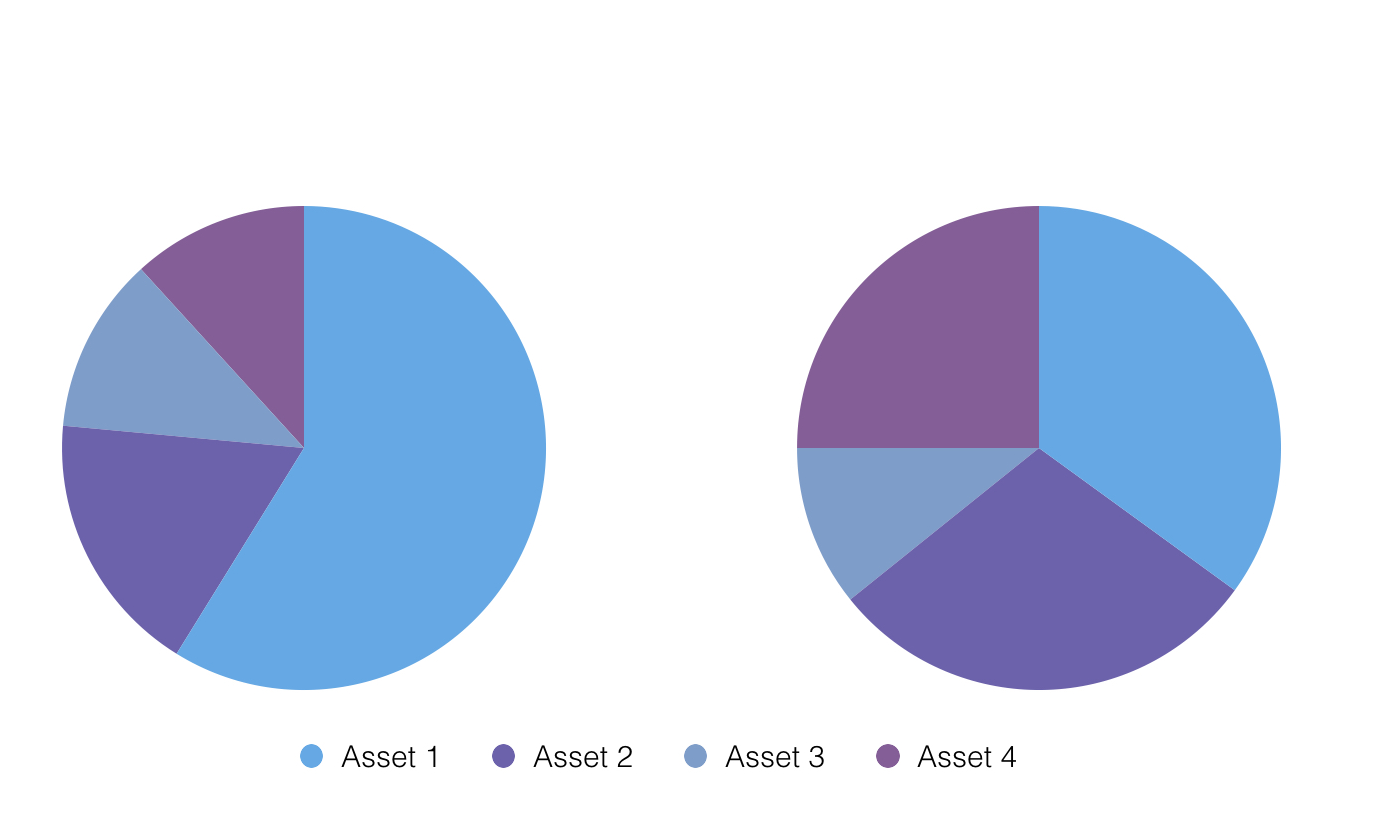

Percent risk contribution

$$\%RC_i = \frac{RC_i}{\text{Portfolio volatility}}$$

- where $\displaystyle \sum_{i=1}^{N} \% RC_i = 1$

Relatively less risky assets: $\%RC_i > w_i$

Relatively more risky assets: $\%RC_i < w_i$

Let's practice!

Introduction to Portfolio Analysis in R