Modern portfolio theory of Harry Markowitz

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

Portfolio weights are optimal

...when they optimize an objective function while satisfying the constraints.

| Possible Objectives | Possible Constraints |

|---|---|

| Maximize expected return | Only positive weights |

| Minimize the variance | Weights sum to 1 (all capital needs to be invested) |

| Maximize the Sharpe ratio | Portfolio expected return equals a target value |

Harry Markowitz

- Nobel Prize Winner

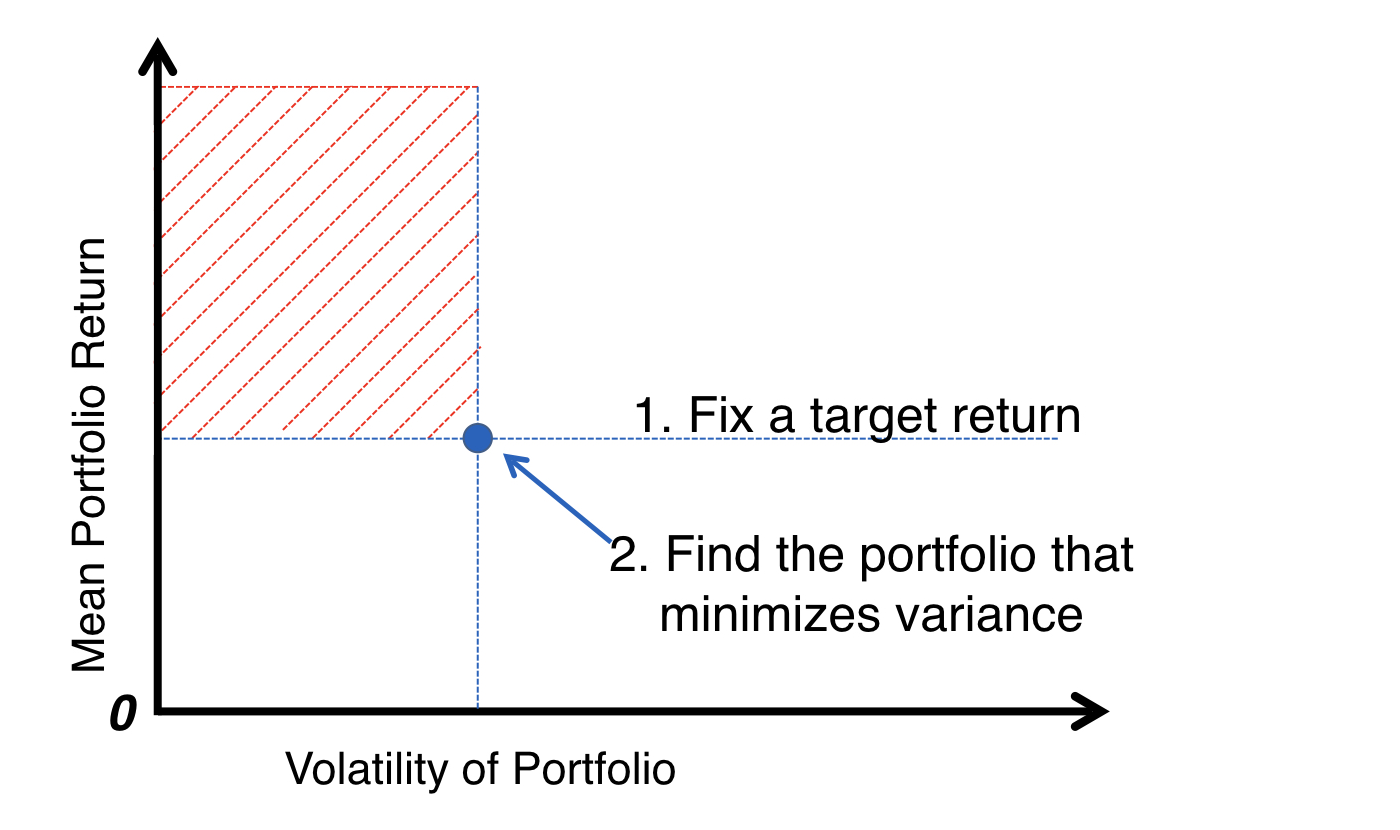

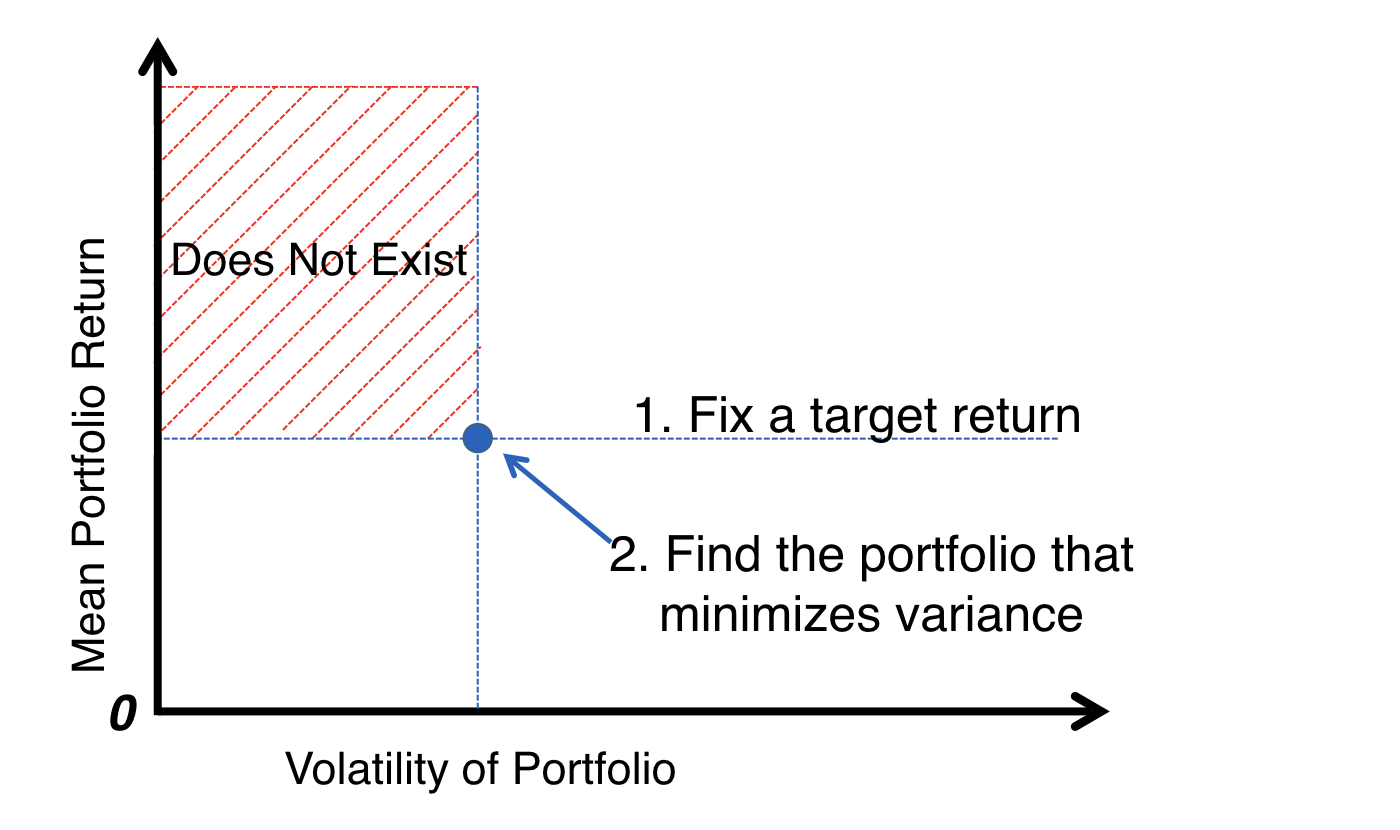

- Recommends finding optimal portfolios by

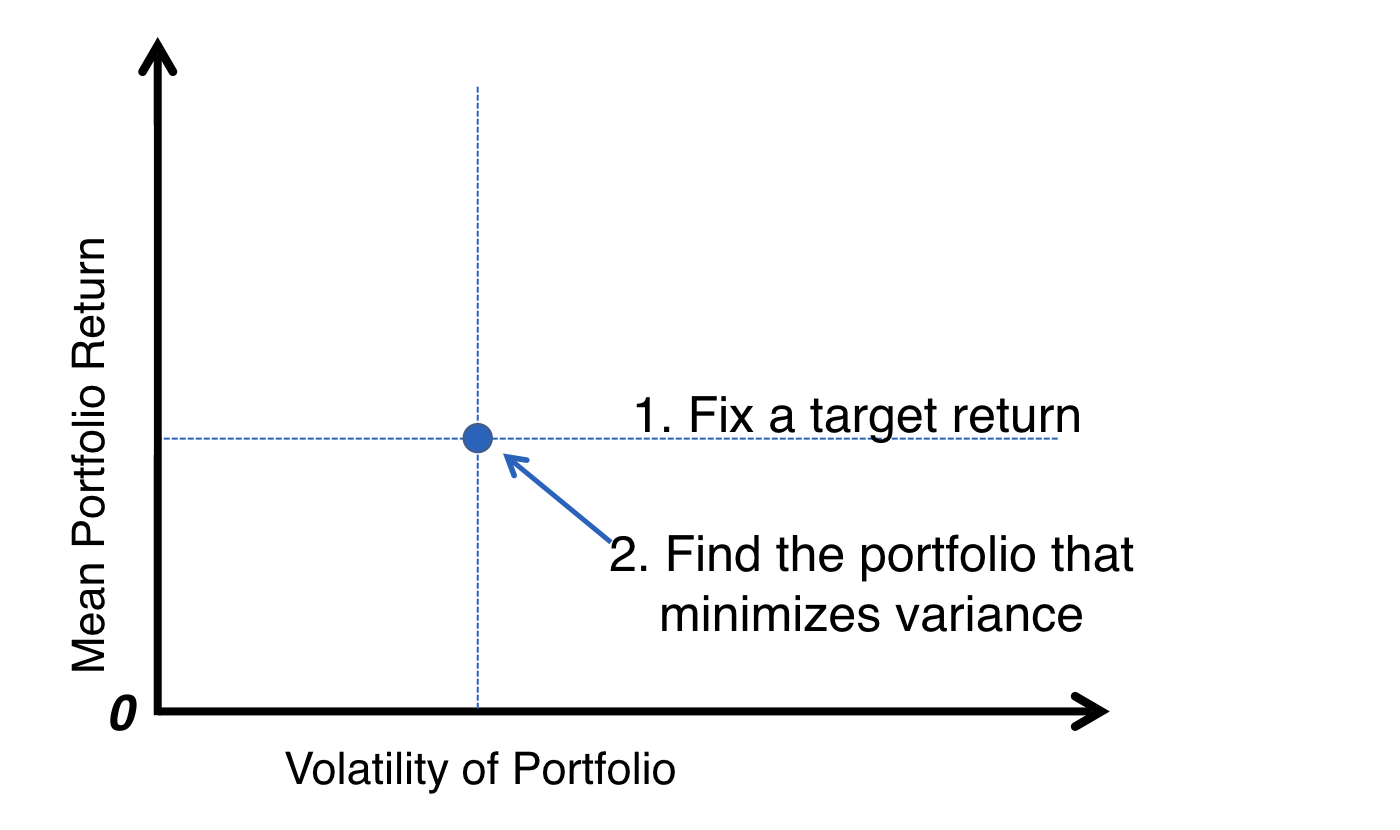

- Objective: Minimize portfolio variance

- Constraints:

- Full investment

- Expected return should be equal to a pre-specified target return

The H. Markowitz approach

The H. Markowitz approach

The H. Markowitz approach

The H. Markowitz approach

The H. Markowitz approach

Let's practice!

Introduction to Portfolio Analysis in R