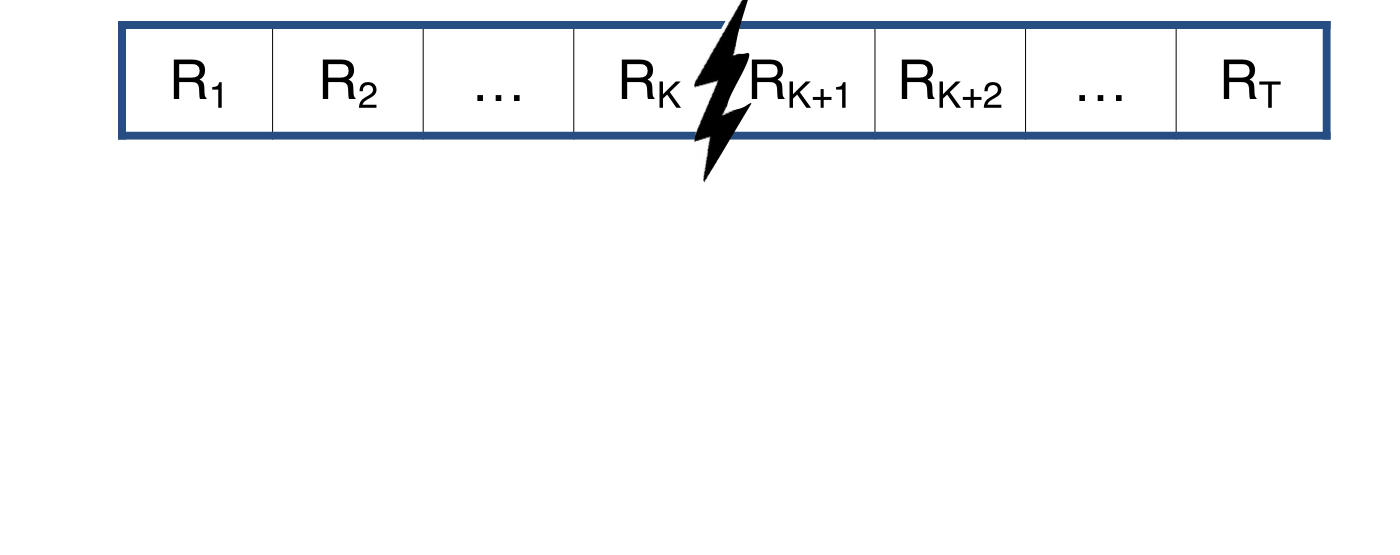

In-sample vs. out-of-sample evaluation

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

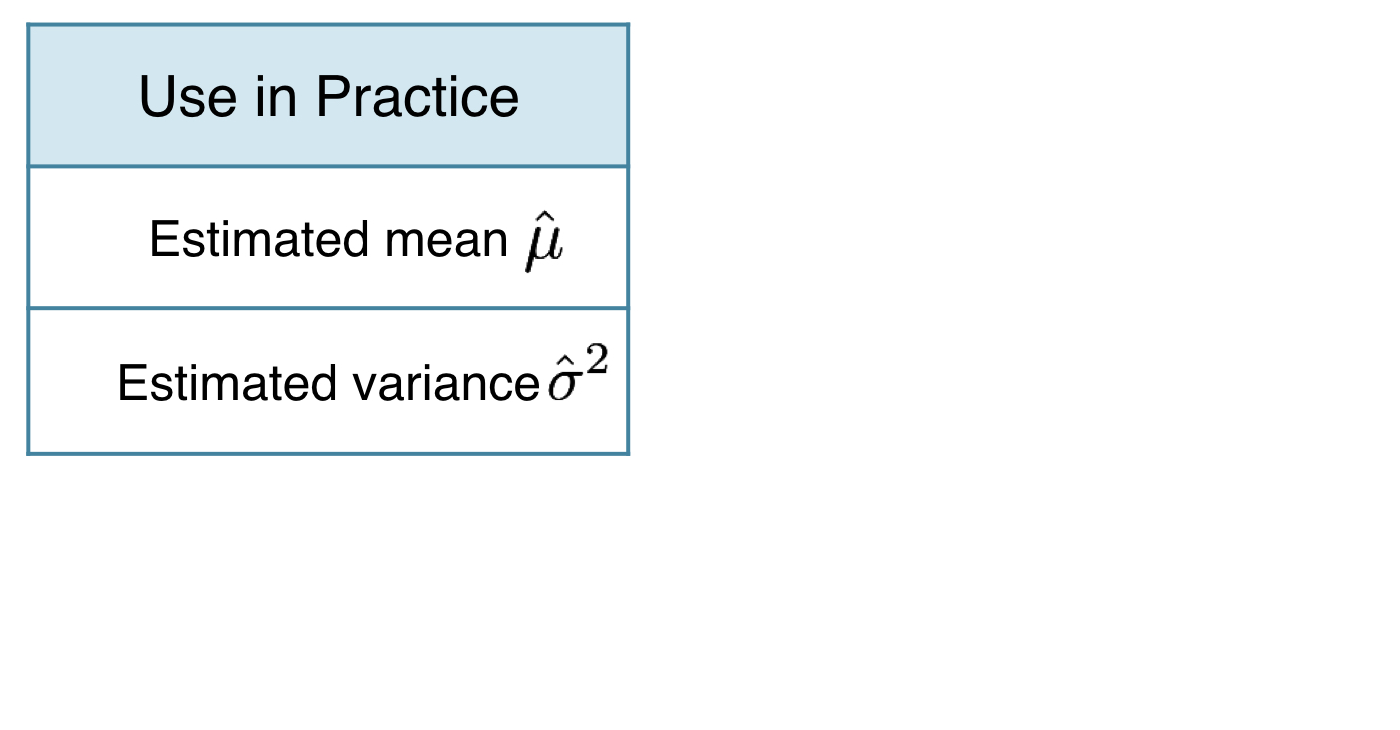

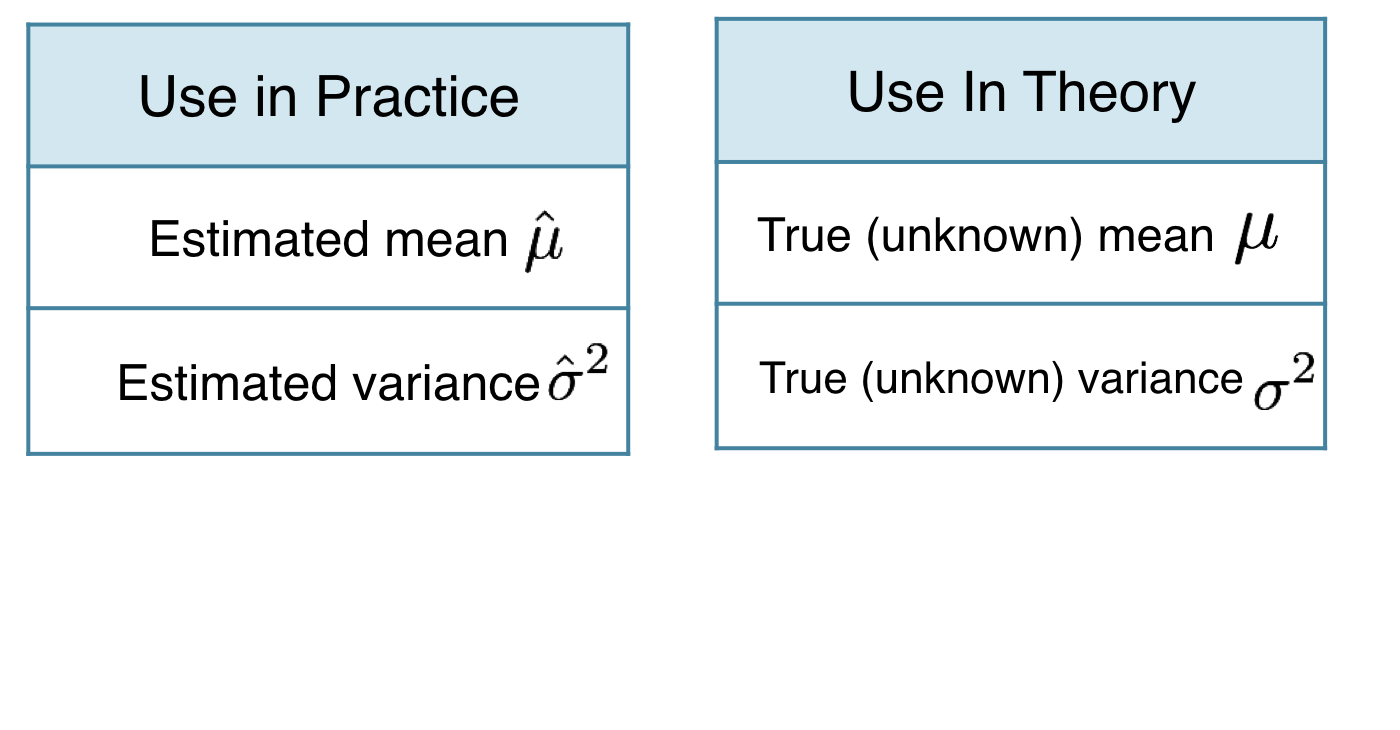

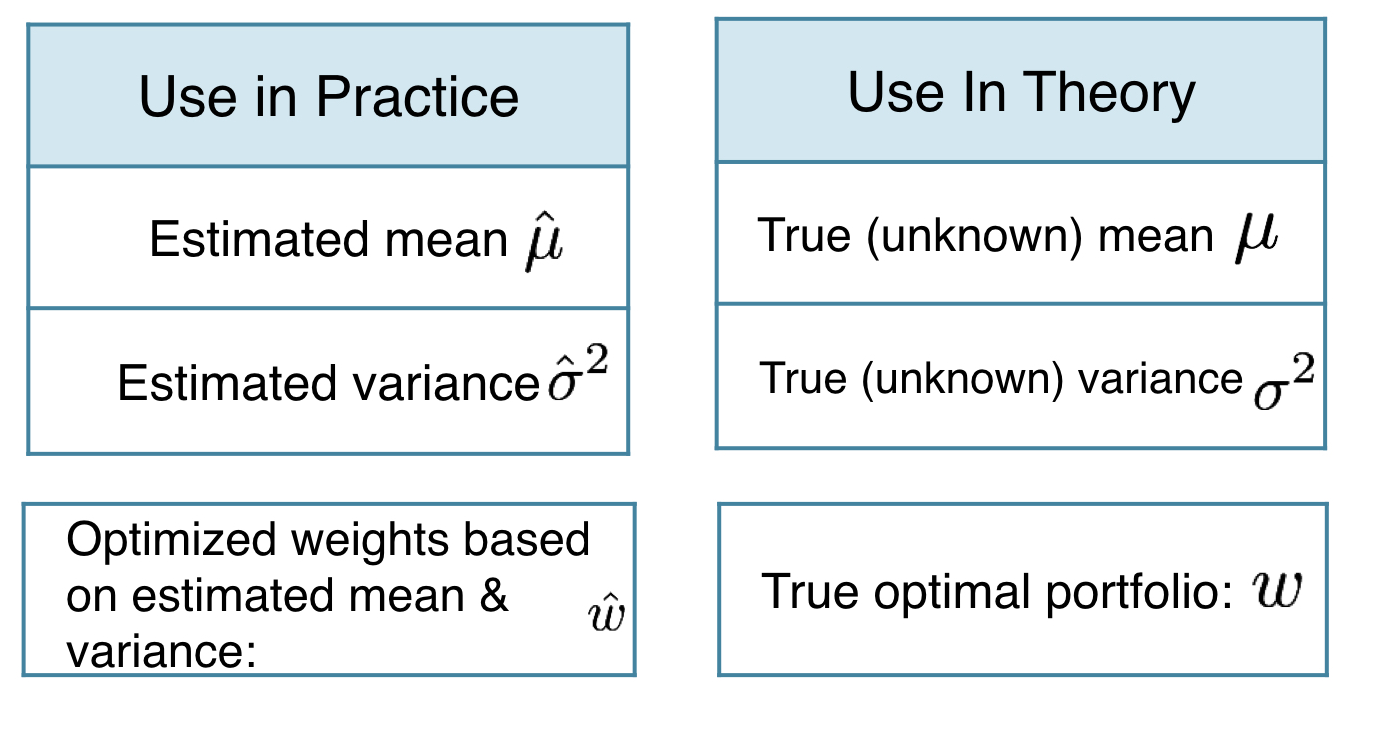

Bad news: estimation error

- Limitation to data-driven portfolio allocation:

Bad news: estimation error

- Limitation to data-driven portfolio allocation:

Bad news: estimation error

- Limitation to data-driven portfolio allocation:

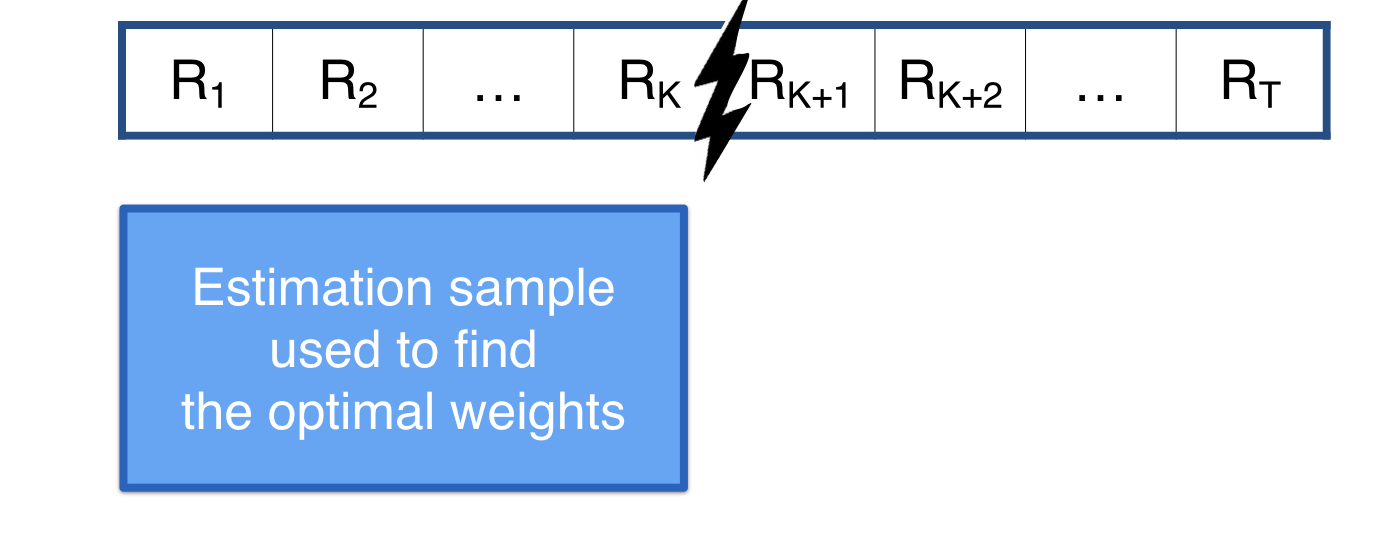

Good news: opportunities

- Do not ignore estimation error

- Use split-sample analysis to do a realistic evaluation of portfolio performance

Good news: opportunities

- Do not ignore estimation error

- Use split-sample analysis to do a realistic evaluation of portfolio performance

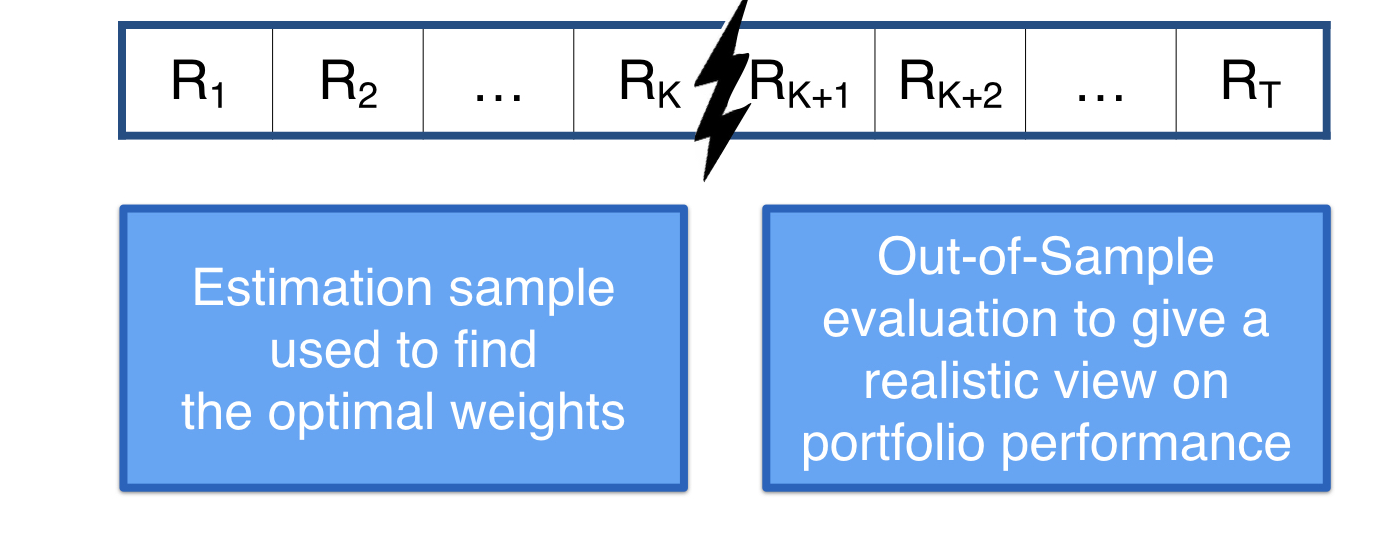

Good news: opportunities

- Do not ignore estimation error

- Use split-sample analysis to do a realistic evaluation of portfolio performance

Good news: opportunities

- Do not ignore estimation error

- Use split-sample analysis to do a realistic evaluation of portfolio performance

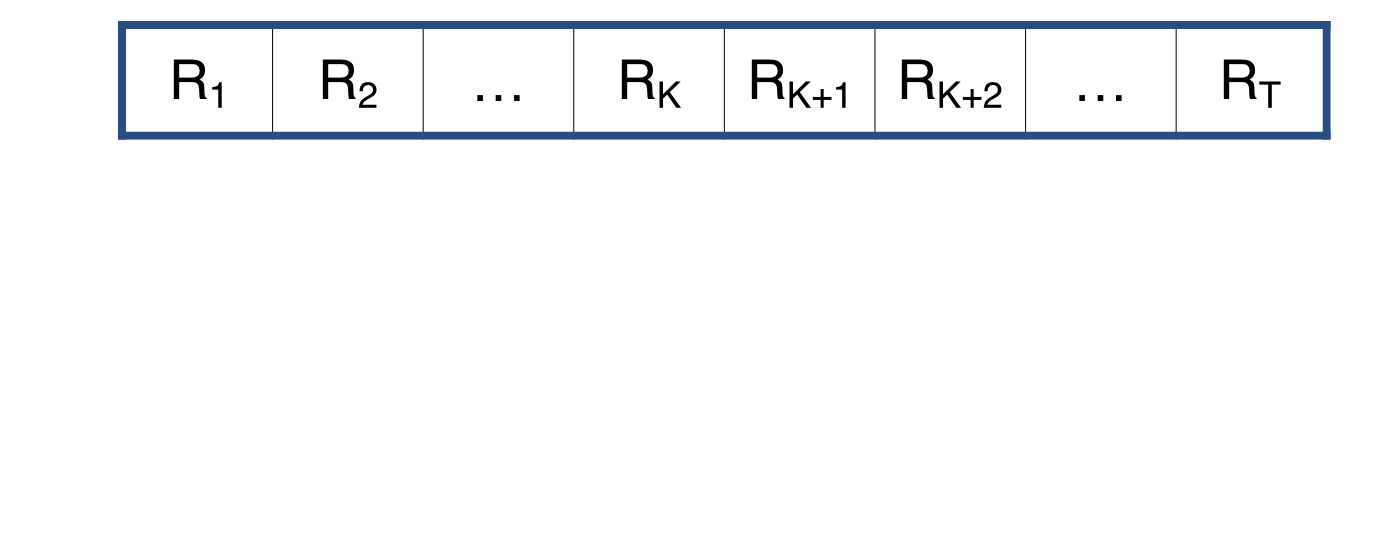

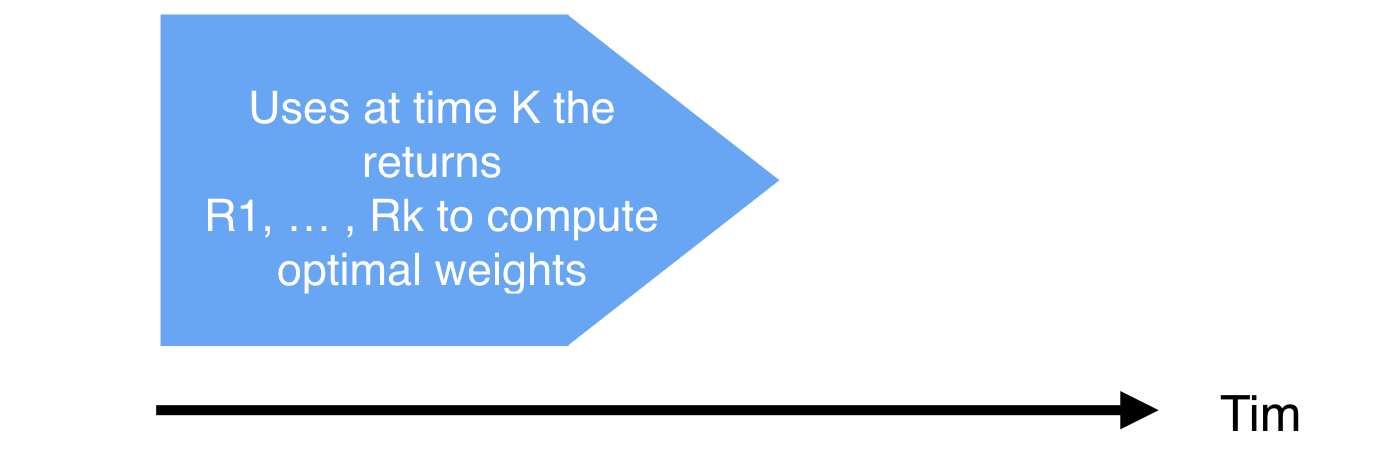

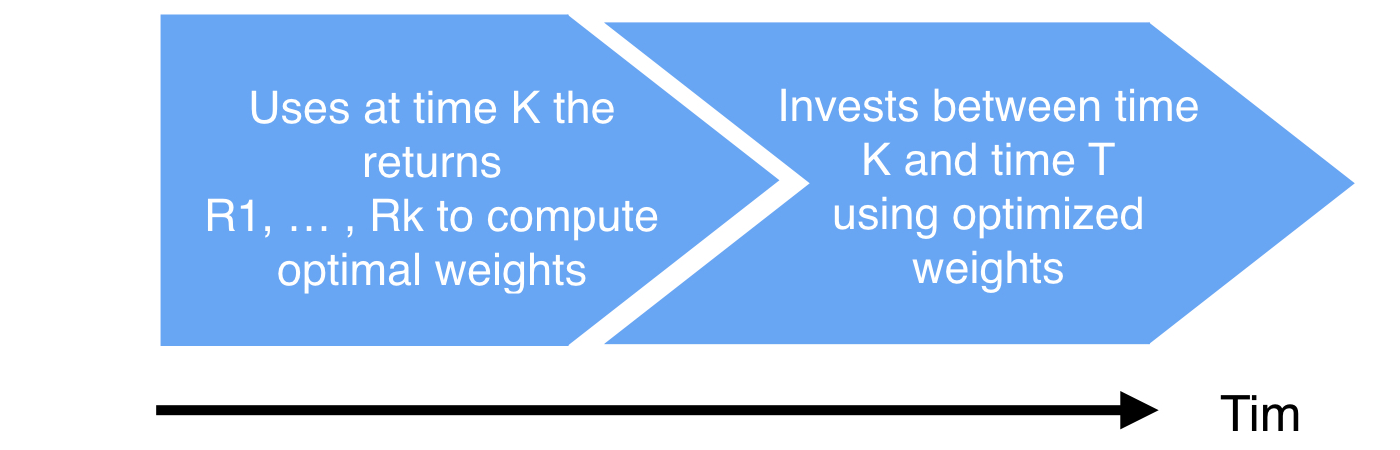

No look-ahead bias in optimized weights

- Split-sample design matches with the investor who:

No look-ahead bias in optimized weights

- Split-sample design matches with the investor who:

- Function

window()to do split-sample analysis in R

Let's practice!

Introduction to Portfolio Analysis in R