Non-normality of the return distribution

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

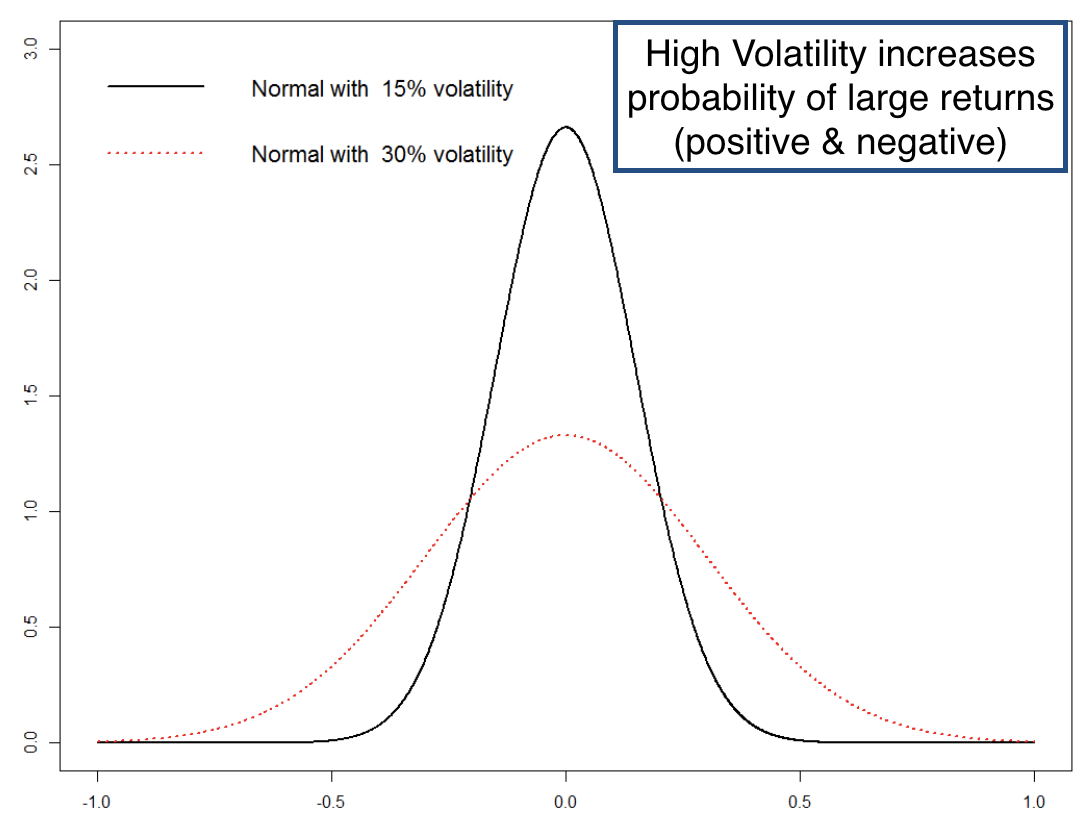

Volatility describes "normal" risk

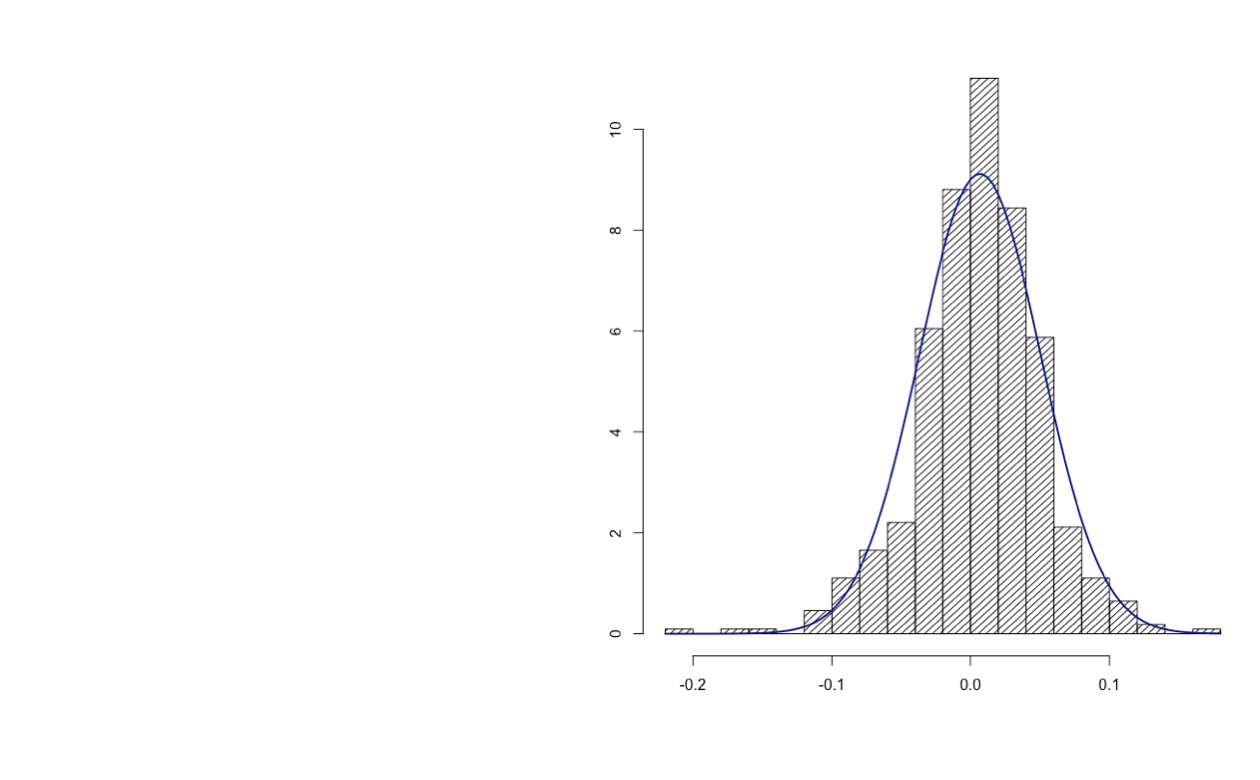

Non-normality of return

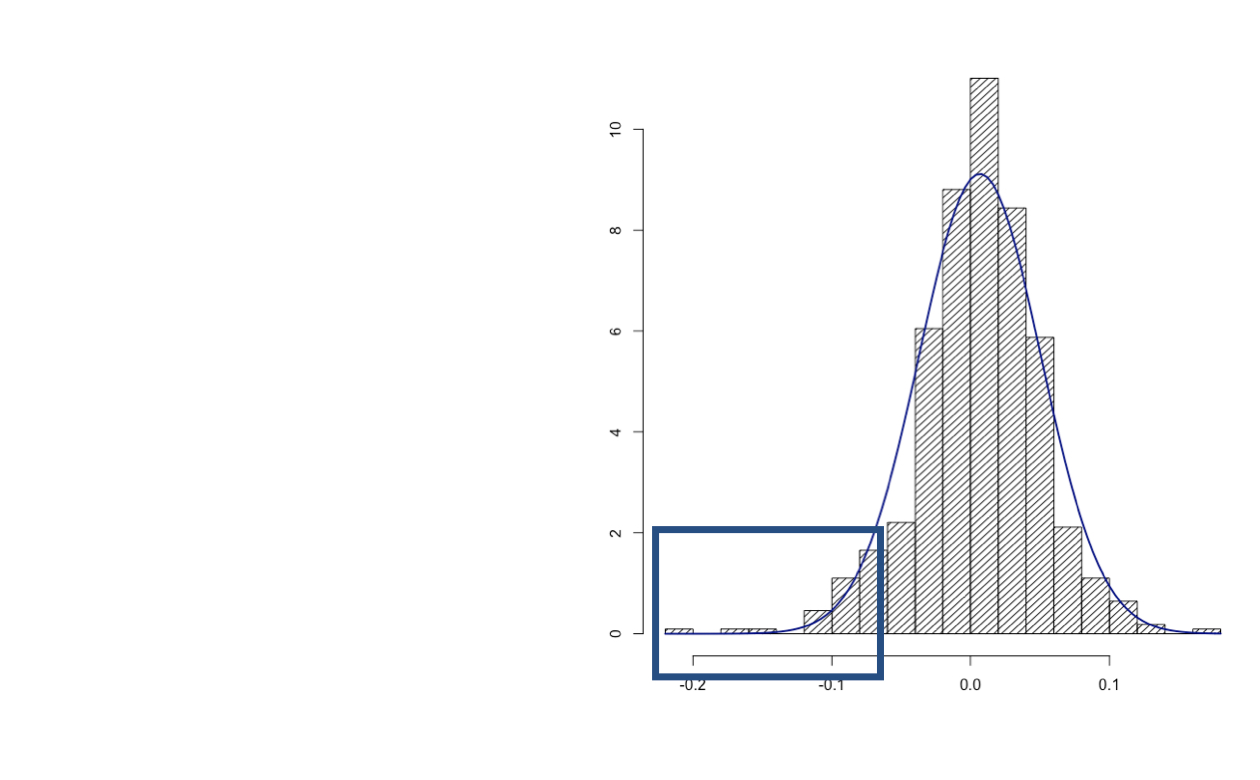

Non-normality of return

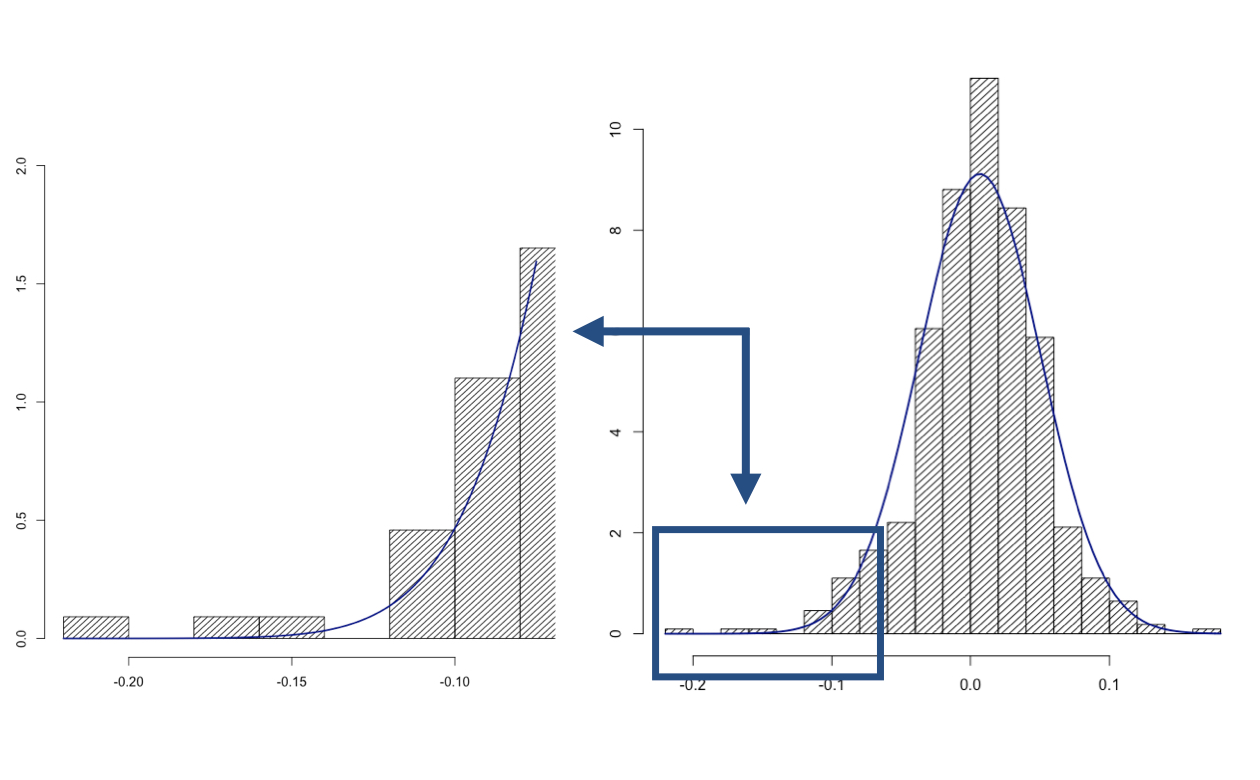

Non-normality of return

Portfolio return semi-deviation

Standard Deviation of portfolio returns:

Take the full sample of returns

$$SD = \sqrt{\frac{(R_1-\mu)^2 + (R_2-\mu)^2 + ... + (R_T-\mu)^2}{T-1}}$$

Semi-Deviation of portfolio returns:

Take the subset of returns below the mean

$$ SemiDev = \sqrt{\frac{(Z_1-\mu)^2 + (Z_2-\mu)^2 + ... + (Z_n-\mu)^2}{n}}$$

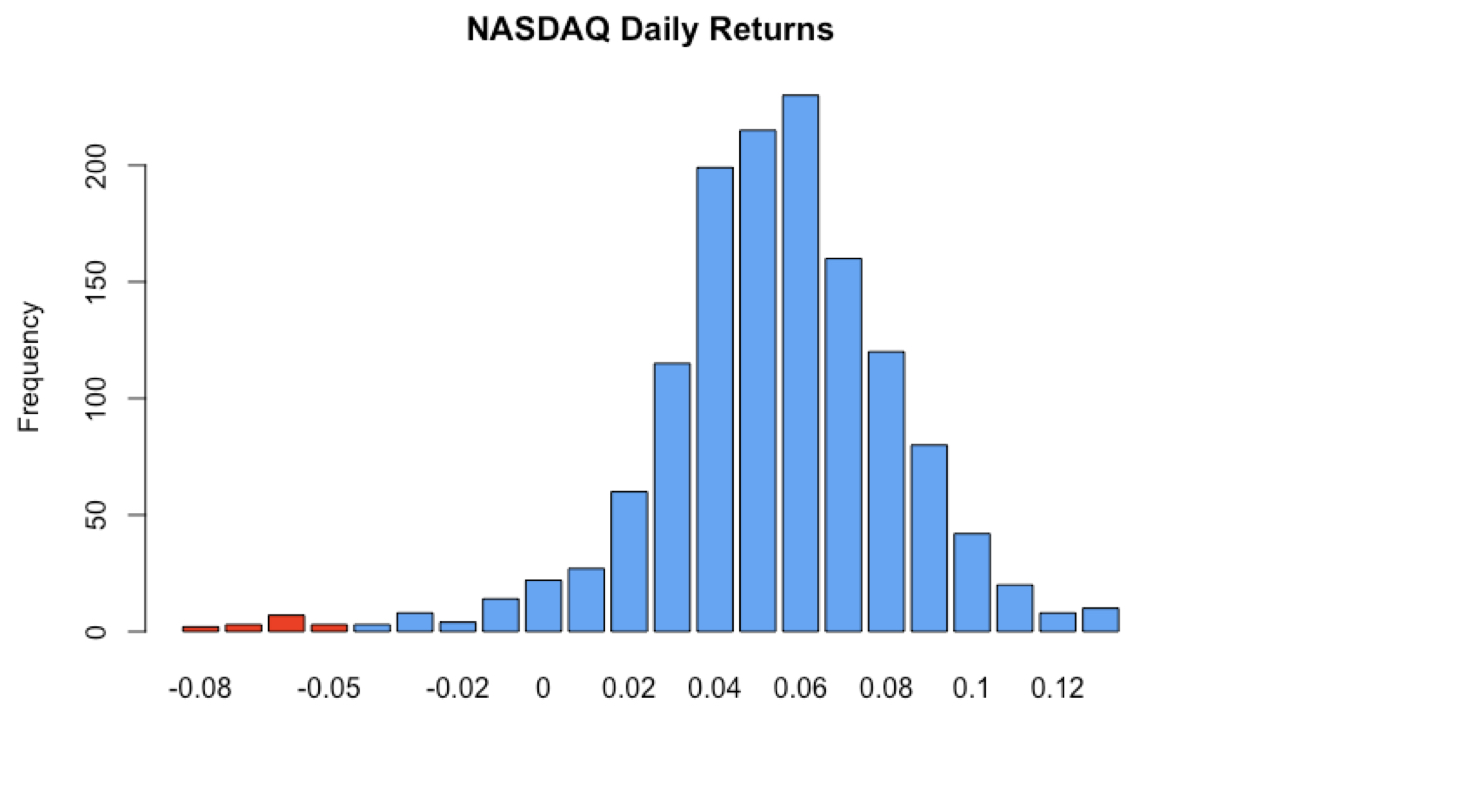

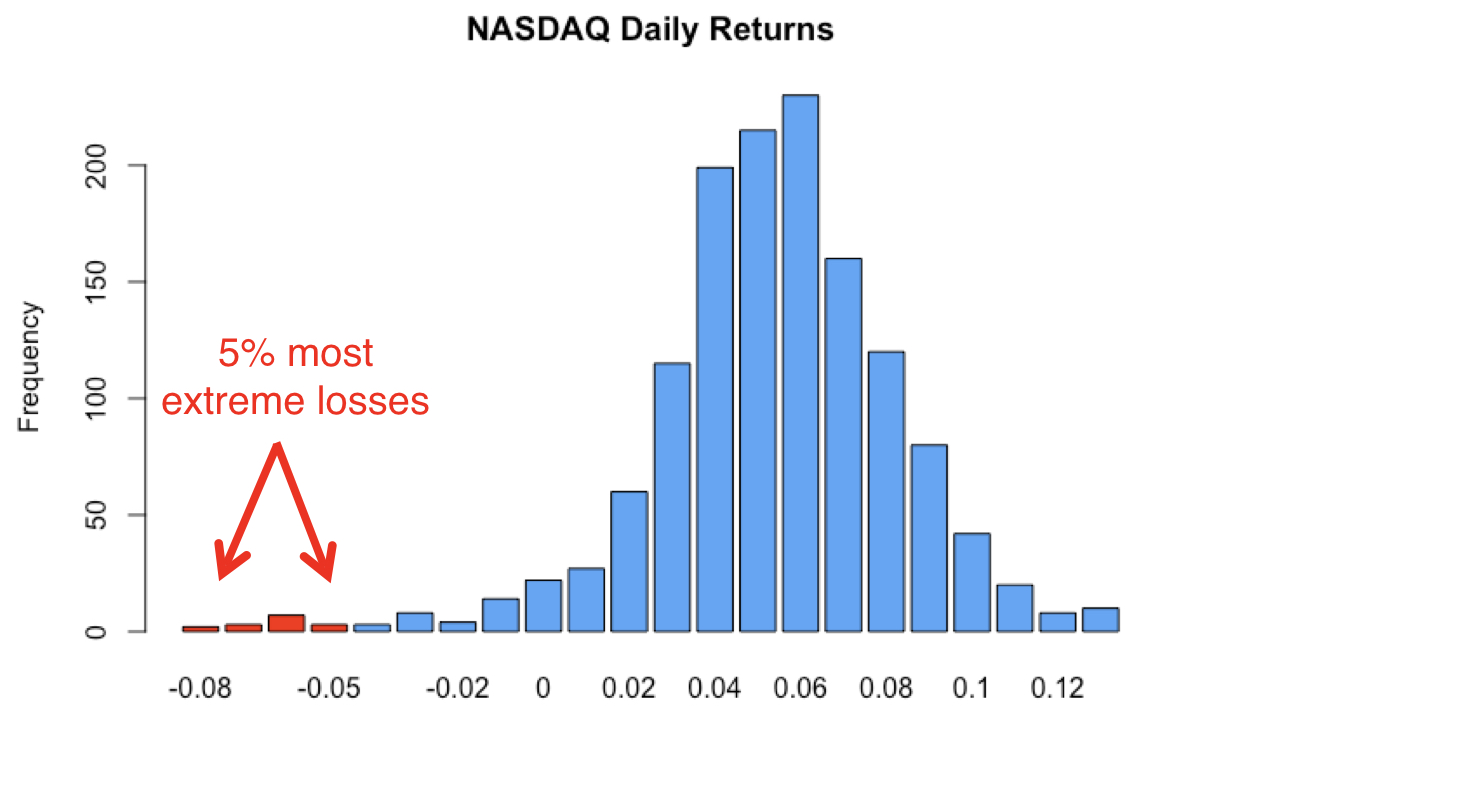

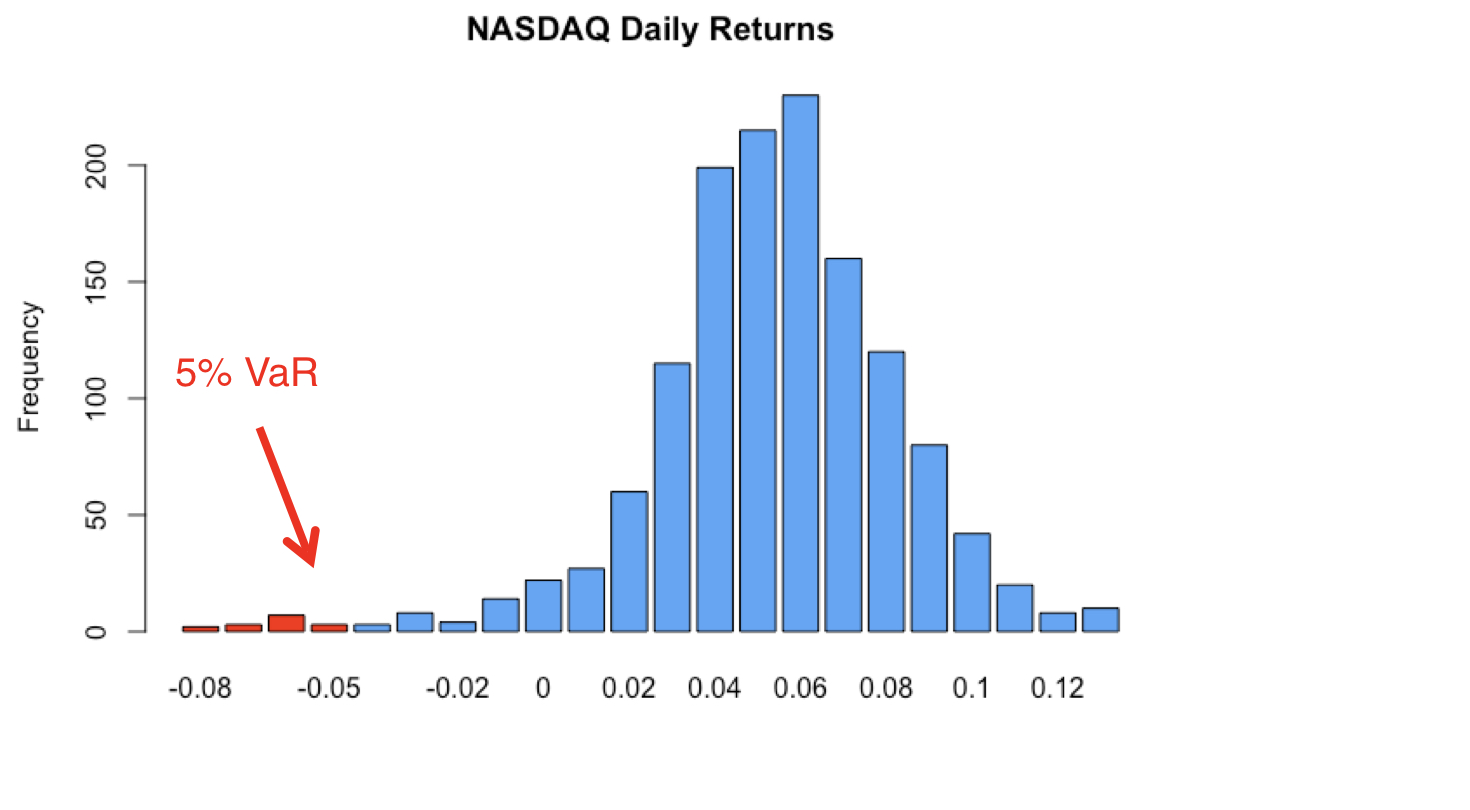

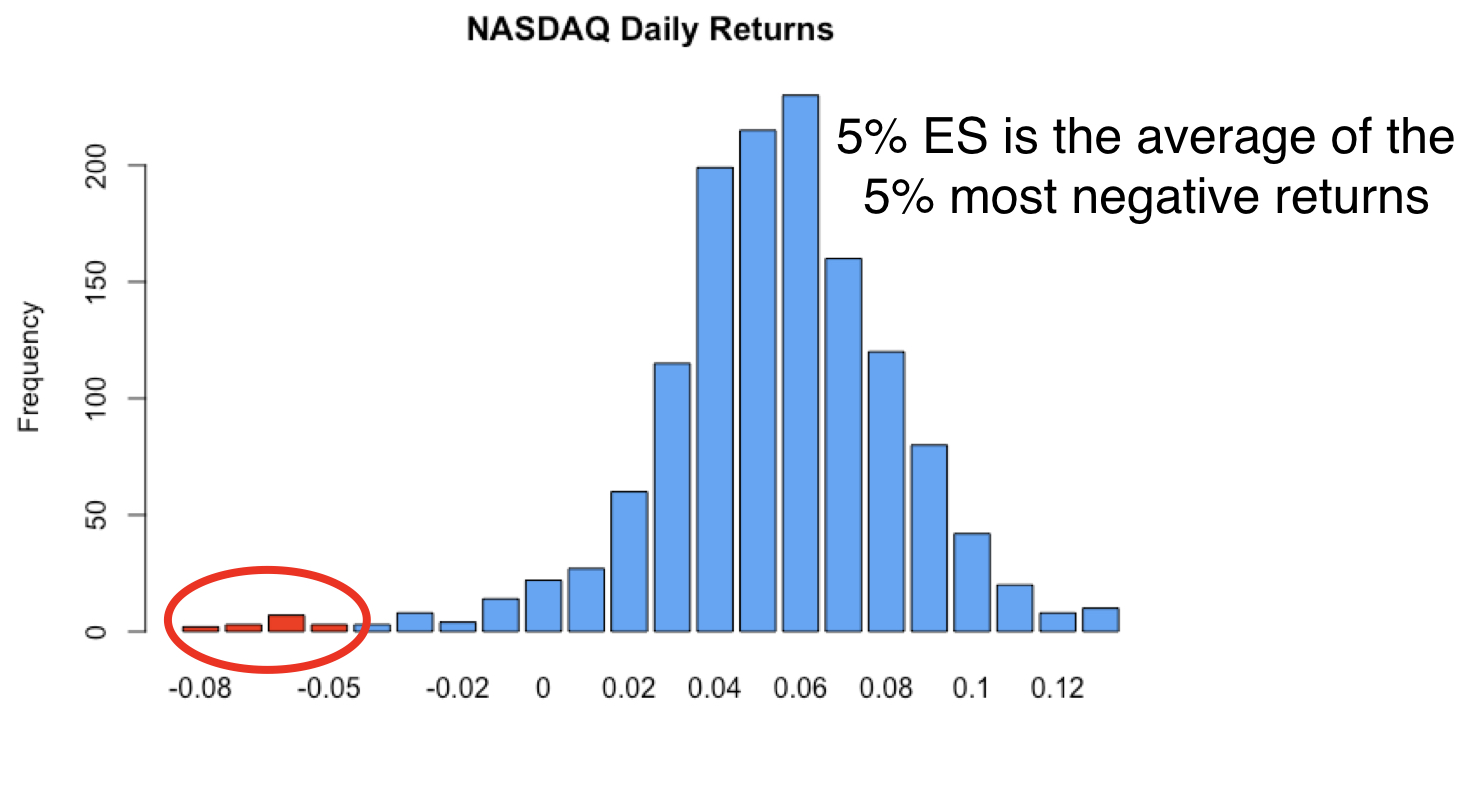

Value-at-risk & expected shortfall

Value-at-risk & expected shortfall

Value-at-risk & expected shortfall

Value-at-risk & expected shortfall

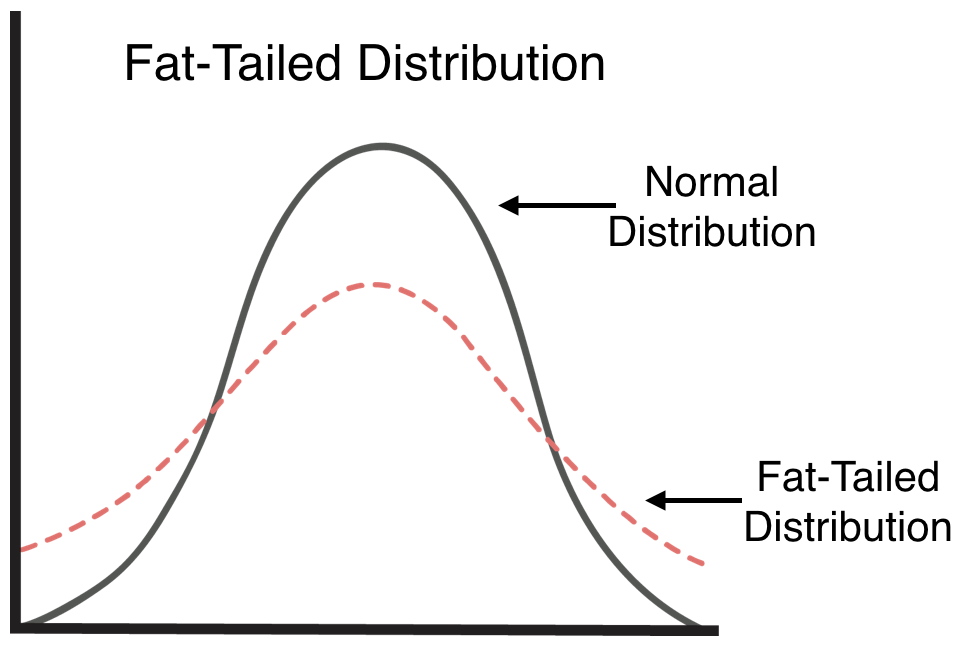

Shape of the distribution

- Is it symmetric?

- Check the skewness

- Are the tails fatter than those of the normal distribution?

- Check the excess kurtosis

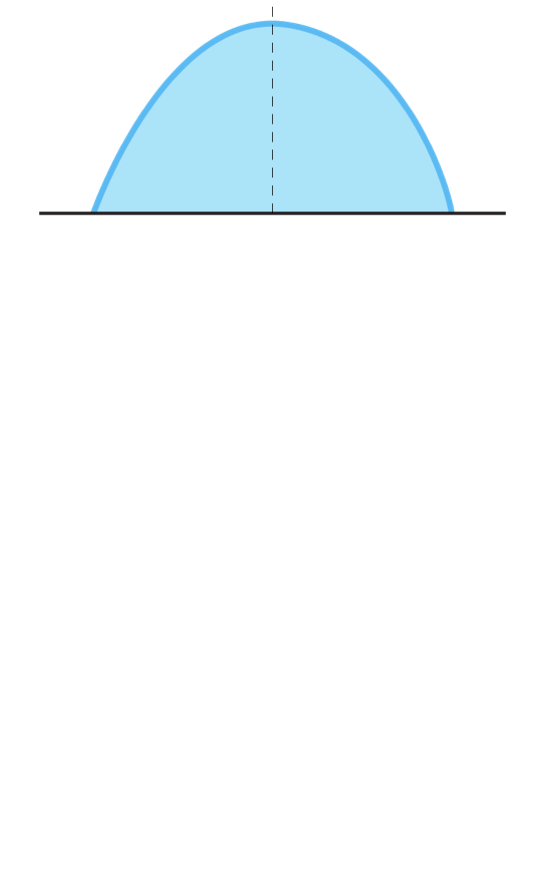

Skewness

- Zero Skewness

- Distribution is symmetric

Skewness

Zero Skewness

- Distribution is symmetric

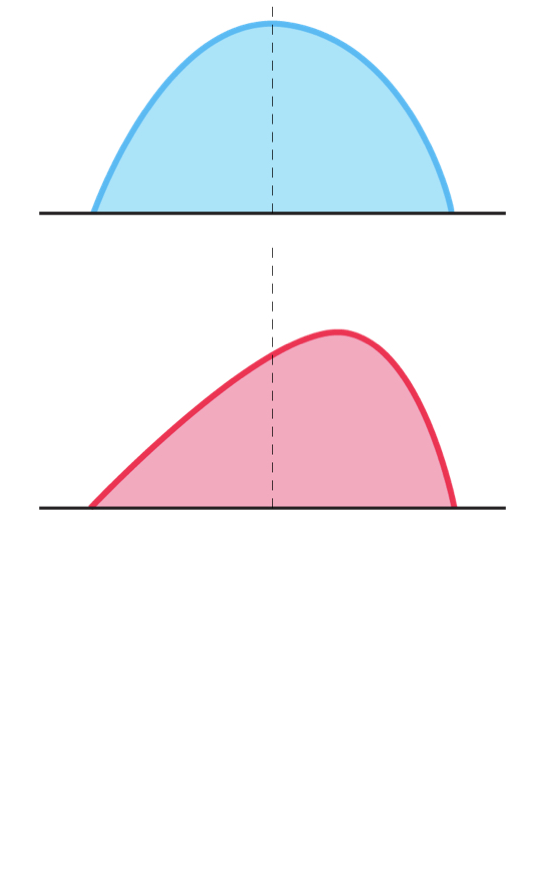

Negative Skewness

- Large negative returns occur more often than large positive returns

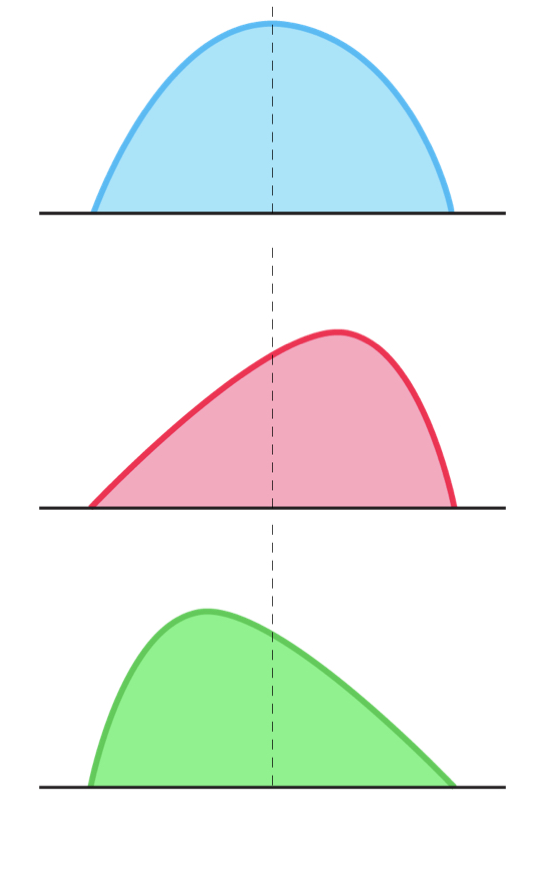

Skewness

Zero Skewness

- Distribution is symmetric

Negative Skewness

- Large negative returns occur more often than large positive returns

Positive Skewness

- Large positive returns occur more often than large negative returns

Kurtosis

- The distribution is fat-tailed when the excess kurtosis > 0

Let's practice!

Introduction to Portfolio Analysis in R