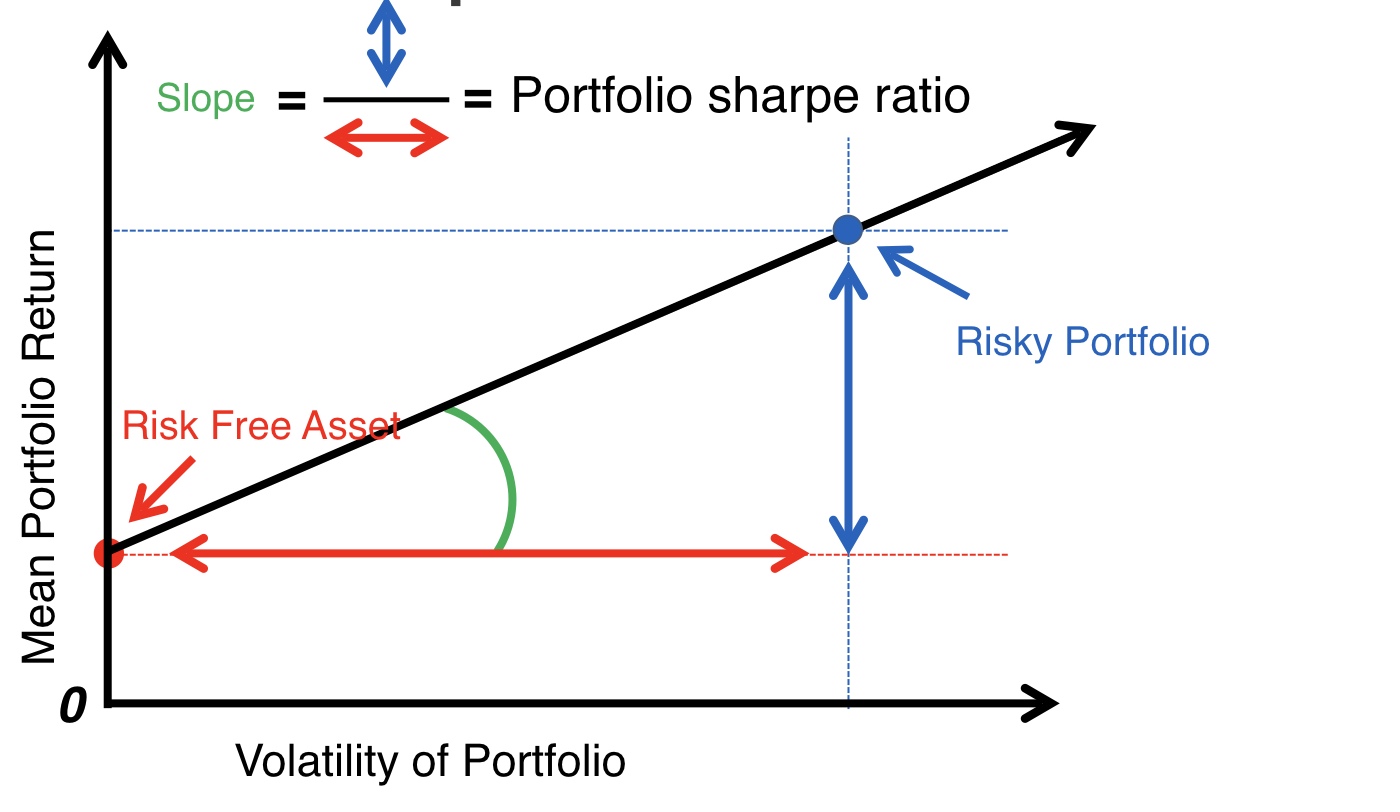

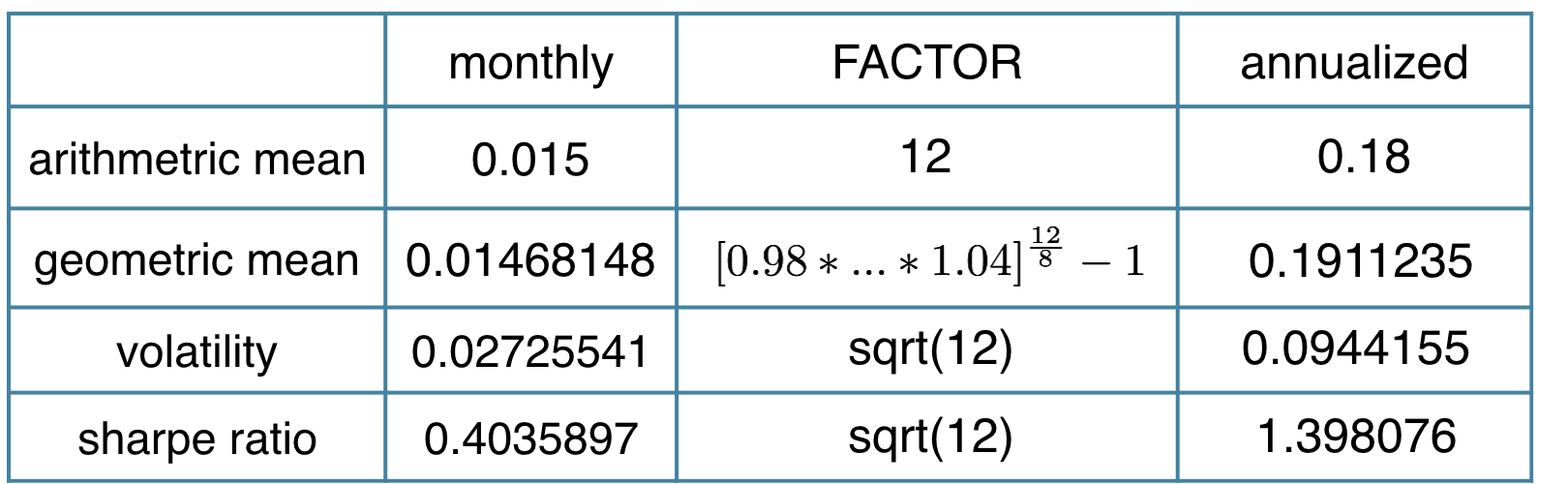

The (annualized) Sharpe ratio

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

Benchmarking performance

Benchmarking performance

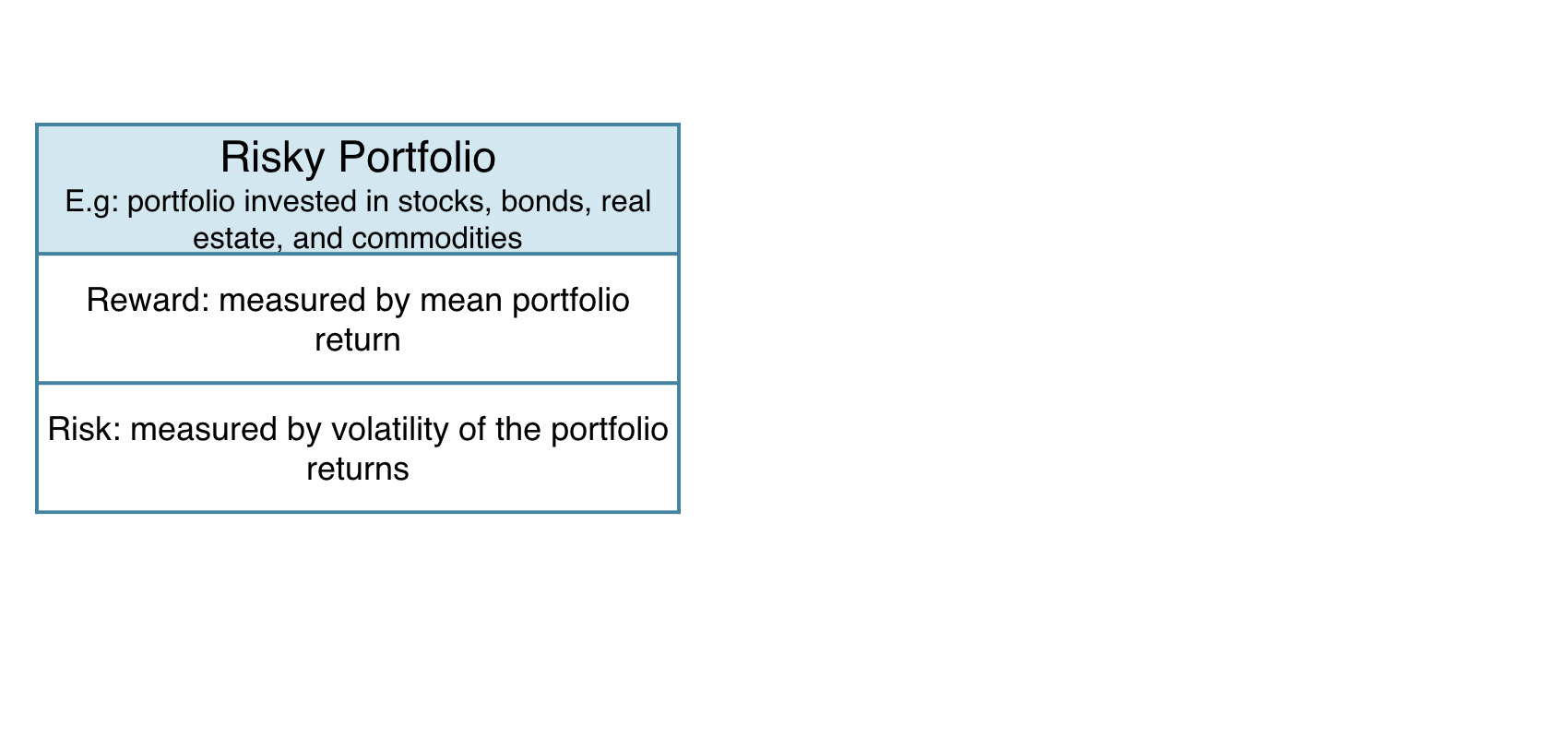

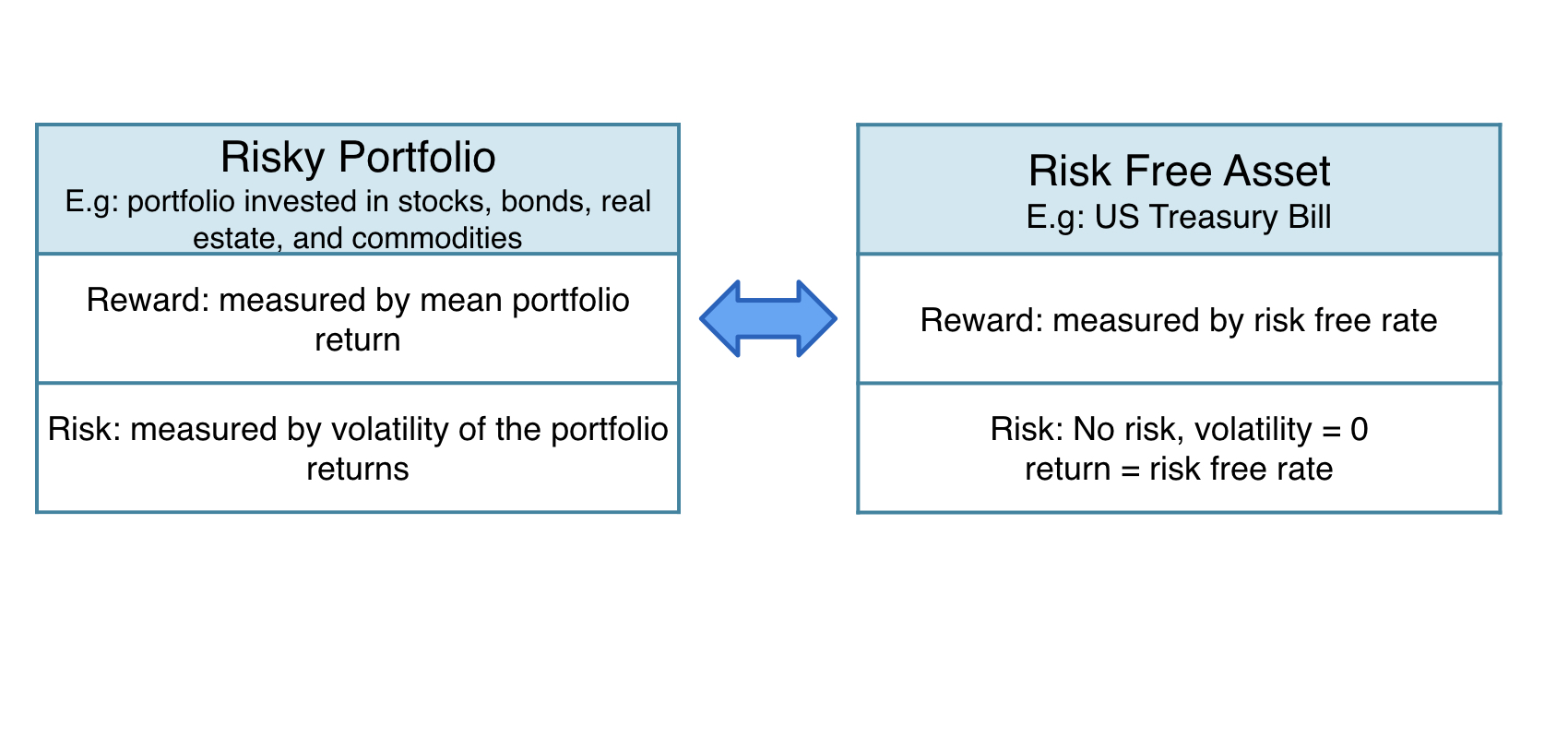

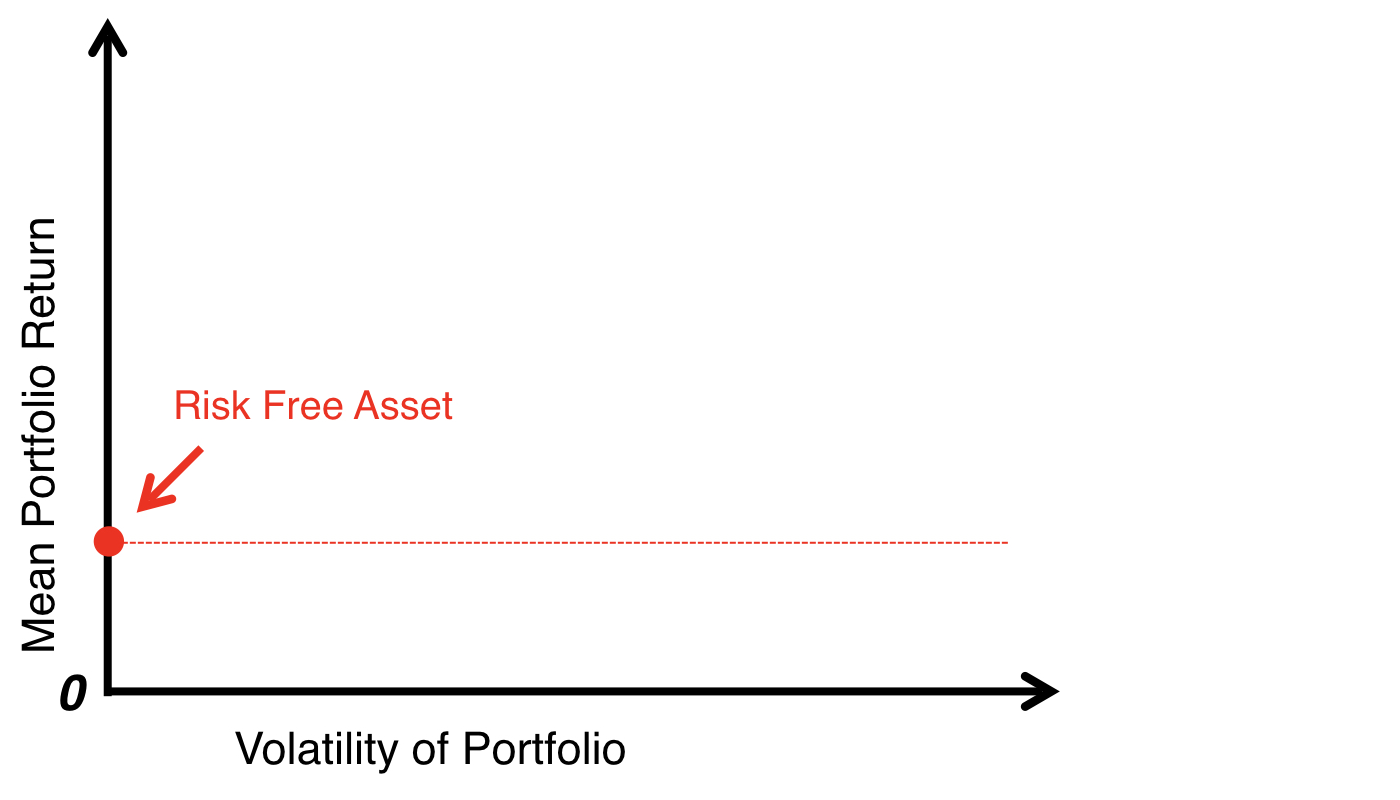

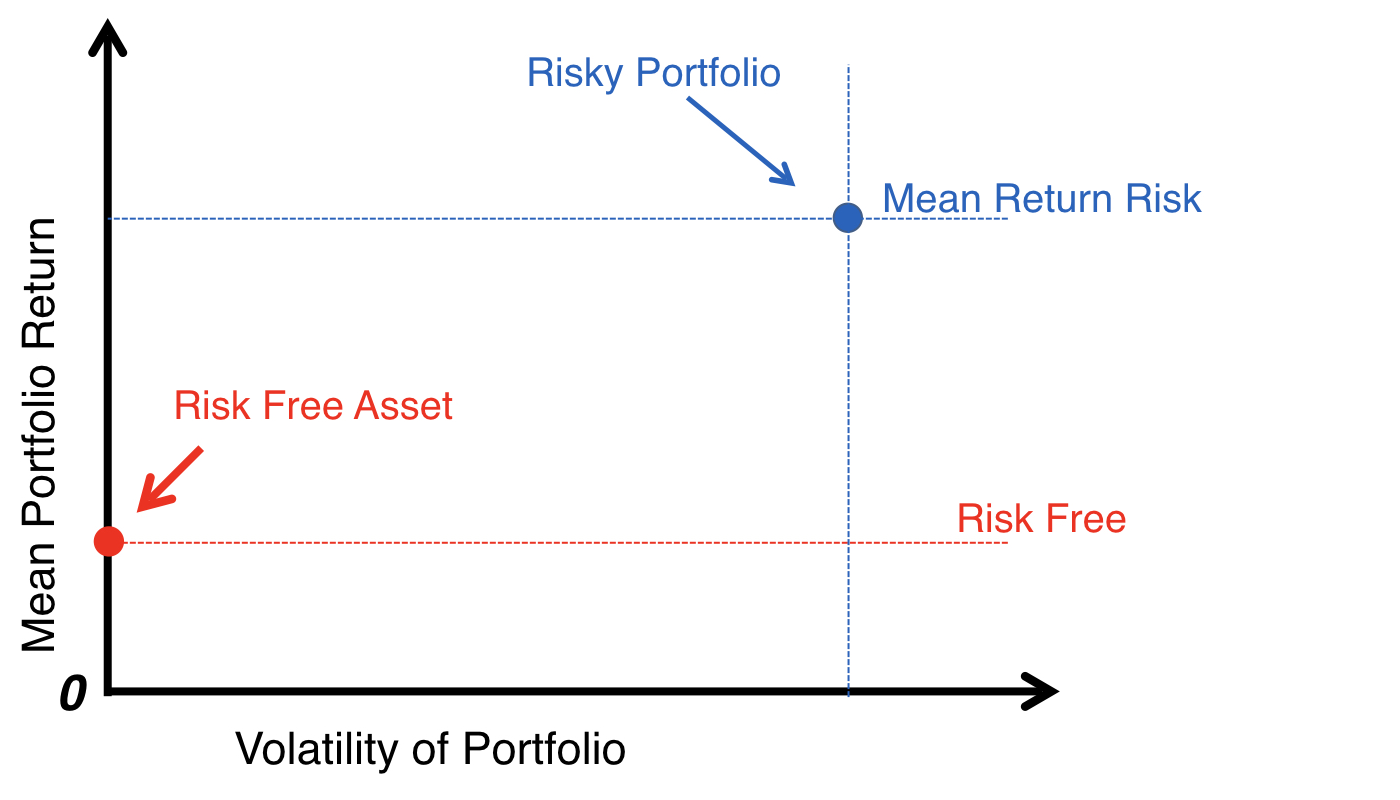

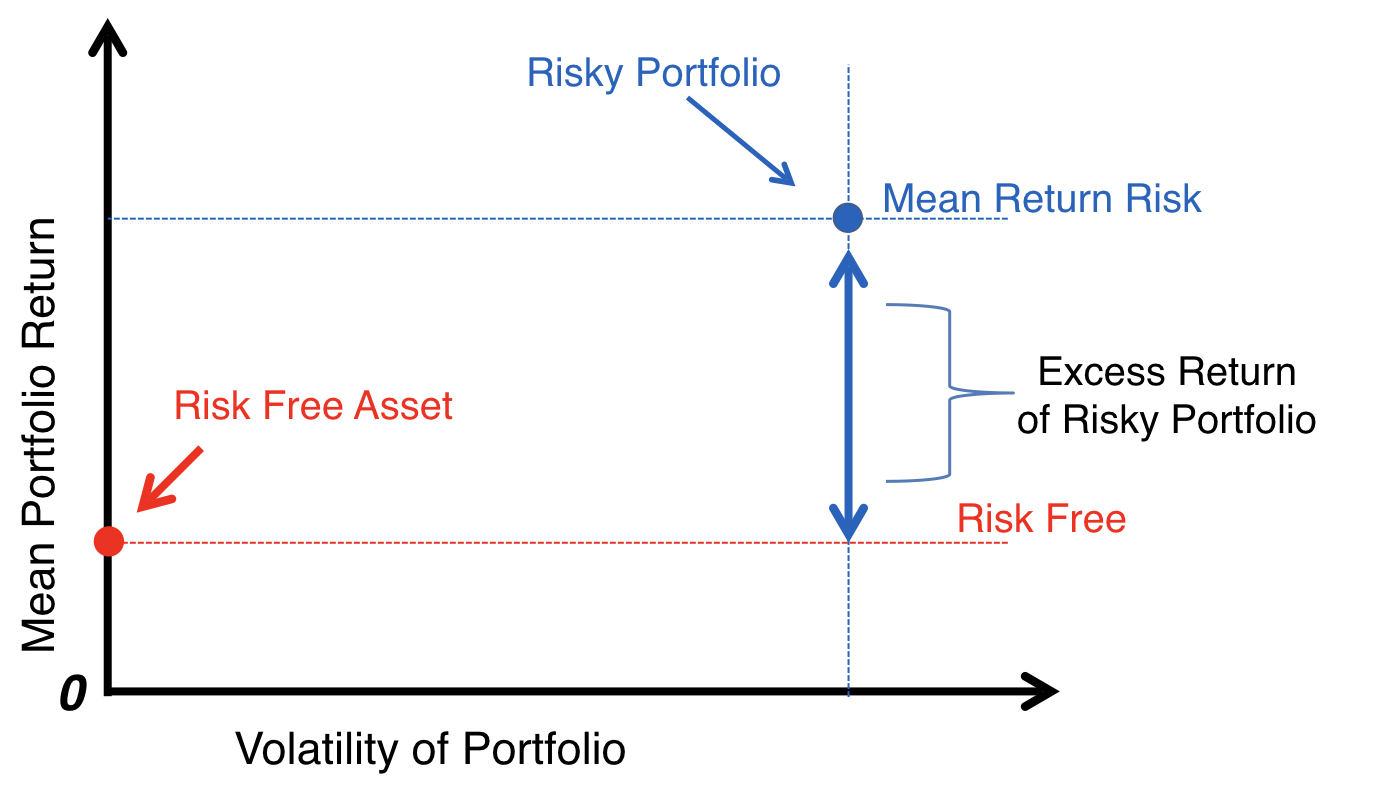

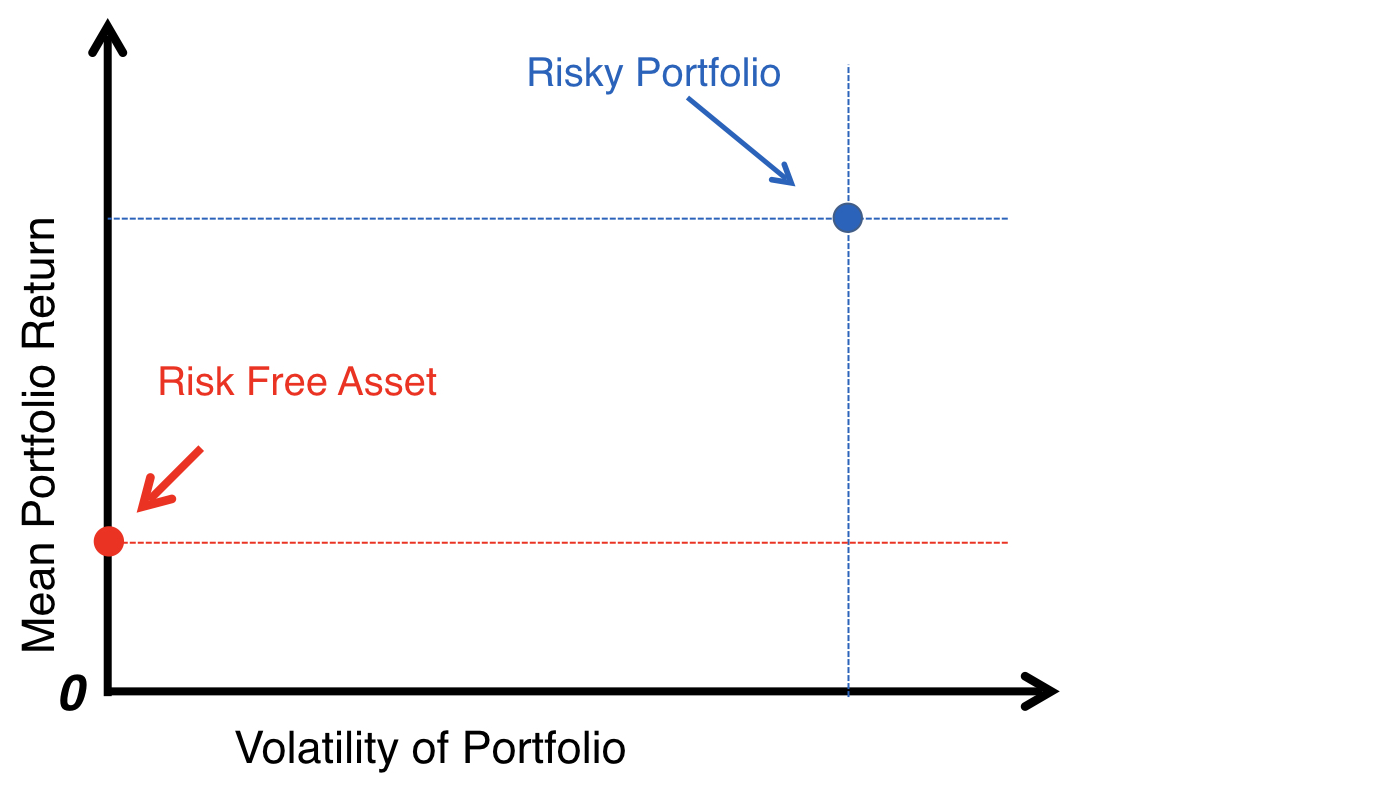

Risk-return trade-off

Risk-return trade-off

Risk-return trade-off

Risk-return trade-off

Risk-return trade-off

Risk-return trade-off

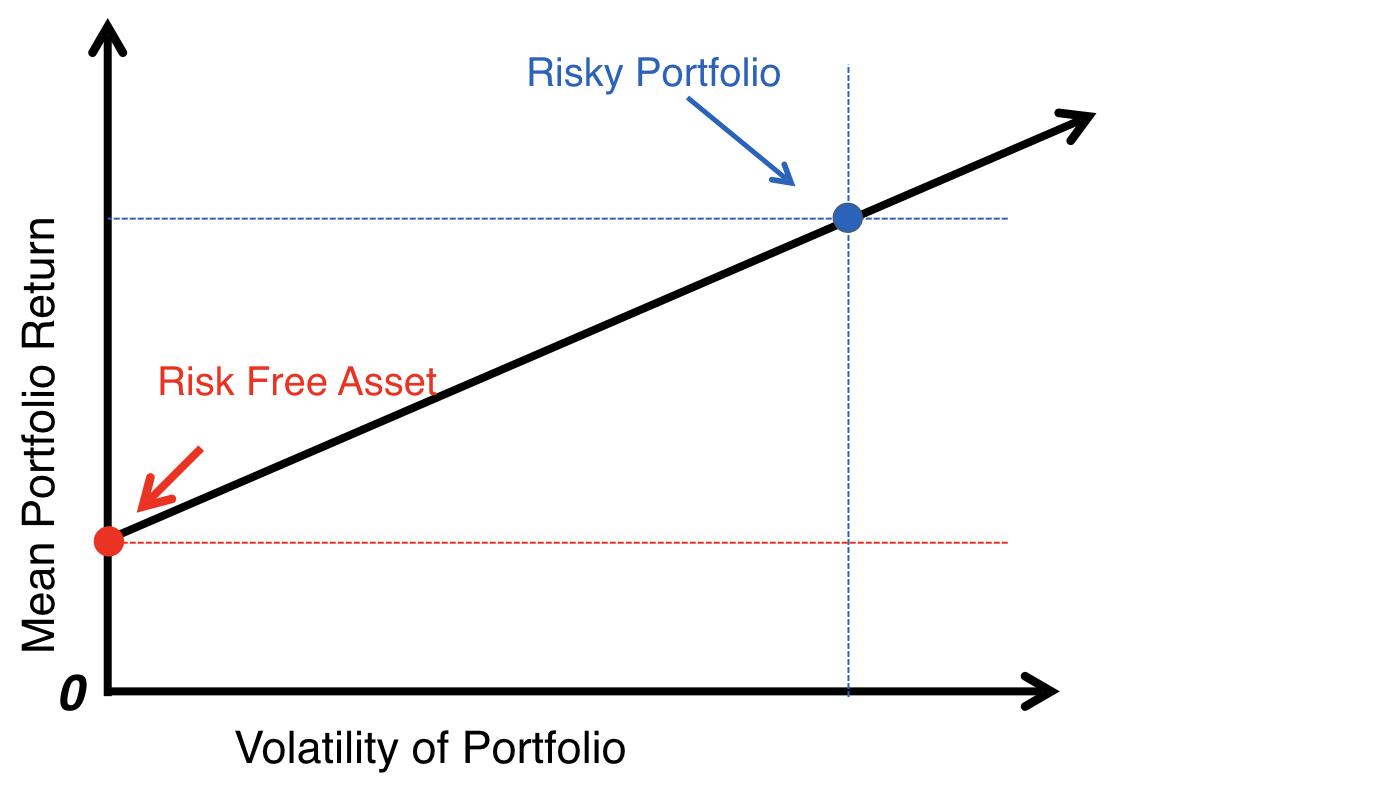

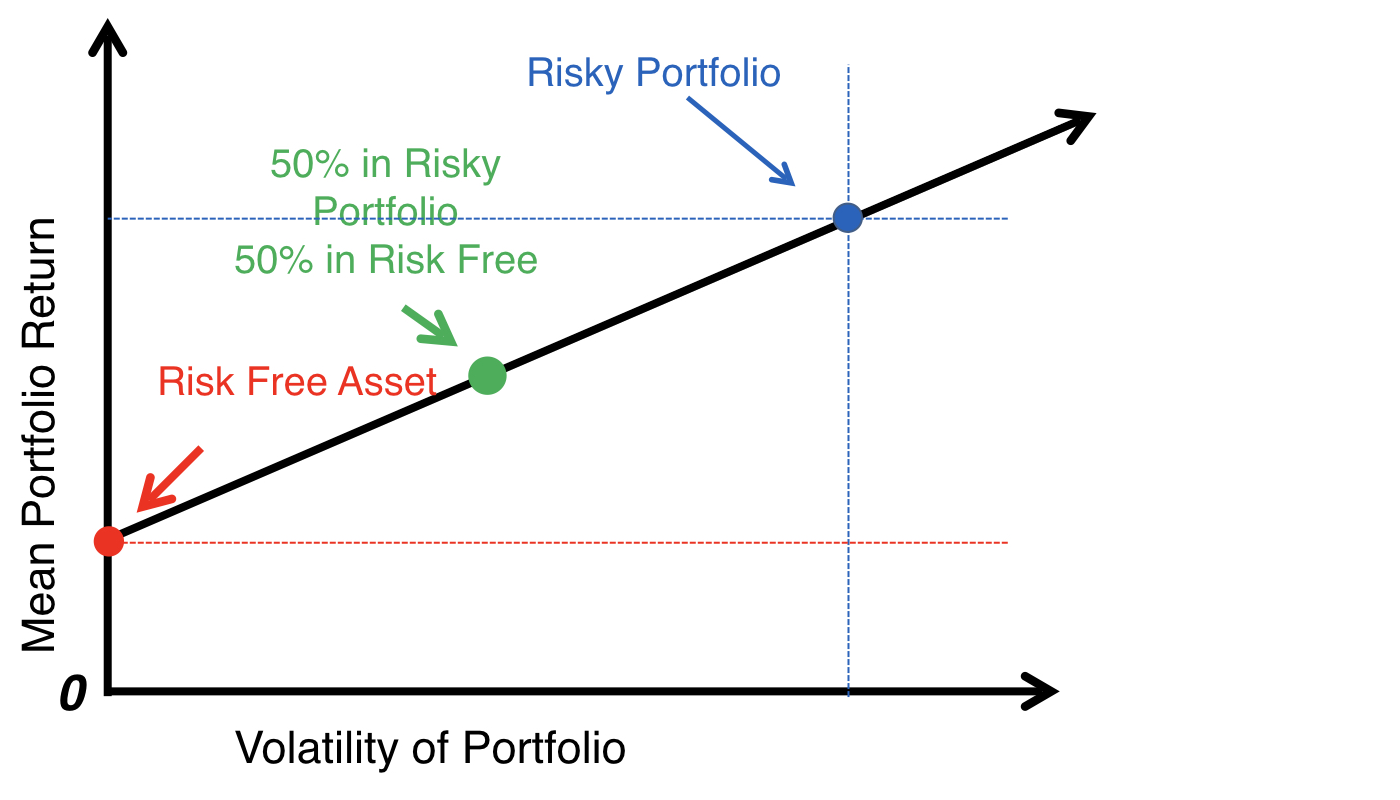

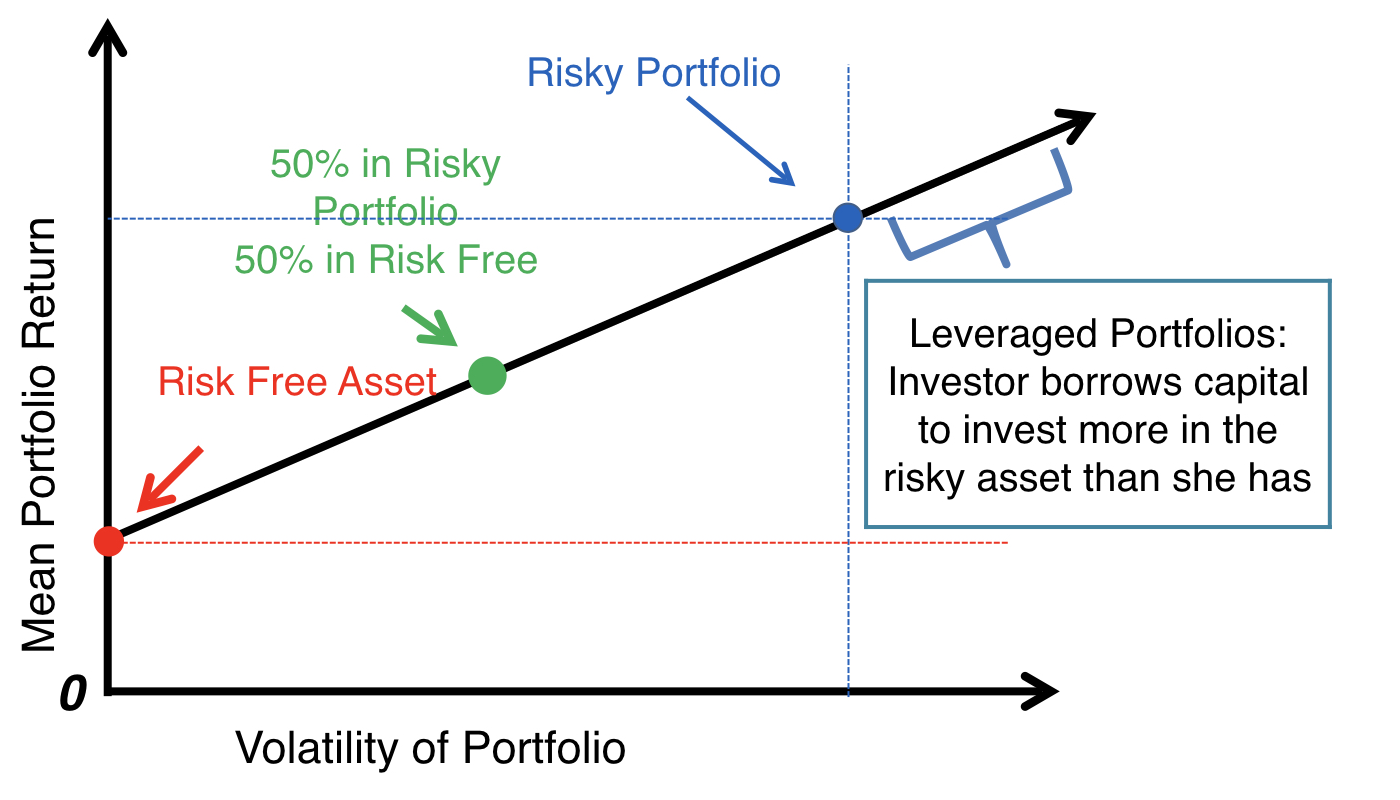

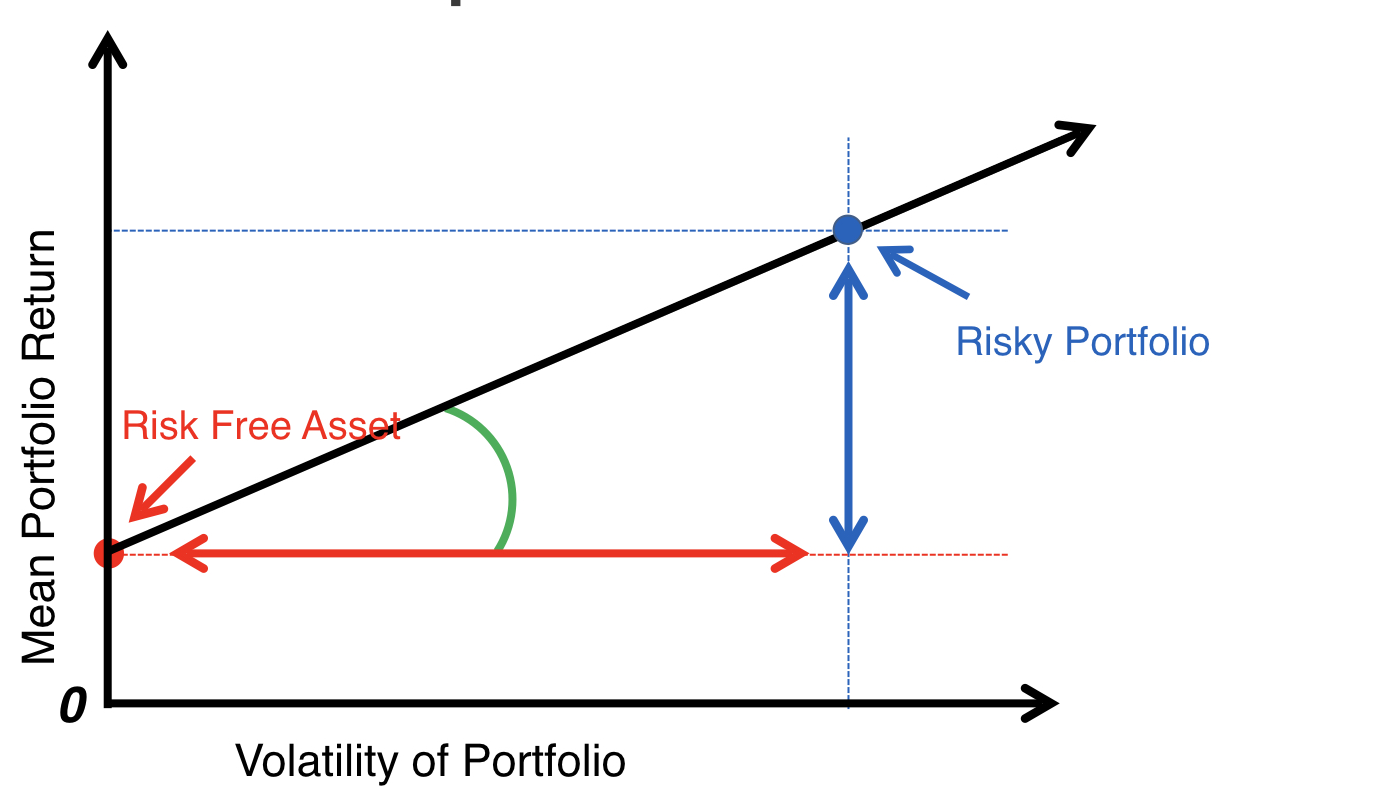

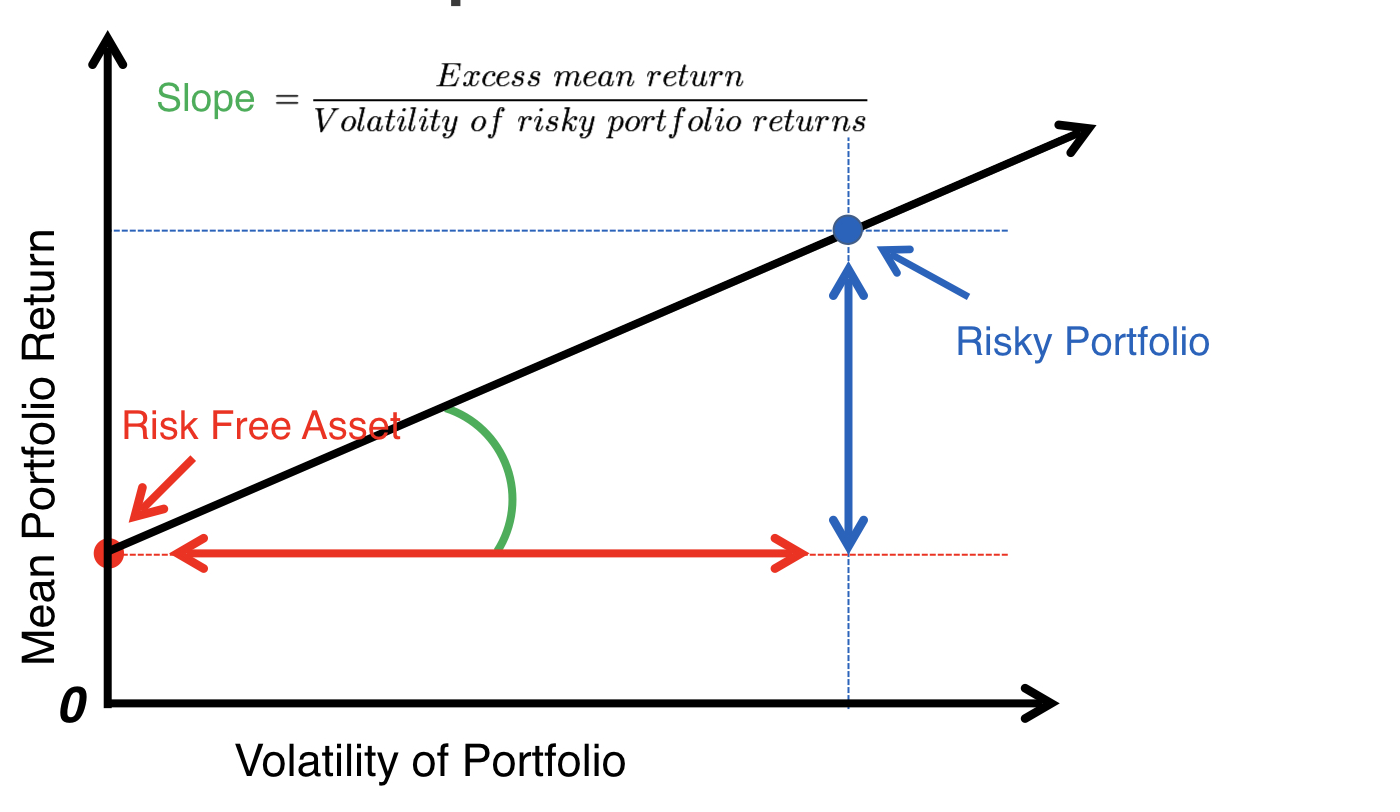

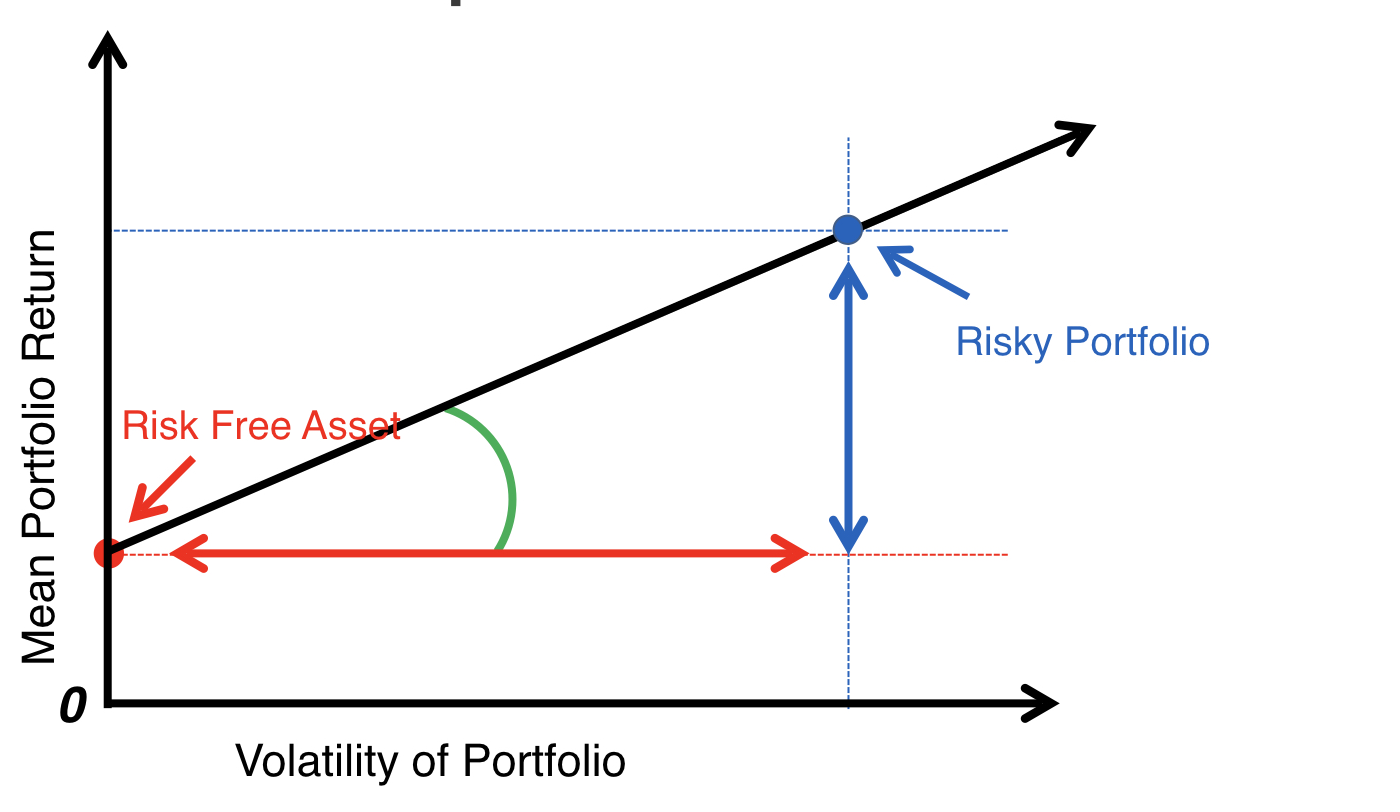

Capital allocation line

Capital allocation line

Capital allocation line

Capital allocation line

The Sharpe ratio

The Sharpe ratio

The Sharpe ratio

The Sharpe ratio

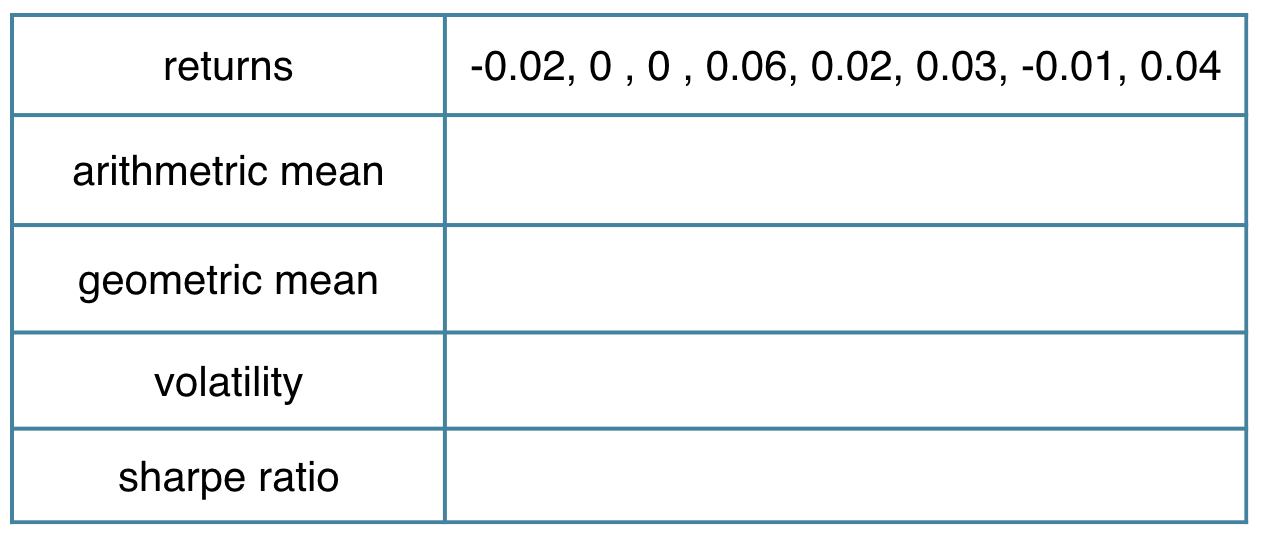

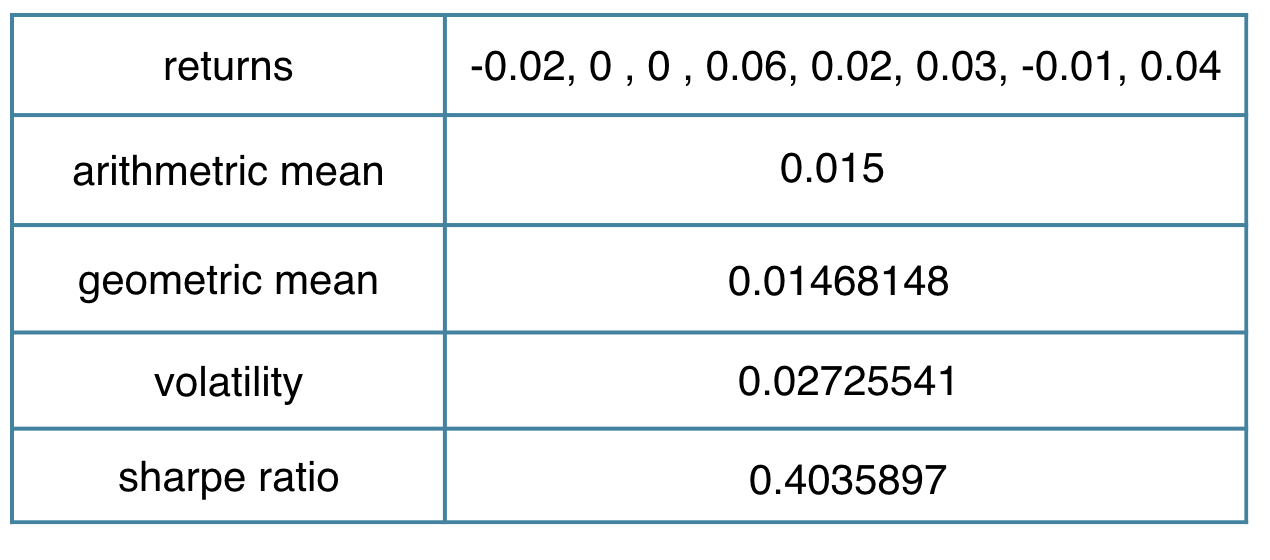

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c(-0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

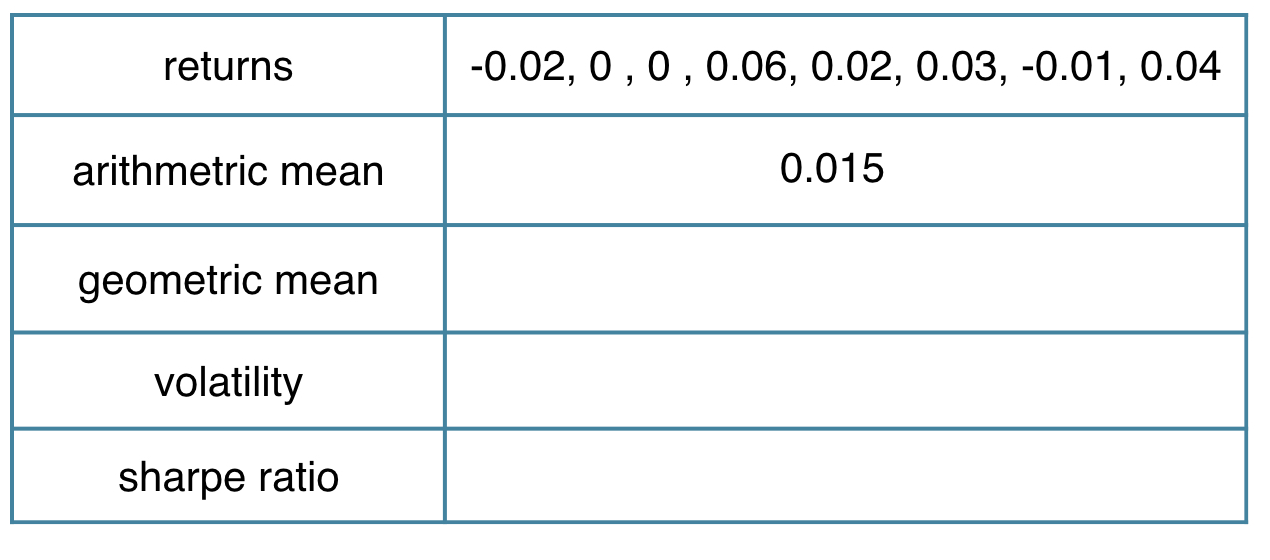

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c(-0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

mean(sample_returns)

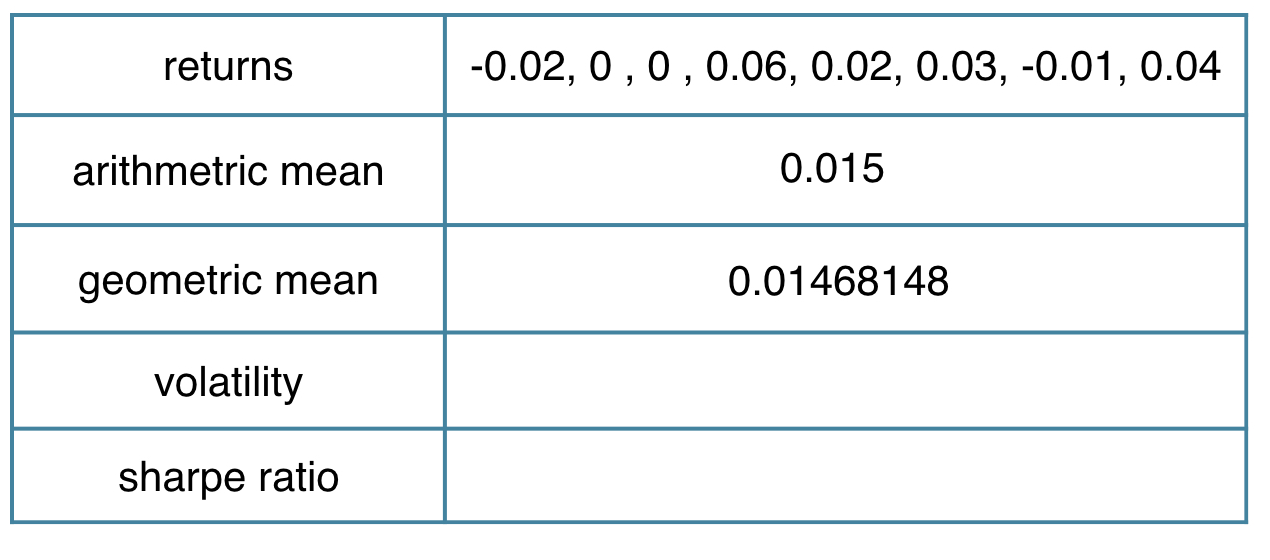

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c(-0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

mean.geometric(sample_returns)

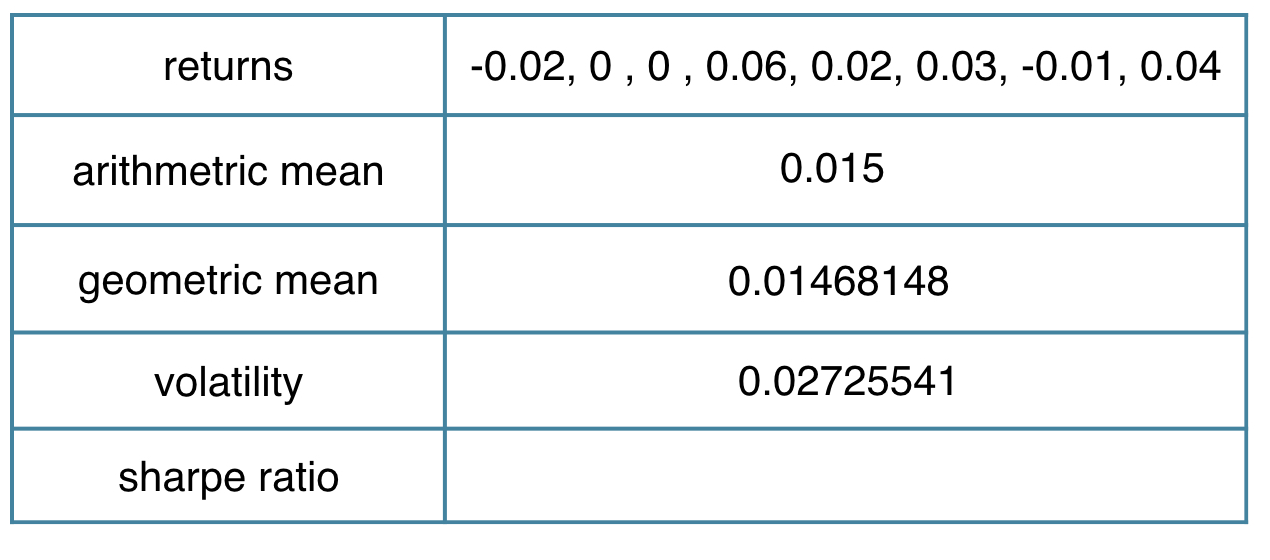

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c(-0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

StdDev(sample_returns)

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c(-0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

(mean(sample_returns)-0.004)/StdDev(sample_returns)

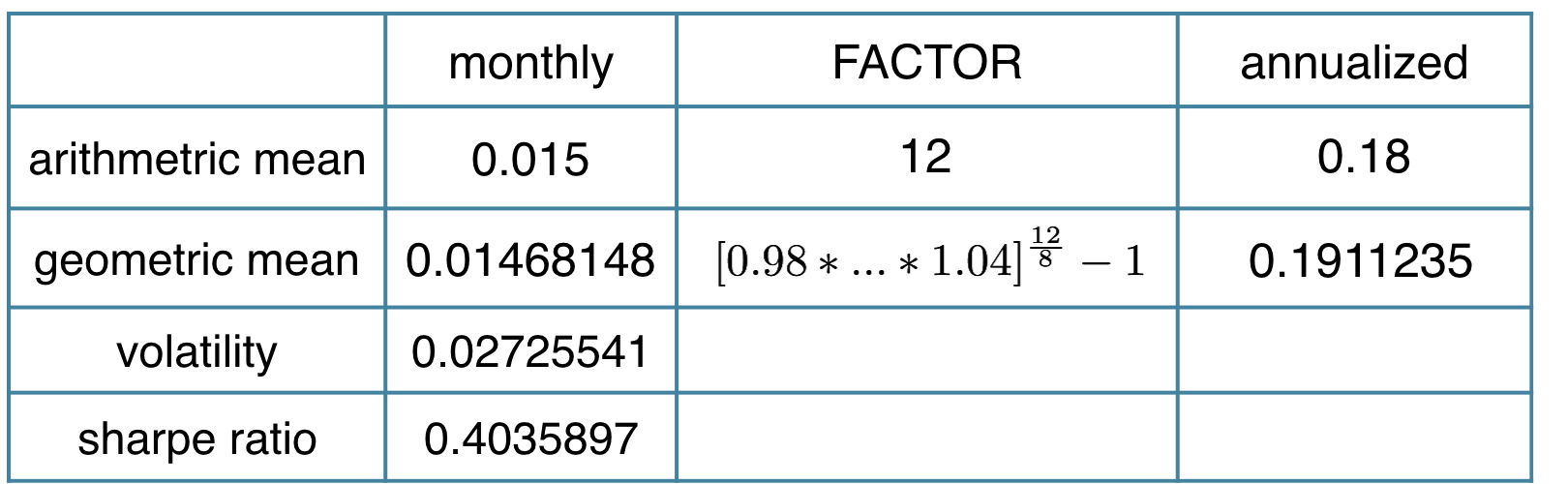

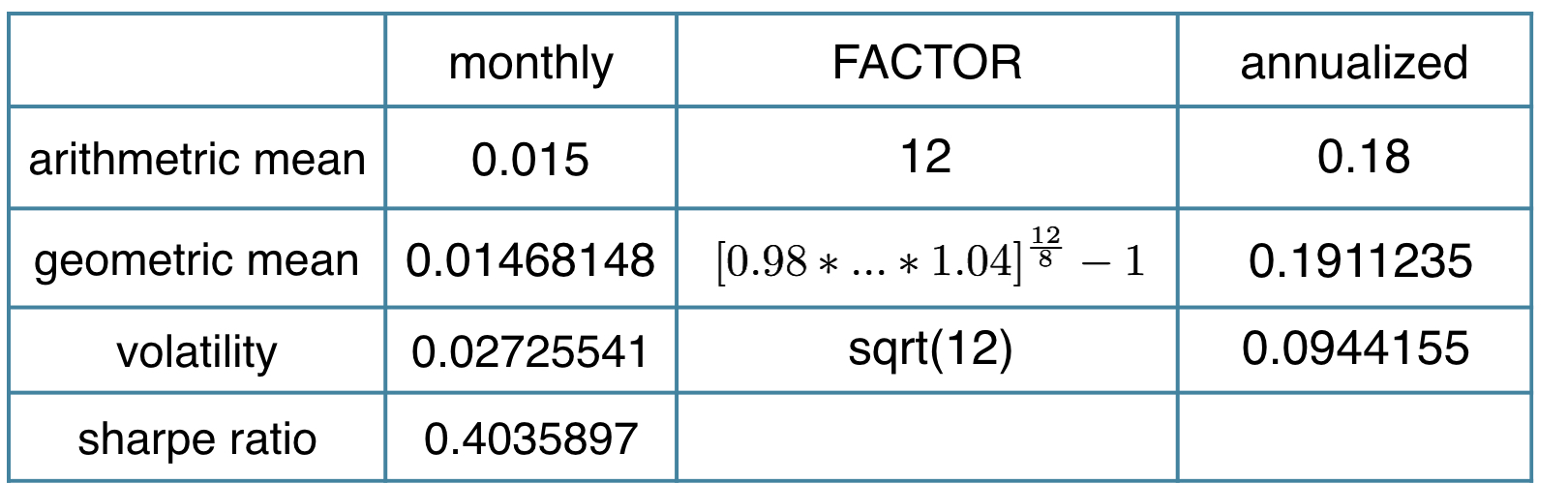

Annualize monthly performance

- Arithmetric mean: monthly mean * 12

- Geometric mean, when $R_i$ are monthly returns:

- $[(1+R_1)\cdot(1+R_2)\cdot...\cdot(1+R_T)]^{12/T} -1$

- Volatility: monthly volatility * sqrt(12)

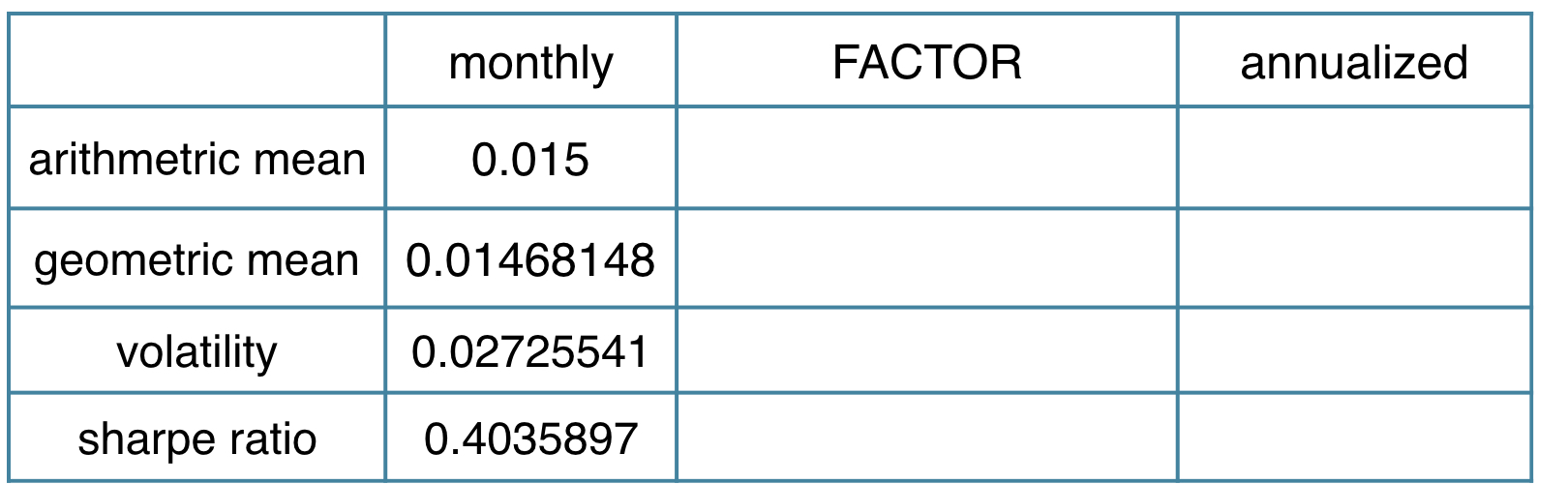

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c( -0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c( -0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

Return.annualized(sample_returns, scale = 12, geometric = FALSE)

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c( -0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

Return.annualized(sample_returns, scale = 12, geometric = TRUE)

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c( -0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

Std.Dev.annualized(sample_returns, scale = 12)

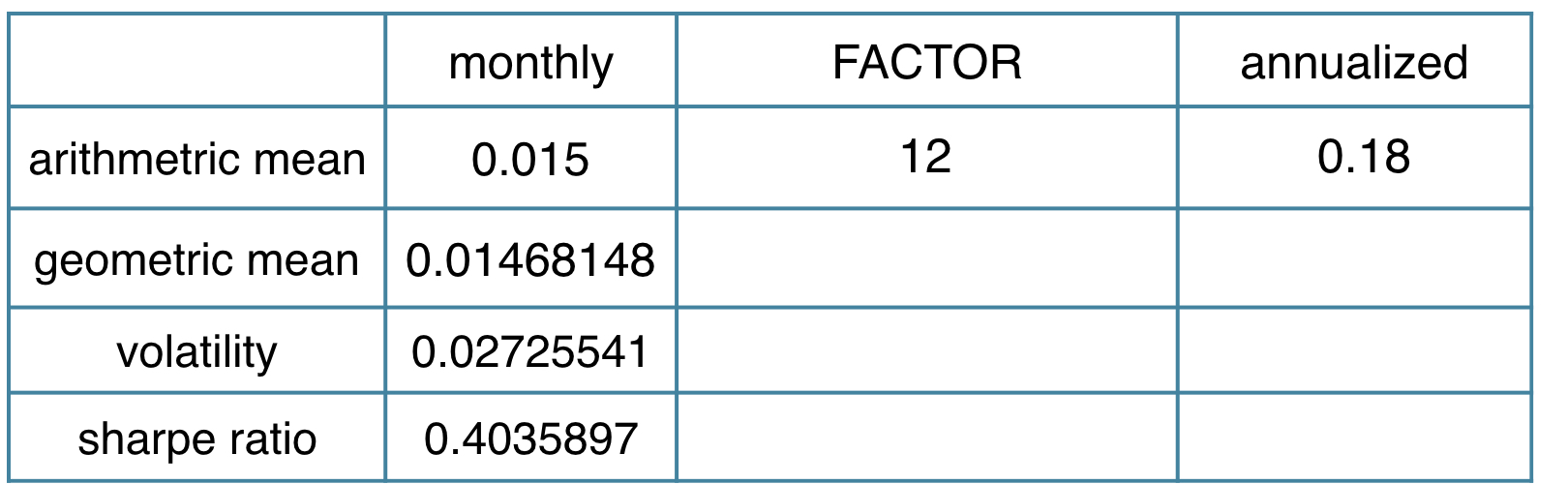

Performance statistics in action

library(PerformanceAnalytics)

sample_returns <- c( -0.02, 0.00, 0.00, 0.06, 0.02, 0.03, -0.01, 0.04)

Return.annualized(sample_returns, scale = 12)/

Std.Dev.annualized(sample_returns, scale = 12)

Let's practice!

Introduction to Portfolio Analysis in R