Drivers in the case of two assets

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

Future returns are random in nature

Future returns are random in nature

Future returns are random in nature

Future returns are random in nature

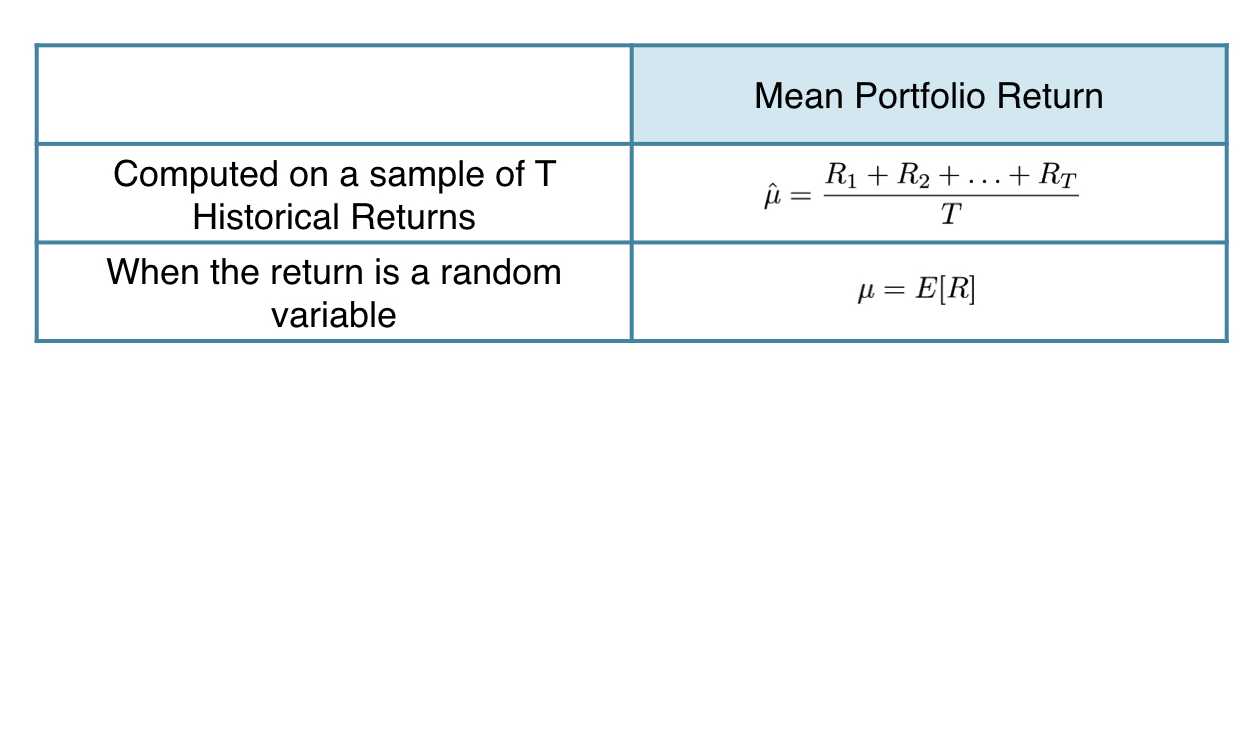

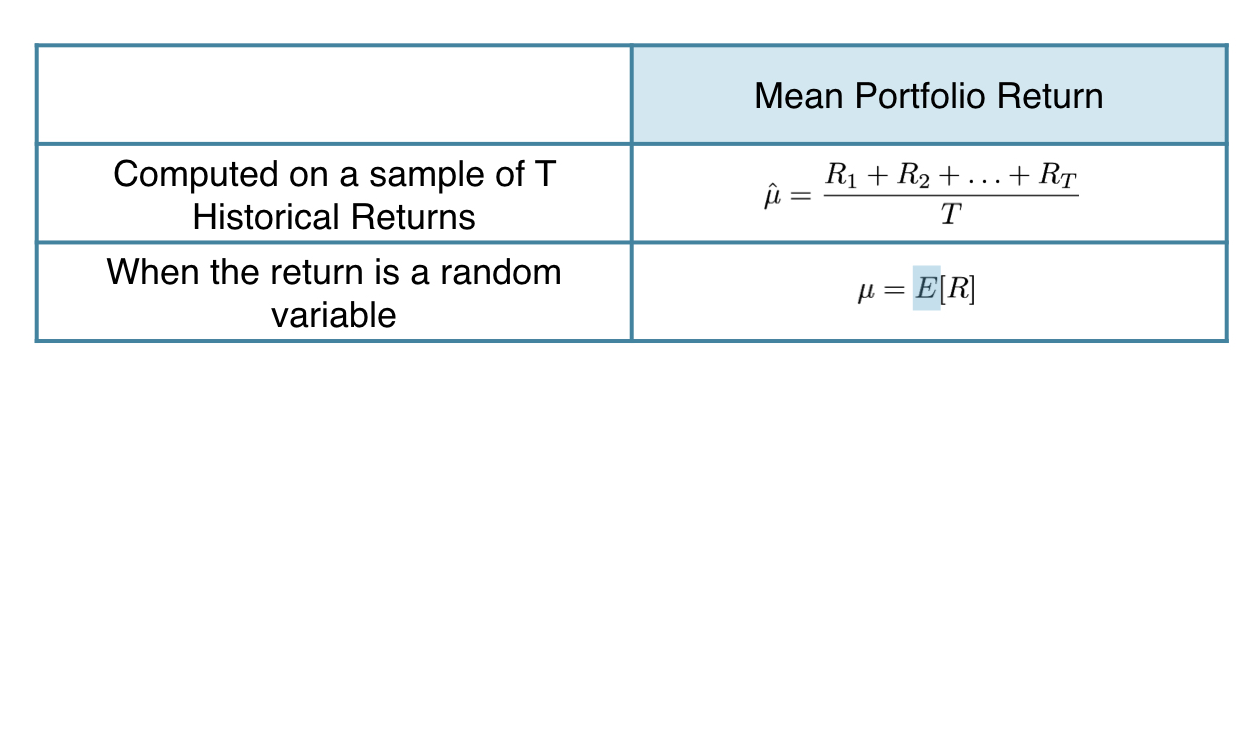

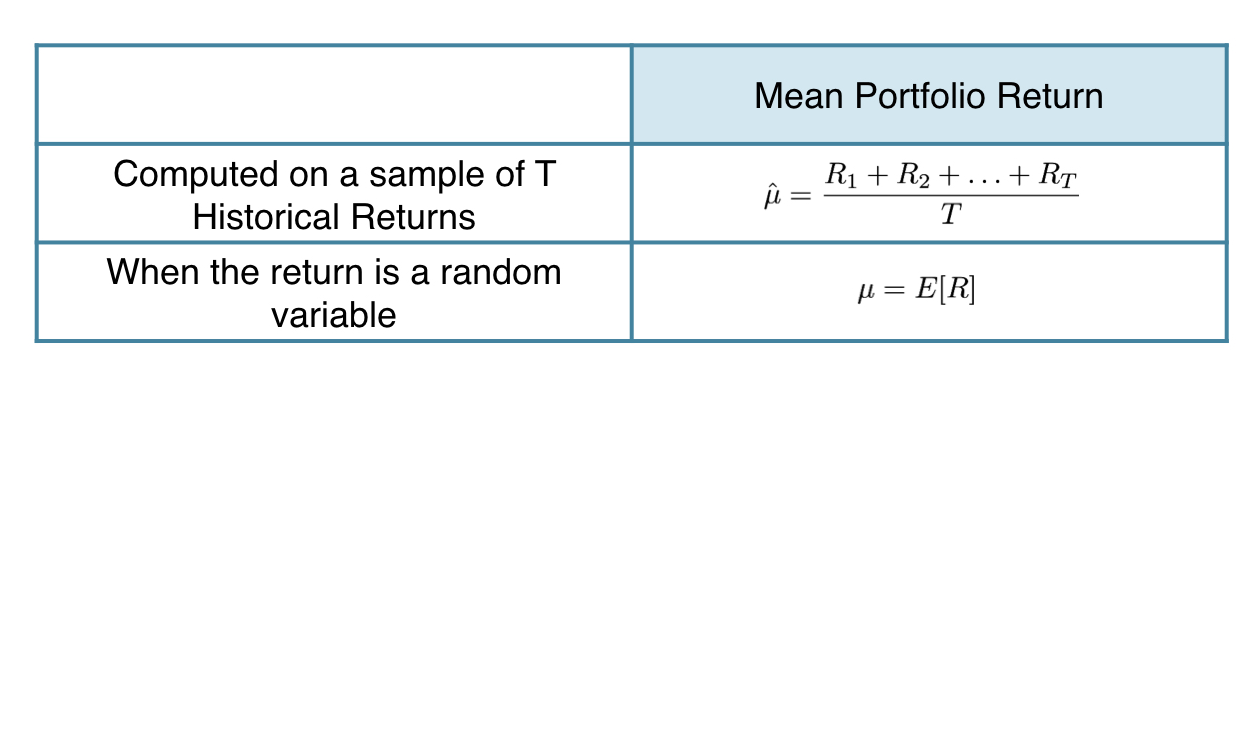

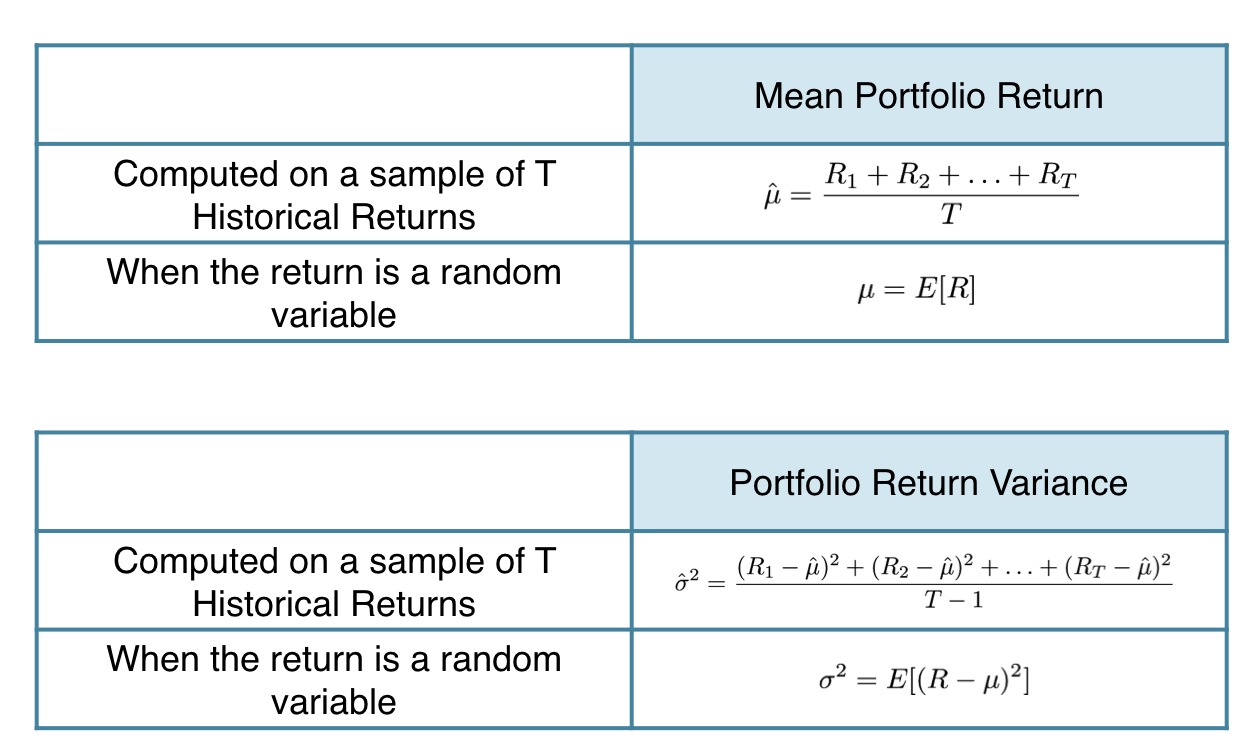

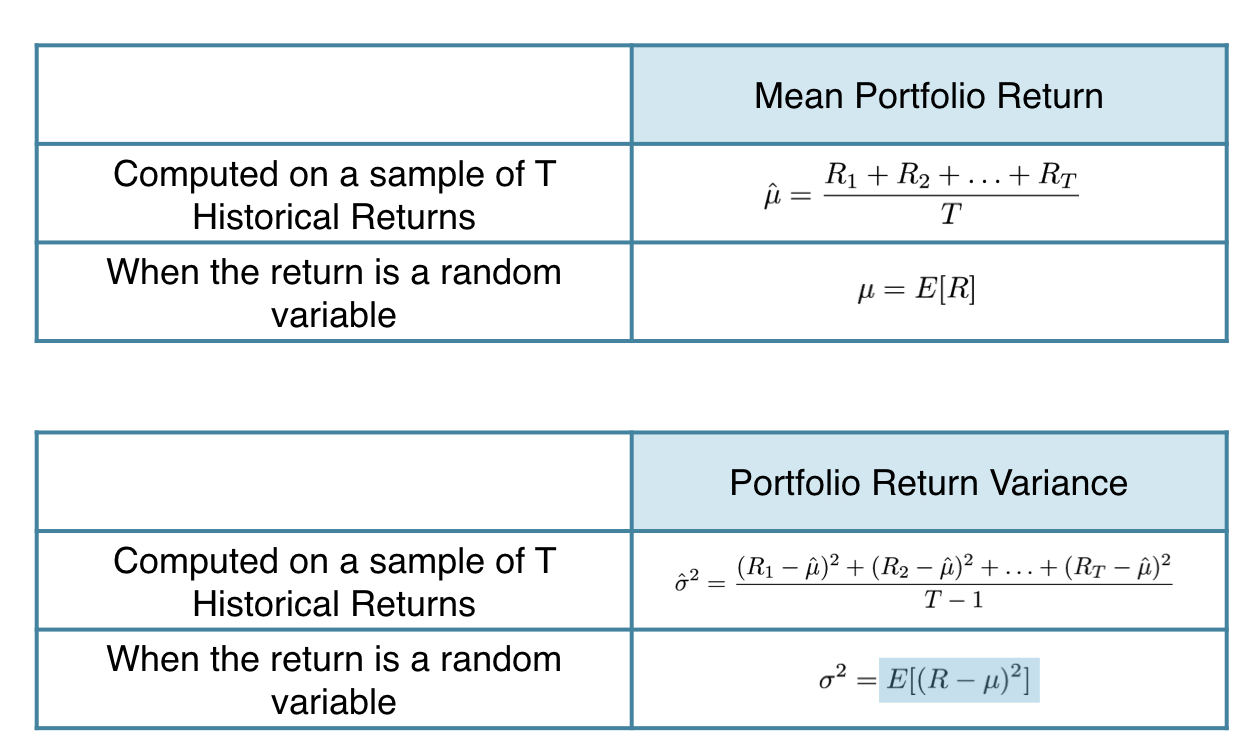

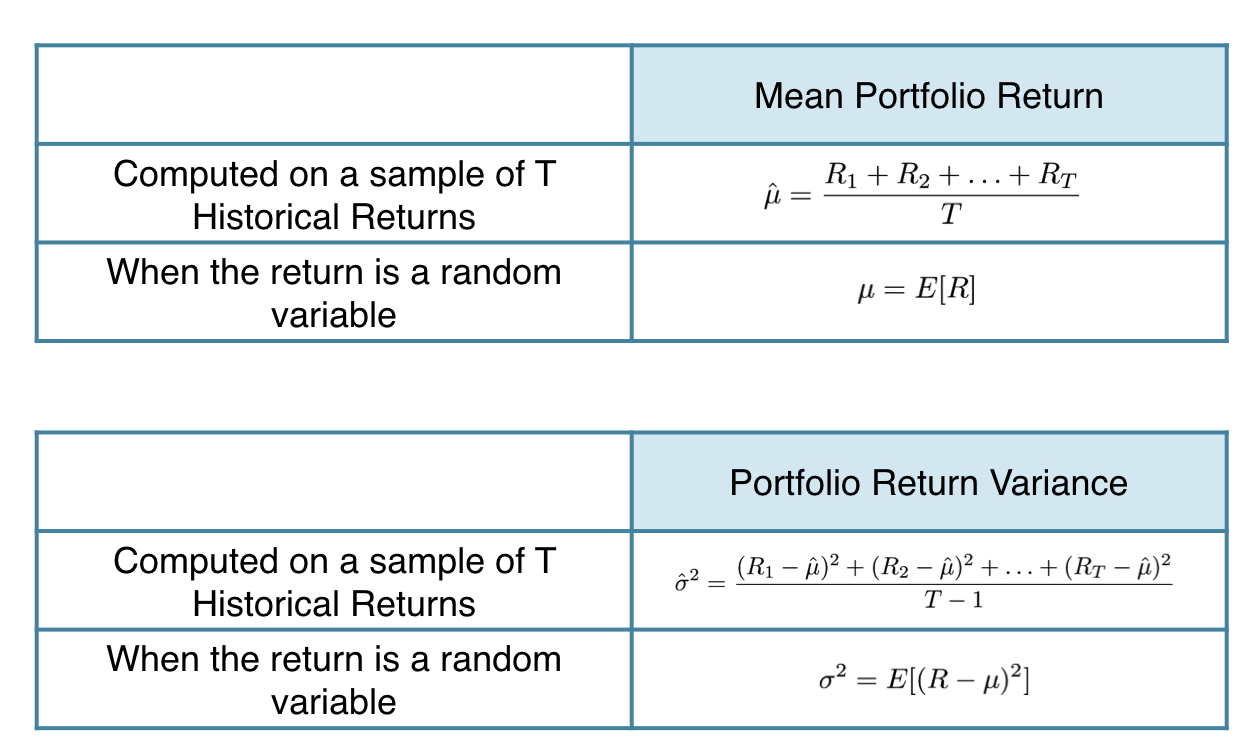

Past performance to predictions

Past performance to predictions

Past performance to predictions

Past performance to predictions

Past performance to predictions

Past performance to predictions

Drivers of mean & variance

- Assume two assets:

| Asset 1 | Asset 2 |

|---|---|

| Weight: $w_1$ | Weight: $w_2$ |

| Return: $R_1$ | Return: $R_2$ |

- Portfolio Return, $P = w1 \cdot R1 + w2\cdot R2$

- Thus: $E[P] = w_1\cdot E[R_1]+ w_2\cdot E[R_2]$

Portfolio return variance

Again, for a portfolio with 2 assets

- $var(P)$ = $w_1^2\cdot var(R_1) $ $+ w_2^2\cdot var(R_2) $ $+ 2\cdot w_1 \cdot w_2 \cdot cov(R_1, R_2)$

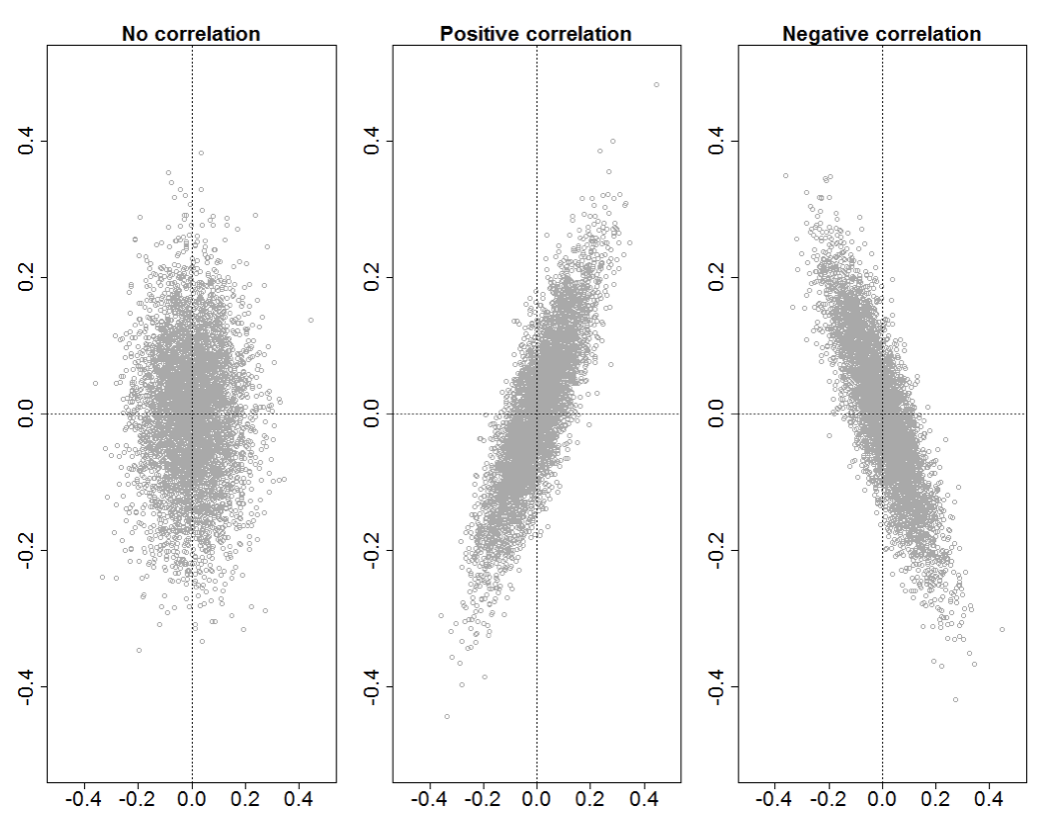

Covariance between return 1 and 2

- $Cov(R_1,R_2)$

- $ = E[(R_1 - E[R_1])(R_2 - E(R_2))]$

- $ = StdDev(R_1)\cdot StdDev(R_2)\cdot corr(R_1,R_2)$

Correlations

Take away formulas

E[Portfolio Return] = $E[P] = w_1\cdot E[R_1] + w_2\cdot E[R_2]$

var(Portfolio Return) = $var(P)$ = $w_1^2\cdot var(R_1) $ $+ w_2^2\cdot var(R_2) $ $+ 2\cdot w_1 \cdot w_2 \cdot cov(R_1, R_2)$

Let's practice!

Introduction to Portfolio Analysis in R