Time-variation in portfolio performance

Introduction to Portfolio Analysis in R

Kris Boudt

Professor, Free University Brussels & Amsterdam

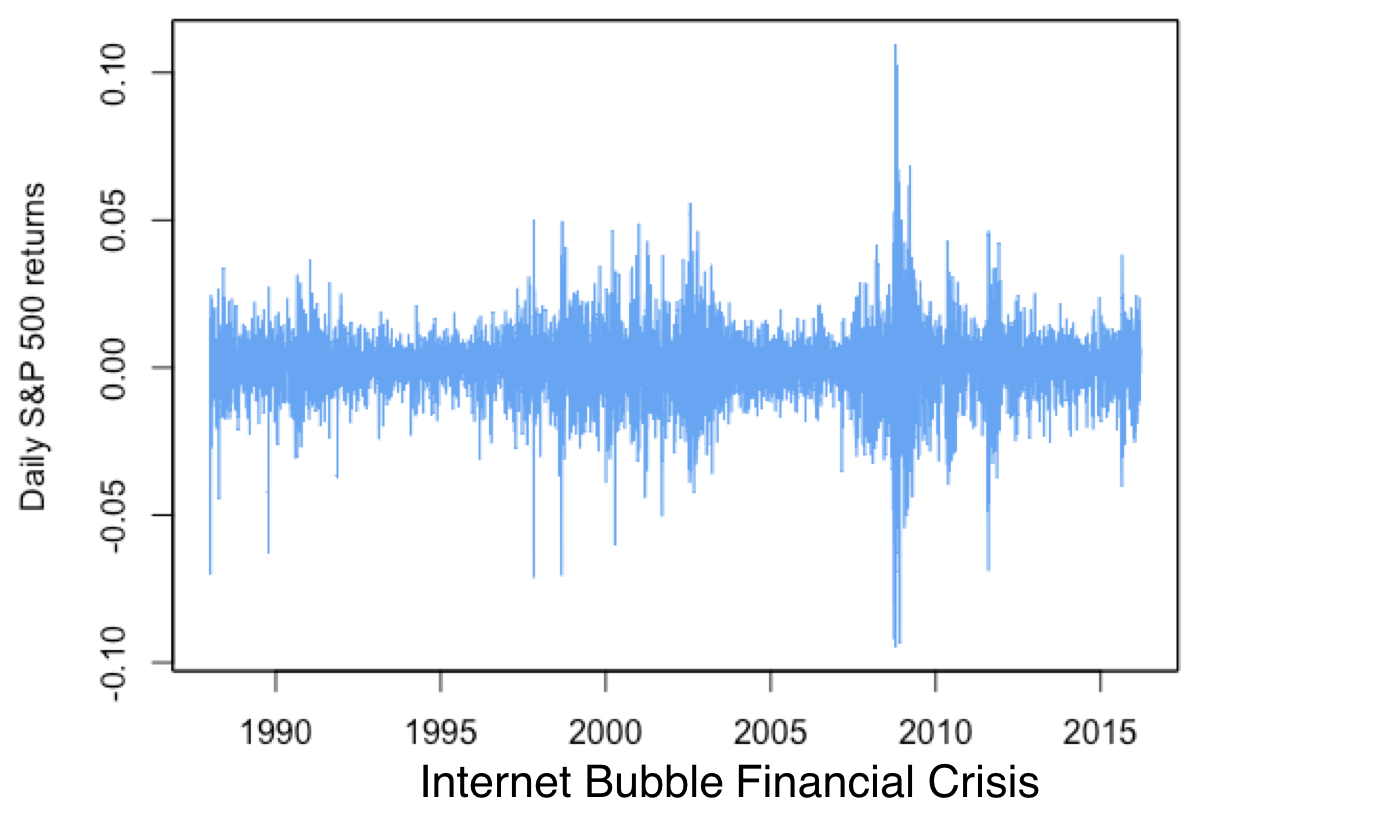

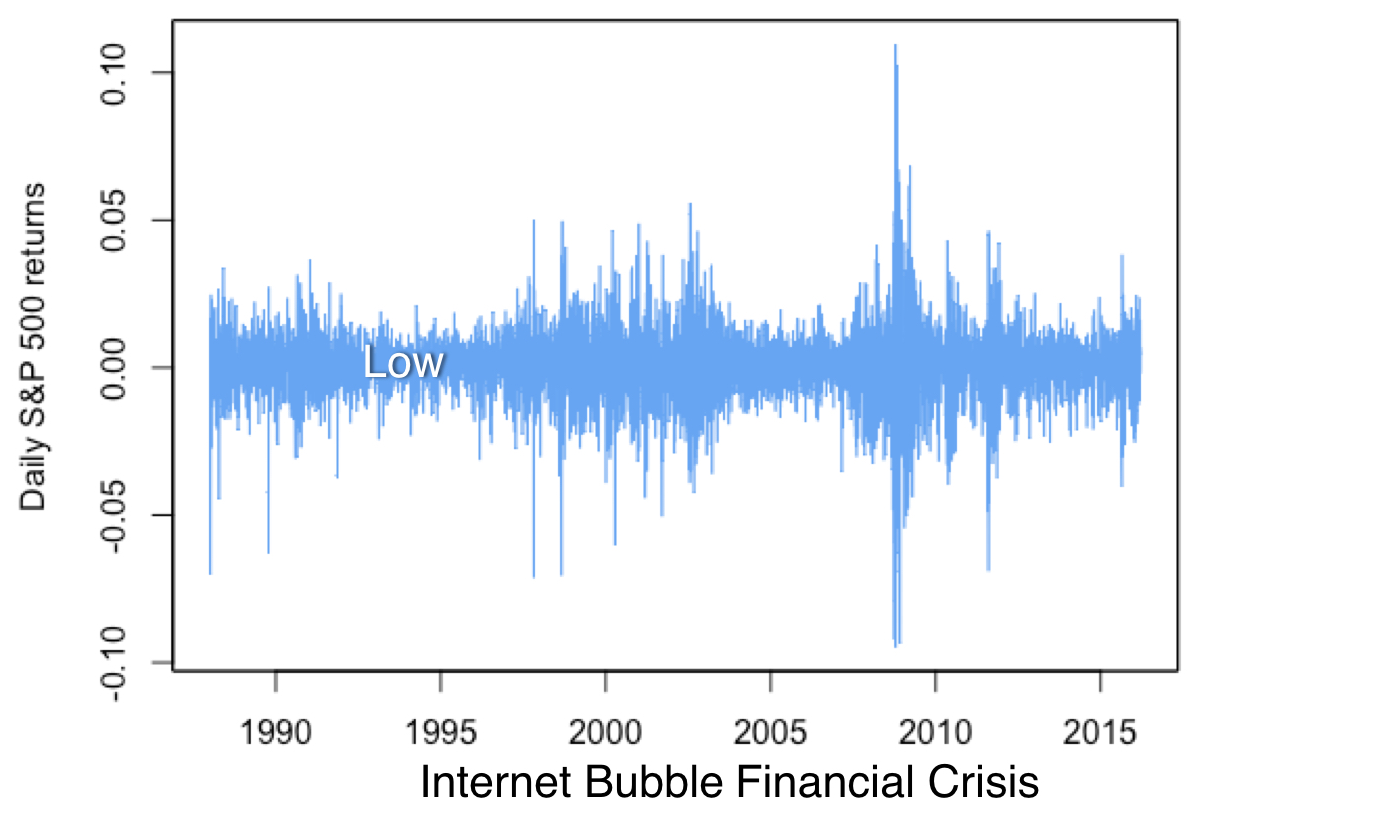

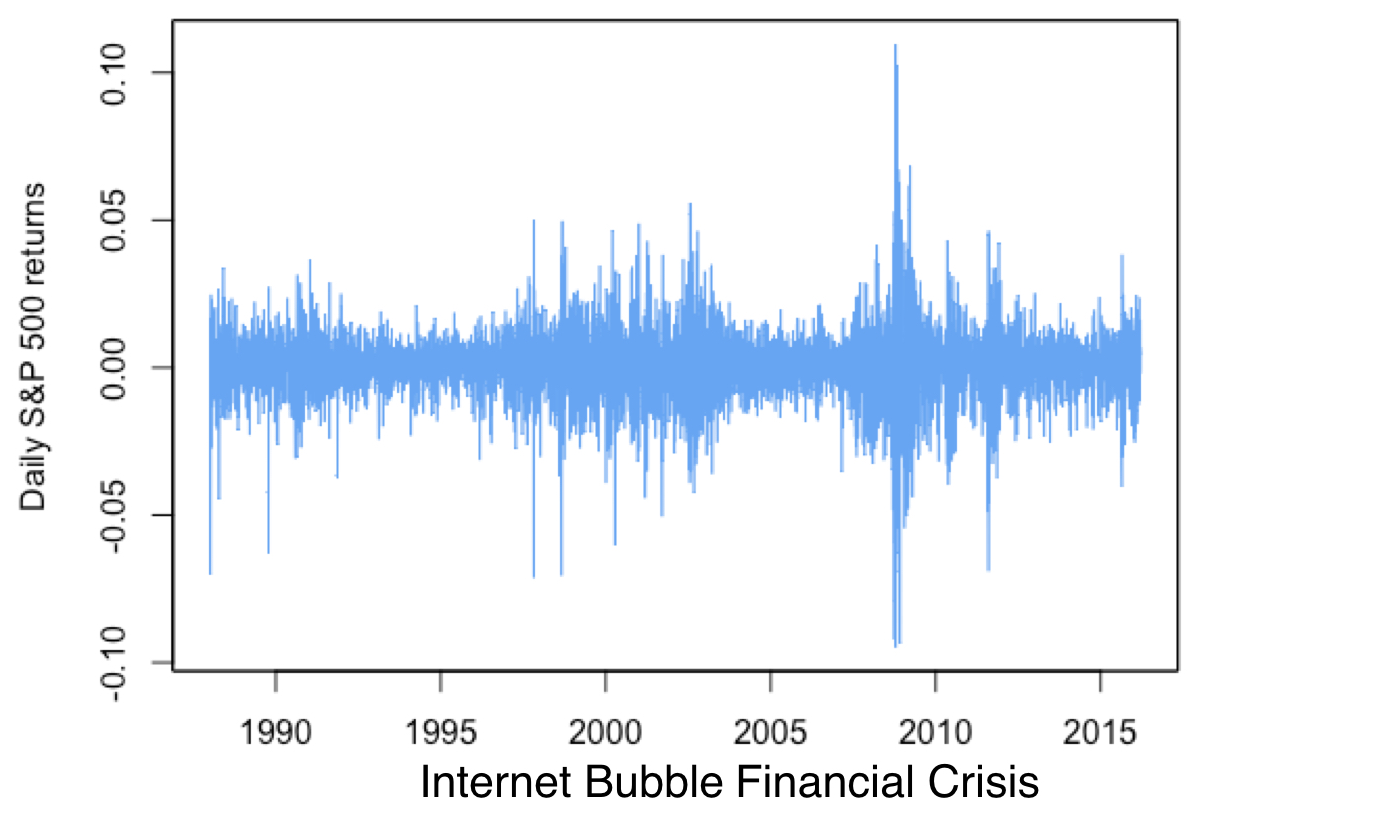

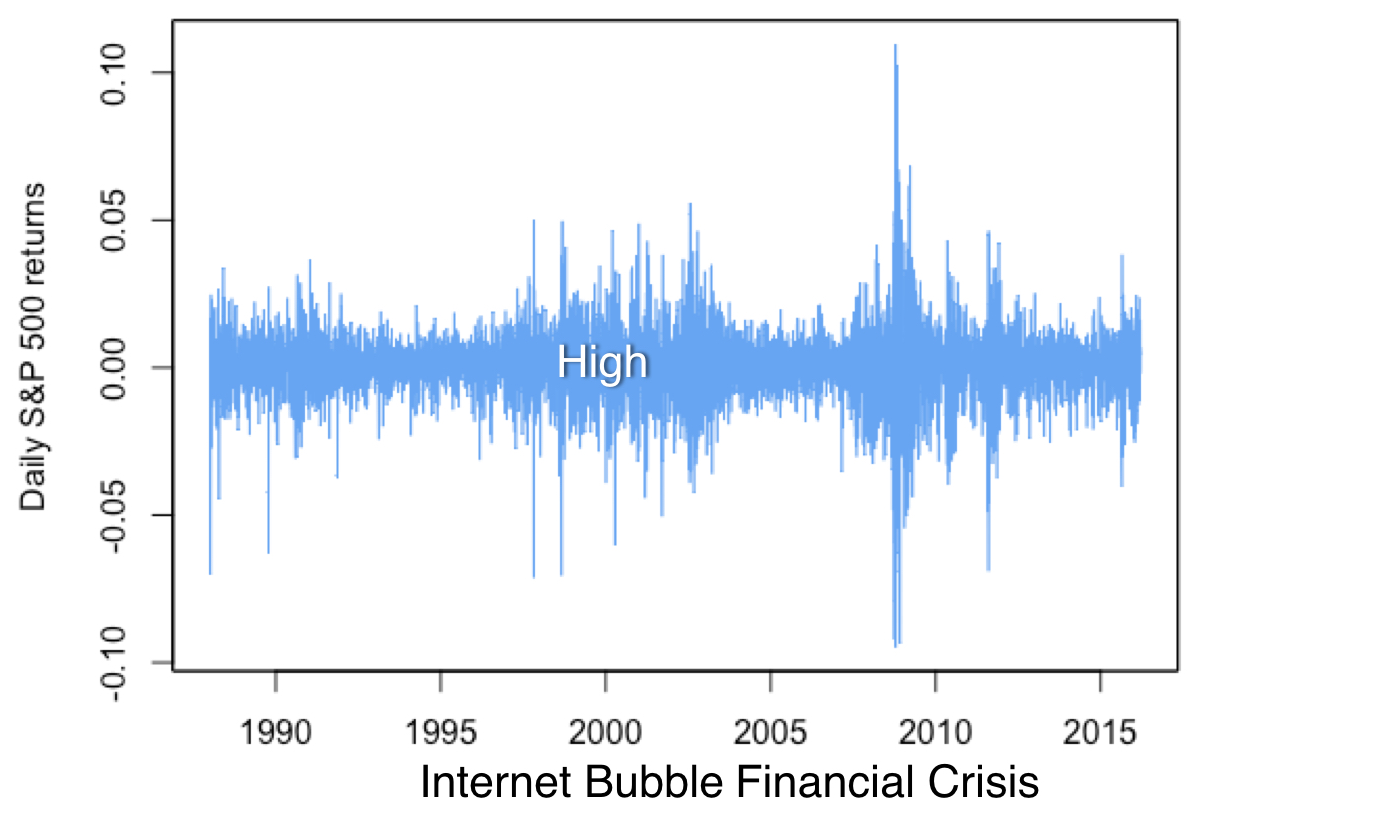

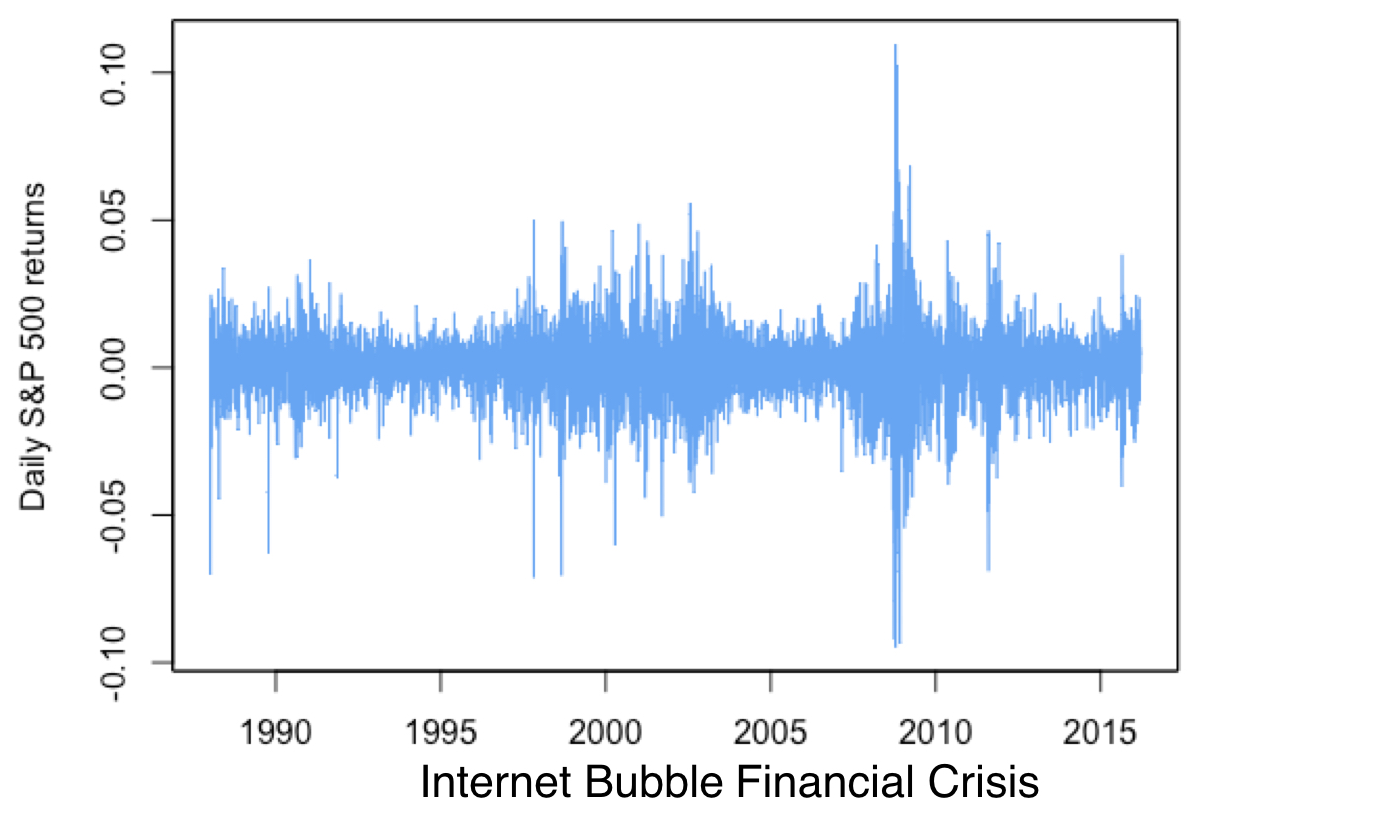

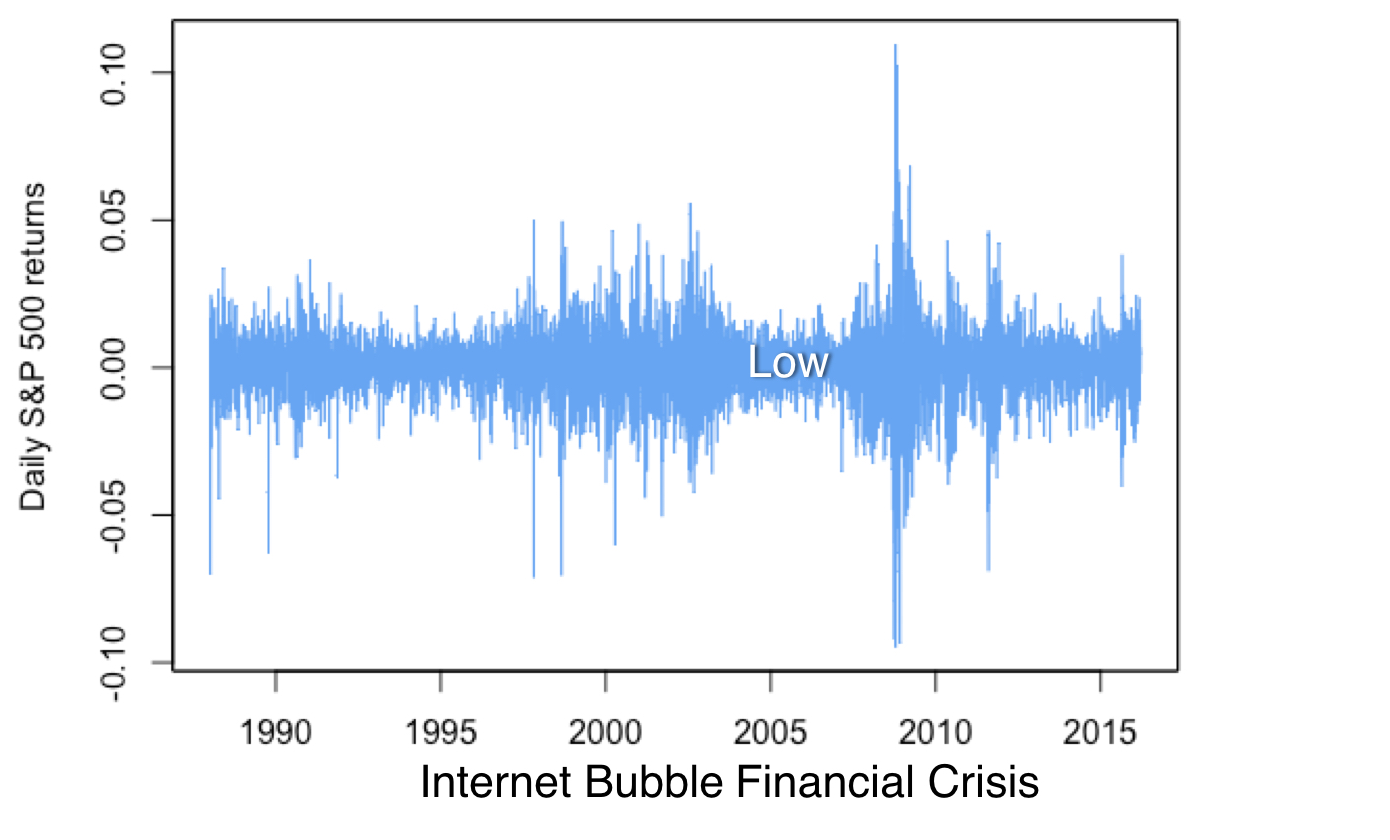

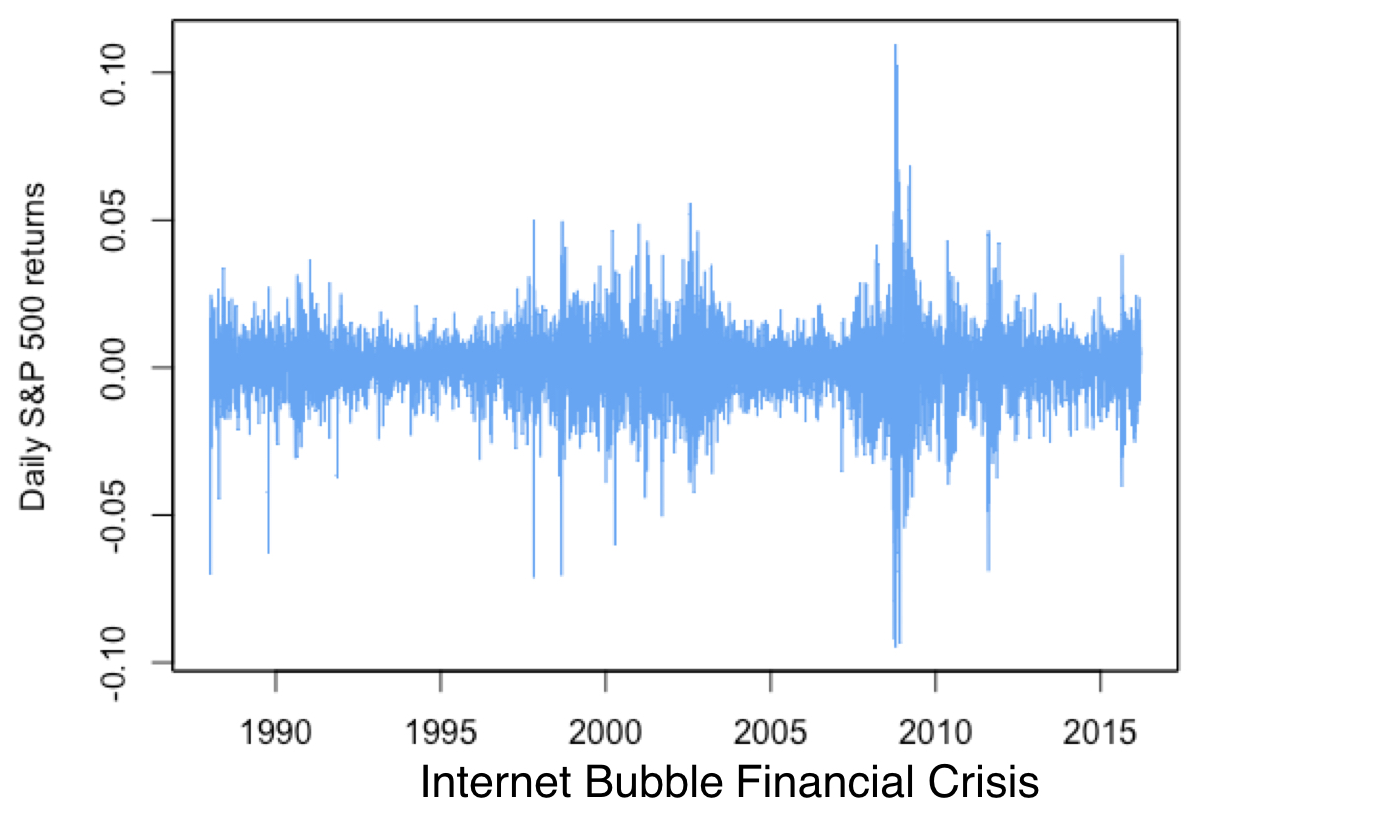

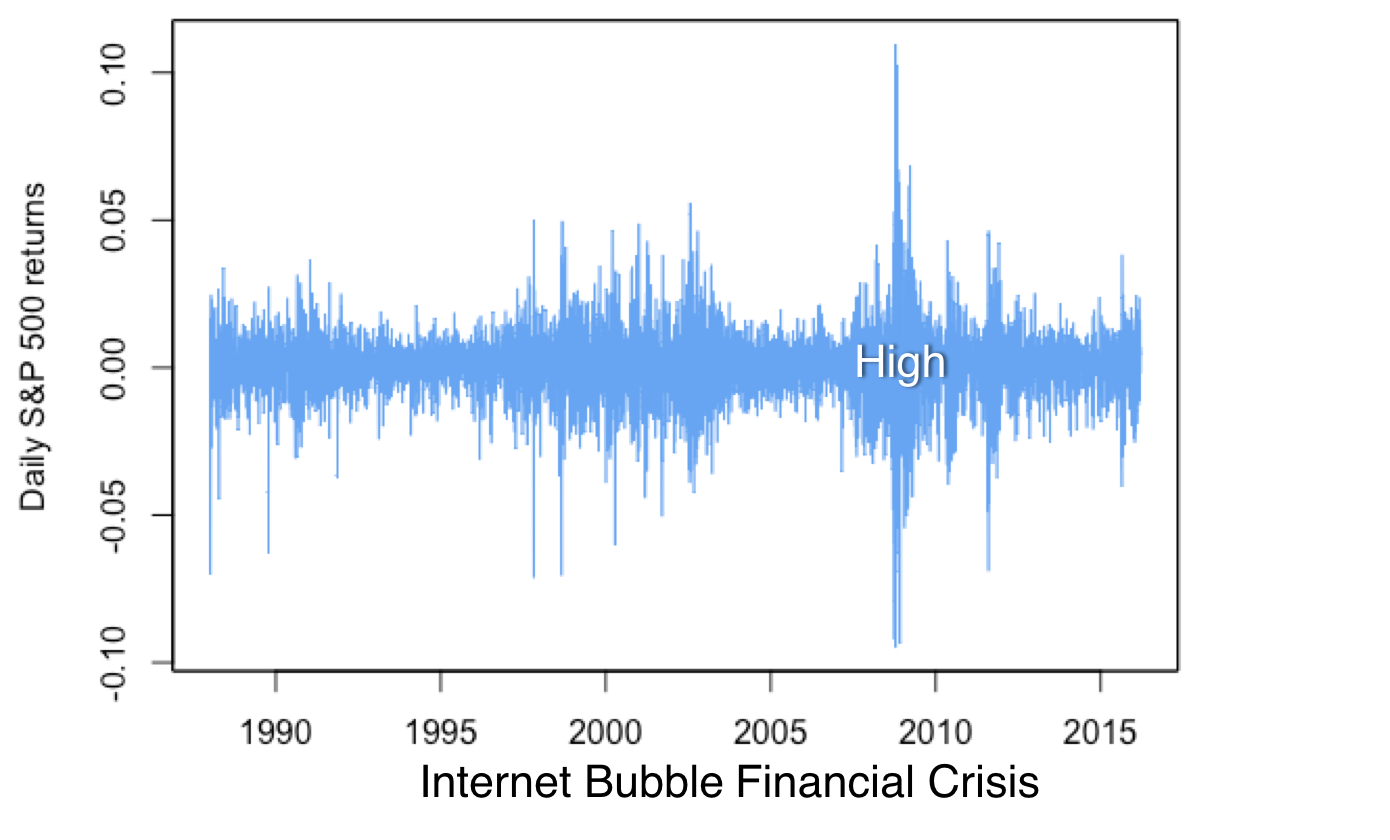

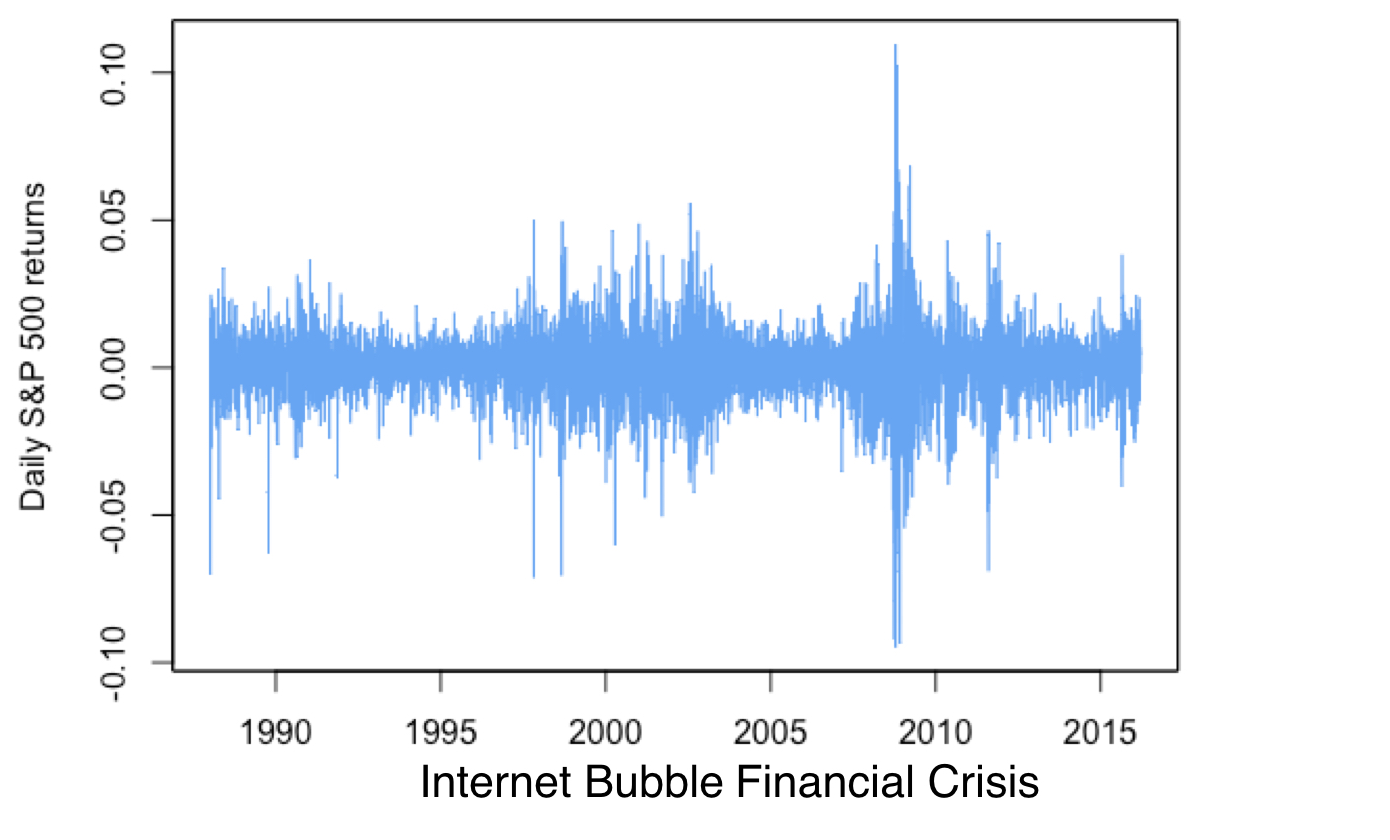

Bulls & bears

- Business cycle, news, and swings in the market psychology affect the market

Clusters of high & low volatility

Performance statistics in action

Performance statistics in action

Performance statistics in action

Performance statistics in action

Performance statistics in action

Performance statistics in action

Performance statistics in action

Performance statistics in action

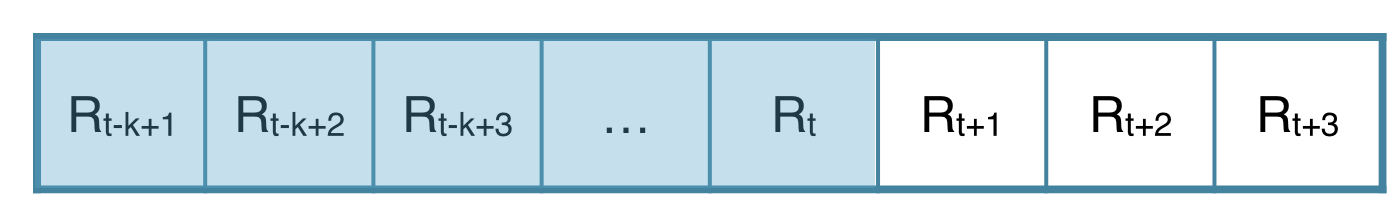

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

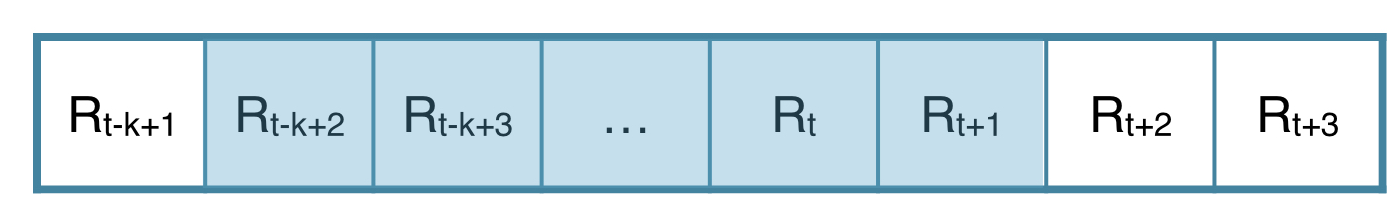

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

Rolling estimation samples

- Rolling samples of K observations:

- Discard the most distant and include the most recent

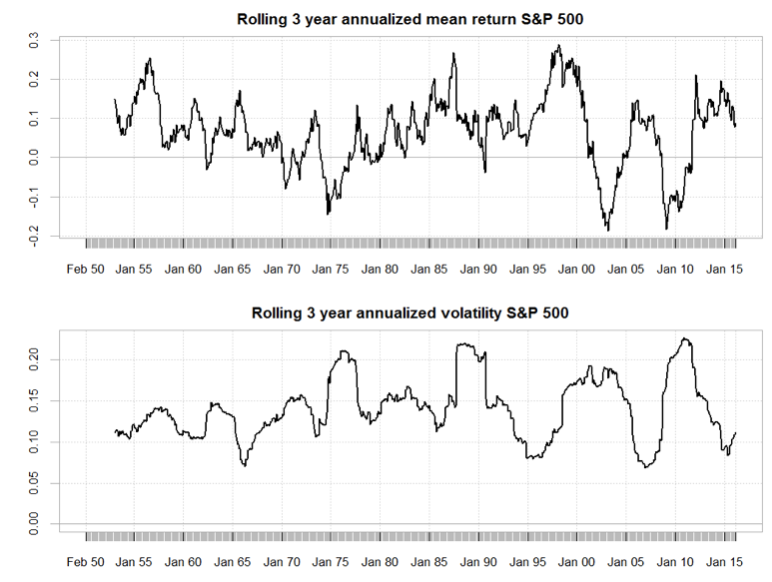

Rolling performance calculation

Choosing window length

- Need to balance noise (long samples) with recency (shorter samples)

- Longer sub-periods smooth highs and lows

- Shorter sub-periods provide more information on recent observations

Let's practice!

Introduction to Portfolio Analysis in R