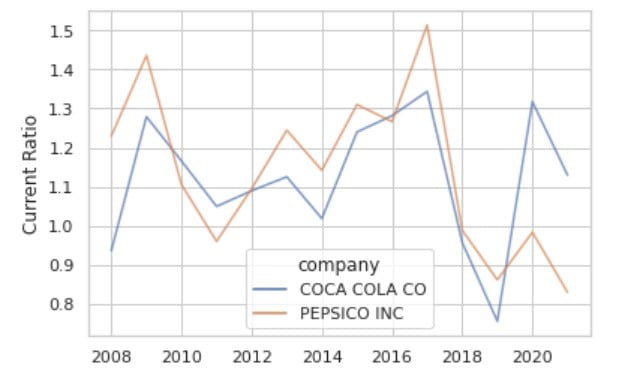

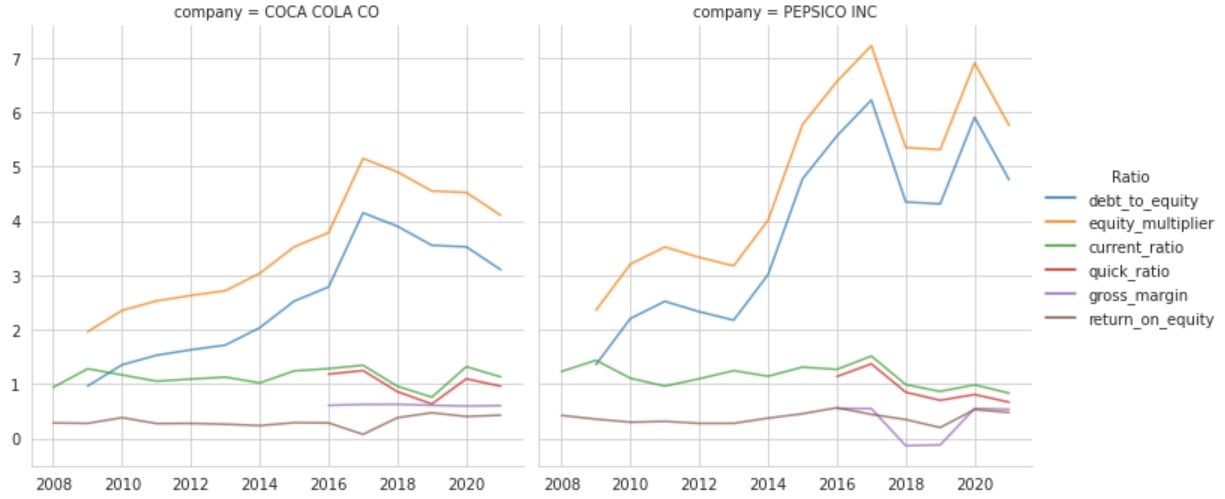

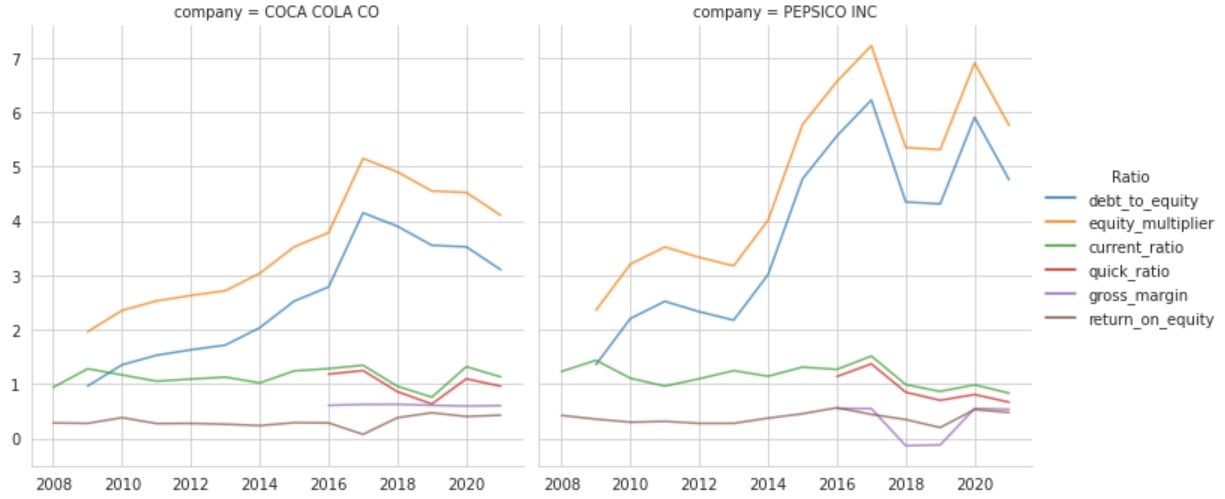

Visualizing financial ratios for comparison

Analyzing Financial Statements in Python

Rohan Chatterjee

Risk Modeler

Plotting the ratios of two companies

sns.set_style("whitegrid")

ax = sns.lineplot(data=current_ratio,

x="Year",y='current_ratio',

hue="company", alpha=0.7)

plt.xlabel("Year")

plt.ylabel("Current Ratio")

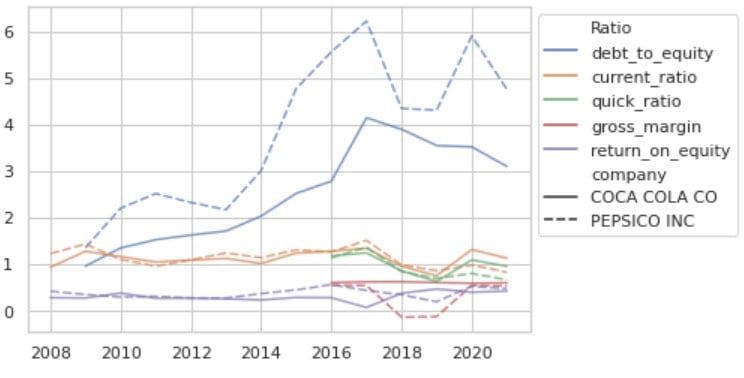

Overcrowding when using sns.lineplot()

This graph has too much information in too little space, making it overcrowded

Introducing sns.relplot()

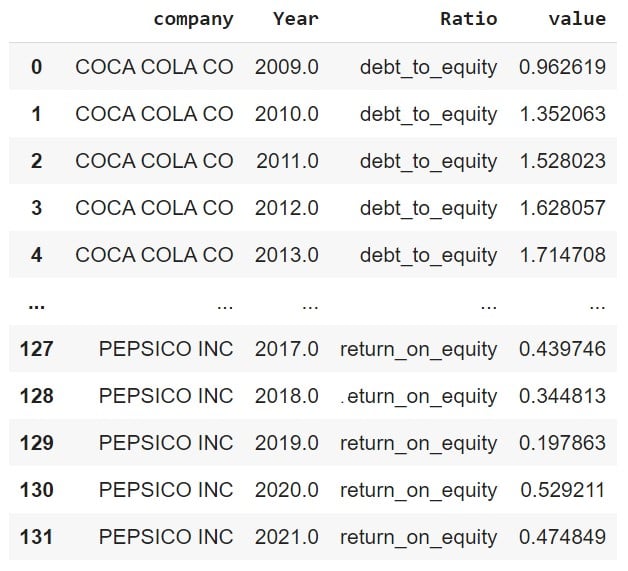

First step is to melt the DataFrame to get longitudinal data.

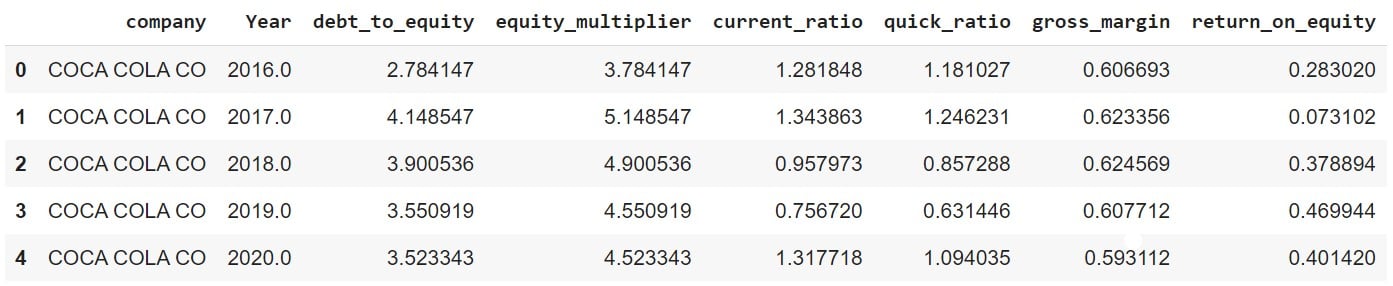

The "unmelted" DataFrame:

plot_df.head()

Now, melt the DataFrame

plot_df_melt = plot_df.melt(id_vars = ['company','Year'], var_name = "Ratio")

Plot ratios using sns.relplot()

ax = sns.relplot(data=df_melt, x="Year",

y="value", hue="Ratio",

alpha=0.7,

col='company',

kind='line')

ax.set_ylabels('')

ax.set_xlabels('')

A closer look at the plot

Let's practice!

Analyzing Financial Statements in Python